What Causes a Financial Crisis? Top Factors Behind Economic Meltdowns Explained Simply

Imagine a calm sea suddenly turning into a raging storm, tossing ships around and threatening to capsize everything in its path. That’s a bit like what a financial crisis feels like for an economy. It’s a severe and sudden disruption where financial assets rapidly lose value, companies struggle, banks face collapse, and people lose jobs and savings.

Understanding what causes these economic storms is crucial, not just for economists, but for everyone. While no two crises are exactly alike, and they are often complex events with many moving parts, certain common factors tend to contribute to their onset.

Let’s break down the top causes of a financial crisis in easy-to-understand terms.

1. Excessive Debt: When Everyone Borrows Too Much

One of the most common culprits behind a financial crisis is simply too much borrowing. Whether it’s individuals, businesses, or governments, when debt levels become unsustainable, the entire system becomes fragile.

- Household Debt: Imagine families taking out huge mortgages they can barely afford, or racking up credit card bills that spiral out of control. When interest rates rise or incomes fall, these debts become impossible to repay. Defaults spread, hitting banks that lent the money.

- Corporate Debt: Businesses often borrow to expand, invest, or even just cover their day-to-day costs. If they borrow too much, and their ventures don’t pay off, they can’t repay their loans, leading to bankruptcies and job losses.

- Government Debt: Countries also borrow money, often to fund public services or stimulate the economy. If a government borrows excessively and can’t convince investors it can repay its debts, it can face a sovereign debt crisis, leading to a loss of confidence in the entire economy.

Why it’s a problem: High debt levels make the economy like a house of cards. One small tremor can cause it to collapse because everyone is so financially stretched.

2. Asset Bubbles and Speculation: When Prices Defy Reality

An asset bubble occurs when the price of an asset (like housing, stocks, or even cryptocurrencies) rises rapidly and far beyond its true, underlying value. This is often fueled by speculation, where people buy the asset not because they believe in its intrinsic worth, but simply because they expect its price to keep going up, hoping to sell it for a quick profit.

- The "Bubble" Effect: Think of the housing market before the 2008 financial crisis. People were buying houses they couldn’t afford, believing prices would always go up. Lenders were happy to give them loans because they believed the collateral (the house) would always be worth more.

- The "Burst": Eventually, reality sets in. Prices stop rising, and then they start to fall. As prices drop, the speculative buyers panic and try to sell, flooding the market and causing prices to crash even faster. This is when the "bubble bursts."

- Consequences: When a major asset bubble bursts, it destroys wealth, makes people feel poorer, and can lead to widespread defaults on loans tied to that asset, impacting banks and the broader economy.

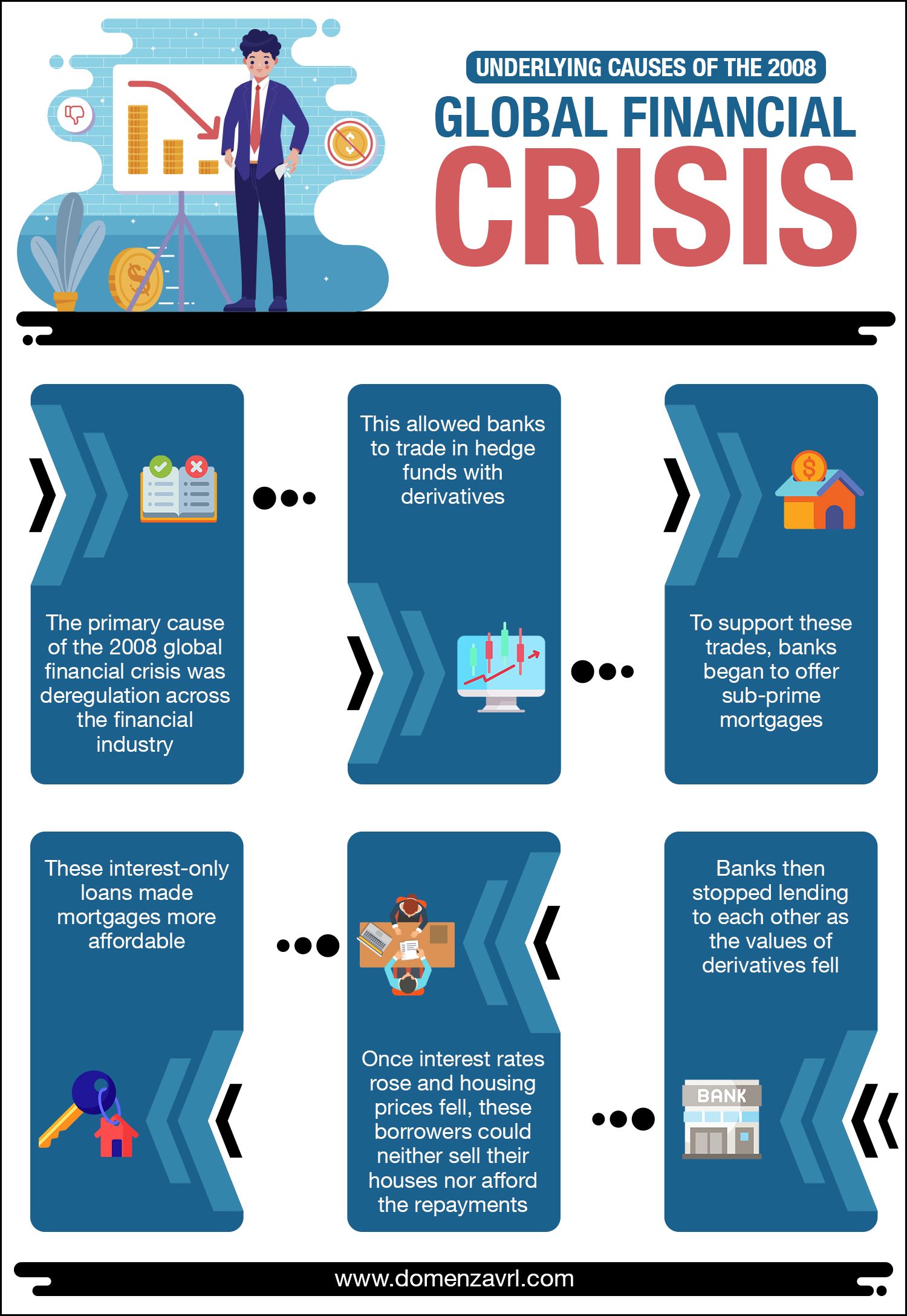

3. Lack of or Ineffective Regulation: The Rules of the Game

Financial systems need rules and oversight (regulation) to ensure stability and prevent excessive risk-taking. When regulation is weak, outdated, or poorly enforced, it opens the door for dangerous practices.

- Too Much Risk-Taking: Without proper rules, banks and financial institutions might take on too much risk, making risky loans or investing in complex, dangerous assets.

- "Shadow Banking": Sometimes, financial activities move outside the traditional, regulated banking system into a less-regulated "shadow banking" sector. This can include hedge funds or specific types of investment firms. When these entities get into trouble, the lack of oversight makes it harder to contain the damage.

- Example (2008): A key factor in the 2008 crisis was the lax regulation around subprime mortgages (loans given to borrowers with poor credit) and the complex financial products built from them. Regulators didn’t fully understand or control the risks involved.

The Balancing Act: It’s a tricky balance. Too much regulation can stifle innovation and growth, but too little can lead to reckless behavior and systemic collapse.

4. Sudden Interest Rate Changes: The Cost of Money

Interest rates are essentially the cost of borrowing money. Central banks (like the Federal Reserve in the U.S.) control these rates to manage the economy. Sudden or significant changes can have a ripple effect.

- Rising Rates: If interest rates rise too quickly, it makes existing loans more expensive to repay (especially those with variable rates), and new borrowing becomes less attractive. This can slow down economic activity, make it harder for businesses to invest, and increase the burden on indebted households and governments.

- Falling Rates (Indirectly): While falling rates usually stimulate borrowing and economic activity, if they stay too low for too long, they can encourage excessive risk-taking and asset bubbles, as borrowing becomes incredibly cheap and people search for higher returns in riskier investments.

The "Straw That Breaks the Camel’s Back": Sometimes, a sharp increase in interest rates can be the trigger that pops an existing asset bubble or pushes over-indebted borrowers into default.

5. Loss of Confidence and Panic: The Psychological Factor

Financial markets are heavily influenced by psychology. Confidence is key. When people believe the system is stable, they invest, lend, and spend. But when confidence erodes, panic can set in, leading to a "run" on banks or a massive sell-off in markets.

- Bank Runs: If people suddenly lose faith in a bank, they might all rush to withdraw their money at once. Since banks only keep a fraction of deposits on hand (most is lent out), a bank run can quickly make even a healthy bank insolvent.

- Market Sell-offs: When investors panic, they sell stocks, bonds, or other assets en masse, fearing further losses. This rapid selling drives prices down, creating a vicious cycle and wiping out significant wealth.

- Self-Fulfilling Prophecy: Fear can become a self-fulfilling prophecy. If enough people believe a crisis is coming, their actions (withdrawing money, selling assets) can actually cause the crisis.

6. Contagion and Interconnectedness: The Domino Effect

In today’s globalized world, financial systems are highly interconnected. Problems in one part of the system or one country can quickly spread to others, like a contagious disease. This is known as contagion.

- Bank-to-Bank Lending: Banks lend money to each other constantly. If one major bank gets into trouble, it can’t repay its loans to other banks, which then face their own liquidity problems, potentially triggering a chain reaction.

- Globalized Markets: Thanks to globalization, money flows freely across borders. A crisis in one major economy can cause investors to pull money out of other countries, leading to currency crashes, stock market declines, and economic instability worldwide.

- The "Too Big to Fail" Problem: Some financial institutions are so large and interconnected that their collapse would cause catastrophic damage to the entire system. Governments often feel compelled to bail them out, which creates its own set of problems.

7. Complex Financial Instruments: The "Black Boxes"

Over time, financial markets create increasingly complex products, often called derivatives. These are financial contracts whose value is "derived" from an underlying asset (like stocks, bonds, or commodities). While they can be useful for managing risk, they can also become incredibly dangerous.

- Opaque and Risky: Many of these instruments are so complex that even the people trading them don’t fully understand the risks involved. They can hide liabilities and amplify losses rapidly.

- Example (2008): Collateralized Debt Obligations (CDOs) and Credit Default Swaps (CDS) were highly complex derivatives that played a central role in the 2008 crisis. They allowed risks from subprime mortgages to be spread throughout the global financial system in ways that were not transparent or well-understood.

8. Government Policy Mistakes: When Good Intentions Go Wrong

While governments and central banks try to prevent crises, sometimes their policies can inadvertently contribute to them.

- Fiscal Policy Errors: Governments might spend too much, accumulate excessive debt, or implement tax policies that create imbalances in the economy.

- Monetary Policy Errors: Central banks might keep interest rates too low for too long, fueling asset bubbles, or raise them too quickly, stifling growth.

- Bailouts and Moral Hazard: Sometimes, governments bail out failing banks or companies to prevent a wider collapse. While this can stop immediate contagion, it can also create "moral hazard" – where institutions take bigger risks in the future, believing the government will always save them.

The Interconnected Web: A Recipe for Disaster

It’s rare for a financial crisis to have just one cause. More often, it’s a combination of several of these factors interacting and amplifying each other. For example, excessive debt might fuel an asset bubble, which then bursts due to rising interest rates, leading to a loss of confidence that spreads through the interconnected financial system because of complex, unregulated financial instruments.

Think of it as a complex recipe for disaster, where all the ingredients come together at the wrong time.

Can We Predict Financial Crises?

Not precisely. While economists can identify warning signs – like rapidly rising debt, inflated asset prices, or unusual risk-taking – predicting the exact timing and trigger of a crisis is incredibly difficult. Human behavior, unforeseen events (like a pandemic or a geopolitical shock), and the sheer complexity of the global economy make precise predictions impossible.

However, by understanding these underlying causes, we can be better prepared, implement smarter policies, and hopefully, build a more resilient financial system. Learning from history is our best defense against future economic storms.

Post Comment