Unveiling the Mystery: What is the Stock Market and How Does it Work? (A Beginner’s Guide)

The world of finance can seem daunting, filled with complex terms and rapid-fire news reports. But at its heart, the stock market is a powerful and accessible tool for growth, both for companies and for individuals looking to build wealth. If you’ve ever wondered what the stock market is, how it operates, or if it’s something you should understand, you’ve come to the right place.

This comprehensive guide will demystify the stock market, breaking down its core components and functions into easy-to-understand language. By the end, you’ll have a clear grasp of this vital economic engine and perhaps even feel inspired to take your first steps into the world of investing.

Table of Contents:

- What Exactly is the Stock Market?

- More Than Just a Building

- The Dual Purpose of the Market

- Understanding Stocks: A Piece of the Pie

- What is a Stock (or Share)?

- Why Companies Issue Stocks

- Why Investors Buy Stocks

- How Does the Stock Market Actually Work? (The Mechanics)

- The Primary Market: Going Public (IPOs)

- The Secondary Market: Where the Action Happens

- The Role of Stock Exchanges (NYSE, NASDAQ)

- The Power of Supply and Demand

- The Role of Brokers

- Market Hours and Liquidity

- Understanding Market Indices

- Key Players in the Stock Market Ecosystem

- Companies (Issuers)

- Investors (You!)

- Brokers

- Exchanges

- Regulators

- Why Invest in the Stock Market? Benefits for Beginners

- Potential for Long-Term Growth

- Beating Inflation

- Passive Income Through Dividends

- Accessibility

- Risks and Considerations for Beginners

- Market Volatility

- Loss of Capital

- The Importance of Research

- Emotional Investing

- Getting Started: A Beginner’s Path to Investing

- Educate Yourself

- Define Your Financial Goals

- Choose the Right Brokerage Account

- Start Small and Invest Regularly

- Diversify Your Investments

- Think Long-Term

- Common Stock Market Terms Explained

- Conclusion: Empowering Your Financial Future

1. What Exactly is the Stock Market?

Imagine a bustling marketplace, not for fruits and vegetables, but for ownership stakes in businesses. That’s essentially what the stock market is.

More Than Just a Building

When you hear "stock market," you might picture the New York Stock Exchange (NYSE) building with its iconic columns. While these physical locations exist, the "stock market" is more of a concept and a vast network of buyers and sellers. It’s a digital ecosystem where parts of companies are bought and sold every single day.

The Dual Purpose of the Market

The stock market serves two fundamental purposes:

- For Companies: It’s a vital platform for businesses to raise capital (money). Instead of borrowing from banks, companies can sell small pieces of their ownership (called "shares" or "stocks") to the public. This money helps them expand, develop new products, hire more people, and grow.

- For Investors: It provides an opportunity for individuals and institutions to invest their money and potentially grow their wealth over time. When you buy a stock, you become a tiny part-owner of that company, hoping its value will increase, and your investment will grow with it.

2. Understanding Stocks: A Piece of the Pie

To understand the stock market, you must first understand what a "stock" actually is.

What is a Stock (or Share)?

Think of a company as a giant pie. When a company decides to go public (more on this soon), it slices that pie into many, many tiny pieces. Each of these pieces is called a share or a stock.

- When you buy a share of a company’s stock, you are buying a tiny fraction of ownership in that company.

- As an owner, you gain certain rights, such as potentially receiving a portion of the company’s profits (called dividends) and sometimes even having a say in major company decisions through voting rights.

Why Companies Issue Stocks

Companies issue stocks primarily for one reason: to raise money for growth.

- Instead of taking out a massive loan from a bank (which comes with interest payments and strict repayment schedules), a company can sell shares to thousands or millions of individual investors.

- This influx of capital allows the company to fund its operations, invest in research and development, expand into new markets, or pay off debt. It’s a way to get funding without incurring traditional debt.

Why Investors Buy Stocks

People buy stocks for a few key reasons:

- Capital Appreciation: The most common reason. Investors hope that the company will grow and become more valuable over time. If the company’s value increases, the price of its stock also tends to rise, allowing investors to sell their shares for more than they paid for them.

- Dividends: Some companies share a portion of their profits with shareholders in the form of regular cash payments called dividends. This can provide a steady stream of income.

- Diversification: Stocks can be part of a broader investment portfolio that includes other assets like bonds or real estate, helping to spread risk.

- To Beat Inflation: Over long periods, the stock market has historically provided returns that outpace inflation, helping your money grow faster than the cost of living.

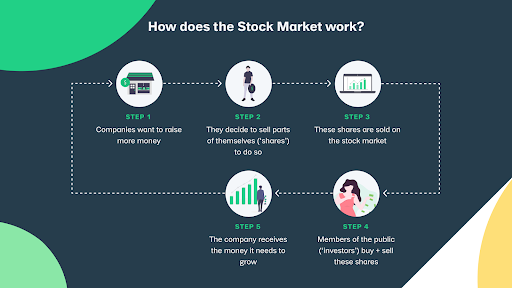

3. How Does the Stock Market Actually Work? (The Mechanics)

Now that we know what stocks are, let’s explore the process of how they are bought and sold.

The Primary Market: Going Public (IPOs)

When a private company decides it wants to raise money from the public for the first time, it undergoes a process called an Initial Public Offering (IPO).

- This is where the company sells its shares directly to the public for the very first time.

- It’s a one-time event for a specific block of shares, facilitated by investment banks.

- After the IPO, these shares become available for trading on the "secondary market."

The Secondary Market: Where the Action Happens

The vast majority of stock market activity happens in the secondary market. This is where investors buy and sell shares from each other, not directly from the company itself.

- Think of it like a used car market. Once a car is sold new from the dealership (IPO), it can be resold multiple times by individuals (secondary market).

- The company whose stock is being traded doesn’t directly receive money from these secondary market transactions. However, the continuous trading and price discovery on the secondary market are crucial for the company’s reputation and its ability to raise more capital in the future (e.g., by issuing more shares).

The Role of Stock Exchanges (NYSE, NASDAQ)

Stock exchanges are the organized marketplaces where buyers and sellers meet to trade stocks. They provide the infrastructure and rules for fair and orderly trading.

- New York Stock Exchange (NYSE): One of the oldest and largest stock exchanges in the world, known for its "floor trading" (though much is now electronic).

- NASDAQ (National Association of Securities Dealers Automated Quotations): A primarily electronic exchange, often home to technology and growth companies.

These exchanges ensure that orders are matched efficiently and that prices are transparent.

The Power of Supply and Demand

The price of a stock, like any other commodity, is primarily determined by the forces of supply and demand:

- High Demand + Low Supply = Higher Price: If many investors want to buy a particular stock, but there aren’t many sellers, the price will tend to go up.

- Low Demand + High Supply = Lower Price: If many investors want to sell a stock, but there aren’t many buyers, the price will tend to go down.

Many factors influence supply and demand, including a company’s financial performance, industry trends, economic news, investor sentiment, and global events.

The Role of Brokers

You can’t just call up Google and say, "I want to buy 10 shares!" To participate in the stock market, you need a broker.

- A broker (or brokerage firm) acts as an intermediary between you (the investor) and the stock exchange.

- They execute your buy and sell orders.

- Today, most individual investors use online discount brokers (like Fidelity, Charles Schwab, Vanguard, E*TRADE, Robinhood) that offer user-friendly platforms and low or no commission fees.

Market Hours and Liquidity

- The major U.S. stock exchanges typically operate from 9:30 AM to 4:00 PM Eastern Time, Monday through Friday, excluding holidays.

- Liquidity refers to how easily an asset can be bought or sold without affecting its price significantly. Stocks traded on major exchanges are generally very liquid, meaning you can typically buy or sell them quickly at their current market price.

Understanding Market Indices

A market index is like a barometer for a specific segment of the stock market or the market as a whole. It’s a hypothetical portfolio of stocks that represents a particular market or industry.

- Dow Jones Industrial Average (DJIA): Tracks 30 large, well-established U.S. companies.

- S&P 500 (Standard & Poor’s 500): Consists of 500 of the largest U.S. companies, widely considered the best gauge of large-cap U.S. equities.

- NASDAQ Composite: Tracks all stocks listed on the NASDAQ exchange, heavily weighted towards technology companies.

When you hear "the market is up today," it usually refers to one or more of these major indices rising.

4. Key Players in the Stock Market Ecosystem

Understanding the roles of different participants helps clarify how the market functions.

- Companies (Issuers): The businesses that issue shares to raise capital. Their performance directly impacts stock prices.

- Investors (You!): Individuals, mutual funds, pension funds, hedge funds, and other entities that buy and sell stocks to grow wealth.

- Brokers: The financial firms that facilitate trading between investors and exchanges.

- Stock Exchanges: The organized platforms (like NYSE, NASDAQ) where trading takes place.

- Regulators: Government bodies (like the Securities and Exchange Commission – SEC in the U.S.) that create and enforce rules to protect investors and ensure fair, transparent markets.

5. Why Invest in the Stock Market? Benefits for Beginners

Despite the perceived complexity, investing in the stock market offers compelling benefits, especially for those looking to build long-term wealth.

- Potential for Long-Term Growth: Historically, the stock market has been one of the most effective ways to grow wealth over extended periods. While there are ups and downs, the overall trend has been upward.

- Beating Inflation: Inflation erodes the purchasing power of your money over time. Money sitting in a savings account might lose value. Stock market investments have the potential to grow faster than inflation, preserving and increasing your buying power.

- Passive Income Through Dividends: As mentioned, some companies pay dividends, offering a regular income stream without you having to sell your shares. This can be particularly appealing for retirement planning.

- Accessibility: With online discount brokers, investing is more accessible and affordable than ever. You can start with relatively small amounts of money.

6. Risks and Considerations for Beginners

While the stock market offers great potential, it’s crucial to be aware of the inherent risks.

- Market Volatility: Stock prices can fluctuate significantly in the short term due to news, economic data, or even rumors. What goes up can also come down.

- Loss of Capital: It’s possible to lose money when investing in stocks. If you sell a stock for less than you paid for it, you incur a loss. There’s no guarantee of returns.

- The Importance of Research: Investing blindly is a recipe for disaster. Thorough research into the companies you’re considering is vital. Understand their business, financials, and industry.

- Emotional Investing: Fear and greed can lead to poor decisions. Panicking and selling during a downturn or chasing "hot" stocks can be detrimental to your long-term goals. Stick to your strategy.

7. Getting Started: A Beginner’s Path to Investing

Feeling ready to dip your toes in? Here’s a simplified roadmap for beginners:

- Educate Yourself: You’re already doing it! Continue learning about investing principles, different types of investments (not just individual stocks), and financial planning.

- Define Your Financial Goals: What are you saving for? A down payment, retirement, a child’s education? Your goals will influence your investment strategy and risk tolerance.

- Choose the Right Brokerage Account: Research online discount brokers (e.g., Fidelity, Schwab, Vanguard, E*TRADE, Robinhood). Look for low fees, good customer service, educational resources, and a platform that’s easy to use.

- Start Small and Invest Regularly: You don’t need a fortune to begin. Many brokers allow you to start with small amounts. Consider investing a fixed amount regularly (e.g., $50 or $100 per month) – this is called dollar-cost averaging and helps mitigate risk over time.

- Diversify Your Investments: Don’t put all your eggs in one basket. Instead of just buying one company’s stock, consider investing in Exchange Traded Funds (ETFs) or mutual funds. These are collections of many stocks (or other assets) in one package, offering instant diversification.

- Think Long-Term: The stock market is not a get-rich-quick scheme. For most investors, a long-term approach (years, even decades) helps smooth out short-term fluctuations and maximizes the power of compounding returns.

8. Common Stock Market Terms Explained

- Bear Market: A market condition where stock prices are falling, typically by 20% or more from recent highs. Reflects widespread pessimism.

- Bull Market: A market condition where stock prices are rising, typically by 20% or more from recent lows. Reflects widespread optimism.

- Dividend: A portion of a company’s profits paid out to its shareholders, usually on a regular basis (quarterly).

- Volatility: The degree of variation of a trading price over time. High volatility means prices can swing wildly.

- Portfolio: The collection of all your investments (stocks, bonds, funds, etc.).

- Market Capitalization (Market Cap): The total value of a company’s outstanding shares. Calculated by multiplying the current share price by the number of shares outstanding. Used to categorize companies (e.g., large-cap, small-cap).

- IPO (Initial Public Offering): The first time a private company offers its shares for sale to the public.

- ETF (Exchange Traded Fund): A type of investment fund that holds a collection of assets (like stocks, bonds, commodities) and trades on stock exchanges like individual stocks. They offer diversification and low fees.

- Mutual Fund: A professionally managed investment fund that pools money from many investors to purchase a diversified portfolio of securities.

Conclusion: Empowering Your Financial Future

The stock market, at its core, is a sophisticated system that allows businesses to grow and individuals to build wealth. While it has its complexities and risks, understanding the basics can empower you to make informed financial decisions.

Remember, successful investing isn’t about predicting the future or getting rich overnight. It’s about patience, consistent learning, setting clear goals, managing risk, and taking a long-term perspective. By starting small, diversifying, and staying disciplined, you can harness the power of the stock market to work towards your financial goals and secure a brighter future.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. It is recommended to consult with a qualified financial advisor before making any investment decisions.

Post Comment