Your Essential Guide: How to Get a Business License (Step-by-Step)

Starting a new business is an exciting journey filled with passion, innovation, and big dreams. But amidst the excitement of developing your product or service, crafting a business plan, and finding your first customers, there’s a crucial, often overlooked, step: getting the right business licenses and permits.

For many new entrepreneurs, the world of business licenses can seem like a confusing maze of jargon, forms, and different government levels. Don’t worry! This comprehensive guide is designed to simplify the process, breaking down everything you need to know about how to get a business license into easy-to-understand steps.

What Exactly is a Business License?

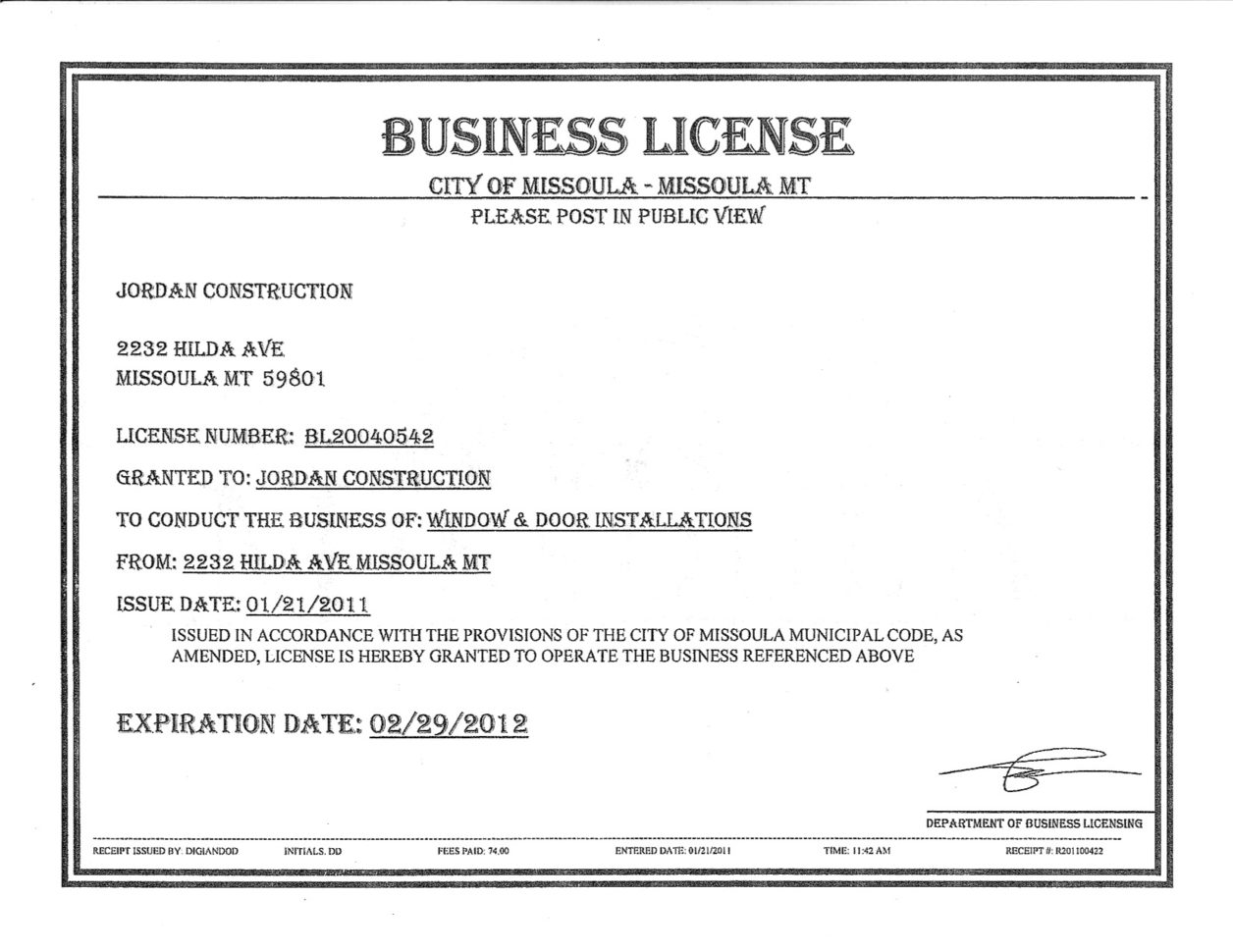

At its core, a business license is official permission from a government agency (federal, state, county, or city) that allows you to legally operate your business. Think of it as a stamp of approval that signifies your business meets specific regulations and standards.

It’s important to understand that there isn’t just one "business license" that covers everything. Depending on your business type, location, and activities, you might need a combination of:

- General business licenses: Often required by your city or county.

- Professional or occupational licenses: For specific trades (e.g., doctor, lawyer, contractor, hairdresser).

- Sales tax permits: If you sell taxable goods or services.

- Zoning permits: To ensure your business location is approved for its intended use.

- Health permits: For businesses handling food or providing personal services.

- Environmental permits: For businesses that impact the environment.

- Federal permits: For specific industries regulated by the federal government (e.g., aviation, alcohol, firearms).

The specific licenses and permits you need will vary significantly based on these factors.

Why Do You Need a Business License?

You might be thinking, "Do I really need one for my small online shop or my freelance gig?" The answer, in most cases, is a resounding yes! Here’s why obtaining the proper licenses and permits is non-negotiable for any legitimate business:

- It’s the Law: Operating without the required licenses can lead to significant fines, penalties, or even forced closure of your business. Ignorance of the law is not an excuse.

- Builds Credibility and Trust: Having the proper licenses shows your customers, partners, and investors that you are a legitimate, professional, and compliant operation. It builds trust and confidence.

- Avoids Legal Headaches: Licensed businesses are less likely to face legal challenges from disgruntled customers or competitors. It protects you and your personal assets.

- Access to Resources: Many business loans, grants, and support programs require you to be a legally registered and licensed entity.

- Professional Image: Displaying your licenses (where required) adds to your professional image and can attract more business.

- Tax Compliance: Many licenses are linked to tax obligations, ensuring you’re set up correctly for state and local taxes.

Are All Businesses Required to Get a License?

Generally, yes, almost all businesses need some form of license or permit. Even if you operate from home, sell goods online, or offer services as a freelancer, you’ll likely need to register your business with your local government and potentially acquire specific permits.

Common misconceptions:

- "I’m just a side hustle, so I don’t need one." Even small side hustles generating income are typically considered businesses and fall under licensing requirements.

- "I operate entirely online, so location doesn’t matter." While you might not need a physical storefront permit, your home address is still your business’s legal address, and you’ll need to comply with local regulations for home-based businesses.

- "I’m a sole proprietor, so it’s simpler." While sole proprietorships might have fewer initial registration steps than an LLC or corporation, they are still subject to the same federal, state, and local licensing requirements based on their business activities.

When in doubt, always assume you need one and research thoroughly. It’s better to be over-prepared than to face penalties later.

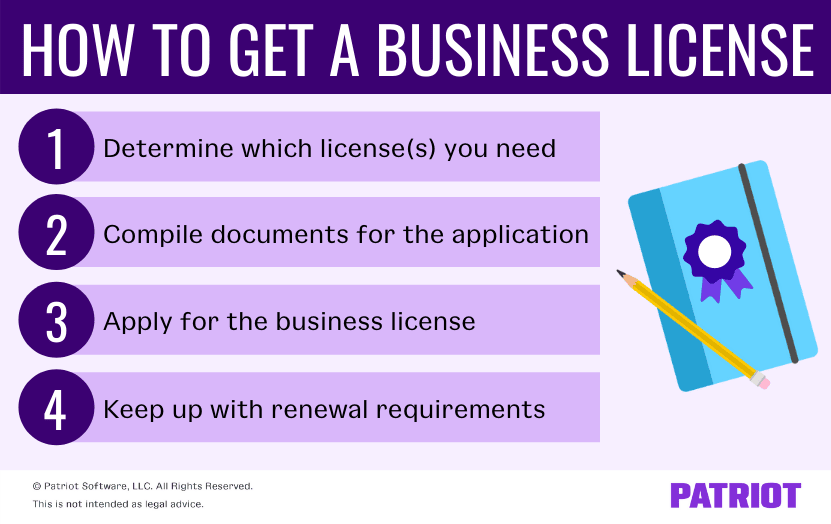

How to Get a Business License: Your Step-by-Step Walkthrough

Navigating the licensing process can feel overwhelming, but by breaking it down, it becomes much more manageable. Here’s a clear, actionable guide:

Step 1: Understand Your Business Structure

Before you can apply for licenses, you need to know how your business is legally structured. This choice impacts your tax obligations, personal liability, and some registration processes.

- Sole Proprietorship: Simplest structure, owned by one person. No legal distinction between you and your business.

- Partnership: Owned by two or more people.

- Limited Liability Company (LLC): A hybrid structure offering personal liability protection like a corporation, but with simpler tax treatment.

- Corporation (S-Corp, C-Corp): A separate legal entity from its owners, offering the strongest liability protection.

Why this matters: Registering an LLC or Corporation often starts at the state level (Secretary of State), which can precede some local license applications. For sole proprietorships, you might go straight to local licenses after getting an EIN (if needed).

Step 2: Research Federal Requirements

While most businesses don’t need a general federal business license, certain industries or activities are regulated at the federal level.

- Employer Identification Number (EIN): If you plan to hire employees or operate as a corporation or partnership, you’ll need an EIN from the IRS. Think of it as a Social Security number for your business. It’s free and easy to apply for online.

- Specific Federal Licenses/Permits: Industries like:

- Agriculture

- Alcoholic beverages

- Aviation

- Firearms, explosives

- Fisheries

- Mining and drilling

- Radio and television broadcasting

- Transportation and logistics

- Manufacturing or distributing certain products (e.g., drugs, medical devices regulated by the FDA).

- Action: Visit the official websites of federal agencies related to your industry (e.g., FDA, FCC, FAA) or the Small Business Administration (SBA) website for guidance.

Step 3: Research State Requirements

Each state has its own set of business licensing rules. This is often where you’ll find requirements for formally registering your business entity (like an LLC or Corporation) and specific state-level permits.

- Business Registration:

- Secretary of State (or similar office): This is where you’ll typically register your LLC, Corporation, or Partnership. This creates your legal business entity. You’ll need to choose a unique business name and potentially file "Articles of Organization" (for LLCs) or "Articles of Incorporation" (for Corporations).

- Fictitious Business Name (DBA – "Doing Business As"): If your business name is different from your personal name (for sole proprietors) or your registered legal entity name, you might need to file a DBA.

- Sales Tax Permit (Seller’s Permit/Resale Certificate): If you sell products or certain services, you’ll likely need to collect sales tax. You’ll register with your state’s Department of Revenue or Tax Office. This allows you to legally collect and remit sales tax.

- Professional/Occupational Licenses: Many professions require state-issued licenses (e.g., doctors, lawyers, real estate agents, contractors, barbers, cosmetologists, accountants, childcare providers). Check your state’s professional licensing boards.

- Environmental Permits: If your business has a significant environmental impact (e.g., manufacturing, waste disposal), you might need state environmental permits.

- Action: Visit your state’s Secretary of State website and your state’s Department of Revenue/Taxation website. Search for "business licensing [Your State]" or "[Your State] business registration."

Step 4: Research Local Requirements (City and County) – This is Crucial!

This is often the most complex and overlooked part of the licensing process, as requirements can vary significantly from one city or county to another, even within the same state.

- General Business License (Business Tax Certificate/Occupational License): Most cities and counties require nearly all businesses to obtain a general business license. This is often the first local permit you’ll get.

- Zoning and Land Use Permits: Your business location must be zoned for your specific type of business. If you’re operating from home, you’ll need to check if your residential zoning allows for your commercial activity (some cities have specific home-based business permits). If you’re opening a physical storefront, this is essential.

- Health Permits: Required for any business that prepares, sells, or serves food (restaurants, food trucks, bakeries), or provides personal services like spas, salons, tattoo parlors, or childcare facilities.

- Fire Department Permits: For businesses that host large numbers of people, use hazardous materials, or have specific building requirements.

- Building and Construction Permits: If you’re renovating, expanding, or building a new commercial space.

- Signage Permits: To install or change business signs.

- Alarm Permits: If you install a security alarm system.

- Action:

- For city requirements: Visit your city’s official website (e.g., City of [Your City Name]). Look for departments like "Business Licensing," "City Clerk," "Planning Department," "Code Enforcement," or "Finance Department."

- For county requirements (if you’re outside city limits or your county handles certain permits): Visit your county’s official website (e.g., [Your County Name] County Government).

- Tip: Call the city or county business licensing office directly. Explain your business type and location, and they can often guide you to the specific permits you need.

Step 5: Gather Necessary Information and Documentation

Once you know which licenses you need, start collecting the required information and documents. This typically includes:

- Your legal business name and any DBA names.

- Your business address and contact information.

- Your Employer Identification Number (EIN) or Social Security Number (for sole proprietors).

- Your business structure (Sole Proprietorship, LLC, etc.).

- A detailed description of your business activities.

- Owner(s) information (names, addresses, SSNs/EINs).

- Copies of state registrations (e.g., LLC Articles of Organization).

- Any professional licenses you hold.

- Lease agreement or proof of property ownership.

Step 6: Apply and Pay Fees

With all your research and documents in hand, you’re ready to apply.

- Online Applications: Many federal, state, and local agencies offer online application portals, which are often the quickest way to apply.

- Mail or In-Person: Some smaller jurisdictions might still require mail-in or in-person applications.

- Fees: Be prepared to pay application and licensing fees. These vary widely based on the type of license, your business activity, and the issuing agency. Keep a record of all payments.

- Processing Time: Be patient. Processing times can range from a few days to several weeks or even months for complex permits. Apply well in advance of your planned opening date.

Step 7: Stay Compliant and Renew

Getting your licenses is not a one-time event. To maintain legal operation, you must:

- Display Licenses: Some licenses (like health permits or general business licenses) must be prominently displayed at your place of business.

- Renew on Time: Most licenses have an expiration date (annual, biennial, etc.). Mark your calendar and renew them before they expire to avoid penalties or a lapse in your legal operating status.

- Update Information: If your business name, address, ownership, or activities change, you must notify the relevant licensing agencies.

- Keep Records: Maintain a file (digital and/or physical) of all your license applications, approvals, and renewal confirmations.

Common Types of Business Licenses and Permits

To give you a clearer picture, here are some of the most common types you might encounter:

- General Business License (Local): The most fundamental license, often required by your city or county to simply operate a business within their jurisdiction.

- Sales Tax Permit (State): Required if you sell taxable goods or services and need to collect sales tax from customers.

- Employer Identification Number (EIN) (Federal): A tax ID for businesses with employees, or those structured as corporations or partnerships.

- Professional/Occupational Licenses (State): For specific regulated professions like doctors, lawyers, beauticians, contractors, and real estate agents.

- Zoning and Land Use Permits (Local): Ensures your business location is approved for commercial activity and complies with local zoning laws. Crucial for physical storefronts or home-based businesses.

- Health Permits (Local): Essential for any business that handles food (restaurants, cafes, food trucks) or provides personal services that could affect public health (salons, tattoo parlors).

- Building Permits (Local): If you’re constructing, renovating, or altering a commercial space.

- Fire Department Permits (Local): For businesses that accommodate large groups, use hazardous materials, or have specific fire safety requirements.

- Environmental Permits (Federal/State/Local): For businesses whose operations might impact air, water, or land quality.

Tips for a Smooth Licensing Process

- Start Early: Don’t wait until the last minute. Research and apply for licenses well before your planned launch date.

- Be Thorough: Read all instructions carefully. Missing information is the most common reason for delays.

- Utilize Government Resources: The Small Business Administration (SBA) website, your state’s Department of Commerce, and your local Chamber of Commerce are excellent resources. They often have guides or direct links to relevant agencies.

- Contact Agencies Directly: If you’re unsure about a requirement, call the specific federal, state, city, or county department. Their staff are there to help.

- Consider Professional Help: For complex businesses or if you feel overwhelmed, consult with a business attorney or a professional business registration service. They can help identify necessary licenses and handle the application process for you.

- Keep Meticulous Records: Create a dedicated folder (digital and physical) for all your applications, receipts, permits, and licenses. This will be invaluable for renewals and future reference.

What Happens if You Don’t Get a Business License?

Operating a business without the required licenses and permits is illegal and can lead to severe consequences:

- Hefty Fines and Penalties: Governments can impose significant financial penalties for operating without proper authorization. These fines often accumulate daily.

- Business Closure: Authorities can issue a "Cease and Desist" order, forcing your business to shut down until you comply.

- Loss of Credibility: Word spreads, and your reputation will suffer, making it hard to attract customers or partners.

- Legal Action: Customers or competitors could sue you for operating illegally.

- Difficulty Getting Funding: Banks and investors typically require proof of legal operation before offering loans or investments.

- No Legal Recourse: If a customer doesn’t pay you, or if you have a dispute with a supplier, you may have limited legal options if your business isn’t legally recognized.

- Personal Liability: Without proper licensing and entity registration (like an LLC), your personal assets (home, savings) could be at risk if your business faces legal issues.

Conclusion: Take the Legal Leap

Getting a business license is a critical step in transforming your entrepreneurial vision into a legitimate, successful, and sustainable venture. While the process might seem daunting at first, breaking it down into manageable steps and leveraging available resources can make it much smoother.

By investing the time to properly research and obtain all necessary federal, state, and local licenses and permits, you’re not just complying with the law; you’re building a strong, credible foundation for your business’s future. Don’t let this essential step intimidate you – embrace it as a vital part of your journey to becoming a successful business owner.

Now, take that first step: identify your business structure and start researching the requirements in your specific location!

Post Comment