Unlocking Education Tax Credits: Your Essential Guide to Eligibility and Application

The cost of higher education can be a significant financial burden for students and their families. From tuition and fees to books and supplies, expenses add up quickly. Fortunately, the U.S. government offers valuable tax credits that can help offset these costs, putting more money back in your pocket.

However, navigating the world of tax credits can feel overwhelming, especially for beginners. This comprehensive guide will break down everything you need to know about education tax credits – what they are, who qualifies, what expenses count, and how to claim them – in clear, easy-to-understand language.

What Are Education Tax Credits?

Before diving into the specifics, let’s clarify what a tax credit is and why it’s so beneficial.

- Tax Credit vs. Tax Deduction:

- A tax deduction reduces your taxable income, which in turn reduces the amount of tax you owe. For example, if you’re in the 20% tax bracket, a $1,000 deduction saves you $200.

- A tax credit directly reduces the amount of tax you owe, dollar for dollar. A $1,000 tax credit saves you $1,000, regardless of your tax bracket. This makes credits significantly more powerful than deductions.

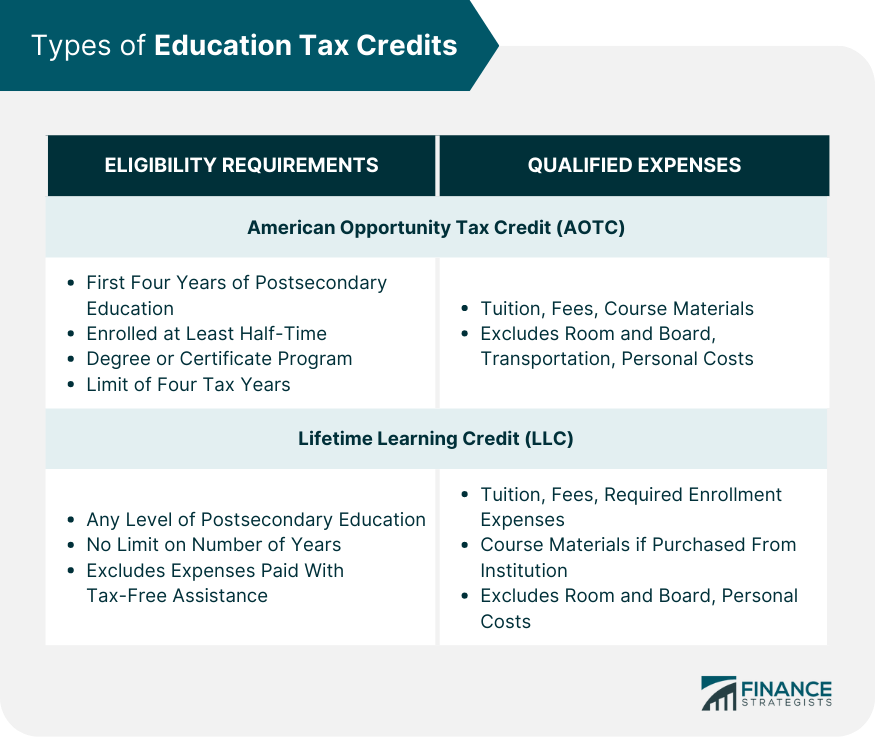

Education tax credits are designed to provide financial relief for students pursuing higher education and those paying for their education. There are two primary education tax credits offered by the IRS: the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

The Two Main Education Tax Credits

Let’s explore each credit in detail.

1. The American Opportunity Tax Credit (AOTC)

The AOTC is generally the most generous education tax credit, offering a substantial benefit for students in their early years of post-secondary education.

-

Maximum Credit: Up to $2,500 per eligible student per year.

-

Refundability: Up to 40% of the AOTC (a maximum of $1,000) is refundable. This means even if the credit reduces your tax liability to $0, you could still get up to $1,000 back as a tax refund.

-

Who is Eligible?

- The student must be pursuing a degree or other recognized educational credential (e.g., a certificate program).

- The student must be enrolled at least half-time for at least one academic period beginning in the tax year.

- The student must be in their first four years of higher education (i.e., not completed the first four years of post-secondary education before the beginning of the tax year).

- The student must not have claimed the AOTC or the former Hope credit for more than four tax years previously.

- The student must not have a felony drug conviction on their record.

-

What Expenses Qualify?

- Tuition and fees required for enrollment or attendance.

- Course-related books, supplies, and equipment that are required for enrollment or attendance at the educational institution. This includes materials that aren’t necessarily purchased directly from the school.

2. The Lifetime Learning Credit (LLC)

The LLC is broader in its applicability than the AOTC, making it suitable for a wider range of educational pursuits, including graduate studies and job skill development.

-

Maximum Credit: Up to $2,000 per tax return per year (20% of the first $10,000 in qualified education expenses).

-

Refundability: The LLC is non-refundable. This means it can reduce your tax liability to $0, but you won’t get any part of the credit back as a refund if it exceeds your tax liability.

-

Who is Eligible?

- The student is enrolled in an eligible educational institution.

- The student is taking courses towards a degree, or to acquire or improve job skills.

- The student must be enrolled for at least one academic period beginning in the tax year. There is no requirement for half-time enrollment.

- There is no limit on the number of years you can claim the LLC. You can use it for undergraduate, graduate, or even non-degree courses.

- There is no felony drug conviction exclusion.

-

What Expenses Qualify?

- Tuition and fees required for enrollment or attendance.

- Course-related books, supplies, and equipment that are required as a condition of enrollment or attendance at the educational institution. Unlike the AOTC, these items usually must be purchased directly from the institution.

Key Differences & Choosing the Right Credit

It’s crucial to understand the distinctions between the AOTC and LLC, as you cannot claim both credits for the same student in the same tax year.

| Feature | American Opportunity Tax Credit (AOTC) | Lifetime Learning Credit (LLC) |

|---|---|---|

| Max Credit | $2,500 per student | $2,000 per tax return |

| Refundable? | Yes (up to 40% / $1,000) | No |

| Degree/Credential? | Yes, must be pursuing a degree/recognized credential | No, can be for job skills or non-degree courses |

| Years of Study | First 4 years of post-secondary education | Unlimited years |

| Enrollment | At least half-time | Can be less than half-time |

| Qualified Expenses | Tuition, fees, required books/supplies (even if not from school) | Tuition, fees, required books/supplies (usually from school only) |

| Per Student/Return | Per eligible student | Per tax return (regardless of how many students) |

| Felony Conviction? | Excludes students with felony drug convictions | No exclusion for felony drug convictions |

When to Choose Which:

- Choose AOTC if: The student is in their first four years of higher education, enrolled at least half-time, and has significant qualified expenses (including books/supplies not bought from the school). Its refundability makes it very attractive.

- Choose LLC if: The student is in graduate school, taking a few classes to improve job skills, or is enrolled less than half-time. It’s also the only option if the student has already completed their first four years of college or has a felony drug conviction.

Who Can Claim the Credit?

Determining who can claim the education credit – the student or the parent – depends on the student’s dependency status and who paid the expenses.

- If the student is claimed as a dependent on someone else’s tax return (usually a parent):

- Only the person claiming the student as a dependent (e.g., the parent) can claim the education credit.

- This is true even if the student paid some of the expenses themselves. The IRS considers any expenses paid by the student to have been paid by the person claiming them as a dependent.

- If the student is NOT claimed as a dependent on anyone else’s tax return:

- The student can claim the education credit themselves.

Important Note: Form 1098-T

Most eligible educational institutions will send you Form 1098-T, Tuition Statement, by January 31st of the following year. This form reports the amount billed for qualified tuition and related expenses, as well as scholarships and grants received. You’ll need this form to help calculate your credit, but remember that the amount in Box 2 (amounts billed) might not be the exact amount you paid or the amount of qualified expenses. Always keep your receipts!

Income Limitations

Both the AOTC and LLC have income limitations based on your Modified Adjusted Gross Income (MAGI). If your MAGI is above these limits, the credit you can claim will be reduced or eliminated entirely.

- For 2023 Tax Year (filed in 2024):

- AOTC Phase-Out:

- Begins at MAGI of $80,000 for single filers ($160,000 for married filing jointly).

- Completely phased out at MAGI of $90,000 for single filers ($180,000 for married filing jointly).

- LLC Phase-Out:

- Begins at MAGI of $80,000 for single filers ($160,000 for married filing jointly).

- Completely phased out at MAGI of $90,000 for single filers ($180,000 for married filing jointly).

- AOTC Phase-Out:

Always check the most current IRS publications or consult a tax professional for the exact income limits for the tax year you are filing.

Qualified Education Expenses

Not all expenses related to education count toward these credits. Here’s a breakdown of what generally does and does not qualify:

What Generally Qualifies:

- Tuition: The cost of courses.

- Fees: Fees required for enrollment or attendance.

- Books, Supplies, and Equipment:

- AOTC: Books, supplies, and equipment are qualified expenses if required for enrollment or attendance. This can include items purchased from sources other than the educational institution.

- LLC: Books, supplies, and equipment are qualified expenses only if required as a condition of enrollment or attendance, and usually must be purchased directly from the educational institution.

What Generally Does NOT Qualify:

- Room and Board: Living expenses are not considered qualified education expenses.

- Transportation: Commuting costs.

- Insurance: Health insurance or other personal insurance costs.

- Medical Expenses:

- Personal, Living, or Family Expenses:

- Sports, Hobbies, or Non-Credit Courses: Unless the course is part of the student’s degree program or is taken to acquire or improve job skills.

Important Note on Tax-Free Educational Assistance:

You must reduce your qualified education expenses by any tax-free educational assistance received. This includes:

- Scholarships or fellowships (that are not taxable).

- Pell Grants.

- Employer-provided educational assistance (tax-free).

- Veterans’ educational benefits (tax-free).

You cannot claim a credit for expenses paid with tax-free funds.

How to Apply for Education Tax Credits

Claiming these credits isn’t overly complicated, but it requires careful record-keeping and accurate reporting on your tax return.

1. Gather Your Documents

- Form 1098-T, Tuition Statement: This form from your educational institution reports qualified tuition and related expenses.

- Receipts for Qualified Expenses: Keep detailed records of all tuition payments, fees, and eligible book/supply purchases. This is especially important for AOTC, where books/supplies don’t have to be purchased directly from the school.

- Proof of Enrollment: Documentation showing the student’s enrollment status (e.g., half-time for AOTC) and academic period.

2. Use IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits)

This is the dedicated form you’ll use to calculate and claim your education credits.

- Part I: Used to claim the American Opportunity Tax Credit.

- Part II: Used to claim the Lifetime Learning Credit.

- Part III: For specific calculations related to the refundable portion of the AOTC.

You’ll input information from your 1098-T and your records of qualified expenses into this form. The form helps you determine the maximum credit you’re eligible for based on your expenses and income.

3. File Your Tax Return

Once you’ve completed Form 8863, you’ll transfer the calculated credit amount to your main tax form (Form 1040).

- Tax Software: Most tax preparation software (like TurboTax, H&R Block, FreeTaxUSA) will guide you through the process of claiming education credits step-by-step. They will prompt you for your 1098-T information and ask about qualified expenses.

- Tax Professional: If your tax situation is complex or you prefer expert assistance, a certified public accountant (CPA) or enrolled agent can help you claim the credits correctly.

- IRS Free File: If your income is below a certain threshold, you may qualify to use IRS Free File software, which also guides you through claiming credits.

4. Keep Thorough Records

The IRS can audit tax returns for up to three years after filing. It’s crucial to keep all supporting documentation for your education expenses, including:

- Form 1098-T

- Canceled checks or payment records

- Receipts for books, supplies, and equipment

- Transcripts or enrollment verification from the school

Important Considerations & Common Pitfalls

- No Double Dipping: You cannot use the same qualified education expenses to claim both an education credit and another education tax benefit (like the tuition and fees deduction, which has been expired but may return, or tax-free distributions from Coverdell ESAs or 529 plans). You must choose which benefit provides the most advantage.

- One Credit Per Student Per Year: You can only claim ONE education credit (either AOTC or LLC) for a single student in a single tax year. If you have multiple students, you might be able to claim a different credit for each student (e.g., AOTC for one child, LLC for another).

- Previous Education Benefits: Be mindful if you’ve previously claimed the AOTC or Hope Credit for more than four years, as this would disqualify you from the AOTC.

- Residency and Citizenship: Generally, the student must be a U.S. citizen, resident alien, or nonresident alien treated as a resident alien for tax purposes.

- Consult a Professional: While this guide provides a solid foundation, tax laws can be complex and change. If you have unique circumstances or substantial expenses, consulting a qualified tax professional is always a wise decision.

Conclusion

Education tax credits offer a significant opportunity to reduce the financial burden of college and other higher education pursuits. By understanding the eligibility requirements, differentiating between the American Opportunity Tax Credit and the Lifetime Learning Credit, tracking your qualified expenses, and correctly filing Form 8863, you can unlock valuable savings.

Don’t leave money on the table! Take the time to assess your situation, gather your documents, and claim the education tax credits you deserve. It’s a smart step toward making higher education more affordable.

Post Comment