Unlocking Growth: Business Investment Patterns During Economic Peaks

The economy is a bit like a rollercoaster – it goes up, it goes down, and sometimes it hits exhilarating high points. These high points are what we call economic peaks, and they represent a period of strong growth, high employment, and booming consumer confidence. For businesses, an economic peak isn’t just a time to celebrate; it’s a critical period for making strategic investment decisions that can shape their future for years to come.

But what exactly do businesses do when the economic sun is shining brightest? Do they splurge, save, or strategically expand? Understanding these business investment patterns during economic peaks is crucial for anyone looking to navigate the world of finance, from aspiring entrepreneurs to seasoned investors. This article will break down these patterns in simple terms, highlighting both the exciting opportunities and the potential pitfalls.

What Exactly is an Economic Peak?

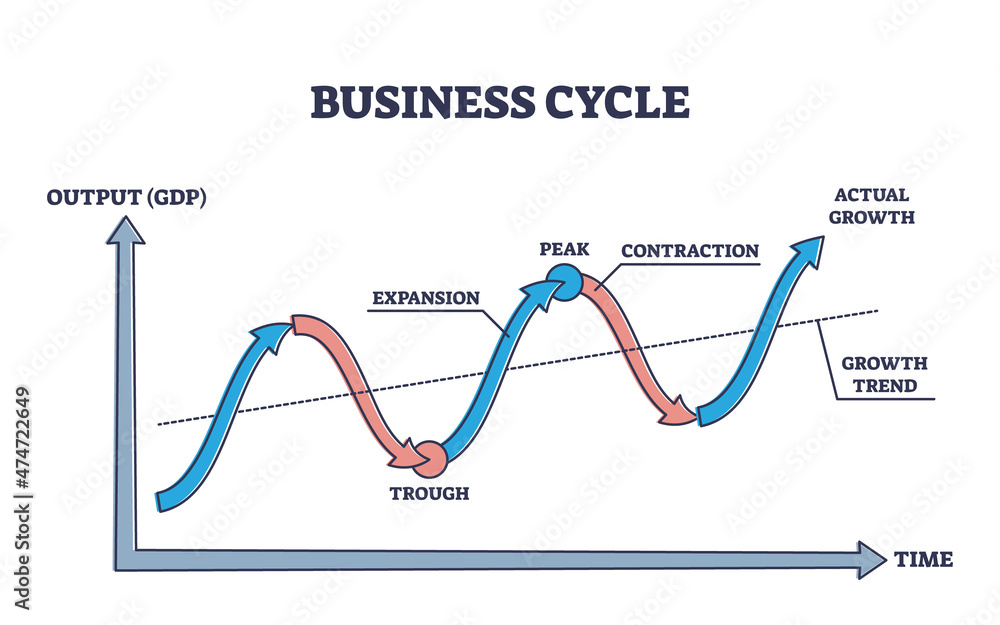

Before we dive into investment, let’s clarify what an economic peak is. Imagine the economy’s performance charted on a graph. It’s usually a wavy line. An economic peak is the highest point on that wave before it starts to turn downwards into a contraction or recession.

Key characteristics of an economic peak include:

- High Gross Domestic Product (GDP) Growth: The total value of goods and services produced in a country is growing rapidly.

- Low Unemployment: Most people who want to work can find jobs.

- High Consumer Confidence: People feel secure in their jobs and finances, so they’re more willing to spend money.

- Increased Business Profits: Companies are selling more and often at better prices, leading to fatter profit margins.

- Easy Access to Credit: Banks are more willing to lend money, and interest rates might still be relatively low (though they can start rising towards the very end of a peak).

Think of it like a party where everyone is spending, earning, and feeling optimistic. Businesses naturally want to capitalize on this vibrant atmosphere.

Why Do Businesses Invest During Economic Peaks?

It might seem obvious, but there are very specific reasons why companies choose to loosen their purse strings during boom times:

- To Meet Soaring Demand: When consumers are confident and spending, demand for products and services goes up. Businesses need to invest to keep up.

- To Capture More Market Share: A growing pie means more slices to go around. Companies invest to grab a larger piece of that expanding market.

- To Capitalize on Higher Profits: With more money coming in, businesses have more cash on hand to reinvest in their operations or new ventures.

- To Gain a Competitive Edge: Investing in new technology, processes, or talent can help a company outperform rivals.

- To Prepare for Future Growth: Even during a peak, smart businesses are looking ahead, anticipating where the market might go next.

Common Business Investment Patterns During Economic Peaks

During economic peaks, businesses typically exhibit several key investment behaviors. These aren’t just random acts; they’re strategic moves aimed at maximizing the benefits of the good times.

1. Expansion and Capacity Building

This is perhaps the most visible form of investment during a boom. When demand is high, businesses need to produce more.

- What it looks like:

- Building new factories or expanding existing ones: Think of car manufacturers adding new production lines or food processing plants increasing their output.

- Opening new retail stores or offices: As populations grow and disposable income rises, businesses expand their physical footprint to reach more customers.

- Increasing inventory: Stocking more products to ensure they don’t miss out on sales opportunities.

- Why it happens: Directly addresses the immediate need to meet increased customer demand and scale operations.

2. Technology and Innovation

Economic peaks often fuel a surge in technological investment. Companies have the resources and the incentive to innovate.

- What it looks like:

- Investing in new software and hardware: Upgrading IT systems, implementing advanced analytics, or adopting cloud computing solutions.

- Research and Development (R&D): Pouring money into developing new products, services, or more efficient processes. This could be anything from new drug discoveries to advanced AI algorithms.

- Automation: Investing in robots or automated systems to improve efficiency, reduce labor costs, and increase output.

- Why it happens: To improve efficiency, reduce costs, create new revenue streams, and stay ahead of competitors in a rapidly evolving market.

3. Mergers and Acquisitions (M&A)

When times are good, companies often look to grow quickly by buying other businesses.

- What it looks like:

- Acquiring competitors: To gain market share, reduce competition, or consolidate industries.

- Buying suppliers or distributors: To control more of the supply chain and reduce costs (known as vertical integration).

- Purchasing companies with new technologies or talent: To quickly expand into new markets or acquire specialized skills.

- Why it happens: M&A offers a fast track to growth, market expansion, diversification, and access to new capabilities or customer bases. It can also be a way to "buy" innovation rather than developing it from scratch.

4. Talent Acquisition and Development

A booming economy means low unemployment, making the hunt for skilled workers more competitive. Businesses invest heavily in their human capital.

- What it looks like:

- Hiring more employees: Especially in sales, marketing, production, and R&D roles to support expansion.

- Increasing wages and benefits: To attract and retain top talent in a tight labor market.

- Training and development programs: Investing in employee skills to boost productivity and prepare them for new roles or technologies.

- Improving workplace culture: Creating a more attractive environment to recruit and keep employees happy.

- Why it happens: People are the backbone of any business. Investing in them ensures a company has the necessary skills and manpower to grow and innovate.

5. Marketing and Brand Building

With more disposable income, consumers are looking to spend. Businesses ramp up efforts to capture their attention.

- What it looks like:

- Increased advertising spending: On TV, digital platforms, social media, and traditional media.

- Sponsorships and partnerships: Aligning with events or organizations to boost brand visibility.

- Product launches and promotions: Aggressively marketing new offerings to capitalize on consumer enthusiasm.

- Investing in customer experience: Improving service, loyalty programs, and overall customer satisfaction to build long-term relationships.

- Why it happens: To maximize sales during a period of high consumer spending and to build brand loyalty that can withstand future economic shifts.

6. Real Estate and Infrastructure

Economic peaks often see a surge in commercial and sometimes residential real estate investment, driven by business expansion and consumer demand.

- What it looks like:

- Purchasing or leasing larger office spaces: To accommodate growing teams.

- Investing in warehouses and logistics centers: To manage increased inventory and distribution needs.

- Developing new commercial properties: Such as shopping centers or industrial parks.

- Upgrading existing infrastructure: Improving roads, internet connectivity, or energy systems to support business operations.

- Why it happens: Businesses need physical space to expand operations, and improved infrastructure is vital for efficient supply chains and market access.

The Double-Edged Sword: Risks of Investing During Peaks

While investing during an economic peak offers immense opportunities, it’s not without its dangers. The optimism of a boom can sometimes lead to costly mistakes.

- Over-investment and Overcapacity: Businesses might get too enthusiastic and build more capacity (factories, staff) than the market can sustain once the peak passes. This leads to idle resources and wasted money.

- Rising Costs: As demand for resources (labor, materials) increases, so do their prices. What seemed like a good investment at one price might become expensive later.

- Interest Rate Hikes: Central banks often raise interest rates towards the end of a boom to prevent inflation. This makes borrowing money more expensive, increasing the cost of new investments and debt.

- Market Saturation: Everyone is expanding, leading to more competition. What started as a profitable market can quickly become oversaturated, making it harder to generate returns.

- Ignoring Future Downturns: The biggest risk is a false sense of security. Businesses might neglect to build up cash reserves or plan for a potential economic slowdown, leaving them vulnerable when the cycle turns.

- "Bubble" Formation: Excessive investment in certain sectors (like tech or real estate) can lead to asset bubbles, where prices inflate beyond their true value, eventually leading to a painful crash.

Strategic Considerations for Businesses During Economic Peaks

So, how can businesses smartly navigate the investment landscape during a boom? It’s about balancing ambition with caution.

- Focus on Long-Term Value: Don’t just invest for immediate gains. Consider how an investment will contribute to the company’s growth and resilience over the next 5-10 years, not just the next quarter.

- Maintain Financial Discipline: Even with high profits, it’s crucial to manage cash flow wisely. Avoid taking on excessive debt that could become burdensome if interest rates rise or revenues fall.

- Diversify Investments: Don’t put all your eggs in one basket. Spread investments across different areas (e.g., R&D, marketing, capacity) to mitigate risk.

- Monitor Market Signals Closely: Pay attention to economic indicators like inflation, interest rates, and consumer confidence. These can provide early warnings that the peak might be nearing its end.

- Innovate Wisely: While innovation is key, ensure R&D projects are well-researched and have a clear path to commercialization, rather than just chasing the latest fad.

- Invest in Efficiency and Agility: Investments that make operations more efficient or allow the business to adapt quickly to changing conditions can be invaluable when the economy eventually slows down.

- Build a "War Chest": Use some of the peak profits to build up cash reserves. This provides a safety net and allows for opportunistic investments during a downturn when assets might be cheaper.

Conclusion: Riding the Wave Responsibly

Economic peaks are exhilarating times for businesses. They offer unparalleled opportunities for growth, expansion, and innovation. The investment patterns we see – from building new factories and embracing cutting-edge technology to acquiring competitors and nurturing talent – are all geared towards capitalizing on this period of prosperity.

However, the smart business leader understands that every peak eventually gives way to a trough. The most successful companies during economic peaks are those that invest strategically, balancing their ambition for growth with a healthy dose of foresight and financial prudence. By understanding these patterns and the inherent risks, businesses can not only unlock incredible growth during the good times but also build the resilience needed to weather the inevitable economic shifts that follow. It’s about riding the wave, but always with an eye on the horizon.

Post Comment