What is a Budget and Why Every Business Needs One? Your Ultimate Guide to Financial Clarity

Have you ever felt like your business’s finances are a bit like a tangled ball of yarn? Money comes in, money goes out, and at the end of the month, you’re not entirely sure where it all went or if you’re truly making a profit. You’re not alone! Many business owners, especially those just starting out, feel overwhelmed by the financial side of things.

But what if there was a simple, powerful tool that could untangle that yarn, give you a clear roadmap for your money, and help you make smarter decisions for your business’s future?

That tool is a budget.

In this comprehensive guide, we’re going to break down exactly what a budget is, why it’s not just for big corporations, and how even the smallest business can benefit immensely from having one. We’ll cut through the jargon and make it easy for anyone to understand why a budget is your business’s best friend.

Table of Contents:

- What Exactly Is a Business Budget? (Simplified)

- Why Your Business Can’t Live Without a Budget: The Core Benefits

- Gain Crystal-Clear Financial Vision

- Set & Achieve Realistic Goals

- Make Smarter, Data-Driven Decisions

- Identify Financial Strengths & Weaknesses

- Master Your Cash Flow

- Boost Accountability

- Secure Funding More Easily

- Plan for Growth and the Future

- Common Budgeting Myths & Mistakes to Avoid

- Getting Started: How to Create a Simple Business Budget (Step-by-Step)

- Step 1: Gather Your Financial Data

- Step 2: Estimate Your Income

- Step 3: List Your Expenses (Fixed vs. Variable)

- Step 4: Calculate Your Profit or Loss

- Step 5: Monitor and Adjust Regularly

- Frequently Asked Questions (FAQs) About Business Budgeting

- Conclusion: Empower Your Business with a Budget

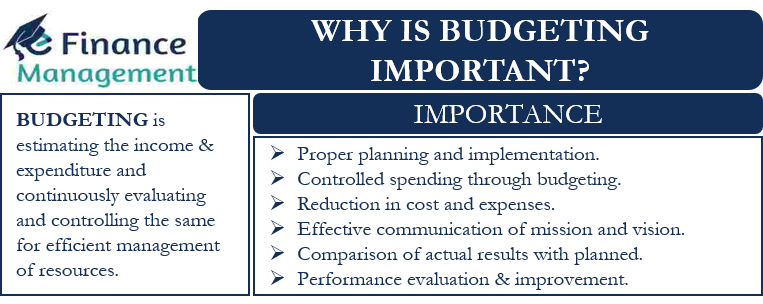

1. What Exactly Is a Business Budget? (Simplified)

Think of a budget like a financial GPS for your business. Just as a GPS helps you plan your route, estimate your arrival time, and avoid unexpected detours, a budget helps you:

- Plan where your money will come from (income).

- Decide where your money will go (expenses).

- Understand your financial destination (profit or loss).

In simple terms, a business budget is a detailed financial plan that estimates your expected income and expenses over a specific period, usually a month, quarter, or year.

It’s not about restricting your spending or making you feel guilty about every dollar. Instead, it’s about giving you control and clarity. It’s a proactive tool that helps you predict, track, and manage your financial resources effectively.

Key Components of Any Budget:

- Income/Revenue: All the money your business expects to bring in from sales of products, services, investments, etc.

- Expenses: All the money your business expects to spend. These can be broken down into:

- Fixed Expenses: Costs that generally stay the same each month (e.g., rent, insurance premiums, loan payments, salaries).

- Variable Expenses: Costs that change based on your business activity (e.g., raw materials, marketing spend based on campaigns, shipping costs, utility bills that fluctuate).

- Profit/Loss: The difference between your income and your expenses. If income is higher than expenses, you have a profit. If expenses are higher, you have a loss.

A budget is a living document – it’s not set in stone. It needs to be reviewed and adjusted as your business evolves and new opportunities or challenges arise.

2. Why Your Business Can’t Live Without a Budget: The Core Benefits

Still wondering if a budget is really worth the effort? Let’s dive into the compelling reasons why every business, no matter its size or industry, absolutely needs one.

1. Gain Crystal-Clear Financial Vision

Imagine driving a car without a dashboard – no speedometer, no fuel gauge, no warning lights. That’s what running a business without a budget can feel like. A budget acts as your financial dashboard, providing a clear, real-time picture of:

- Where your money is coming from.

- Where it’s going.

- How much you have available.

- Whether you’re on track to meet your financial goals.

This clarity helps you avoid surprises and empowers you to make informed decisions.

2. Set & Achieve Realistic Goals

Whether your goal is to launch a new product, expand into a new market, hire more staff, or simply increase your profit margins, a budget is essential. It helps you:

- Quantify your goals: How much revenue do you need to generate? How much can you afford to spend on marketing or research and development?

- Create a roadmap: A budget breaks down big goals into manageable financial steps. You can see what’s financially feasible and what adjustments you need to make to get there.

- Stay accountable: By setting financial targets, you and your team have clear benchmarks to work towards.

3. Make Smarter, Data-Driven Decisions

Guesswork is a dangerous strategy in business. A budget provides the data you need to make intelligent choices, such as:

- Pricing strategies: Are your prices high enough to cover costs and generate a desired profit?

- Investment decisions: Can you afford that new equipment? Is this marketing campaign likely to yield a good return on investment?

- Hiring plans: Can your current finances support new employees, or do you need to increase revenue first?

- Cutting costs: Where can you trim expenses without impacting quality or growth?

With a budget, you’re reacting to facts, not just feelings.

4. Identify Financial Strengths & Weaknesses

A budget helps you pinpoint what’s working well and what’s not. You might discover:

- Profit centers: Which products or services are generating the most revenue relative to their cost?

- Cost centers: Where are you spending too much? Are there unnecessary expenses or areas where you could negotiate better deals?

- Underperforming areas: Are certain parts of your business consistently losing money? This insight allows you to take corrective action, whether it’s optimizing, restructuring, or even eliminating.

5. Master Your Cash Flow

Cash flow is the lifeblood of any business. It’s the movement of money in and out. Even profitable businesses can fail if they run out of cash. A budget helps you:

- Anticipate lean periods: Are there seasonal dips in your income? A budget helps you prepare for these by setting aside funds or finding alternative revenue streams.

- Manage payment cycles: When are your bills due, and when do you expect to receive payments from customers? A budget helps you ensure you have enough cash on hand to cover your obligations.

- Prevent cash shortages: By monitoring your cash flow, you can proactively address potential shortfalls before they become crises.

6. Boost Accountability

When you have a budget, every department or team member responsible for a certain line item has a clear target. This fosters:

- Responsibility: Everyone knows their financial limits and expectations.

- Transparency: It’s clear where money is being spent and who is accountable for those expenditures.

- Performance measurement: You can easily track actual spending against budgeted amounts, allowing for performance reviews and adjustments.

7. Secure Funding More Easily

If you ever need a loan from a bank, attract investors, or apply for grants, a well-structured and consistently maintained budget is non-negotiable. It demonstrates that you:

- Are serious about your business.

- Understand your financial position.

- Have a plan for how you’ll use the funds and repay them.

- Are a responsible and reliable borrower/investment opportunity.

It’s proof that you’re managing your business proactively, not just reacting to circumstances.

8. Plan for Growth and the Future

A budget isn’t just about managing today; it’s about preparing for tomorrow. By understanding your current financial state and projecting future trends, you can:

- Identify opportunities for expansion.

- Allocate resources for research and development.

- Build a financial cushion for emergencies.

- Strategically invest in long-term assets.

It allows you to move beyond day-to-day survival and start thinking about sustainable growth and innovation.

3. Common Budgeting Myths & Mistakes to Avoid

Before you dive in, let’s clear up some common misconceptions and pitfalls that can make budgeting seem harder than it is.

- Myth: Budgeting is only for big businesses.

- Reality: False! Even a solopreneur or a tiny startup benefits immensely from understanding their income and expenses. The principles are the same, just on a smaller scale.

- Myth: Once you set a budget, it’s set in stone.

- Reality: Budgets are living documents. Your business changes, the market changes, and your budget should too. Regular review and adjustment are key.

- Mistake: Being too rigid.

- Avoid: Don’t let your budget become a straitjacket that prevents you from seizing new opportunities or adapting to unforeseen circumstances. It’s a guide, not a dictator.

- Mistake: Ignoring small expenses.

- Avoid: Those "small" things like office supplies, subscription services, or coffee runs can add up quickly. Track everything!

- Mistake: Not reviewing your budget regularly.

- Avoid: A budget is useless if you create it and then forget about it. Compare your actual results to your budget monthly or quarterly.

- Mistake: Overcomplicating it.

- Avoid: You don’t need fancy software or a finance degree to start. A simple spreadsheet is perfectly fine for many businesses. Start simple and add complexity as needed.

- Mistake: Using it as a punishment.

- Avoid: Don’t view your budget as a tool to shame yourself or your team for overspending. View it as a tool for understanding, learning, and improving.

4. Getting Started: How to Create a Simple Business Budget (Step-by-Step)

Ready to create your first business budget? It’s easier than you think! Here’s a simplified, beginner-friendly approach:

Step 1: Gather Your Financial Data

You can’t plan where your money will go if you don’t know where it’s been. Collect all your financial records from the past 3-12 months. This includes:

- Bank statements

- Credit card statements

- Sales records/invoices

- Receipts for all purchases

- Payroll records

- Previous tax returns (if applicable)

This historical data will give you a realistic baseline for your income and expenses.

Step 2: Estimate Your Income (Revenue)

Look at your historical sales data. How much money has your business typically brought in each month?

- For established businesses: Average your monthly revenue over the last 6-12 months.

- For new businesses: Make educated guesses based on market research, sales projections, and competitor analysis. Be conservative with your estimates – it’s better to underestimate income and be pleasantly surprised than to overestimate and fall short.

Pro-Tip: If your income is seasonal, make sure your budget reflects those peaks and valleys.

Step 3: List Your Expenses (Fixed vs. Variable)

Now, identify everything your business spends money on. This is where your gathered financial data comes in handy. Categorize them into two main groups:

A. Fixed Expenses:

These are costs that generally stay the same each month, regardless of your sales volume.

- Examples:

- Rent/Lease payments

- Insurance premiums

- Loan repayments

- Software subscriptions (monthly)

- Salaries (for permanent staff)

- Website hosting

- Bookkeeping services

B. Variable Expenses:

These costs fluctuate based on your business activity, sales volume, or usage.

- Examples:

- Cost of Goods Sold (COGS) – raw materials, production costs

- Marketing and advertising spend

- Shipping costs

- Commissions for sales staff

- Office supplies (unless a fixed monthly order)

- Utilities (electricity, water, gas – can fluctuate)

- Travel expenses

- Hourly wages for temporary staff

Important: Don’t forget those small, seemingly insignificant expenses. They add up! Create clear categories for easy tracking.

Step 4: Calculate Your Profit or Loss

This is the moment of truth! For your chosen budget period (e.g., monthly):

Total Estimated Income – Total Estimated Expenses = Estimated Profit or Loss

- If you have a positive number: Great! This is your estimated profit. You can then decide how to allocate this profit (reinvest, save, owner’s draw, etc.).

- If you have a negative number: This indicates an estimated loss. Don’t panic! This is valuable information. It means you need to either:

- Increase your estimated income.

- Decrease your estimated expenses.

- Or a combination of both.

This step helps you understand if your current business model is financially viable as planned.

Step 5: Monitor and Adjust Regularly

Creating the budget is only half the battle. The real power comes from using it consistently.

- Review Monthly/Quarterly: At the end of each month or quarter, compare your actual income and expenses to your budgeted amounts.

- Where did you go over budget? Why?

- Where did you come in under budget? Why?

- Did you earn more or less than expected?

- Identify Trends: Look for patterns. Are certain expenses consistently higher than planned? Is your revenue steadily increasing or decreasing?

- Make Adjustments: Based on your review, tweak your budget for the next period. Maybe you need to allocate more for marketing, find a cheaper supplier, or raise your prices.

- Stay Flexible: Your business environment is always changing. Your budget should be able to adapt to new opportunities, challenges, or economic shifts.

Tools for Budgeting:

- Spreadsheets: Google Sheets or Microsoft Excel are powerful and flexible for basic budgeting.

- Accounting Software: Tools like QuickBooks, Xero, or FreshBooks often have budgeting features built-in and automate expense tracking.

- Budgeting Apps: Many user-friendly apps are designed specifically for small businesses.

Choose a tool that you find easy to use and that fits your business’s complexity. The best tool is the one you’ll actually use!

5. Frequently Asked Questions (FAQs) About Business Budgeting

Here are answers to some common questions beginners have about business budgeting:

Q1: How often should I create or review my business budget?

A: You should typically create an annual budget. However, you should review and adjust it at least monthly or quarterly to ensure it remains relevant and accurate.

Q2: What if my actual expenses are always higher than my budget?

A: This is a common issue! It means your budget isn’t realistic or you have spending habits that need to be re-evaluated.

- Solution 1: Adjust your budget. Make sure your expense estimates are realistic based on past spending.

- Solution 2: Cut costs. Look for areas where you can reduce spending without impacting quality or essential operations.

- Solution 3: Increase income. Explore ways to boost your sales or revenue streams.

The budget helps you identify this gap so you can take action.

Q3: Do I need special software to create a budget?

A: No! While accounting software can streamline the process, you can start with a simple spreadsheet (like Excel or Google Sheets) or even a pen and paper. The most important thing is to start tracking.

Q4: Is a budget the same as a forecast?

A: Not quite, but they are related.

- A budget is a plan for what you intend to happen financially. It’s about setting targets.

- A forecast is a prediction of what will happen based on current trends and data. It’s about estimating future outcomes.

You use past budget performance and current data to create more accurate forecasts.

Q5: What’s the difference between a cash flow budget and a profit & loss budget?

A:

- Profit & Loss (P&L) Budget: Focuses on revenue earned and expenses incurred, regardless of when cash changes hands. It tells you if you’re making a profit over a period.

- Cash Flow Budget: Focuses on the actual movement of cash in and out of your business. It’s crucial for ensuring you have enough liquid funds to pay bills on time. You can be profitable on paper but still run out of cash! Both are important.

Conclusion: Empower Your Business with a Budget

The idea of creating a budget might seem daunting at first, but it’s truly one of the most empowering things you can do for your business. It transforms financial uncertainty into clarity, guesswork into informed decisions, and vague hopes into achievable goals.

A budget isn’t just about numbers; it’s about control, confidence, and the freedom to grow your business strategically. By embracing this fundamental financial tool, you’ll not only understand where your money is going but also gain the ability to direct it towards the future you envision for your company.

Don’t wait for a financial crisis to start budgeting. Begin today, even with a simple spreadsheet. Your business, and your peace of mind, will thank you for it.

Post Comment