Unpacking the Corporate Debt Bomb: Understanding the Risks to the Global Economy

Corporate debt might not grab headlines like inflation or stock market crashes, but it’s a silent giant whose growth could have profound and far-reaching consequences for the global economy. Often misunderstood or overlooked by the general public, the sheer volume of money businesses owe can create a fragile financial landscape, ready to crack under pressure.

This comprehensive guide will demystify corporate debt, explain why it’s been on the rise, and most importantly, break down the significant risks it poses to our economic stability in language anyone can understand.

What Exactly is Corporate Debt? (The Basics)

Imagine you want to buy a house, but you don’t have all the cash upfront. You take out a mortgage – that’s your personal debt. Companies do something similar, but on a much larger scale.

Corporate debt refers to the money that companies borrow from various sources to finance their operations, expansion, acquisitions, or even to pay dividends to shareholders. It’s essentially a loan that a business has to repay, usually with interest.

Why do companies borrow?

- Expansion: Building new factories, opening new stores, entering new markets.

- Research & Development (R&D): Investing in new products or technologies.

- Working Capital: Covering day-to-day expenses like salaries, inventory, or utilities, especially during slow periods.

- Acquisitions: Buying other companies.

- Refinancing: Paying off old debt with new, cheaper debt.

- Shareholder Returns: Sometimes companies borrow to buy back their own shares or pay dividends, boosting shareholder value (though this can be controversial).

Common forms of corporate debt include:

- Bank Loans: Direct loans from financial institutions.

- Corporate Bonds: IOUs issued by companies to investors. Investors buy these bonds, and the company promises to pay back the principal amount along with interest over a set period.

- Lines of Credit: Flexible borrowing arrangements with banks.

Is Corporate Debt Always Bad?

Absolutely not! In fact, it’s a vital tool for economic growth. Responsible borrowing allows companies to invest, innovate, and create jobs, driving progress. The problem arises when debt becomes excessive, poorly managed, or taken on by companies that are already struggling.

The Swelling Tide: Why Corporate Debt Has Skyrocketed

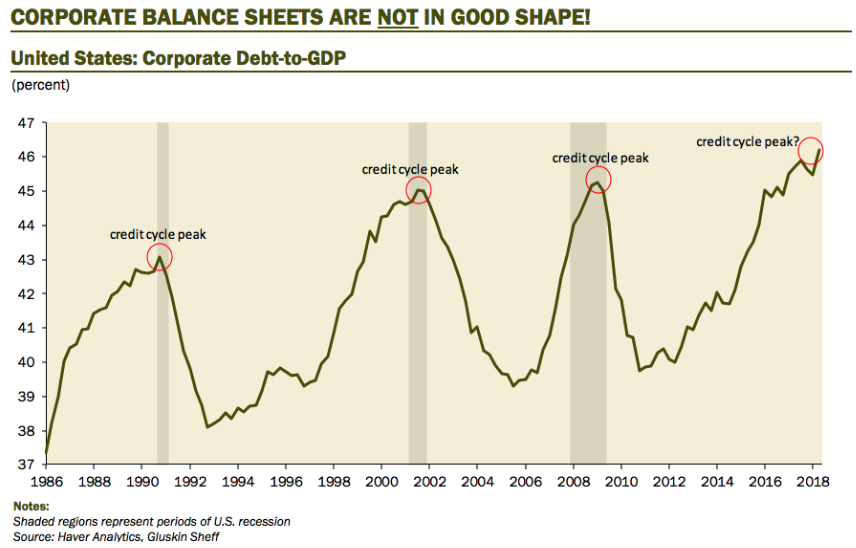

Over the past decade, global corporate debt has reached unprecedented levels, soaring into the tens of trillions of dollars. Several key factors have fueled this surge:

- Ultra-Low Interest Rates: Following the 2008 financial crisis and the COVID-19 pandemic, central banks worldwide slashed interest rates to near zero. This made borrowing incredibly cheap, encouraging companies to take on more debt.

- Quantitative Easing (QE): Central banks also injected vast amounts of money into the financial system through QE, pushing down bond yields and making it easier for companies to issue new debt.

- Search for Yield: With low returns on traditional investments, investors eagerly sought out corporate bonds, even those from riskier companies, in search of better returns. This high demand made it even easier for companies to borrow.

- Mergers & Acquisitions (M&A): A significant portion of new debt has been used to fund corporate takeovers, often leaving the combined entity with a much larger debt load.

- Shareholder Demands: Pressure from investors for higher returns has sometimes led companies to borrow money to fund share buybacks or dividends, rather than investing in long-term growth.

This period of "cheap money" created an environment where companies, both healthy and struggling, could pile on debt with relative ease, setting the stage for potential future problems.

The Alarming Risks: How Corporate Debt Threatens the Economy

When corporate debt levels become too high, or economic conditions change, the risks can quickly multiply, sending ripples throughout the entire economy. Here’s how:

1. Increased Risk of Corporate Defaults and Bankruptcies

This is the most direct and obvious risk. When a company borrows too much and can’t generate enough cash to pay back its loans or bondholders, it defaults. If the situation is severe, the company might be forced into bankruptcy.

- Domino Effect: A major company’s bankruptcy isn’t an isolated event. It can trigger a chain reaction:

- Suppliers: Companies that supplied goods or services to the bankrupt firm lose revenue and might struggle to collect payments, potentially leading to their own financial distress.

- Employees: Thousands of jobs can be lost, impacting individual livelihoods and local economies.

- Lenders (Banks & Investors): Banks that loaned money and investors who bought corporate bonds face significant losses, weakening their financial positions.

- Loss of Confidence: A wave of bankruptcies can erode business and consumer confidence, making people less likely to spend or invest, further slowing the economy.

2. Reduced Investment and Innovation (Stifling Growth)

When companies are heavily indebted, a large portion of their profits (or even revenue) must go towards servicing that debt – paying interest and principal. This leaves less money for:

- Capital Expenditures: Investing in new equipment, technology, or facilities.

- Research & Development: Developing new products or improving existing ones.

- Expansion: Entering new markets or hiring more staff.

This lack of investment in productive assets can slow down long-term economic growth, reduce productivity, and make an economy less competitive globally. It creates a cycle where companies are just trying to stay afloat rather than pushing forward.

3. Financial Market Instability and "Contagion"

High corporate debt can make financial markets much more volatile and prone to crises.

- Credit Rating Downgrades: If a company’s financial health deteriorates, credit rating agencies (like Moody’s or S&P) might downgrade its debt. This makes it harder and more expensive for the company to borrow in the future, often accelerating its decline.

- Panic Selling: News of defaults or downgrades can cause investors to panic and sell off corporate bonds, driving down their prices and creating a liquidity crunch (meaning it’s hard to find buyers).

- Contagion: Problems in one part of the market can quickly spread. For example, if many companies in a particular sector (e.g., real estate or tech) start defaulting, it could trigger widespread fear and selling across other sectors, impacting the entire stock and bond markets.

- Impact on Banks: Banks are significant lenders to corporations. If many of their corporate clients default, banks face substantial losses, which can weaken their balance sheets, restrict their ability to lend, and potentially lead to a banking crisis.

4. The Rise of "Zombie Companies"

A particularly insidious risk is the proliferation of "zombie companies." These are businesses that earn just enough money to cover their operating costs and interest payments on their debt, but not enough to significantly invest, grow, or pay down their principal debt.

- Resource Drain: Zombie companies tie up capital, labor, and resources that could otherwise be used by more productive, innovative businesses.

- Suppressed Competition: They linger on, preventing healthier companies from emerging or expanding, thus stifling competition and overall economic dynamism.

- Fragility: They are extremely vulnerable to any economic downturn or interest rate hike, making them potential catalysts for a broader crisis.

5. Amplified Economic Downturns (Making Recessions Worse)

When an economy enters a recession, high corporate debt acts as an accelerant, making the downturn deeper and longer.

- Reduced Demand: During a recession, consumer spending and business investment typically fall. Heavily indebted companies are less able to weather this storm.

- Layoffs and Spending Cuts: To survive, these companies often resort to mass layoffs and drastic spending cuts, further reducing demand and deepening the recession.

- Credit Crunch: Banks become more cautious during downturns, tightening lending standards. This "credit crunch" makes it even harder for struggling companies (and even healthy ones) to access financing, exacerbating their problems.

6. Constrained Monetary Policy Effectiveness

Central banks use tools like interest rates to manage the economy. However, high corporate debt can tie their hands.

- The Dilemma: If inflation is high, central banks might need to raise interest rates to cool down the economy. But doing so would significantly increase the cost of borrowing for indebted companies, potentially pushing many into default or bankruptcy.

- "Debt Trap": This creates a "debt trap" where central banks are hesitant to raise rates too aggressively, even if needed, for fear of triggering a widespread corporate debt crisis. This can lead to prolonged periods of inflation or other economic imbalances.

7. Impact on Employment and Consumer Spending

Ultimately, the health of corporations directly affects the job market and household finances.

- Job Losses: Corporate defaults and widespread business struggles lead to job cuts, increasing unemployment.

- Reduced Wages: Even for those who remain employed, job insecurity and business struggles can put downward pressure on wages.

- Lower Consumer Confidence: People who are worried about their jobs or the economy are less likely to spend money on non-essentials, further slowing economic activity. This creates a negative feedback loop.

Factors Exacerbating the Current Corporate Debt Risks

Several current global trends are making the existing corporate debt load even riskier:

- Rising Interest Rates: Central banks globally are now raising interest rates to combat inflation. This means companies will have to pay significantly more to service their existing variable-rate debt or refinance maturing debt, putting immense pressure on their cash flows.

- Persistent Inflation: Higher costs for raw materials, energy, and labor erode profit margins, making it harder for companies to generate the cash needed to pay their debts.

- Slowing Global Growth: Forecasts for global economic growth are being revised downwards, meaning less demand for products and services, making it tougher for businesses to earn revenue.

- Supply Chain Disruptions: Ongoing issues in global supply chains increase costs and uncertainty, further squeezing corporate profits.

- Geopolitical Instability: Conflicts and trade tensions add another layer of uncertainty, impacting investment decisions and market confidence.

Who is Most Affected by Corporate Debt Risks?

While the entire economy is at risk, certain groups are particularly vulnerable:

- Small and Medium-sized Enterprises (SMEs): Often have less access to diverse financing and are more sensitive to rising interest rates and economic downturns.

- Households: Through job losses, reduced investment in their retirement funds (if invested in corporate bonds/stocks), and overall economic instability.

- Investors: Those holding corporate bonds (especially "junk" bonds from riskier companies) or stocks in highly indebted companies face potential losses.

- Banks: As major lenders, they bear the direct risk of corporate defaults.

- Governments: May face pressure to bail out critical industries or provide unemployment benefits, straining public finances.

Mitigating the Risks: What Can Be Done?

Addressing the corporate debt challenge requires a multi-pronged approach involving various stakeholders:

- For Companies:

- Prudent Debt Management: Focusing on paying down debt, especially when interest rates are low, and avoiding excessive borrowing for non-productive uses.

- Strong Balance Sheets: Maintaining healthy cash reserves and diversified revenue streams to weather economic shocks.

- Transparency: Providing clear financial reporting to investors and lenders.

- For Regulators and Policymakers:

- Stricter Lending Standards: Encouraging banks and financial institutions to be more cautious in their lending practices, especially to highly leveraged companies.

- Monitoring and Oversight: Regularly assessing corporate debt levels and identifying potential areas of systemic risk.

- Targeted Interventions: Developing tools to support critical industries without encouraging moral hazard (where companies take on too much risk assuming they’ll be bailed out).

- For Central Banks:

- Careful Monetary Policy: Balancing the need to control inflation with the potential impact of interest rate hikes on corporate debt. Communicating policy changes clearly and predictably.

- For Investors:

- Due Diligence: Thoroughly researching the financial health and debt levels of companies before investing in their bonds or stocks.

- Diversification: Spreading investments across various asset classes and companies to reduce risk.

Conclusion: Vigilance is Key

Corporate debt, while a necessary engine for economic growth, has swelled to levels that demand serious attention. It’s a complex issue with the potential to trigger widespread financial instability, deepen economic downturns, and stifle long-term prosperity.

As global economic conditions shift from an era of cheap money to one of rising costs and uncertainty, the risks posed by excessive corporate debt become increasingly pronounced. Understanding these risks is the first step towards advocating for responsible financial practices and policies that can safeguard our economic future. Vigilance from companies, regulators, and individuals alike will be crucial in navigating these turbulent waters and preventing a potential corporate debt bomb from detonating.

Post Comment