Unveiling Quantitative Easing (QE): Your Easy Guide to Its Global Economic Ripple Effect

The phrase "Quantitative Easing" (QE) often sounds like something out of a complex financial textbook, designed to mystify rather than clarify. Yet, this powerful tool, wielded by central banks around the world, has profoundly shaped our modern economy, impacting everything from the price of your home to the strength of your national currency.

If you’ve ever wondered how governments respond to a financial crisis, why interest rates sometimes hit rock bottom, or what connects the Federal Reserve to a stock market boom (or bust), understanding QE is a crucial first step.

In this comprehensive guide, we’ll demystify Quantitative Easing, breaking down its mechanisms, exploring why central banks use it, and dissecting its far-reaching global economic impacts – all in language that’s easy for beginners to understand.

What Exactly is Quantitative Easing (QE)? The Basics Explained

Imagine the economy is a car that’s stuck in mud. Normally, the central bank (like the Federal Reserve in the U.S. or the European Central Bank in Europe) would try to get it moving by adjusting the "accelerator" – that is, by lowering or raising a key interest rate. Lower rates make it cheaper to borrow, encouraging people and businesses to spend and invest.

But what if the accelerator is already pressed to the floor, and the car is still stuck? This is what happens when interest rates hit near zero and the economy is still struggling, often during a deep recession or financial crisis. This is where Quantitative Easing comes in.

Quantitative Easing (QE) is a type of unconventional monetary policy where a central bank buys large quantities of government bonds and other financial assets from commercial banks and other financial institutions.

Think of it less like "printing money" in the literal sense (though it does increase the money supply) and more like a massive digital asset swap. The central bank creates new money (digitally) to buy these assets.

Key Components of QE:

- Who does it? Central Banks (e.g., Federal Reserve, European Central Bank, Bank of Japan, Bank of England).

- What do they buy? Primarily government bonds (debt issued by the government) and sometimes mortgage-backed securities (bundles of home loans).

- From whom? Commercial banks and other financial institutions, not directly from the government.

- Why? To inject liquidity (money) into the financial system, lower long-term interest rates, and encourage lending and investment.

Why Do Central Banks Resort to QE? The Need for an Economic "Bazooka"

Central banks typically have two main tools to manage the economy:

- Interest Rate Adjustments: Raising or lowering the short-term interest rate they charge banks. This influences all other interest rates in the economy.

- Reserve Requirements: How much money banks must keep on hand.

However, during severe economic downturns, these traditional tools can become ineffective:

- The Zero Lower Bound (ZLB): When the central bank’s main interest rate is already near zero, it can’t go any lower. This is like the "accelerator already being pressed to the floor."

- Lack of Confidence: Even if borrowing is cheap, if businesses and consumers are worried about the future, they won’t borrow or spend.

- Deflationary Spiral: A dangerous situation where prices fall, leading people to delay purchases (expecting even lower prices), which further reduces demand, causing more price drops. QE aims to prevent this.

In such scenarios, QE acts as an "unconventional" or "extraordinary" measure, a sort of economic "bazooka" to provide additional stimulus when traditional methods are exhausted. Its primary goals are to:

- Lower Long-Term Interest Rates: By buying long-term bonds, the central bank pushes up their prices, which in turn pushes down their yields (interest rates). This makes it cheaper for businesses to borrow for investments and for individuals to get mortgages.

- Increase Money Supply and Liquidity: Banks that sell bonds to the central bank receive cash, increasing their reserves. This gives them more money to lend out.

- Boost Asset Prices: The increased demand for bonds can push investors into other assets like stocks or real estate, driving up their prices. This creates a "wealth effect," making people feel richer and more likely to spend.

- Signal Commitment: QE signals the central bank’s strong commitment to supporting the economy and fighting deflation.

How Does QE Work Its "Magic"? The Mechanisms in Action

Let’s break down the pathways through which QE impacts the economy:

-

Lowering Long-Term Interest Rates:

- Direct Effect: When the central bank buys a large amount of long-term bonds, it increases the demand for those bonds. This drives up their prices and, consequently, lowers their yields (interest rates).

- Portfolio Rebalancing Effect: With lower yields on safe government bonds, investors are encouraged to seek higher returns elsewhere. They might sell their government bonds (to the central bank) and use the money to buy corporate bonds, stocks, or real estate. This increased demand for other assets also drives down their interest rates or increases their prices.

-

Increasing the Money Supply and Bank Lending:

- When the central bank buys bonds from commercial banks, the banks’ reserves at the central bank increase. These are like funds that banks can use for lending.

- While banks don’t have to lend this money out immediately, the increased liquidity and lower borrowing costs encourage them to do so, hopefully stimulating credit growth for businesses and consumers.

-

Boosting Asset Prices (The "Wealth Effect"):

- As investors move out of lower-yielding bonds into other assets (stocks, real estate), the prices of these assets tend to rise.

- This makes individuals and companies who own these assets feel wealthier, potentially leading to increased spending and investment. For instance, a higher stock market can make people more confident about their retirement savings.

-

Weakening the Currency (Potentially):

- By increasing the domestic money supply, QE can sometimes make a country’s currency less attractive to foreign investors. This is because there’s more of that currency circulating, potentially reducing its value relative to other currencies.

- A weaker currency makes a country’s exports cheaper for foreign buyers and imports more expensive for domestic buyers, potentially boosting exports and reducing imports, which can help economic growth.

The Global Economic Impact of QE: A Double-Edged Sword

QE doesn’t happen in a vacuum. Its effects ripple across borders, influencing both the economies where it originates (developed nations) and those far away (emerging markets).

Impact on Developed Economies (Where QE Originates)

Potential Benefits (The Upside):

- Recession Prevention/Mitigation: QE has been credited with preventing deeper recessions and even deflation during major crises like the 2008 financial crisis and the COVID-19 pandemic.

- Financial Market Stability: By providing ample liquidity, QE can calm panicked markets and prevent systemic collapses.

- Lower Borrowing Costs: For governments, businesses, and consumers, lower interest rates mean cheaper loans for everything from infrastructure projects to mortgages.

- Stimulated Investment & Spending: Cheaper borrowing and increased confidence can encourage businesses to invest and expand, creating jobs, and consumers to spend.

- Wealth Effect: Rising asset prices (stocks, real estate) can boost household wealth, leading to increased consumer confidence and spending.

Potential Risks & Drawbacks (The Downside):

- Inflation Risk: Injecting vast amounts of money into the economy could lead to too much money chasing too few goods, driving up prices. However, this risk often hasn’t fully materialized in past QE programs due to underlying weak demand.

- Asset Bubbles: The rush for higher returns might inflate the prices of assets like stocks or real estate beyond their fundamental value, creating bubbles that could burst later.

- Increased Income Inequality: Those who own significant assets (stocks, property) tend to benefit most from rising asset prices, while those who don’t see their purchasing power eroded by any inflation without corresponding asset gains.

- "Zombie" Companies: Extremely low interest rates can allow less productive or inefficient companies (often called "zombies") to survive by borrowing cheaply, rather than being forced to innovate or exit the market.

- Future Debt Burden: While QE lowers the immediate cost of government borrowing, the long-term increase in the central bank’s balance sheet (assets held) could eventually lead to losses when interest rates rise, potentially impacting government finances.

- Difficulty in "Exiting" QE: Reversing QE (known as "tapering" or "quantitative tightening") can be tricky and lead to market volatility.

Impact on Emerging Markets (The Spillover Effect)

QE in major developed economies often creates significant "spillover" effects on developing and emerging market economies, which can be both beneficial and detrimental.

Potential Benefits for Emerging Markets:

- Capital Inflows: When interest rates are low in developed countries, investors seek higher returns in emerging markets, leading to increased foreign investment. This can boost local stock markets and provide capital for infrastructure projects.

- Lower Borrowing Costs: The global search for yield can also drive down borrowing costs for emerging market governments and companies, making it cheaper for them to finance development.

- Increased Trade: If QE boosts demand in developed countries, it can lead to increased demand for exports from emerging markets.

Potential Risks & Drawbacks for Emerging Markets:

- Currency Appreciation: Large capital inflows can cause an emerging market’s currency to strengthen rapidly. While this makes imports cheaper, it makes exports more expensive and less competitive, hurting export-oriented industries.

- Asset Bubbles: The influx of "hot money" can inflate asset prices (stocks, real estate) in emerging markets, creating unsustainable bubbles that could burst if capital suddenly flows out.

- Increased External Debt: While borrowing becomes cheaper, emerging markets might accumulate more foreign currency-denominated debt, making them vulnerable if their currency depreciates or global interest rates rise.

- "Taper Tantrum" Risk: Perhaps the most significant risk. When developed central banks signal they will reduce or stop QE (i.e., "taper"), investors often pull money out of emerging markets quickly, leading to:

- Sharp currency depreciation.

- Stock market declines.

- Increased borrowing costs.

- Financial instability. (This happened notably in 2013 when the U.S. Federal Reserve first hinted at tapering).

- Reduced Policy Autonomy: Emerging market central banks might feel pressured to keep their interest rates low to deter capital inflows and currency appreciation, even if their domestic economic conditions suggest higher rates are needed.

QE’s Legacy and The Path to "Normalization"

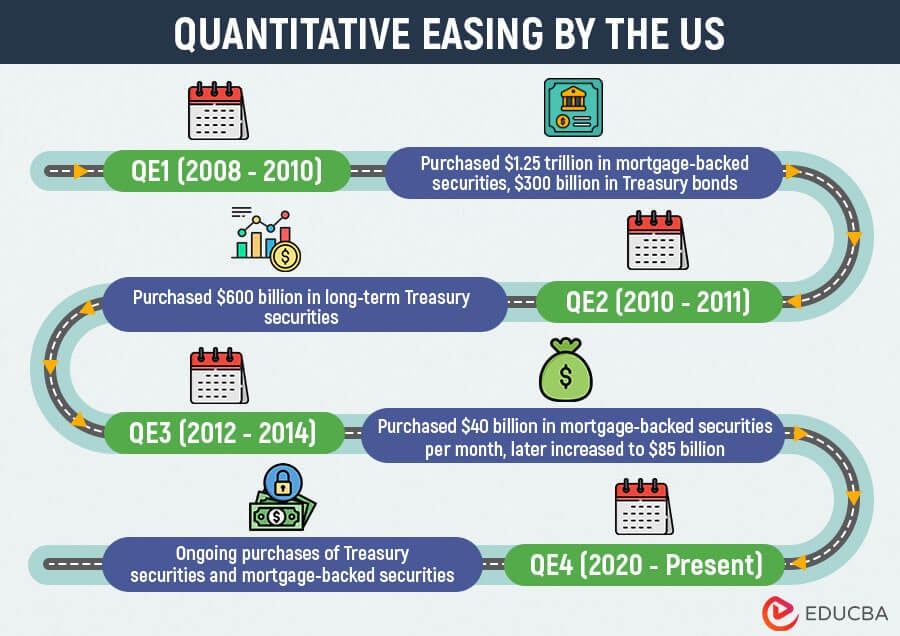

QE has become a staple in the central bank toolkit during crises. The 2008 financial crisis saw the U.S. Federal Reserve, the European Central Bank, the Bank of England, and the Bank of Japan all implement massive QE programs. More recently, the COVID-19 pandemic triggered another round of unprecedented QE globally.

However, QE is not meant to last forever. Central banks eventually aim to "normalize" monetary policy, which involves:

- Tapering: Gradually reducing the pace of asset purchases. This is often the first step to signal a move away from highly accommodative policy.

- Quantitative Tightening (QT): Actively reducing the size of their balance sheet by selling off assets or allowing bonds to mature without reinvesting the proceeds.

- Raising Interest Rates: The more traditional method of tightening monetary policy.

The challenge lies in executing this exit strategy smoothly. Removing liquidity too quickly can trigger market panic and slow economic growth, as seen with the "Taper Tantrum." Moving too slowly risks runaway inflation or asset bubbles. It’s a delicate balancing act for central bankers.

Is QE a Good Idea? The Ongoing Debate

Quantitative Easing remains a highly debated topic among economists and policymakers.

Arguments for QE often highlight:

- Necessity in Crisis: Proponents argue that QE was essential to prevent a deeper economic collapse in 2008 and 2020 when traditional tools were ineffective.

- Effectiveness: They point to evidence that QE did help lower long-term interest rates, boost asset prices, and support aggregate demand.

- Avoiding Deflation: QE was seen as a critical tool to combat the threat of a deflationary spiral.

Arguments against QE often focus on:

- Unintended Consequences: Critics raise concerns about inflation, asset bubbles, and exacerbating income inequality.

- Moral Hazard: Some argue that QE creates a "moral hazard" by bailing out financial institutions and encouraging excessive risk-taking, knowing the central bank will step in during a crisis.

- Limited Real Economic Impact: Doubts are sometimes raised about whether QE truly translates into significant real economic activity (e.g., jobs, business investment) or if its effects are mainly confined to financial markets.

Ultimately, there’s no easy answer. QE is a powerful, complex tool with both significant potential benefits in crisis situations and considerable risks that must be carefully managed.

Conclusion: QE’s Enduring Role in Modern Monetary Policy

Quantitative Easing has undeniably transformed the landscape of modern monetary policy. Once considered an exotic, last-resort measure, it has now become a relatively standard tool in the central bank’s arsenal for fighting severe economic downturns.

From lowering borrowing costs for homeowners and businesses to influencing global capital flows and the value of currencies, QE’s ripple effects are felt far and wide. While it has proven effective in providing crucial liquidity and preventing economic collapse during crises, its long-term consequences – particularly concerning inflation, asset bubbles, and wealth inequality – continue to be a subject of intense scrutiny and debate.

As the global economy navigates future challenges, understanding QE is no longer just for economists. It’s vital for anyone seeking to grasp the forces shaping our financial world, reminding us of the immense power and responsibility held by the central banks that steer the global economic ship.

Post Comment