Zero-Based Budgeting for Small Businesses: Master Your Spending, Boost Your Bottom Line (Pros & Cons Explained)

Every small business owner knows the thrill of growth, but also the constant pressure of managing finances. Cash flow, unexpected expenses, and making every dollar count are daily realities. While traditional budgeting often starts with last year’s figures and adds a percentage, there’s a more radical, yet potentially powerful, approach gaining traction: Zero-Based Budgeting (ZBB).

But is this "clean slate" method a game-changer for your small business, or an administrative nightmare? In this comprehensive guide, we’ll dive deep into Zero-Based Budgeting for small businesses, exploring its core principles, how it works, and critically, its pros and cons, to help you decide if it’s the right fit for your entrepreneurial journey.

What Exactly is Zero-Based Budgeting (ZBB)?

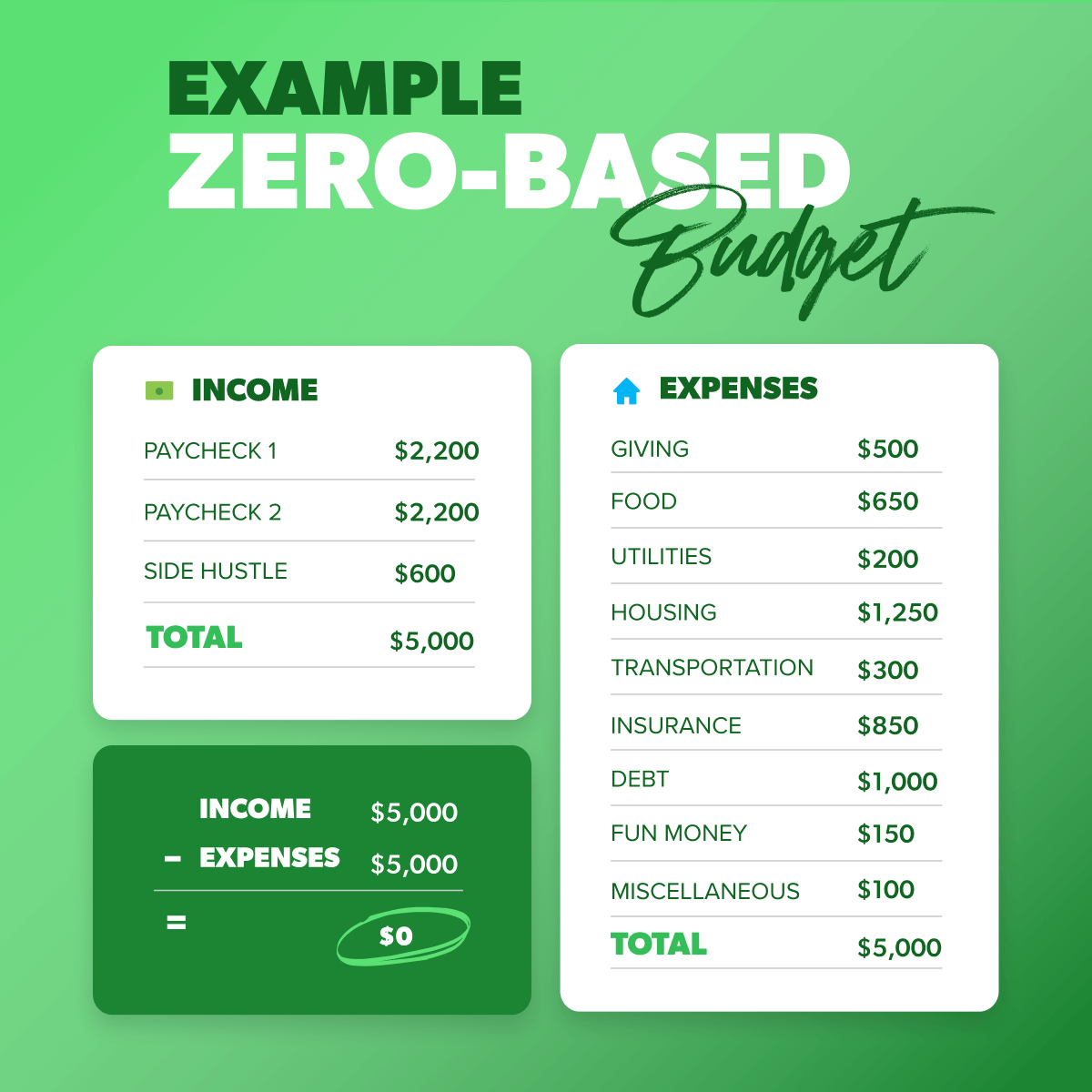

Imagine you’re starting your business’s budget from scratch, every single time. That’s the essence of Zero-Based Budgeting. Instead of assuming last year’s expenses are necessary, ZBB requires every single dollar of expenditure to be justified and approved for the new budget period, regardless of whether it’s a new or existing cost.

Think of it like this:

- Traditional Budgeting: Starts with a partially filled glass and asks, "How much more water do we need?"

- Zero-Based Budgeting: Starts with an empty glass and asks, "Do we need water at all? If so, how much, and why?"

This "clean slate" approach forces you to critically evaluate every expense, challenging assumptions and identifying areas of waste or inefficiency that might otherwise go unnoticed.

How Does Zero-Based Budgeting Work for Small Businesses? (A Step-by-Step Guide)

While it sounds intimidating, implementing ZBB for a small business can be broken down into manageable steps:

-

Identify "Decision Units":

- This is the first step in breaking down your business. For a small business, decision units might be departments (e.g., Marketing, Operations, Sales), specific projects, or even major cost categories (e.g., Software Subscriptions, Office Supplies, Travel).

- The goal is to define areas where costs are incurred and decisions about spending are made.

-

List and Analyze ALL Expenses:

- For each decision unit, list every single expense, no matter how small. This includes recurring costs like rent and salaries, but also variable costs like marketing campaigns, software licenses, training, and even office snacks.

- Don’t just list them; categorize them as fixed, variable, or discretionary.

-

Justify Every Expense (The Core of ZBB):

- This is the most crucial step. For each expense listed, you must provide a clear, concise justification for why it’s necessary and what value it brings to your business.

- Ask tough questions:

- "Is this expense absolutely essential for our operations or growth?"

- "What would be the impact if we eliminated or reduced this cost?"

- "Is there a more cost-effective way to achieve the same outcome?"

- "Does this expense align with our current business goals?"

- Example: Instead of "Marketing Budget: $5,000," it becomes "Social Media Ad Spend: $2,000 (to acquire 100 new leads at $20/lead)," "SEO Content Creation: $1,500 (to improve organic search ranking for keywords X, Y, Z)," etc.

-

Prioritize and Allocate Funds:

- Once all expenses are justified, rank them by priority based on their contribution to your business’s objectives.

- Allocate funds starting with the highest-priority items until your budget is exhausted or your desired profit margin is achieved. This often means some lower-priority items might not get funded.

-

Monitor and Review Continuously:

- ZBB isn’t a one-and-done process. Regularly track your actual spending against your zero-based budget.

- Be prepared to adjust as circumstances change, always going back to the "justify everything" principle.

The Pros of Zero-Based Budgeting for Small Businesses

For agile, growth-focused small businesses, ZBB offers several compelling advantages:

-

1. Enhanced Cost Control & Waste Elimination:

- Benefit: By scrutinizing every expense, ZBB forces you to identify and cut unnecessary spending, "fat" that might have accumulated over time in traditional budgets. This leads to leaner operations and improved profitability.

- Small Business Relevance: Every dollar saved can be reinvested into growth, product development, or marketing – critical for small businesses with limited capital.

-

2. Improved Resource Allocation:

- Benefit: ZBB ensures that funds are directed to areas that provide the most value and directly support your strategic goals. You’re not just funding what you did last year, but what you need to do this year.

- Small Business Relevance: Maximize the impact of every limited resource. You can pivot quickly to fund new opportunities or essential needs.

-

3. Increased Financial Transparency & Accountability:

- Benefit: Everyone involved in the budgeting process gains a deeper understanding of where money is going and why. Each expense has a clear purpose and justification.

- Small Business Relevance: Fosters a culture of financial responsibility among team members, even in small teams, as they understand the "why" behind spending decisions.

-

4. Greater Agility & Adaptability:

- Benefit: Unlike rigid traditional budgets, ZBB is inherently flexible. It encourages regular re-evaluation, allowing your business to adapt quickly to market changes, new opportunities, or economic shifts.

- Small Business Relevance: Essential in today’s fast-paced business environment where market conditions can change rapidly.

-

5. Fosters Innovation & Efficiency:

- Benefit: The "why" behind spending often leads to exploring more efficient processes or innovative solutions. If a traditional method is too expensive, ZBB encourages finding a better, cheaper way.

- Small Business Relevance: Can uncover creative solutions to achieve goals with fewer resources, giving you a competitive edge.

-

6. Better Decision-Making:

- Benefit: With a clearer understanding of costs and their value, business owners can make more informed decisions about investments, staffing, and strategic initiatives.

- Small Business Relevance: Reduces guesswork and helps prioritize investments that will truly move the needle for your business.

The Cons of Zero-Based Budgeting for Small Businesses

While the benefits are significant, ZBB isn’t without its challenges, especially for time-strapped small business owners:

-

1. Time-Consuming & Resource-Intensive:

- Challenge: The most significant drawback. Justifying every single expense from scratch requires a considerable amount of time, effort, and detailed analysis.

- Small Business Relevance: Small business owners often wear many hats and have limited time. The initial setup and ongoing maintenance can be a heavy lift without dedicated finance personnel.

-

2. Initial Complexity & Learning Curve:

- Challenge: For those new to ZBB, the methodology can seem daunting and complex. It requires a different mindset than traditional budgeting.

- Small Business Relevance: May require a significant upfront investment in learning and process development, which can feel overwhelming.

-

3. Potential for Micromanagement & Employee Frustration:

- Challenge: If not implemented carefully, the constant justification of expenses can feel like micromanagement, leading to frustration or demotivation among team members.

- Small Business Relevance: In a small team, trust and autonomy are crucial. A heavy-handed ZBB approach could damage morale if employees feel their every spending decision is questioned.

-

4. May Discourage Long-Term Investments:

- Challenge: The intense focus on short-term justification can sometimes inadvertently discourage investments in long-term projects (e.g., R&D, brand building, extensive training) whose immediate ROI is hard to quantify.

- Small Business Relevance: Could lead to a focus on immediate gains at the expense of sustainable future growth if not balanced with strategic vision.

-

5. Resistance to Change:

- Challenge: People naturally resist new processes, especially those that add perceived workload or scrutiny.

- Small Business Relevance: Even in a small team, getting buy-in and enthusiastic participation can be a hurdle.

-

6. Not Ideal for Very Simple Businesses:

- Challenge: For extremely small businesses with very few, highly predictable expenses, the overhead of ZBB might outweigh the benefits.

- Small Business Relevance: A solopreneur with minimal variable costs might find it overkill, though the principles of scrutinizing expenses are always valuable.

Is Zero-Based Budgeting Right for Your Small Business?

Deciding whether to adopt ZBB depends on your specific circumstances, size, and growth stage.

ZBB Might Be a Great Fit If:

- You’re a Startup or New Business: Starting with a clean slate from day one is natural and sets excellent financial habits.

- You’re Facing Tight Cash Flow or Profitability Issues: ZBB can quickly identify areas to cut costs and improve your bottom line.

- You’ve Had Significant Changes: A new product line, a market shift, or a rapid growth phase makes past budgets irrelevant.

- You Want Maximum Efficiency: You’re committed to optimizing every dollar spent and fostering a cost-conscious culture.

- You Have the Time/Resources: You’re willing to invest the initial effort required for setup and ongoing management.

You Might Find ZBB Challenging If:

- You Have Extremely Predictable & Stable Expenses: If your costs rarely change, the effort might not yield significant new insights.

- You Have Very Limited Time: If you’re stretched thin, the initial setup could overwhelm you.

- Your Team Resists Change: Without buy-in, implementation can be difficult.

- You Prioritize Simplicity Above All Else: A basic traditional budget might be sufficient for your current needs.

Consider a Hybrid Approach: Many small businesses find success by adopting elements of ZBB for certain categories (e.g., marketing, technology, travel) while maintaining a more traditional approach for fixed, predictable costs like rent or utilities. This allows you to reap some benefits without fully committing to the intensive process.

Tips for Implementing Zero-Based Budgeting Successfully

If you decide to embrace ZBB, here are some tips to make the transition smoother:

- Start Small: Don’t try to implement ZBB across your entire business overnight. Choose one or two key expense categories or departments to pilot the process.

- Communicate & Educate: Explain the "why" behind ZBB to your team. Emphasize the benefits for the business’s health and stability, not just cost-cutting. Provide clear guidelines and support.

- Leverage Technology: Budgeting software, spreadsheets, or even dedicated ZBB tools can help streamline the process of tracking, justifying, and analyzing expenses.

- Focus on Value, Not Just Cost: When justifying expenses, encourage a focus on the return on investment or the value created by the spending, not just the cost itself.

- Be Patient & Flexible: ZBB is a cultural shift. It takes time to master. Be prepared to refine your process and adapt as you learn what works best for your unique business.

- Review Regularly: Make budgeting an ongoing conversation, not just an annual event. Monthly or quarterly reviews keep you agile and on track.

Conclusion

Zero-Based Budgeting is a powerful financial management strategy that can unlock significant efficiencies, improve financial clarity, and drive smarter decision-making for small businesses. While its demanding nature, particularly the initial setup, can be a hurdle, the long-term benefits of enhanced cost control and optimal resource allocation can be transformative.

By understanding both its pros and cons, and considering a phased or hybrid approach, you can harness the power of Zero-Based Budgeting to build a leaner, more agile, and ultimately, more profitable small business. The question isn’t just "Can we afford it?" but "Is this the best possible use of our hard-earned money?" ZBB helps you answer that question with confidence.

Post Comment