When to Consider a Balance Transfer Credit Card: Your Beginner’s Guide to Smarter Debt Management

Are you feeling overwhelmed by high-interest credit card debt? Watching your minimum payments barely chip away at the principal balance can be incredibly frustrating. If this sounds familiar, you might have heard whispers about "balance transfer credit cards" and wondered if they could be your financial knight in shining armor.

A balance transfer credit card isn’t a magic wand that makes debt disappear, but it can be a powerful tool for taking control of your finances – if used wisely. This comprehensive guide will help you understand what a balance transfer is, when it’s a smart move, and what to watch out for, all in easy-to-understand language.

What Exactly Is a Balance Transfer Credit Card?

At its core, a balance transfer credit card allows you to move debt from one or more high-interest credit cards to a new credit card, usually offering a promotional 0% or very low Annual Percentage Rate (APR) for a specific period.

Think of it like this: You have a loan with Bank A that charges you 20% interest. A new Bank B offers to let you transfer that loan to them, and they won’t charge you any interest for the first 12, 18, or even 21 months. This gives you a crucial window to pay down your debt without the burden of accumulating interest charges.

Key Components to Understand:

- Promotional APR: This is the temporary low (often 0%) interest rate. It’s the main appeal of a balance transfer.

- Promotional Period: The length of time the special APR lasts (e.g., 6, 12, 18, or 21 months). Once this period ends, the interest rate reverts to the card’s standard APR, which can be quite high.

- Balance Transfer Fee: Most balance transfer cards charge a fee for moving your debt. This is typically 3-5% of the amount transferred. For example, transferring $5,000 with a 3% fee would cost you $150. You need to factor this into your savings calculation.

- Credit Limit: The maximum amount of debt you can transfer will be limited by the credit limit you’re approved for on the new card.

When a Balance Transfer Credit Card Shines: The Ideal Scenarios

A balance transfer isn’t for everyone, but it can be an excellent strategy under the right circumstances. Here are the top situations where it’s worth considering:

1. You Have High-Interest Credit Card Debt

This is the most common and compelling reason. If you’re paying 18%, 20%, or even 25% interest on your current credit cards, a balance transfer can save you hundreds or even thousands of dollars in interest charges.

- Example: If you owe $5,000 at 20% APR, you’re paying roughly $83 in interest per month ($1,000 per year). With a 0% APR balance transfer, that $83 goes directly to paying down your principal.

2. You Have a Clear and Realistic Repayment Plan

This is crucial for success. A balance transfer is a temporary reprieve, not a permanent solution. You must have a plan to pay off the transferred balance before the promotional APR period ends.

- Ask Yourself: How much can I realistically afford to pay each month? Can I pay off the entire balance within the 0% APR period? Use an online balance transfer calculator to project your payments.

3. You Have Good to Excellent Credit

Lenders reserve the best balance transfer offers (0% APR for long periods) for applicants with strong credit scores (typically FICO 670+). A good score signals to lenders that you are a responsible borrower.

- Why it Matters: A higher credit score increases your chances of approval, getting a higher credit limit (allowing you to transfer more debt), and securing the longest promotional periods.

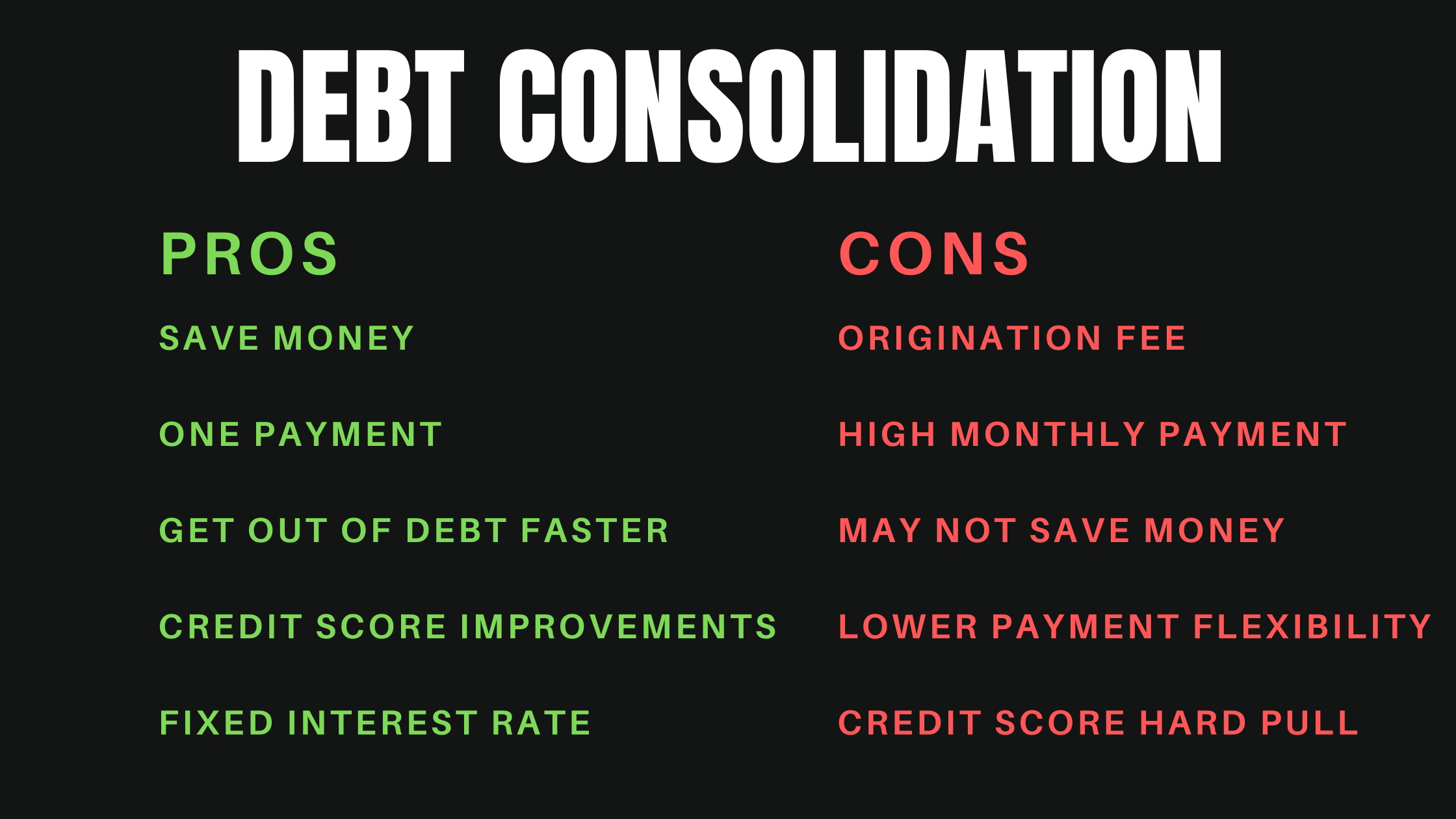

4. You Want to Simplify Your Debt Payments

If you’re juggling multiple credit card debts, a balance transfer can consolidate them into one monthly payment to a single lender. This makes budgeting and tracking your progress much easier.

- Benefit: Reduces the mental load of managing several due dates and minimum payments.

5. You’ve Identified and Fixed Your Spending Habits

A balance transfer is a fresh start. If you haven’t addressed the underlying reasons you accumulated debt in the first place (e.g., overspending, impulse purchases), you risk transferring debt and then racking up new debt on your old cards.

- Before Applying: Create a strict budget and commit to sticking to it. Cut up your old cards if necessary, or freeze them in a block of ice!

When to Think Twice: Red Flags and Risky Scenarios

While powerful, a balance transfer isn’t a magic bullet. Here are situations where it might not be the best choice, or could even make your financial situation worse:

1. You Don’t Have a Repayment Plan

If your strategy is simply to move debt around without a concrete plan to pay it off, you’re just delaying the inevitable. Once the promotional period ends, you’ll be stuck with a potentially high standard APR, possibly on a larger balance.

- Warning: This can lead to a cycle of transferring debt, accumulating fees, and never truly getting out of debt.

2. You Have a Tendency to Overspend

If you struggle with impulse control or sticking to a budget, opening a new credit card (even for a balance transfer) can be dangerous. The temptation to use the old, now empty, cards or even the new card for new purchases can lead to more debt.

- Risk: You could end up with more debt than when you started, spread across multiple cards.

3. Your Credit Score Isn’t Strong Enough

If your credit score is fair or poor, you might not qualify for the best 0% APR offers. You could be approved for a card with a much shorter promotional period, a higher balance transfer fee, or a higher standard APR, making the transfer less beneficial.

- Alternative: Focus on improving your credit score first through responsible credit use and paying bills on time.

4. You Have Too Much Debt to Transfer

Balance transfer cards come with credit limits. If your total debt exceeds the likely credit limit you’d be approved for, you might only be able to transfer a portion of your debt, limiting the overall savings.

- Consider: A personal loan or debt management plan might be more suitable for very large debt amounts.

5. The Balance Transfer Fee is Too High

While a 3-5% fee is standard, sometimes it can negate the interest savings, especially if you have a shorter promotional period or a smaller balance. Always calculate the fee into your total cost.

- Math Matters: Ensure the interest you save significantly outweighs the transfer fee.

6. You’ll Need to Make New Purchases Soon

If you anticipate needing to make large purchases (e.g., a new appliance, medical bills) in the near future, opening a balance transfer card might not be ideal. Many balance transfer cards apply payments to the promotional balance first, meaning new purchases would immediately incur interest at the standard (higher) APR.

- Strategy: Avoid new purchases on your balance transfer card altogether.

Key Factors to Evaluate Before Applying

Before you jump into a balance transfer application, do your homework. Compare these critical features:

- Promotional APR Duration: How long is the 0% or low APR period? Aim for the longest period you can get to maximize your payment window.

- Balance Transfer Fee: What is the percentage, and how much will it add to your transferred balance?

- Standard APR: What will the interest rate revert to after the promotional period ends? This is crucial if you can’t pay off the full balance in time.

- Credit Limit: Estimate the credit limit you might qualify for. Will it be enough to cover all the debt you want to transfer?

- Impact on Credit Score: Applying for new credit can temporarily ding your score. Ensure you’re prepared for this minor dip.

- New Purchase APR: Will new purchases on the card also get the 0% APR, or will they start accruing interest immediately? Most good balance transfer cards apply the 0% to transfers only.

Steps to Take for a Successful Balance Transfer

If you’ve determined a balance transfer is right for you, follow these steps for the best chance of success:

- Calculate Your Potential Savings: Use an online balance transfer calculator to see how much you could save on interest by paying off your debt within the promotional period.

- Create a Strict Repayment Plan: Determine exactly how much you need to pay each month to clear the balance before the 0% APR ends. Build this into your budget.

- Research and Compare Cards: Don’t just pick the first offer you see. Look at cards from different issuers, comparing promotional periods, fees, and standard APRs.

- Check Your Credit Score: Know where you stand before applying. This will help you target cards you’re more likely to be approved for.

- Apply Carefully: Apply for only one card at a time to avoid multiple hard inquiries on your credit report.

- Stop Using Old Cards: Once the balance is transferred, resist the urge to use your old credit cards. Consider cutting them up or locking them away.

- Pay On Time, Every Time: Missing a payment can often revoke your promotional APR, immediately charging you the standard, high interest rate. Set up automatic payments to avoid this.

What if a Balance Transfer Isn’t Right for You? (Alternative Solutions)

If a balance transfer doesn’t seem like the right fit, don’t despair! There are other strategies to tackle debt:

- Debt Snowball or Avalanche Method: These are budgeting strategies to systematically pay off debt by focusing on one card at a time (snowball: smallest balance first; avalanche: highest interest rate first).

- Personal Loan: You might qualify for a low-interest personal loan to consolidate your debt into a single, fixed monthly payment. This works well for those with good credit who prefer a predictable repayment schedule.

- Debt Management Plan (DMP): A non-profit credit counseling agency can help you create a DMP, negotiating lower interest rates with your creditors and consolidating your payments into one monthly sum.

- Budgeting and Frugality: Sometimes, the most effective solution is simply to cut expenses, find ways to earn more, and aggressively pay down debt with the extra cash.

Conclusion: Take Control of Your Debt

A balance transfer credit card can be an incredibly effective tool for managing and reducing high-interest debt, but it’s not a decision to be taken lightly. By understanding how they work, recognizing when they’re a good fit, and committing to a solid repayment plan, you can leverage these cards to save money, simplify your finances, and accelerate your journey to becoming debt-free.

Always do your research, read the fine print, and make sure any financial decision aligns with your long-term goals for financial health.

Post Comment