Unlocking Your Financial Superpower: How Your Credit Score is Calculated (The Beginner’s Guide)

Your credit score. It’s a three-digit number that often feels like a mysterious, all-powerful entity. It can open doors to new apartments, lower interest rates on loans, and even influence job prospects. But how is this crucial number actually calculated? What’s the secret recipe behind it?

If you’ve ever felt confused, you’re not alone. Many people know their credit score matters, but few truly understand the ingredients that go into it. This comprehensive guide will demystify the process, breaking down exactly how your credit score is calculated in a way that’s easy for anyone to understand. Get ready to unlock your financial superpower!

What Exactly Is a Credit Score?

Think of your credit score as a numerical report card of your financial responsibility. It’s a snapshot, at a specific moment in time, of how well you’ve managed borrowed money in the past. Lenders (banks, credit card companies, mortgage providers) use this score to quickly assess the risk of lending you money. A higher score generally means you’re a lower risk, making you a more attractive borrower.

The most commonly used credit scores range from 300 (poor) to 850 (excellent). While there are many different scoring models, two dominate the landscape: FICO Score and VantageScore.

The Big Players: FICO Score vs. VantageScore

Before we dive into the specific factors, it’s important to understand that while both FICO and VantageScore aim to predict your credit risk, they are distinct scoring models.

- FICO Score: Developed by the Fair Isaac Corporation, FICO is the granddaddy of credit scores, used by roughly 90% of top lenders. There are many different versions of FICO scores (e.g., FICO Score 8, FICO Score 9, industry-specific scores), but they all rely on similar core data points.

- VantageScore: Created by the three major credit bureaus (Experian, Equifax, and TransUnion), VantageScore is a newer model that also aims to provide an accurate risk assessment. It’s gaining popularity, especially among free credit monitoring services.

The good news? While their exact algorithms and weighting might differ slightly, both FICO and VantageScore look at the same fundamental categories of your credit behavior. Understanding these categories is key, regardless of which score you’re looking at.

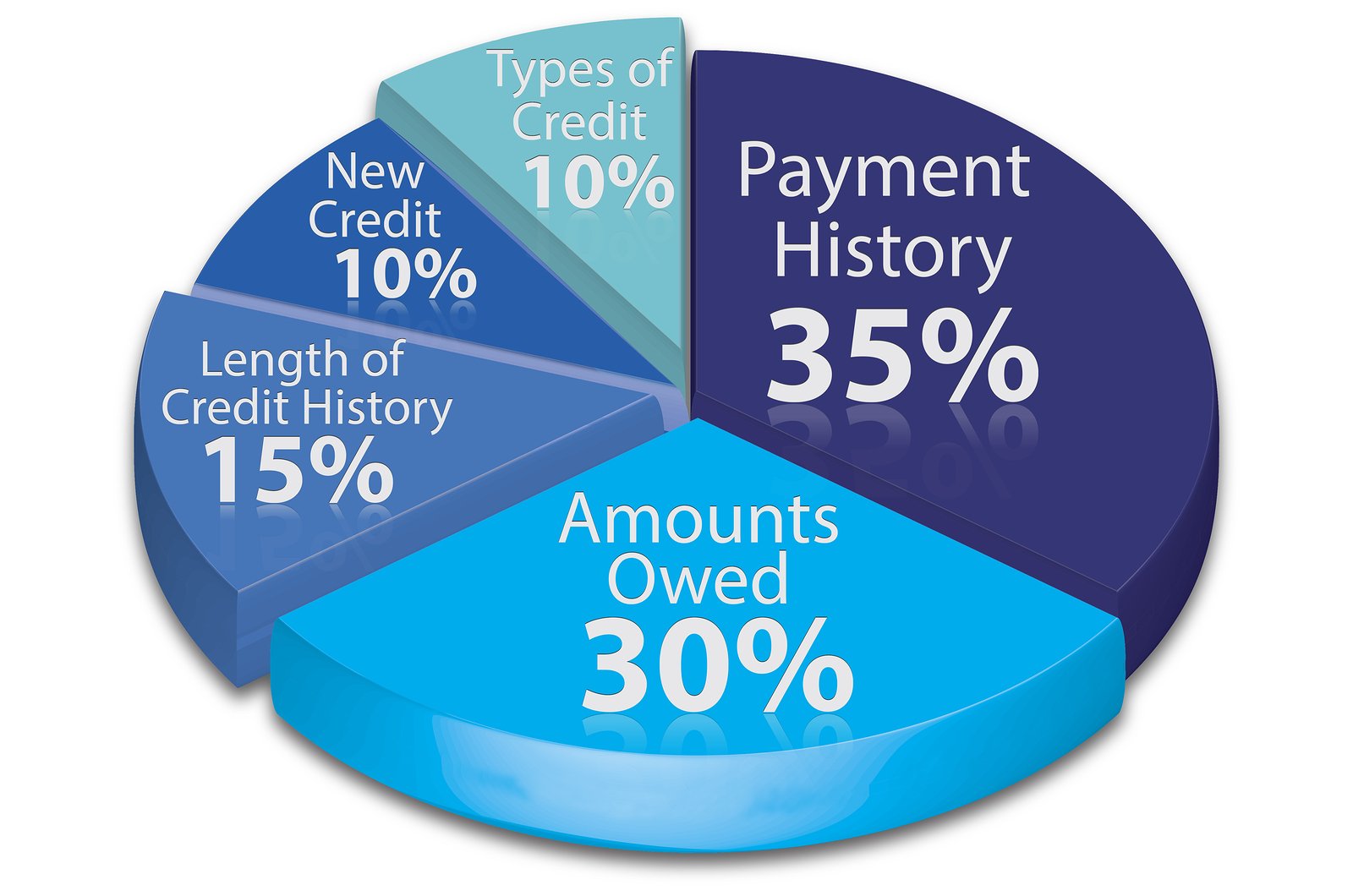

The Five Pillars: How Your FICO Score is Calculated (The Main Ingredients)

Let’s break down the main factors that contribute to your FICO Score. These are the "ingredients" in your credit score recipe, and each one has a specific weight or impact on your final number.

1. Payment History (35%): Your Financial Report Card

This is, by far, the most important factor in your credit score calculation. It’s like the main course of your credit score meal. Lenders want to know: Do you pay your bills on time?

- What it includes:

- On-time payments: Every payment made on or before its due date helps your score.

- Late payments: Payments reported 30, 60, 90, or more days past due are serious red flags. The later the payment, the more damage it does.

- Bankruptcies, foreclosures, collections, and charge-offs: These are severe negative marks that can significantly drop your score and stay on your report for many years.

- Why it matters: It directly reflects your reliability. If you’ve consistently paid on time, you’re seen as a trustworthy borrower. If you have a history of missed payments, lenders will be hesitant.

- Beginner Tip: Set up auto-pay or calendar reminders. Never miss a payment, even if it’s just the minimum.

2. Amounts Owed / Credit Utilization (30%): How Much You’re Using

This is the second most influential factor. It’s not just if you pay, but how much debt you’re carrying relative to your available credit. This is often referred to as your credit utilization ratio.

- What it includes:

- Total debt: The sum of all your outstanding balances on credit cards, loans, etc.

- Credit limits: The maximum amount of credit you have available across all your accounts.

- Credit utilization ratio: This is calculated by dividing your total current credit card balances by your total available credit. For example, if you have a $1,000 balance on a card with a $5,000 limit, your utilization is 20%. If you have multiple cards, it’s your total balances divided by your total limits.

- Why it matters: High utilization suggests you’re heavily reliant on credit or might be in financial distress, making you a higher risk.

- Beginner Tip: Aim to keep your credit card utilization below 30% on each card and overall. Lower is always better – ideally, below 10%. Paying off balances in full each month is the best strategy.

3. Length of Credit History (15%): Time is Money (and Credit!)

This factor assesses how long you’ve been managing credit. It’s about showing consistency and a track record over time.

- What it includes:

- Age of your oldest account: The longer your oldest credit account has been open, the better.

- Age of your newest account: Recent accounts can slightly lower your average age.

- Average age of all your accounts: This is a key metric.

- How long specific accounts have been active: The duration of each individual account matters.

- Why it matters: A longer credit history generally indicates more experience and stability in managing debt. It gives lenders more data to assess your habits.

- Beginner Tip: Don’t rush to close old, paid-off accounts, especially credit cards, even if you don’t use them frequently. They contribute positively to your average credit age.

4. New Credit (10%): Are You Seeking More?

This factor looks at how often and how recently you’ve applied for new credit.

- What it includes:

- Hard inquiries: When you apply for a new loan or credit card, the lender often pulls your credit report, which results in a "hard inquiry." A few inquiries within a short period can suggest you’re desperately seeking credit and might be a higher risk.

- Number of new accounts: Opening many new accounts in a short time can also be a red flag.

- Why it matters: A sudden surge in applications or new accounts can signal financial distress or an increased risk of taking on too much debt too quickly.

- Beginner Tip: Be strategic about applying for new credit. Only apply when you truly need it, and spread out your applications over time. Shopping for rates on a mortgage or car loan within a short window (typically 14-45 days, depending on the scoring model) will usually count as a single inquiry, so do your rate shopping efficiently.

5. Credit Mix (10%): A Well-Rounded Portfolio

This factor considers the variety of credit accounts you have.

- What it includes:

- Revolving credit: Accounts like credit cards, where you can borrow up to a certain limit, pay it down, and borrow again.

- Installment credit: Loans with fixed payments over a set period, like mortgages, auto loans, or student loans.

- Why it matters: Having a healthy mix of both revolving and installment credit shows lenders that you can responsibly manage different types of debt.

- Beginner Tip: Don’t open accounts just to "improve your credit mix." This factor has the smallest impact. Focus on managing your existing credit responsibly. As you naturally take on different types of debt (e.g., a car loan, then a mortgage), your mix will evolve.

How VantageScore Differs (Slightly)

While VantageScore uses the same five core categories, it may weigh them slightly differently. For example, VantageScore often emphasizes "Payment History" and "Depth of Credit" (a combination of utilization and credit mix) as the most influential factors. It also has a slightly different approach to "new credit" and "length of credit history."

The key takeaway is that the principles remain the same: responsible borrowing, on-time payments, and keeping debt low are universally rewarded.

Beyond the Numbers: What Doesn’t Affect Your Score (Directly)

It’s equally important to understand what doesn’t directly factor into your credit score:

- Your income: While it affects your ability to get approved for credit, your salary itself isn’t part of your credit score calculation.

- Your age, race, gender, religion, marital status: These personal characteristics are not used in credit scoring models.

- Your employment history: While lenders may look at your job stability, it’s not a factor in the score itself.

- "Soft inquiries": When you check your own credit score, or a potential employer or landlord pulls your credit for informational purposes, it results in a "soft inquiry." These do NOT affect your credit score.

- Debit card usage: Spending money from your bank account doesn’t involve borrowing, so it’s irrelevant to your credit score.

Why Understanding This Matters: Your Financial Superpower

Knowing how your credit score is calculated isn’t just academic; it’s empowering. It allows you to:

- Make informed financial decisions: You can see how your actions (or inactions) impact your score.

- Identify areas for improvement: If your score isn’t where you want it, you now know which levers to pull.

- Save money: A higher credit score often translates to lower interest rates on loans and credit cards, saving you thousands of dollars over time.

- Achieve your goals: Whether it’s buying a home, a car, or even renting an apartment, a good credit score makes these goals more attainable.

Actionable Steps: Improving Your Credit Score

Based on the factors we’ve discussed, here are the most effective ways to build and maintain a strong credit score:

- Pay Every Bill On Time, Every Time: This is the golden rule. Set up reminders or automatic payments.

- Keep Credit Card Balances Low (Below 30% Utilization): Pay off your credit card balances in full each month if possible. If not, aim to keep your utilization ratio as low as you can.

- Don’t Close Old Accounts (Unless Necessary): They contribute to your length of credit history.

- Be Strategic About New Credit Applications: Only apply for credit when you genuinely need it, and avoid opening too many accounts at once.

- Monitor Your Credit Report Regularly: You can get a free credit report from each of the three major bureaus once a year at AnnualCreditReport.com. Check for errors and unauthorized accounts.

- Diversify Your Credit Mix (Naturally): As your financial life evolves, you’ll likely acquire different types of loans. Don’t force it, but be aware that a mix is beneficial.

Conclusion: Take Control of Your Credit Journey

Your credit score isn’t a fixed, mysterious number. It’s a dynamic reflection of your financial behavior, calculated based on clear, understandable factors. By understanding the five pillars – payment history, amounts owed, length of credit history, new credit, and credit mix – you gain the knowledge to actively shape your financial future.

Start taking control today. Make smart choices, be diligent with your payments, and watch your credit score grow, opening up a world of financial opportunities. You now have the recipe; it’s time to start cooking up a great credit score!

Post Comment