What is a Recession? A Beginner’s Guide to Global Economic Downturns

The word "recession" often conjures images of financial chaos, job losses, and economic despair. While a recession is indeed a challenging period, understanding what it is, what causes it, and how it impacts us can help demystify the concept and empower you to navigate uncertain times.

Think of an economy like a living organism. It breathes, grows, and sometimes, it catches a cold or even the flu. A recession is essentially the economy catching a serious flu – a period where its normal healthy activities slow down significantly. It’s a natural, albeit painful, part of the economic cycle, and understanding it is key to making informed decisions, whether you’re an individual, a business owner, or just curious about the world around you.

In this comprehensive guide, we’ll break down the complex topic of recessions into easy-to-understand language, exploring everything from their definition to their global impact and how we can prepare.

I. What Exactly is a Recession? The Simple Definition

At its core, a recession is a significant decline in general economic activity. While there’s no single, universally agreed-upon definition, the most commonly cited benchmark comes from the National Bureau of Economic Research (NBER) in the United States, which is often referenced globally.

The NBER defines a recession as:

"A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."

Let’s break that down even further:

-

Gross Domestic Product (GDP): The Economic Report Card

The most straightforward and widely used indicator for a recession is a fall in Gross Domestic Product (GDP). GDP measures the total value of all goods and services produced within a country’s borders over a specific period. It’s essentially the country’s economic "report card."- The "Two Consecutive Quarters" Rule: Many people and media outlets simplify the NBER definition, stating that a recession is when a country experiences two consecutive quarters (six months) of negative GDP growth. This means the economy is shrinking instead of growing. While this is a widely used rule of thumb, it’s important to remember that the NBER’s definition is broader, considering multiple factors.

-

Beyond GDP: A Holistic View

Economists look at more than just GDP. They consider a range of other factors to confirm if an economy is truly in a downturn:- Real Income: How much money people are earning, adjusted for inflation. If people’s real income is falling, they have less to spend.

- Employment: The number of people working. A significant and widespread increase in unemployment is a strong indicator of economic trouble.

- Industrial Production: How much factories and industries are producing. A decline here means less manufacturing and output.

- Wholesale-Retail Sales: How much businesses are selling to each other (wholesale) and to consumers (retail). A drop indicates reduced demand and spending.

So, while negative GDP is a major red flag, a true recession is characterized by a widespread and sustained contraction across various parts of the economy, not just one metric.

II. The Signs and Indicators of an Impending Recession

Recessions don’t typically happen overnight without warning. There are often several "flashing lights" or indicators that economists and policymakers watch closely. Think of these as the early symptoms of the economic flu:

- Rising Unemployment Rates: This is one of the most noticeable and painful signs. When businesses face declining sales and uncertainty, they often slow down hiring or even lay off employees to cut costs.

- Declining Consumer Confidence: If people are worried about their jobs, their income, or the future, they tend to spend less. This reduced spending can create a downward spiral for businesses.

- Falling Retail Sales: A direct consequence of reduced consumer confidence and income, people simply buy fewer goods and services.

- Decreased Manufacturing and Industrial Production: Factories produce less when demand for goods falls, leading to fewer orders and often, job cuts in the manufacturing sector.

- Stock Market Volatility and Decline: While not a direct cause, significant and sustained drops in stock market indices (like the S&P 500 or Dow Jones Industrial Average) often reflect investor fears about future corporate earnings and the broader economy.

- Inverted Yield Curve: This is a more technical indicator but highly watched. Normally, long-term bonds offer higher interest rates than short-term bonds (because you’re tying up your money for longer). An "inverted" yield curve is when short-term rates become higher than long-term rates, which has historically been a very reliable predictor of recessions. It suggests investors expect lower interest rates in the future due to an economic slowdown.

- Housing Market Slowdown: A decline in new home sales, housing starts, and house prices can signal a broader economic cooling, as housing is a major driver of economic activity.

III. What Causes a Recession? The Triggers of Economic Downturns

Recessions are complex and rarely have a single cause. Instead, they often result from a combination of factors that snowball into a widespread economic contraction. Here are some of the most common triggers:

-

1. Sudden Economic Shocks:

- Supply Shocks: Events that suddenly disrupt the supply of essential goods or services, leading to price spikes and production halts. Examples include:

- Sharp oil price increases: Makes transportation and manufacturing more expensive.

- Natural disasters: Destroy infrastructure and disrupt supply chains.

- Pandemics (like COVID-19): Force businesses to shut down, disrupt global trade, and lead to widespread layoffs.

- Demand Shocks: Events that cause a sudden and significant drop in consumer or business spending. This could be due to a loss of confidence, a financial crisis, or even a major policy change.

- Supply Shocks: Events that suddenly disrupt the supply of essential goods or services, leading to price spikes and production halts. Examples include:

-

2. Asset Bubbles Bursting:

- An "asset bubble" occurs when the price of an asset (like stocks, real estate, or even cryptocurrencies) inflates rapidly and unsustainably, far exceeding its true underlying value.

- When these bubbles "burst," prices crash, leading to a loss of wealth, reduced confidence, and often, a ripple effect across the financial system and broader economy.

- Example: The dot-com bubble burst in 2000-2001 and the subprime mortgage crisis (housing bubble) that triggered the Great Recession of 2008.

-

3. High Interest Rates / Tight Monetary Policy:

- Central banks (like the Federal Reserve in the US or the European Central Bank) raise interest rates to combat high inflation (when prices rise too quickly).

- While necessary to cool an overheating economy, excessively high interest rates can make borrowing money more expensive for businesses (hindering investment) and consumers (discouraging big purchases like homes or cars). This can slow down economic activity too much, pushing it into recession.

-

4. Debt Overhang:

- When households, businesses, or governments accumulate too much debt, it can become unsustainable.

- If a large number of borrowers default on their loans, it can destabilize banks and the financial system, making it harder for everyone to borrow and spend.

-

5. Deflation:

- The opposite of inflation, deflation is a sustained decrease in the general price level of goods and services.

- While it might sound good, deflation can be very damaging. If people expect prices to fall further, they postpone purchases, leading to reduced demand, lower corporate profits, and ultimately, job cuts. It also makes existing debt more expensive in real terms.

-

6. Global Economic Contagion:

- In an increasingly interconnected global economy, a recession in one major country or region can spread to others.

- This can happen through reduced international trade, decreased foreign investment, or financial market shocks that ripple across borders.

- Example: The 2008 financial crisis, which started in the US housing market, quickly spread globally due to interconnected financial systems.

IV. The Impact of a Recession: Who Gets Hit and How?

Recessions have widespread and often painful consequences that affect nearly everyone, though some more severely than others.

A. Impact on Individuals and Households:

- Job Losses and Unemployment: This is often the most direct and devastating impact. Businesses reduce staff, freeze hiring, or even close down, leading to widespread unemployment.

- Reduced Income: Even for those who keep their jobs, wages may stagnate or fall, and bonuses might disappear. Overtime hours are often cut.

- Declining Wealth: Stock market declines can erode retirement savings (like 401ks), and falling home values can reduce personal equity.

- Difficulty Getting Loans: Banks become more cautious, making it harder to get mortgages, car loans, or even small business loans.

- Increased Stress and Mental Health Issues: Financial insecurity and uncertainty can take a significant toll on well-being.

- Delayed Life Plans: People may postpone buying a home, starting a family, or retiring due to financial instability.

B. Impact on Businesses:

- Decreased Sales and Revenue: As consumers spend less, businesses see their sales plummet.

- Reduced Profits: Lower sales and potentially higher costs (if supply chains are disrupted) shrink profit margins.

- Bankruptcies and Closures: Weaker businesses, or those heavily reliant on consumer spending, may not survive the downturn.

- Reduced Investment: Businesses postpone or cancel plans for expansion, new equipment, or research and development, further slowing economic growth.

- Tighter Credit: Banks are less willing to lend, making it difficult for businesses to access the capital they need to operate or grow.

C. Impact on Governments:

- Reduced Tax Revenue: With fewer people working and businesses making less profit, tax collections (income tax, corporate tax, sales tax) fall significantly.

- Increased Spending on Social Safety Nets: Governments often need to spend more on unemployment benefits, food assistance, and other social programs to support those affected by the recession.

- Increased Borrowing: To cover the gap between falling revenue and rising expenses, governments often have to borrow more, increasing national debt.

- Pressure for Stimulus: There’s immense pressure on governments to implement policies to stimulate the economy (see next section).

D. Impact on the Global Economy:

- Reduced International Trade: As countries produce and consume less, demand for imports falls, and exports decline.

- Falling Commodity Prices: Demand for raw materials (like oil, metals, agricultural products) often drops, hurting commodity-exporting nations.

- Reduced Foreign Investment: Investors become more risk-averse and pull money out of foreign markets.

- Currency Fluctuations: Economic instability can lead to significant shifts in currency values, impacting trade and investment.

- Contagion: A severe recession in one major economy can easily spread to others through trade links, financial markets, and investor confidence.

V. How Do Governments and Central Banks Respond? The Toolkit

When a recession hits, governments and central banks don’t just stand by. They have powerful tools at their disposal to try and soften the blow, shorten the duration of the downturn, and stimulate recovery.

A. Monetary Policy (Central Banks – e.g., Federal Reserve, European Central Bank):

Central banks primarily manage the money supply and interest rates.

-

1. Lowering Interest Rates:

- This is the most common tool. By reducing their benchmark interest rate, central banks make it cheaper for commercial banks to borrow money.

- This, in turn, encourages banks to lend more to businesses and consumers at lower rates.

- Effect: Lower borrowing costs stimulate spending (e.g., buying homes, cars) and investment (e.g., businesses expanding), boosting economic activity.

-

2. Quantitative Easing (QE):

- If interest rates are already near zero and the economy still needs a boost, central banks might resort to QE.

- This involves the central bank buying large quantities of government bonds and other financial assets from commercial banks.

- Effect: This injects more money directly into the financial system, increasing liquidity, pushing down long-term interest rates, and encouraging banks to lend more.

-

3. Forward Guidance:

- Central banks communicate their future intentions regarding monetary policy.

- Effect: By signaling that interest rates will remain low for an extended period, they can provide certainty to businesses and consumers, encouraging long-term planning and investment.

B. Fiscal Policy (Governments – e.g., Parliament, Congress, Treasury):

Governments use their spending and taxation powers to influence the economy.

-

1. Increased Government Spending:

- Infrastructure Projects: Building roads, bridges, and public transport creates jobs directly and indirectly, and improves long-term productivity.

- Social Programs: Increased unemployment benefits, food stamps, and housing assistance provide a safety net and ensure people have money to spend, supporting demand.

- Direct Stimulus Checks: Sending money directly to citizens to encourage immediate spending (e.g., during the COVID-19 pandemic).

- Effect: This directly injects money into the economy, boosting demand and creating jobs.

-

2. Tax Cuts:

- For Individuals: Reducing income taxes leaves people with more disposable income, encouraging spending.

- For Businesses: Cutting corporate taxes or offering tax credits can encourage companies to invest, hire, or expand.

- Effect: Aims to stimulate spending and investment by increasing the money available to individuals and businesses.

-

3. Bailouts and Loans:

- In severe crises, governments might provide financial assistance to struggling industries (e.g., banks, auto manufacturers) to prevent widespread collapse and job losses.

- Effect: Stabilizes critical sectors of the economy and prevents a broader systemic failure.

These policies are often implemented in combination, and their effectiveness can depend on the specific nature of the recession and the global economic context.

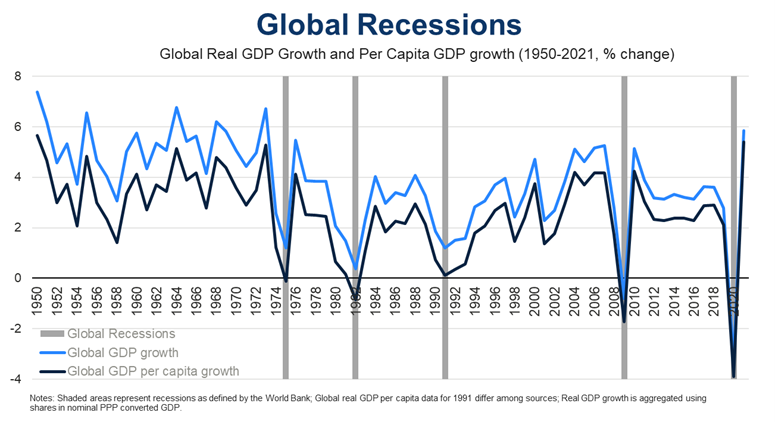

VI. Historical Examples of Global Economic Downturns

Recessions are not new phenomena. History is replete with examples of economic downturns, each with its own unique triggers and characteristics.

-

The Great Depression (1929-1939):

- Cause: Triggered by the stock market crash of 1929, compounded by banking panics, restrictive trade policies, and a severe drought.

- Impact: The deepest and longest economic downturn in modern history, leading to mass unemployment (up to 25% in the US), widespread poverty, and significant social unrest globally.

-

The Dot-Com Bubble Burst (2000-2001):

- Cause: Speculative investment in internet-based companies led to inflated stock prices, which then crashed.

- Impact: A relatively mild recession, primarily affecting the technology sector and stock markets, but it did lead to job losses and a slowdown in investment.

-

The Great Recession (2008-2009):

- Cause: Originated in the US subprime mortgage market, where risky loans led to a housing bubble and subsequent collapse. This triggered a global financial crisis due to interconnected banking systems and complex financial products.

- Impact: Severe global economic contraction, widespread job losses, massive government bailouts of financial institutions, and a prolonged period of slow recovery in many countries.

-

The COVID-19 Recession (2020):

- Cause: A sudden and unprecedented global pandemic led to widespread lockdowns, travel restrictions, and business closures to contain the virus. This was a unique "supply and demand shock" simultaneously.

- Impact: The sharpest and deepest, but also shortest, recession in modern history. Governments and central banks responded with massive fiscal and monetary stimulus, leading to a relatively quick, albeit uneven, recovery.

Each of these downturns highlights the diverse nature of recessions and the evolving strategies used to combat them.

VII. Is a Recession Always Bad? The Silver Linings (A Brief Look)

While recessions are undoubtedly painful, some economists argue that they can also have a "cleansing" effect on the economy.

- Elimination of Inefficient Businesses: Weaker, less productive businesses that were only surviving during good times may fail, allowing resources (labor, capital) to be reallocated to more efficient and innovative companies.

- Spurring Innovation: Economic pressure can force businesses to become more efficient, innovate, and find new ways to operate, leading to long-term productivity gains.

- Reduced Inflation: A slowdown in demand can help to bring down stubbornly high inflation, restoring purchasing power in the long run.

- Correction of Asset Bubbles: While painful, the bursting of bubbles can prevent even larger, more catastrophic crashes later on.

- Opportunity for Prudent Businesses: Companies with strong balance sheets and good management can often acquire assets or talent at lower prices during a downturn, positioning themselves for stronger growth when recovery begins.

It’s crucial to acknowledge that these "silver linings" come at a significant human cost, but they are part of the broader economic cycle that, over time, contributes to overall growth and efficiency.

VIII. Preparing for a Potential Recession: Personal and Business Strategies

While you can’t control the global economy, you can certainly take steps to prepare yourself and your finances for a potential downturn.

A. For Individuals and Households:

- Build an Emergency Fund: Aim for at least 3-6 months (or even 6-12 months for extra security) of essential living expenses saved in an easily accessible account. This is your first line of defense against job loss or reduced income.

- Reduce Debt: Pay down high-interest debt (credit cards, personal loans). Less debt means fewer monthly obligations if your income shrinks.

- Diversify Your Income Streams: If possible, explore side hustles, freelance work, or develop skills that can be monetized outside your primary job.

- Review Your Budget: Cut unnecessary expenses now to free up cash. Understand where every dollar goes.

- Invest Cautiously (but don’t panic sell): If you have long-term investments (like retirement accounts), avoid panic selling during a market downturn. Market recoveries often follow recessions, and you risk locking in losses. Consider consulting a financial advisor.

- Upskill or Reskill: Enhance your existing job skills or learn new ones that are in demand, making you more marketable if job hunting becomes necessary.

- Maintain a Strong Professional Network: Connect with colleagues, mentors, and industry contacts. Networking can be invaluable for job searching or career advice.

B. For Businesses:

- Strengthen Your Cash Flow: Focus on maintaining strong liquidity. Build up cash reserves and manage accounts receivable tightly.

- Reduce Non-Essential Costs: Identify and cut unnecessary expenses before a downturn forces your hand.

- Diversify Revenue Streams: Don’t rely too heavily on a single product, service, or customer segment.

- Review and Optimize Supply Chains: Identify potential vulnerabilities and have contingency plans for disruptions.

- Invest in Technology and Efficiency: Automation and digital tools can help reduce operating costs and improve productivity, making your business more resilient.

- Maintain Good Relationships with Lenders: Having a strong banking relationship can be crucial if you need access to credit during tough times.

- Retain Key Talent: While cost-cutting is necessary, losing your best employees can hinder recovery. Focus on retaining your most valuable assets.

- Communicate Transparently: Keep employees, customers, and investors informed about your strategies and challenges.

Conclusion: Understanding and Navigating the Economic Cycle

Recessions are a recurring feature of the global economic landscape. They are periods of contraction, often painful, characterized by declining GDP, rising unemployment, and reduced spending. While they can be triggered by diverse factors – from financial bubbles to pandemics – their impact is far-reaching, affecting individuals, businesses, and governments alike.

However, understanding what a recession is, recognizing its signs, and knowing the tools policymakers use to combat it can help alleviate some of the fear and uncertainty. Furthermore, by taking proactive steps in your personal and business financial planning, you can build resilience and better weather these economic storms.

The global economy is a dynamic system, constantly evolving. By staying informed and prepared, you can navigate its ups and downs with greater confidence and emerge stronger on the other side.

Post Comment