Venture Capital Funding: A Comprehensive Guide for Startups to Secure Investment

For many startups, securing venture capital (VC) funding is the dream ticket to rapid growth and market domination. It’s not just about the money; it’s about gaining strategic partners, invaluable expertise, and a network that can propel your company light-years ahead. However, the world of venture capital can seem like a mysterious labyrinth, especially for first-time founders.

This comprehensive guide is designed to demystify venture capital funding, breaking down complex concepts into easy-to-understand language. Whether you’re just starting your entrepreneurial journey or actively seeking your next round of investment, this article will equip you with the knowledge you need to navigate the VC landscape with confidence.

What is Venture Capital (VC)? The Rocket Fuel for High-Growth Startups

At its core, Venture Capital is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth.

Think of VC as "rocket fuel" for businesses. Unlike traditional bank loans, venture capitalists don’t lend money; they invest in your company in exchange for an equity stake (ownership shares). They believe in your vision and potential, and they’re willing to take a significant risk with their capital in hopes of a substantial return when your company grows and eventually sells (acquisition) or goes public (IPO).

Key Characteristics of Venture Capital:

- Equity Investment: VCs become part-owners of your company.

- High Risk, High Reward: They invest in risky, unproven companies expecting a large payoff from a few successful investments.

- Long-Term Horizon: VC investments are typically for the long haul, often 5-10 years.

- Active Involvement: VCs often take a hands-on approach, offering strategic guidance, mentorship, and access to their networks.

- Focus on Scalability: They seek companies that can grow rapidly and capture significant market share.

Why Consider Venture Capital? The Pros and Cons

Deciding whether to pursue VC funding is a critical strategic choice. It’s not for every business, and it comes with its own set of advantages and disadvantages.

The Advantages of Venture Capital Funding

-

Significant Capital Injection:

- Fuel for Growth: VCs provide the large sums of money needed for rapid expansion, product development, market penetration, and hiring top talent.

- No Debt Burden: Unlike loans, you don’t have to repay the capital with interest, reducing financial pressure during critical growth phases.

-

Strategic Guidance and Expertise:

- Experienced Mentors: VC partners often have deep industry knowledge, operational experience, and a track record of scaling successful companies.

- Problem Solving: They can offer invaluable advice on everything from business model adjustments to market entry strategies.

-

Access to Powerful Networks:

- Industry Connections: VCs open doors to potential customers, partners, future investors, and key talent that would otherwise be inaccessible.

- Credibility: Having a reputable VC firm invest in your company adds significant credibility, making it easier to attract talent, customers, and subsequent funding rounds.

-

Accelerated Growth:

- Faster Execution: With more resources and strategic input, you can execute your plans more quickly and capitalize on market opportunities.

- Market Leadership: VC funding can help you outpace competitors and establish a dominant position.

The Disadvantages of Venture Capital Funding

-

Equity Dilution:

- Loss of Ownership: You sell a portion of your company, meaning founders and early employees will own a smaller percentage over time.

- Future Rounds: Each subsequent funding round further dilutes your ownership.

-

Loss of Control and Influence:

- Board Representation: VCs typically demand a seat (or seats) on your company’s board of directors, giving them a say in major strategic decisions.

- Investor Pressure: You’ll face pressure to meet aggressive growth targets and deliver returns on their investment, which can sometimes conflict with your original vision.

-

Intense Scrutiny and Demanding Expectations:

- Regular Reporting: You’ll need to provide frequent updates on performance, financials, and milestones.

- High Stakes: VCs are looking for multi-billion dollar outcomes, which means constant pressure to perform and demonstrate exponential growth.

-

Lengthy and Complex Process:

- Time-Consuming: The fundraising process, from initial outreach to closing the deal, can take many months, diverting valuable time and attention away from running your business.

- Legal Fees: Due diligence and legal negotiations can be costly.

Is Venture Capital Right for Your Startup? What VCs Look For

VC funding isn’t suitable for every business. VCs are highly selective, looking for very specific characteristics that signal massive potential for return on investment. If your startup doesn’t align with these criteria, pursuing VC might be a waste of time.

Here’s what venture capitalists typically look for:

-

A Massive Market Opportunity (TAM):

- Total Addressable Market (TAM): VCs want to see that your product or service targets a market large enough to generate billions in revenue. They’re looking for disruption, not incremental improvements.

- Growth Potential: The market itself should be growing rapidly.

-

A Strong, Diverse, and Coachable Team:

- Founding Team: This is often the most critical factor. VCs invest in people. They look for founders with relevant experience, complementary skills, passion, resilience, and a deep understanding of their market.

- Execution Ability: Can this team execute on their vision and adapt to challenges?

- Coachability: Are you open to feedback and strategic guidance?

-

Compelling Product/Solution:

- Solves a Real Problem: Does your product genuinely address a significant pain point for a large customer base?

- Innovation: Is it unique, differentiated, and difficult for competitors to replicate?

- User Experience: Is it intuitive and delightful for users?

-

Demonstrable Traction and Validation:

- Proof of Concept: Have you built an MVP (Minimum Viable Product)?

- Early Metrics: Do you have evidence that people want and use your product? This could be user growth, engagement rates, revenue (even small amounts), positive customer feedback, or successful pilot programs.

- Product-Market Fit: Have you found a segment of customers who love your product and use it regularly?

-

Defensible Competitive Advantage (Moat):

- Intellectual Property (IP): Do you have patents, unique technology, or proprietary algorithms?

- Network Effects: Does the value of your product increase as more people use it (e.g., social media platforms)?

- Brand Strength: A strong, recognizable brand can be a barrier to entry.

- High Switching Costs: Is it difficult for customers to leave your product for a competitor?

-

Clear Path to Scalability:

- Repeatable Business Model: Can your company grow rapidly without a proportional increase in costs?

- Operational Efficiency: Can you deliver your product or service efficiently to a large customer base?

-

Exit Strategy Potential:

- Liquidity Event: VCs invest with the expectation of a significant return. They want to see a plausible path to an "exit" – typically an acquisition by a larger company or an Initial Public Offering (IPO).

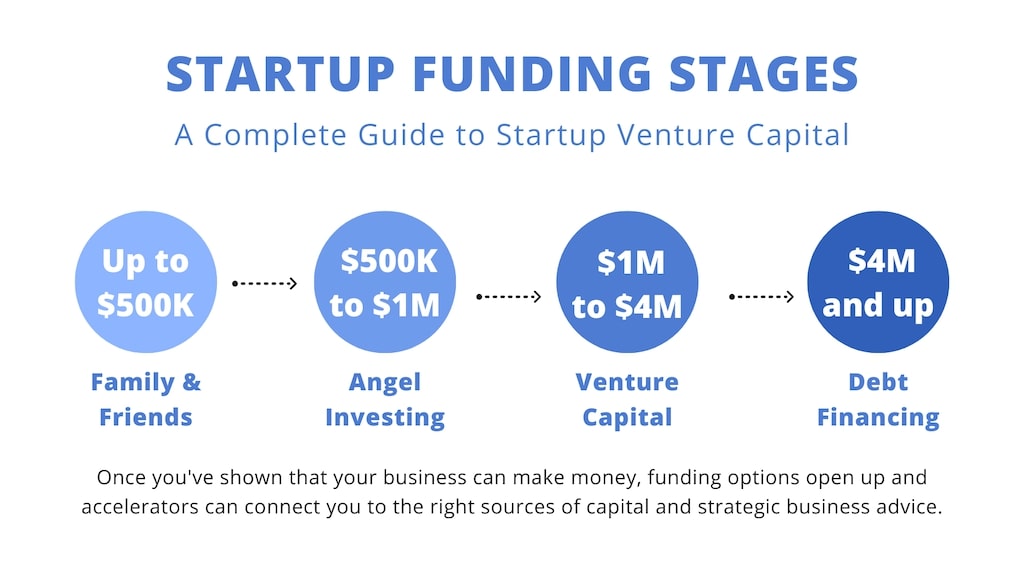

The Venture Capital Funding Stages Explained

VC funding typically occurs in distinct stages, each designed to fuel growth at a specific point in a startup’s lifecycle. Understanding these stages is crucial for knowing what type of investors to approach and what expectations they’ll have.

1. Pre-Seed Stage

- Focus: Idea validation, team formation, initial product development (MVP).

- Source: Founders’ own money (bootstrapping), friends and family, angel investors, incubators, accelerators.

- Amount: Typically under $500K – $1M.

- What Investors Look For: A compelling idea, a strong founding team, and initial proof that there’s a problem worth solving.

2. Seed Stage

- Focus: Building out the MVP, acquiring initial users/customers, proving early product-market fit.

- Source: Seed-stage VC funds, super angels, crowdfunding platforms.

- Amount: Usually $500K – $3M.

- What Investors Look For: Early traction (e.g., thousands of users, some revenue), clear customer acquisition strategy, and a well-defined product roadmap.

3. Series A

- Focus: Scaling the product, team, and customer acquisition. Achieving clear product-market fit and a repeatable business model.

- Source: Larger VC firms, corporate venture capital.

- Amount: Typically $2M – $15M+.

- What Investors Look For: Strong, consistent growth metrics (revenue, users, engagement), clear unit economics, a scalable business model, and a robust team capable of handling rapid expansion. This is often the stage where startups begin to professionalize.

4. Series B

- Focus: Expanding market reach, developing new product lines, potentially exploring international expansion, or making strategic acquisitions.

- Source: Later-stage VC firms, growth equity funds.

- Amount: Usually $10M – $50M+.

- What Investors Look For: Proven market dominance in a specific niche, highly efficient growth engine, significant revenue, and a clear path to becoming a market leader.

5. Series C (and Beyond)

- Focus: Global expansion, M&A activity, further product diversification, preparing for an IPO (Initial Public Offering) or a significant acquisition.

- Source: Growth equity funds, hedge funds, private equity firms, investment banks.

- Amount: $50M – $200M+.

- What Investors Look For: Substantial revenue, established market leadership, strong profitability (or clear path to it), and a solid management team capable of steering a large, public company.

Navigating the VC Funding Process: A Step-by-Step Guide

Securing VC funding is a marathon, not a sprint. It involves meticulous preparation, strategic networking, and rigorous due diligence.

Step 1: Meticulous Preparation (Before You Even Talk to a VC)

- Refine Your Business Plan: Clearly articulate your vision, mission, market opportunity, product, team, and financial projections.

- Craft a Compelling Pitch Deck: This is your visual story. It should be concise (10-15 slides), visually appealing, and tell a compelling narrative about your company’s potential.

- Key Pitch Deck Slides: Problem, Solution, Product, Market Size, Business Model, Traction, Team, Financials, Ask.

- Build a Robust Financial Model: Develop detailed financial projections (3-5 years) that are realistic and supported by clear assumptions. Understand your unit economics, customer acquisition costs (CAC), and lifetime value (LTV).

- Assemble Your Data Room: This is a secure online repository containing all your legal, financial, operational, and intellectual property documents. Prepare it before VCs ask for it. This shows professionalism and saves time.

- Know Your "Ask": Be clear about how much money you’re seeking and exactly how you plan to use it to achieve specific milestones.

- Understand Your Valuation: Have a realistic sense of your company’s worth, though this will be heavily negotiated.

Step 2: Strategic Outreach and Networking

- Target the Right VCs: Research firms that invest in your industry, at your stage, and have a track record of success with similar companies. Look at their portfolio companies.

- Warm Introductions are Key: Cold emails rarely work. Leverage your network (advisors, mentors, other founders) for introductions to VCs. Attend industry events and pitch competitions.

- Personalize Your Outreach: Show that you’ve done your homework. Explain why you’re reaching out to their firm specifically.

Step 3: The Pitch Meetings

- Initial Meetings (The "Coffee Chat"): These are typically informal and designed for VCs to get a quick overview of your company and team. Focus on telling your story and getting them excited.

- Follow-Up Meetings: If there’s interest, VCs will want deeper dives into specific aspects of your business. Be prepared to answer tough questions and provide more detailed information.

- Iterate and Learn: Every meeting is an opportunity to refine your pitch and address common objections.

Step 4: Due Diligence

- Intense Scrutiny: If a VC is seriously interested, they will initiate a thorough due diligence process. This involves examining every aspect of your business:

- Legal: Corporate structure, contracts, intellectual property, litigation.

- Financial: Audited financials, revenue models, cash flow, projections, cap table (who owns what percentage).

- Operational: Sales pipeline, marketing strategy, product development, technology stack.

- Team: Background checks, reference calls for key personnel.

- Market: Independent market research, competitive analysis, customer calls.

- Be Transparent: Provide all requested information promptly and honestly. Any red flags found later can kill the deal.

Step 5: Term Sheet Negotiation

- The Offer: If due diligence is successful, the VC firm will issue a "term sheet," a non-binding document outlining the proposed terms of the investment.

- Key Terms to Understand and Negotiate:

- Valuation: How much the investors value your company (pre-money and post-money). This directly impacts how much equity you give up.

- Investment Amount: How much capital they are putting in.

- Equity Stake: The percentage of the company the VC will own.

- Liquidation Preference: Determines who gets paid first (and how much) if the company sells for less than expected.

- Board Representation: How many board seats the VC will get.

- Protective Provisions: Clauses that give investors veto power over certain decisions.

- Vesting Schedules: For founder equity.

- Get Legal Counsel: Always engage an experienced startup attorney to review and negotiate the term sheet. This is crucial for protecting your interests.

Step 6: Closing the Deal

- Definitive Agreements: Once the term sheet is agreed upon, lawyers draft the definitive legal documents (e.g., Share Purchase Agreement, Investors Rights Agreement).

- Sign and Fund: After all documents are signed, the funds are wired to your company’s bank account.

- Celebrate (Briefly): This is a huge milestone, but it’s also the beginning of the next, more intense phase of your journey.

Key Documents and Tools for VC Funding

To successfully navigate the VC funding process, you’ll need to prepare and master several essential documents:

- Pitch Deck: Your startup’s story in 10-15 slides. It should cover:

- Problem: What pain point are you solving?

- Solution: Your product/service.

- Market: Who are your customers? How big is the opportunity?

- Traction: What progress have you made (users, revenue, partnerships)?

- Team: Who are the founders and key team members? Why are you the right people to solve this problem?

- Business Model: How will you make money?

- Financials: Key projections and funding ask.

- Competition: Your competitive advantage.

- Financial Model: A detailed spreadsheet outlining your projected revenue, expenses, cash flow, and key assumptions for the next 3-5 years.

- Data Room: A secure cloud-based folder containing all critical company documents, including:

- Legal documents (incorporation, bylaws, agreements)

- Financials (historical, projections, cap table)

- Product documentation (roadmaps, specs)

- Marketing and sales materials

- Team resumes and organizational chart

- IP documentation (patents, trademarks)

- Business Plan (Optional but Recommended): A more comprehensive written document than the pitch deck, detailing your strategy, operations, and market analysis.

- Executive Summary: A one-page overview of your pitch, often sent before the full deck.

What Happens After You Get Funded?

Receiving venture capital funding is not the finish line; it’s the starting gun for an intense new phase of growth.

- Increased Scrutiny and Reporting: You’ll have board meetings, regular reporting requirements, and investors who want to see constant progress towards milestones.

- Hitting Milestones: The funds are often tied to specific growth targets and achievements you promised during your pitch.

- Strategic Partnership: Your VC investors will likely be actively involved, offering advice, making introductions, and pushing you to achieve ambitious goals. Leverage their expertise!

- Preparing for the Next Round: VC funding is often a series of rounds. As you grow, you’ll start thinking about your Series B, C, and so on.

- Pressure to Perform: The expectation for a significant return on investment means constant pressure to grow rapidly and execute flawlessly.

Alternatives to Venture Capital

While VC funding is powerful, it’s not the only path to growth. Consider these alternatives:

- Bootstrapping: Funding your startup solely from personal savings, early revenue, and minimal outside capital. Offers maximum control.

- Angel Investors: High-net-worth individuals who invest their own money, often with less formal terms and more flexibility than VC firms.

- Debt Financing: Loans from banks or other lenders. You retain full equity but have to repay the loan with interest.

- Grants: Non-dilutive funding from government agencies or foundations, often for specific research or social impact projects.

- Crowdfunding: Raising small amounts of money from a large number of people, often through platforms like Kickstarter or Republic.

- Incubators & Accelerators: Programs that provide initial funding, mentorship, and resources in exchange for a small equity stake.

Conclusion: Is VC Funding Your Path to Success?

Venture Capital funding can be a game-changer for startups with high growth potential, providing not just capital but also invaluable expertise and a network that can accelerate your journey. However, it requires a significant commitment, a willingness to dilute ownership, and the ability to operate under intense pressure.

Before embarking on the VC fundraising journey, rigorously assess if your startup truly fits the criteria VCs seek. If it does, prepare meticulously, network strategically, and be ready for a demanding but potentially transformative process. By understanding the landscape, preparing thoroughly, and engaging wisely, you can significantly increase your chances of securing the investment that propels your startup to its next level of success.

Post Comment