Unlocking Tax-Free Growth: Your Comprehensive Guide to the Backdoor Roth IRA Strategy

For many savvy investors, the Roth IRA is the holy grail of retirement savings. Imagine contributing after-tax money today, letting it grow completely tax-free for decades, and then withdrawing every penny – including all the gains – absolutely tax-free in retirement. Sounds incredible, right? It is!

However, there’s a catch for high-income earners: direct contributions to a Roth IRA are limited by your Adjusted Gross Income (AGI). This means many successful individuals find themselves locked out of this incredible tax advantage.

But don’t despair! This is where the Backdoor Roth IRA strategy comes into play. It’s a perfectly legal and widely used method that allows high-income earners to bypass these income limitations and still get money into a Roth IRA.

This comprehensive guide will demystify the Backdoor Roth IRA, explaining:

- What a Roth IRA is and why it’s so desirable.

- The income limits that necessitate this strategy.

- A step-by-step breakdown of how the Backdoor Roth works.

- Who benefits most from this strategy.

- The crucial "pro-rata rule" and how to avoid pitfalls.

- Practical steps for executing your own Backdoor Roth conversion.

Let’s dive in and unlock the power of tax-free retirement growth!

What is a Roth IRA (and Why Do People Love It So Much)?

Before we explain the "backdoor," let’s understand the "front door" – the standard Roth IRA.

A Roth IRA is a type of individual retirement account that offers a unique tax advantage: tax-free withdrawals in retirement.

Here’s how it works:

- After-Tax Contributions: You contribute money that you’ve already paid taxes on (e.g., from your paycheck after income tax has been withheld).

- Tax-Free Growth: Your investments inside the Roth IRA grow completely tax-free. You don’t pay taxes on dividends, interest, or capital gains each year.

- Tax-Free Withdrawals: Once you reach age 59½ and have had the account open for at least five years (known as the "5-year rule"), all qualified withdrawals are 100% tax-free. This includes your original contributions and all the accumulated earnings.

- No Required Minimum Distributions (RMDs): Unlike Traditional IRAs and 401(k)s, Roth IRAs do not require you to start taking money out at a certain age (currently 73). This offers incredible flexibility for estate planning and leaving a legacy.

The catch? The ability to contribute directly to a Roth IRA is phased out once your income (specifically your Modified Adjusted Gross Income or MAGI) reaches certain thresholds. For 2024, for example, the ability to contribute directly begins to phase out for single filers with MAGI over $146,000 and is completely eliminated for those with MAGI over $161,000. These limits adjust annually.

The "Problem": When You Can’t Directly Contribute to a Roth IRA

If your income exceeds the IRS-mandated limits, you are "phased out" of direct Roth IRA contributions. This means you cannot simply write a check and deposit it into a Roth IRA account. For high-income earners who have maxed out their employer-sponsored retirement plans (like a 401(k) or 403(b)) and still want to save more, this can feel like a missed opportunity.

This is precisely the "problem" that the Backdoor Roth IRA strategy solves. It’s a workaround that allows you to contribute to a Roth IRA even if your income is too high for direct contributions.

Enter the Backdoor Roth IRA: The Strategy Explained Step-by-Step

The Backdoor Roth IRA strategy involves two distinct, perfectly legal steps that, when combined, achieve the desired outcome: getting money into a Roth IRA when direct contributions aren’t allowed.

The core idea is to contribute to a Traditional IRA first, and then immediately convert that money to a Roth IRA.

Here’s the detailed, step-by-step process:

Step 1: Contribute to a Non-Deductible Traditional IRA

- Open a Traditional IRA Account: If you don’t already have one, open a Traditional IRA with your preferred brokerage firm (e.g., Fidelity, Vanguard, Schwab).

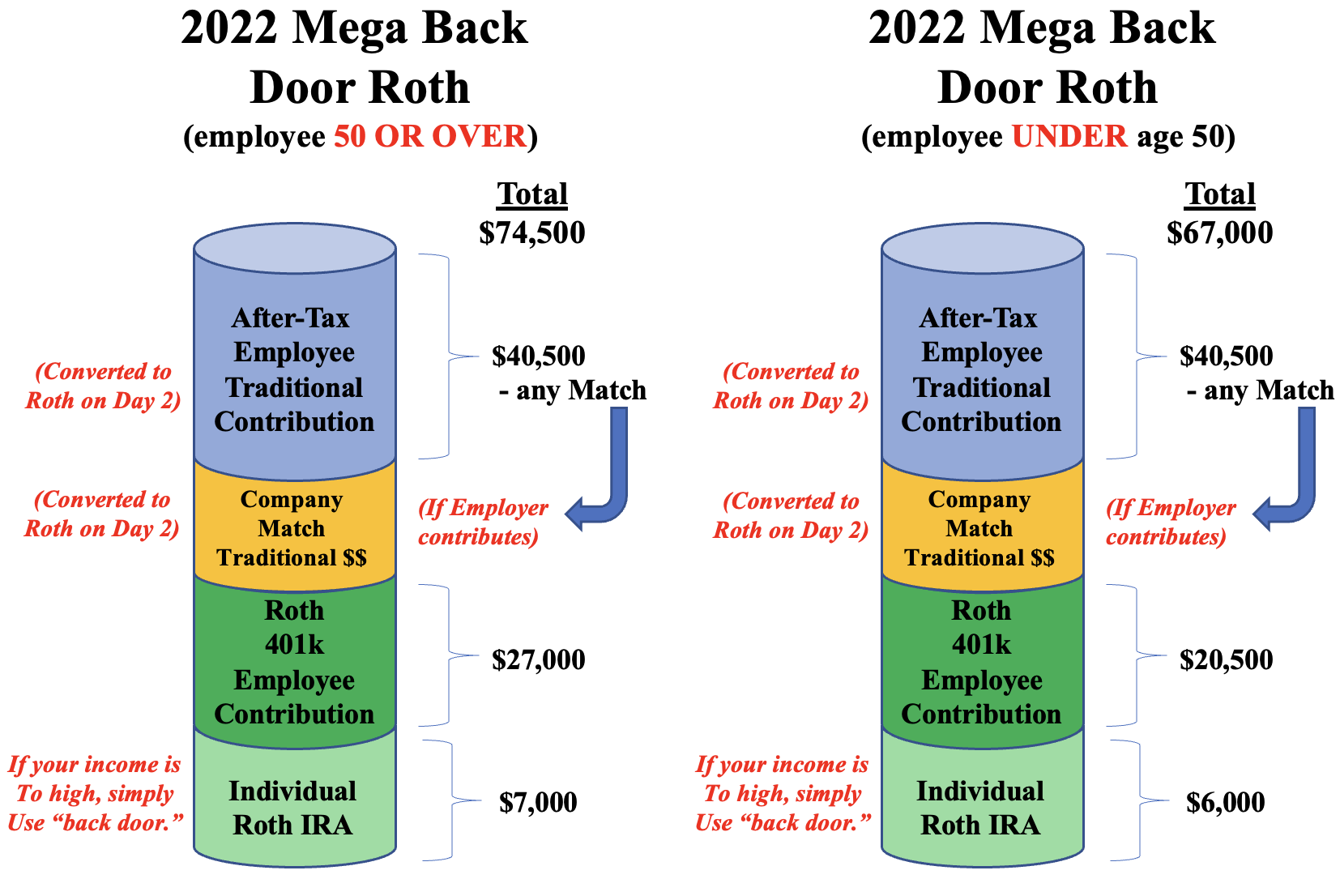

- Make a Contribution: Contribute the maximum allowable amount for the year to this Traditional IRA. For 2023 and 2024, the maximum contribution is $6,500 (or $7,000 if you’re age 50 or older).

- Crucial Point: It Must Be a Non-Deductible Contribution: This is the most critical part for high-income earners. Because your income is too high, you will not deduct this contribution on your tax return. This means you are contributing "after-tax" money, similar to how a direct Roth IRA contribution works.

- Why is this important? If you deducted the contribution, it would be pre-tax money. Converting pre-tax money to a Roth IRA would be a taxable event. By making a non-deductible contribution, you establish a "basis" (meaning you’ve already paid taxes on it), so the subsequent conversion is generally tax-free.

Step 2: Convert Your Traditional IRA Funds to a Roth IRA

- Wait Briefly (Optional but Recommended): While not strictly required, many advisors suggest waiting a day or two after your contribution clears before initiating the conversion. This helps create a clear separation between the contribution and conversion steps for IRS documentation purposes.

- Initiate the Roth Conversion: Contact your brokerage firm and instruct them to convert the funds from your Traditional IRA to a Roth IRA. This is often done online with a few clicks.

- Convert the Full Amount: Convert the entire amount you just contributed. Since you contributed after-tax money, and ideally, there’s been no significant investment growth yet (because you’re doing it immediately), there should be no taxable income generated from this conversion.

And that’s it! You’ve successfully performed a Backdoor Roth IRA conversion. The money you contributed is now sitting in a Roth IRA, where it can grow tax-free and be withdrawn tax-free in retirement.

Who Benefits Most from a Backdoor Roth?

The Backdoor Roth IRA strategy is primarily designed for a specific group of individuals:

- High-Income Earners: Individuals or couples whose Modified Adjusted Gross Income (MAGI) exceeds the IRS limits for direct Roth IRA contributions.

- Those Maxing Out Other Retirement Accounts: People who are already contributing the maximum allowable to their 401(k)s, 403(b)s, and other employer-sponsored plans, but still want to save more for retirement in a tax-advantaged way.

- Individuals Seeking Tax Diversification: Even if you have substantial pre-tax savings (like a Traditional IRA or 401(k)), adding a Roth IRA provides valuable tax diversification. This gives you options in retirement when it comes to withdrawing funds based on your tax situation at that time.

- People Who Believe Tax Rates Will Be Higher in the Future: If you expect to be in a higher tax bracket in retirement than you are now, paying taxes on the money today (via the non-deductible contribution) and enjoying tax-free growth and withdrawals later is a smart move.

The Crucial "Pro-Rata Rule": Understanding the Catch

This is arguably the most important concept to understand when executing a Backdoor Roth, as it’s where most people encounter issues.

The "Pro-Rata Rule" (also known as the "Aggregation Rule") states that the IRS views all your Traditional IRA accounts (including SEP IRAs and SIMPLE IRAs) as one large, aggregated account for tax purposes. This means you cannot pick and choose which money you convert from your Traditional IRA to your Roth IRA.

Here’s the problem: If you have any existing pre-tax money in any Traditional IRA (from deductible contributions, rollovers from 401(k)s, etc.), a portion of your Backdoor Roth conversion will become taxable.

Example of the Pro-Rata Rule in Action:

Let’s say you have:

- $94,000 in an old Traditional IRA from a 401(k) rollover (all pre-tax money).

- You make a $6,000 non-deductible contribution to a new Traditional IRA for your Backdoor Roth.

Now, the IRS views your total Traditional IRA money as $100,000 ($94,000 pre-tax + $6,000 after-tax).

When you convert the $6,000 non-deductible contribution to a Roth IRA, the IRS considers the conversion to be a proportional mix of your pre-tax and after-tax money.

- In this case, 94% ($94,000 / $100,000) of your total IRA money is pre-tax.

- So, 94% of your $6,000 conversion (which is $5,640) would be treated as taxable income.

- Only 6% ($360) would be considered the non-taxable portion of your conversion.

This defeats the purpose of the Backdoor Roth, as you’d owe taxes on a significant portion of the conversion!

How to Avoid the Pro-Rata Rule Pitfall:

The best way to avoid the pro-rata rule is to have a $0 balance in all your pre-tax Traditional IRAs before you perform the Roth conversion.

Here are the common strategies to achieve this:

- Roll Pre-Tax IRA Money into an Employer-Sponsored Plan (e.g., 401(k)): If your current employer’s 401(k) plan allows it, you can roll your existing pre-tax Traditional IRA funds into your 401(k). This effectively "clears out" your Traditional IRA balance, making your Backdoor Roth conversion fully non-taxable.

- Convert All Pre-Tax IRA Money to a Roth IRA (and Pay the Taxes): You could convert all your existing pre-tax Traditional IRA money to a Roth IRA. However, this will be a taxable event, and you’ll owe income tax on the entire converted amount in the year of conversion. This might be a good strategy if you have a relatively small amount of pre-tax IRA money or if you’re in a low-income year.

- Don’t Have Any Existing Pre-Tax IRAs: If you’re starting from scratch with no prior Traditional IRA balances (especially from 401(k) rollovers), you’re in the clear!

Key Takeaway: Before attempting a Backdoor Roth, check all your IRA accounts for any pre-tax money. If you have any, address it first to avoid an unexpected tax bill.

Step-by-Step Guide to Executing a Backdoor Roth Conversion

Let’s put it all together into a clear action plan.

-

Check Your Existing IRA Balances:

- Log into all your brokerage accounts and check every Traditional IRA (including SEP and SIMPLE IRAs).

- Goal: Ensure you have $0 in pre-tax Traditional IRA money. If not, implement one of the strategies above (e.g., roll into a 401(k)) to clear them out before proceeding.

-

Open a Traditional IRA Account:

- If you don’t already have one, open a new Traditional IRA account with your preferred brokerage. This account will temporarily hold your non-deductible contribution.

-

Make Your Non-Deductible Contribution:

- Contribute the maximum allowable amount for the year to your Traditional IRA. For example, in 2024, this is $7,000 if you’re 50 or older, or $6,500 if under 50.

- Important: Designate this as a non-deductible contribution. You will indicate this on IRS Form 8606 when you file your taxes.

-

Open a Roth IRA Account:

- If you don’t already have one, open a Roth IRA account with the same brokerage. This is where the money will ultimately reside.

-

Initiate the Roth Conversion:

- Once your non-deductible contribution has fully settled in your Traditional IRA (usually 1-2 business days), initiate the conversion.

- Instruct your brokerage to convert the full amount from your Traditional IRA to your Roth IRA.

- Timing: While you can contribute for a given tax year up until the tax filing deadline (usually April 15th of the following year), it’s generally best to make the contribution and conversion in the same calendar year to simplify tax reporting. If you contribute in one year and convert in the next, it’s still fine, but requires careful tracking.

-

Maintain Excellent Records:

- Keep documentation of your non-deductible contribution (e.g., confirmation statements).

- Keep documentation of your Roth conversion.

- This is crucial for tax reporting.

-

File IRS Form 8606 with Your Tax Return:

- This is a mandatory step for every year you make a non-deductible IRA contribution or perform a Roth conversion.

- Part I of Form 8606: Reports your non-deductible Traditional IRA contribution, establishing your "basis" (the after-tax money you put in).

- Part II of Form 8606: Reports the Roth conversion, calculating the taxable portion (which should be $0 if you successfully avoided the pro-rata rule).

- Why it’s critical: If you don’t file Form 8606, the IRS has no record that your Traditional IRA contribution was non-deductible. This means they might assume it was pre-tax money and later tax your conversion.

Important Considerations and Common Pitfalls

Even with a clear strategy, there are nuances to consider:

- Tax Reporting is Key (Form 8606): We can’t stress this enough. Failing to properly file Form 8606 can lead to your conversion being taxed, or your original contributions being taxed again in retirement. If you use tax software, it will typically guide you through this, but double-check.

- The 5-Year Rule for Roth Conversions: While your original Roth contributions can be withdrawn tax-free at any time, converted amounts have their own 5-year rule. Each conversion has its own 5-year clock before the earnings portion of that converted money can be withdrawn tax-free. The principal (the amount converted) can generally be withdrawn after 5 years or upon reaching age 59½, whichever is later for each specific conversion.

- Investment Growth Between Contribution and Conversion: If you contribute to the Traditional IRA and wait a long time to convert, any investment growth that occurs during that waiting period will be taxable upon conversion. This is why it’s recommended to convert immediately or within a few days.

- State Taxes: While the federal treatment of a Backdoor Roth is generally tax-free (assuming no pre-tax IRA money), some states might have different rules regarding IRA contributions or conversions. Consult a local tax professional.

- Future Tax Law Changes: Tax laws can change. While the Backdoor Roth strategy has been widely accepted and utilized for years, there’s always a possibility of future legislation impacting its viability. Stay informed.

- Estate Planning: A Roth IRA can be a powerful estate planning tool, as it passes to beneficiaries tax-free.

Is a Backdoor Roth Right for You?

The Backdoor Roth IRA strategy is an excellent tool for high-income earners who are otherwise excluded from direct Roth IRA contributions. It allows you to:

- Grow your retirement savings tax-free.

- Withdraw funds tax-free in retirement.

- Enjoy tax diversification in your portfolio.

- Avoid Required Minimum Distributions (RMDs) on these funds.

However, it’s not without its complexities, particularly regarding the pro-rata rule and accurate tax reporting.

When to Consider Professional Advice:

- If you have existing pre-tax Traditional IRA balances: A financial advisor or tax professional can help you navigate the pro-rata rule and determine the best strategy to clear out those funds.

- If your financial situation is complex: Multiple retirement accounts, self-employment income, or other unique circumstances can make DIY Backdoor Roth conversions tricky.

- If you’re unsure about tax implications: A tax professional can ensure you correctly file Form 8606 and understand any state-specific tax considerations.

Conclusion: Empowering Your Retirement Savings

The Backdoor Roth IRA strategy is a powerful and legitimate way for high-income earners to access the incredible tax benefits of a Roth IRA. By understanding the two-step process, diligently avoiding the pro-rata rule, and meticulously handling your tax reporting with Form 8606, you can unlock a world of tax-free growth and withdrawals in retirement.

Don’t let income limits deter you from building a robust and tax-efficient retirement portfolio. With careful planning and execution, the Backdoor Roth IRA can be a cornerstone of your long-term financial success.

Disclaimer: This article provides general information and is not intended as financial or tax advice. Tax laws are complex and subject to change. Always consult with a qualified financial advisor and tax professional to discuss your specific situation before making any financial decisions.

Post Comment