Unlocking Global Markets: The Law of Supply and Demand Explained for Beginners

Have you ever wondered why the price of your morning coffee changes, or why a new smartphone costs what it does, no matter where you buy it in the world? The answer, at its heart, lies in two fundamental economic principles: The Law of Supply and the Law of Demand.

These aren’t just dry textbook theories; they are the invisible forces that shape our everyday lives, determining everything from the cost of gasoline to the availability of exotic fruits. And in today’s interconnected world, these laws play out not just in your local market, but on a massive, global scale.

This article will break down the Law of Supply and Demand in a way that’s easy to understand, then explore how these powerful forces operate within the complex tapestry of global markets, influencing trade, prices, and even international relations.

What is the Law of Supply and Demand? The Basics

Before we dive into the global stage, let’s understand the core concepts. Think of any product or service you can buy. There are people who want to buy it (demand) and people who want to sell it (supply).

1. The Law of Demand: The Buyer’s Perspective

Imagine you love ice cream.

- The Law of Demand states that as the price of a good or service increases, the quantity demanded by consumers will decrease, and vice-versa.

In simpler terms:

- If ice cream is cheap: You’re more likely to buy a lot of it, maybe even two scoops instead of one.

- If ice cream is expensive: You might buy less, or even skip it altogether for a cheaper dessert.

Key Factors Influencing Demand:

- Consumer Income: If people have more money, they tend to buy more.

- Tastes and Preferences: What’s popular today might not be tomorrow.

- Price of Related Goods:

- Substitutes: If coffee gets too expensive, you might buy more tea.

- Complements: If the price of hot dogs goes down, you might buy more hot dog buns.

- Consumer Expectations: If you expect prices to rise next week, you might buy now.

- Population Size: More people generally mean more demand.

2. The Law of Supply: The Seller’s Perspective

Now, let’s think about the ice cream shop owner.

- The Law of Supply states that as the price of a good or service increases, the quantity supplied by producers will also increase, and vice-versa.

In simpler terms:

- If ice cream can be sold for a high price: The shop owner is motivated to make and sell more ice cream because they can earn more profit. They might even hire more staff or buy more ingredients.

- If ice cream can only be sold for a low price: The shop owner might produce less, as it’s less profitable. They might even consider selling something else.

Key Factors Influencing Supply:

- Cost of Production: The cost of ingredients, labor, rent, etc. If costs go up, supply might go down.

- Technology: Better technology can make production more efficient, increasing supply.

- Number of Sellers: More companies producing a good means more supply.

- Government Policies: Taxes, subsidies, or regulations can affect how much is produced.

- Expectations of Future Prices: If a producer expects prices to rise, they might hold back supply now to sell later.

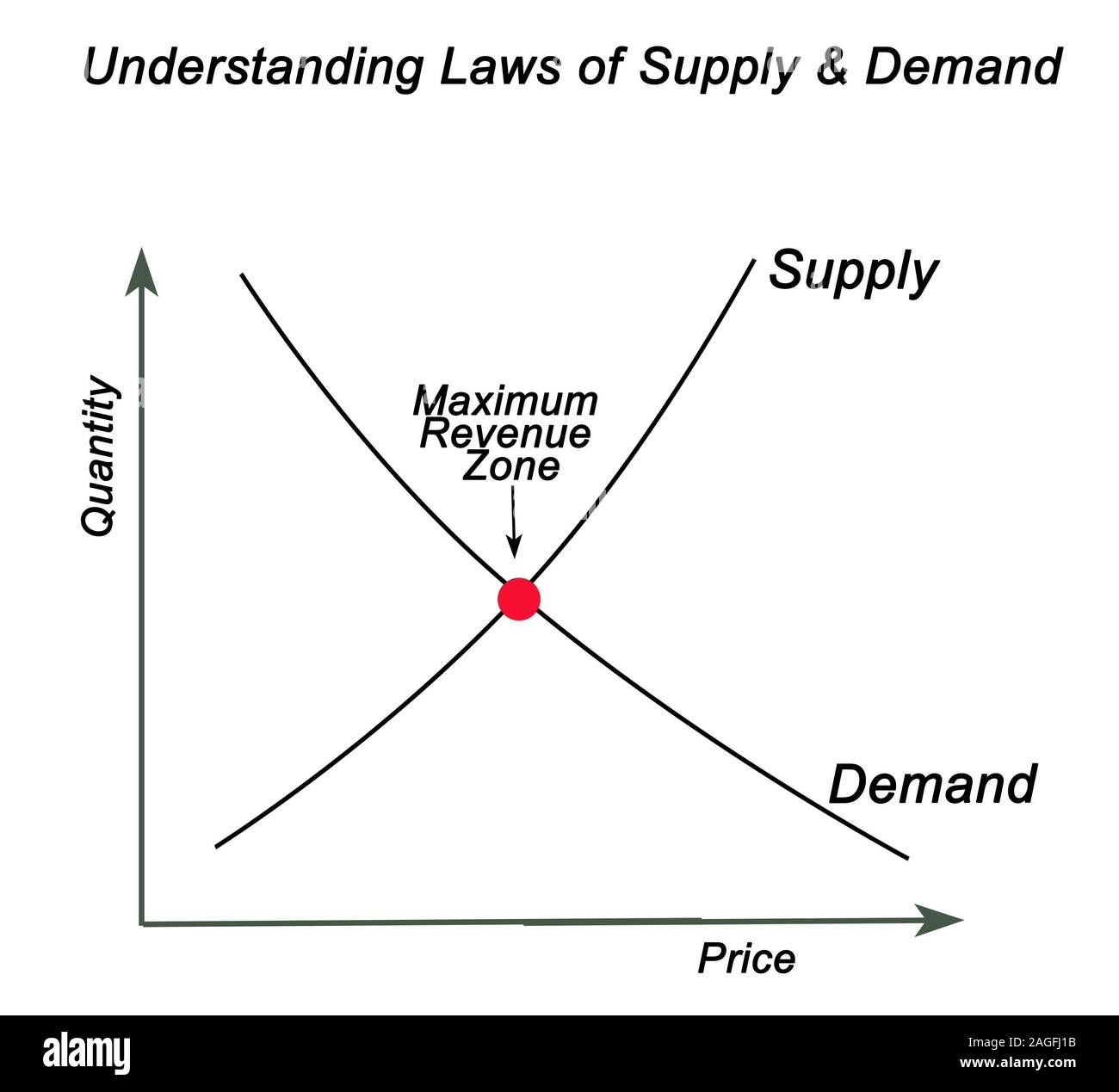

3. Market Equilibrium: The "Sweet Spot"

The magic happens when supply and demand meet.

- Equilibrium is the point where the quantity of a good that buyers are willing and able to purchase is exactly equal to the quantity that sellers are willing and able to produce and sell. At this point, the market is stable, and there’s no pressure for the price to change.

Imagine our ice cream market:

- If the price is too high, sellers have a surplus (more ice cream than buyers want). They’ll lower prices to sell it.

- If the price is too low, buyers create a shortage (more demand than available ice cream). Sellers will raise prices because they know people will pay more.

- Eventually, the price will settle at the equilibrium price, where everyone who wants ice cream at that price can get it, and every seller who wants to sell at that price can.

The Global Stage: Why Supply and Demand Go International

In today’s world, very few products are produced and consumed entirely within one country. Your smartphone might be designed in California, assembled in China, with components from Korea, Japan, and Germany. This is where the "global markets" come in.

Global markets mean:

- Interconnectedness: What happens in one part of the world can quickly affect prices and availability everywhere else.

- Vast Scale: Supply and demand aren’t just about local businesses and consumers; they involve entire nations, multinational corporations, and billions of people.

- Complex Factors: Beyond the basic economic factors, global supply and demand are also influenced by politics, international agreements, exchange rates, and even natural disasters on the other side of the planet.

Factors Influencing Global Supply

When we talk about global supply, we’re looking at the total quantity of a good or service that all producers worldwide are willing to offer for sale.

-

Global Production Costs:

- Labor Costs: Countries with lower wages can produce goods more cheaply, increasing global supply. This is why many manufacturing jobs moved to countries like China or Vietnam.

- Raw Material Prices: The cost of oil, metals, agricultural products – if these global commodity prices rise, it affects production costs everywhere.

- Transportation Costs: Shipping goods across oceans adds to the cost. Fluctuations in fuel prices or shipping container availability can impact global supply.

-

Technological Advancements:

- Innovations in manufacturing (e.g., automation, 3D printing) can drastically reduce production time and cost, boosting global supply.

- New agricultural techniques can increase crop yields worldwide.

-

Government Policies & Regulations:

- Subsidies: Government payments to producers (e.g., to farmers) can encourage more production, increasing global supply.

- Taxes: High taxes on production can discourage it, reducing global supply.

- Environmental Regulations: Strict rules might increase production costs, potentially reducing supply from some regions.

- Trade Agreements: These can reduce barriers to trade, making it easier for goods to flow between countries, effectively increasing supply in various markets.

-

Geopolitical Stability & Natural Events:

- Wars or Political Unrest: Can disrupt production, supply chains, and transportation routes (e.g., conflict in a major oil-producing region).

- Natural Disasters: Earthquakes, floods, or droughts can devastate crops or destroy factories, significantly reducing global supply for certain goods.

- Pandemics: As seen with COVID-19, global health crises can shut down factories, limit shipping, and disrupt supply chains worldwide.

Factors Influencing Global Demand

Global demand represents the total quantity of goods and services that consumers, businesses, and governments worldwide are willing and able to buy.

-

Global Economic Growth & Income Levels:

- When the global economy is booming, people and businesses have more money, leading to increased demand for everything from cars to consumer electronics.

- The rise of a middle class in emerging economies (like India or parts of Africa) creates massive new demand for goods and services.

-

Global Consumer Preferences & Trends:

- Social media and global advertising can quickly spread trends, creating sudden surges in demand for specific products (e.g., a popular gadget, a new fashion item).

- Growing global awareness of issues like climate change can shift demand towards sustainable or eco-friendly products.

-

Exchange Rates:

- The value of one currency compared to another significantly impacts global demand.

- Stronger Currency: If the US dollar is strong, imported goods become cheaper for American consumers, increasing their demand for foreign products.

- Weaker Currency: If the Euro is weak, European goods become cheaper for foreign buyers, increasing global demand for European exports.

-

Population Growth and Demographics:

- A growing global population naturally increases demand for food, housing, energy, and basic goods.

- Aging populations in some developed countries might increase demand for healthcare services, while younger populations in others might drive demand for technology.

-

Government Policies & Trade Barriers:

- Tariffs: Taxes on imported goods make them more expensive, reducing global demand for those specific imports.

- Quotas: Limits on the quantity of goods that can be imported also restrict global demand for foreign products.

- Trade Agreements: By reducing tariffs and other barriers, these agreements can stimulate demand for goods and services across borders.

How Global Markets Shift Supply and Demand

The interaction of these global factors causes constant shifts in supply and demand curves, leading to price volatility and changes in trade patterns.

-

Example 1: The Price of Oil

- Supply Shift: A major oil-producing country experiences political instability (reducing supply). OPEC (Organization of the Petroleum Exporting Countries) decides to cut production (reducing supply).

- Demand Shift: Emerging economies like China and India experience rapid industrial growth (increasing demand). A global recession hits (decreasing demand).

- Result: These shifts cause the global price of oil to fluctuate wildly, impacting everything from transportation costs to manufacturing expenses worldwide.

-

Example 2: Smartphones

- Supply Shift: New factories open in Vietnam with advanced automation (increasing supply). A global chip shortage occurs (reducing supply).

- Demand Shift: A new, must-have feature is introduced (increasing demand). A global economic slowdown reduces consumer spending (decreasing demand).

- Result: The constant innovation and global competition in the smartphone market lead to frequent price adjustments and rapid product cycles.

Government Intervention: A Global Game Changer

Governments don’t just sit back and let supply and demand do all the work. They often intervene in global markets, aiming to protect domestic industries, ensure national security, or achieve specific economic goals.

- Tariffs (Import Taxes):

- How they work: A tax on goods coming into a country.

- Impact: Makes imported goods more expensive, reducing their demand within the importing country and encouraging consumers to buy domestically produced alternatives. Can lead to retaliatory tariffs from other countries.

- Quotas (Import Limits):

- How they work: A numerical limit on the quantity of a good that can be imported.

- Impact: Reduces the overall supply of foreign goods in the domestic market, potentially raising their prices.

- Subsidies (Financial Aid):

- How they work: Government payments to domestic producers.

- Impact: Lowers production costs for domestic firms, allowing them to sell at lower prices and compete better globally, effectively increasing their supply.

- Trade Agreements (e.g., WTO, NAFTA/USMCA):

- How they work: Pacts between countries to reduce or eliminate trade barriers like tariffs and quotas.

- Impact: Generally increases global trade by making it easier and cheaper to import and export goods, boosting both supply and demand across borders.

Real-World Global Examples

-

Coffee Market:

- Global Supply: Affected by weather patterns in Brazil (a major producer), labor costs in Vietnam, and pest outbreaks in Central America.

- Global Demand: Influenced by growing coffee consumption in Asia, health trends in Western countries, and disposable income levels worldwide.

- Result: A drought in Brazil can send global coffee prices soaring, impacting cafes and consumers everywhere.

-

Automobile Industry:

- Global Supply: Relies on complex supply chains spanning dozens of countries for parts, affected by everything from semiconductor shortages in Taiwan to factory shutdowns in Germany.

- Global Demand: Driven by economic growth in emerging markets, consumer preferences for SUVs or electric vehicles, and government incentives for car purchases.

- Result: A single disruption (like a natural disaster affecting a key component factory) can halt production for major car manufacturers globally.

Challenges and Opportunities in a Global S&D World

Challenges:

- Volatility: Prices can change rapidly due to distant events (e.g., a political crisis affecting oil, a crop failure impacting food).

- Supply Chain Vulnerabilities: Reliance on single sources or long supply chains can lead to disruptions (e.g., a port closure, a factory fire).

- Trade Wars: Tariffs and retaliatory measures can hurt businesses and consumers globally.

- Job Displacement: Industries in developed nations may struggle to compete with lower-cost global supply, leading to job losses.

Opportunities:

- Greater Efficiency: Countries can specialize in what they do best, leading to lower production costs and more efficient resource allocation.

- Wider Consumer Choice: Global markets offer consumers a vast array of products from all over the world.

- Lower Prices: Increased competition from global suppliers can drive down prices for consumers.

- Economic Growth: International trade can stimulate innovation, create new markets, and foster economic growth for participating nations.

Conclusion: The Invisible Hand of Global Economics

The Law of Supply and Demand is far more than an academic concept; it’s the invisible hand that guides prices, production, and consumption across the entire globe. Understanding its principles helps us make sense of why certain products are expensive or cheap, why trade policies are enacted, and how events on one side of the world can impact our daily lives.

In a world that is becoming ever more interconnected, recognizing the powerful interplay of global supply and demand is not just for economists – it’s a fundamental insight for anyone wanting to understand how the world economy truly works.

Post Comment