Unlocking Business Success: Essential Key Performance Indicators (KPIs) for Financial Health

Imagine trying to drive a car without a dashboard. No speedometer, no fuel gauge, no warning lights. How would you know if you’re going too fast, running out of gas, or if something is seriously wrong under the hood?

Your business’s financial health is much the same. Without the right "dashboard" – a set of Key Performance Indicators (KPIs) – you’re driving blind. You might be profitable on paper, but struggling with cash flow. Or perhaps your sales are soaring, but your expenses are silently eating away at your margins.

This comprehensive guide will demystify Key Performance Indicators for financial health, making them easy to understand even if you’re new to business finance. We’ll explore why they’re crucial, the most important ones to track, and how to use them to steer your business towards lasting success.

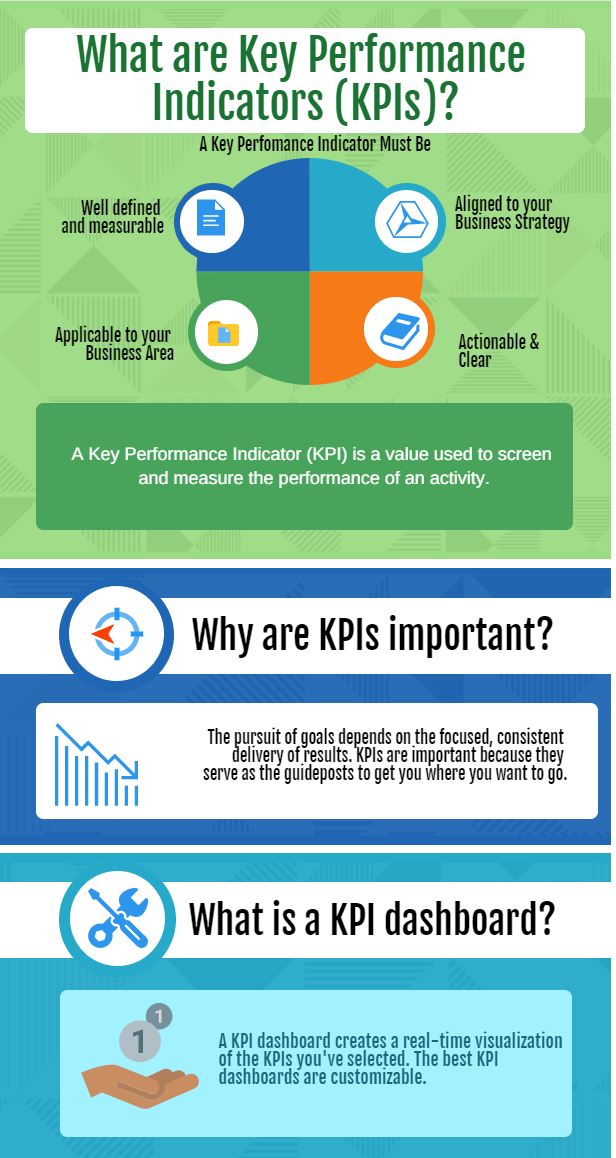

What are Key Performance Indicators (KPIs) and Why Do They Matter for Financial Health?

At its simplest, a Key Performance Indicator (KPI) is a measurable value that demonstrates how effectively a company is achieving its key business objectives. For financial health, these objectives revolve around profitability, stability, efficiency, and growth.

Think of KPIs as your business’s vital signs. Just as a doctor checks your pulse, blood pressure, and temperature, business leaders need to monitor specific financial metrics to understand the current state of their company and predict its future.

Why are Financial Health KPIs so important?

- Informed Decision-Making: KPIs provide objective data, helping you make smart choices about pricing, spending, investments, and staffing. No more guessing!

- Early Warning System: They can alert you to potential problems (like declining profit margins or cash shortages) before they become full-blown crises.

- Measure Progress Towards Goals: Are you on track to hit your revenue targets? Are your cost-cutting efforts paying off? KPIs give you a clear answer.

- Identify Strengths and Weaknesses: Pinpoint what’s working well and where improvements are needed.

- Enhance Accountability: When everyone understands the key metrics, it fosters a culture of shared responsibility for financial success.

- Attract Investors & Lenders: Solid financial KPIs demonstrate a well-managed and stable business, making it more attractive to external funding.

The Core Pillars of Financial Health: Key KPI Categories

To simplify the vast world of financial metrics, we can group KPIs into a few key categories, each revealing a different aspect of your business’s financial well-being:

- Profitability KPIs: How much money is your business actually making?

- Liquidity KPIs: Can your business meet its short-term financial obligations?

- Solvency KPIs: Can your business meet its long-term financial obligations?

- Efficiency/Operational KPIs: How well is your business using its assets to generate revenue?

- Cash Flow KPIs: The true lifeblood – how much cash is moving in and out of your business?

Let’s dive into the specific KPIs within each category!

1. Profitability KPIs: Are You Making Money?

Profitability KPIs show how efficiently your business converts sales into profit. These are often the first numbers people look at, and for good reason!

-

Net Profit Margin

- What it measures: The percentage of revenue that turns into profit after all expenses (including taxes and interest) have been deducted.

- Why it’s important: This is the ultimate indicator of overall profitability. A low or declining net profit margin means your costs are too high or your pricing is too low relative to your sales.

- Formula:

(Net Profit / Revenue) x 100 - Example: If your business has $1,000,000 in revenue and $150,000 in net profit, your Net Profit Margin is (150,000 / 1,000,000) x 100 = 15%.

-

Gross Profit Margin

- What it measures: The percentage of revenue left after deducting the "Cost of Goods Sold" (COGS) – the direct costs of producing your products or services. It doesn’t include operating expenses like rent or marketing.

- Why it’s important: This tells you how profitable your core products or services are. A healthy gross margin is essential to cover your operating expenses and still leave a net profit.

- Formula:

((Revenue - Cost of Goods Sold) / Revenue) x 100 - Example: If your revenue is $1,000,000 and COGS is $400,000, your Gross Profit Margin is ((1,000,000 – 400,000) / 1,000,000) x 100 = 60%.

-

Operating Profit Margin (EBIT Margin)

- What it measures: The percentage of revenue remaining after deducting all operating expenses (COGS, salaries, rent, marketing, etc.) but before interest and taxes.

- Why it’s important: This shows the profitability of your core business operations, separate from financing decisions (interest) or tax rates.

- Formula:

(Operating Profit / Revenue) x 100

-

Return on Investment (ROI)

- What it measures: The efficiency of an investment in generating returns.

- Why it’s important: Helps you evaluate whether specific projects, marketing campaigns, or asset purchases are financially worthwhile.

- Formula:

((Gain from Investment - Cost of Investment) / Cost of Investment) x 100

2. Liquidity KPIs: Can You Pay Your Bills?

Liquidity KPIs assess your business’s ability to meet its short-term financial obligations (bills due within one year). A profitable business can still fail if it runs out of cash to pay its immediate debts.

-

Current Ratio

- What it measures: Your ability to cover your short-term liabilities with your short-term assets.

- Why it’s important: A higher ratio generally indicates better short-term financial health. A ratio of 2:1 (meaning you have $2 in current assets for every $1 in current liabilities) is often considered healthy, but it varies by industry.

- Formula:

Current Assets / Current Liabilities - Example: If you have $200,000 in current assets (cash, accounts receivable, inventory) and $100,000 in current liabilities (accounts payable, short-term loans), your Current Ratio is 200,000 / 100,000 = 2.0.

-

Quick Ratio (Acid-Test Ratio)

- What it measures: Similar to the current ratio, but it excludes inventory from current assets. Inventory can be slow to convert into cash.

- Why it’s important: This is a more conservative measure of immediate liquidity. It shows if you can pay your immediate bills without relying on selling your inventory. A ratio of 1:1 or higher is generally considered good.

- Formula:

(Current Assets - Inventory) / Current Liabilities

-

Cash Conversion Cycle (CCC)

- What it measures: The number of days it takes for your business to convert its investments in inventory and accounts receivable into cash.

- Why it’s important: A shorter cycle is better, as it means cash is tied up for less time. A negative CCC means you receive cash from sales before you have to pay your suppliers, which is excellent!

- Formula:

Days Inventory Outstanding + Days Sales Outstanding - Days Payables Outstanding - Note: This is a more advanced KPI, but crucial for businesses with inventory.

3. Solvency KPIs: Can You Survive Long-Term?

Solvency KPIs assess your business’s ability to meet its long-term financial obligations. While liquidity is about immediate bills, solvency is about the overall financial stability and sustainability of your business.

-

Debt-to-Equity Ratio

- What it measures: Compares the total debt your company has to the value of shareholder equity (the money invested by owners).

- Why it’s important: Shows how much of your business’s assets are financed by debt versus equity. A high ratio means your business relies heavily on borrowing, which can be risky, especially during economic downturns.

- Formula:

Total Debt / Shareholder Equity - Example: If your total debt is $500,000 and equity is $1,000,000, your Debt-to-Equity Ratio is 0.5. A ratio below 1.0 is generally preferred, but this varies significantly by industry.

-

Debt-to-Asset Ratio

- What it measures: The percentage of your company’s assets that are financed by debt.

- Why it’s important: Similar to Debt-to-Equity, this indicates financial leverage and risk. A lower ratio suggests a more stable financial structure.

- Formula:

Total Debt / Total Assets

-

Interest Coverage Ratio

- What it measures: Your company’s ability to pay its interest expenses on outstanding debt.

- Why it’s important: A low ratio suggests that your business might struggle to pay its interest payments, indicating a higher risk of default.

- Formula:

Earnings Before Interest and Taxes (EBIT) / Interest Expense

4. Efficiency/Operational KPIs: Are You Using Resources Wisely?

Efficiency KPIs reveal how well your business uses its assets and manages its operations to generate revenue. They often highlight areas for cost savings and process improvements.

-

Inventory Turnover

- What it measures: How many times your inventory is sold and replaced over a period.

- Why it’s important: A high turnover rate is generally good, indicating efficient sales and minimal obsolete inventory. A low rate might mean too much inventory sitting idle, tying up cash.

- Formula:

Cost of Goods Sold / Average Inventory

-

Accounts Receivable Turnover

- What it measures: How quickly your business collects payments from customers who bought on credit.

- Why it’s important: A higher turnover means you’re collecting cash faster, which improves your cash flow. Slow collection can lead to cash shortages.

- Formula:

Net Credit Sales / Average Accounts Receivable

-

Accounts Payable Turnover

- What it measures: How quickly your business pays its suppliers.

- Why it’s important: This can be a balancing act. Paying too quickly means cash leaves your business faster. Paying too slowly can damage supplier relationships.

- Formula:

Cost of Goods Sold / Average Accounts Payable

5. Cash Flow KPIs: The True Lifeblood

While profit is important, cash is king. A business can show a profit on paper but still run out of cash if payments are delayed or expenses are front-loaded. Cash flow KPIs are vital for day-to-day operations.

-

Operating Cash Flow (OCF)

- What it measures: The cash generated by your normal business operations, before any investing or financing activities.

- Why it’s important: This is arguably the most crucial cash flow KPI. A positive and growing OCF indicates a healthy, self-sustaining business that can fund its operations without needing external financing.

- Formula: Found on your Statement of Cash Flows (usually Net Income + Non-Cash Expenses – Changes in Working Capital).

-

Free Cash Flow (FCF)

- What it measures: The cash left over after a company pays for its operating expenses and capital expenditures (e.g., buying new equipment). This is the cash available for debt repayment, dividends, or expansion.

- Why it’s important: A strong FCF means your business has flexibility and capacity for growth.

- Formula:

Operating Cash Flow - Capital Expenditures

How to Choose the Right Financial KPIs for Your Business

With so many KPIs, it’s easy to feel overwhelmed. Remember, more isn’t always better. The key is to select the KPIs that are most relevant to your specific business goals, industry, and stage of development.

- Align with Your Goals: What are you trying to achieve?

- Want to increase profitability? Focus on Net and Gross Profit Margins.

- Struggling with cash? Prioritize Cash Conversion Cycle and Operating Cash Flow.

- Concerned about debt? Monitor Debt-to-Equity and Interest Coverage.

- Consider Your Industry: Different industries have different benchmarks. A tech startup will have different typical ratios than a manufacturing plant or a retail store.

- Start Simple: Don’t try to track everything at once. Begin with 3-5 core KPIs from the main categories (e.g., Net Profit Margin, Current Ratio, Operating Cash Flow).

- Keep it Relevant: If a KPI doesn’t directly help you make better decisions or understand your performance, you probably don’t need to track it daily.

- Regularly Review: As your business evolves, your most important KPIs might change. Revisit your chosen metrics periodically.

Implementing and Using Your Financial KPIs Effectively

Calculating KPIs is just the first step. The real power comes from using them to drive action.

- Set Clear Targets: For each KPI, establish a realistic and ambitious target. What’s your desired Net Profit Margin? What’s your ideal Current Ratio?

- Track Consistently: Use accounting software, spreadsheets, or dedicated dashboard tools to track your KPIs regularly (monthly, quarterly, annually). Consistency is key for trend analysis.

- Visualize Your Data: Charts and graphs make it much easier to spot trends, identify outliers, and understand performance at a glance.

- Analyze Trends, Not Just Snapshots: A single KPI number tells you where you are right now. Looking at trends over time (e.g., your profit margin over the last 12 months) tells you where you’re headed.

- Benchmark Against Competitors/Industry: Compare your KPIs to industry averages or successful competitors to see how you stack up.

- Take Action: This is the most crucial step! If a KPI shows a problem, investigate why and develop an action plan to address it.

- Example: If your Gross Profit Margin is declining, you might need to review your pricing, negotiate better supplier deals, or reduce production waste.

- Communicate and Educate: Share relevant KPIs with your team. When employees understand how their work impacts financial health, they can make more financially sound decisions.

Common Mistakes to Avoid When Using Financial KPIs

- Tracking Too Many KPIs: This leads to "analysis paralysis" and dilutes focus. Less is often more.

- Ignoring Context: A single KPI number out of context can be misleading. Always consider industry norms, economic conditions, and your company’s specific situation.

- Not Taking Action: Calculating KPIs without using them to inform decisions is a waste of time.

- Lack of Consistency: Changing how you calculate or track KPIs makes it impossible to compare performance over time.

- Focusing Only on Lagging Indicators: While most financial KPIs are "lagging" (they tell you what has happened), try to pair them with "leading" indicators where possible (e.g., number of sales leads generated, which might predict future revenue).

Conclusion: Your Dashboard to Financial Success

Understanding and regularly monitoring Key Performance Indicators for financial health isn’t just for large corporations or finance professionals. It’s an essential practice for any business owner, manager, or entrepreneur who wants to make informed decisions, identify challenges early, and ensure long-term stability and growth.

Think of your financial KPIs as your business’s GPS. They tell you where you are, where you’ve been, and help you chart the best course forward. By embracing these vital metrics, you’re not just tracking numbers; you’re building a more resilient, profitable, and successful future for your business.

Ready to take control of your financial future? Start by identifying 3-5 core KPIs from this list and commit to tracking them consistently. Your business will thank you!

Post Comment