Unlocking Alpha: A Comprehensive Guide to Hedge Fund Strategies for Beginners

Hedge funds. The very name conjures images of exclusive clubs, high-stakes trading, and sophisticated financial maneuvers. While they certainly operate in a world apart from your average savings account, understanding how they work – particularly their diverse hedge fund strategies – is crucial for anyone interested in the broader investment landscape.

This long-form guide will demystify the world of hedge funds, breaking down their core strategies into easy-to-understand concepts. Whether you’re a curious novice or an aspiring investor, prepare to unlock the secrets behind how these powerful funds aim to generate returns, regardless of market conditions.

What Exactly Are Hedge Funds, Anyway?

Before diving into strategies, let’s clarify what a hedge fund is and how it differs from more common investment vehicles like mutual funds.

Hedge funds are privately managed investment funds that employ a wide range of strategies, often using advanced investment techniques, to generate high returns for their investors.

Here are their distinguishing characteristics:

- Less Regulated: Unlike mutual funds, which are heavily regulated by bodies like the SEC (in the U.S.) to protect retail investors, hedge funds face fewer restrictions. This allows them greater flexibility in their investment choices.

- Accredited Investors Only: Due to their higher risk profile and less stringent regulation, hedge funds are typically only open to "accredited investors" – individuals or institutions with a high net worth or significant financial sophistication.

- Flexible Investment Tools: They can use a broader array of tools than mutual funds, including:

- Short Selling: Betting against a stock’s price.

- Leverage: Borrowing money to amplify potential returns (and losses).

- Derivatives: Complex financial instruments like options and futures.

- Performance-Based Fees: Hedge funds typically charge a "2 and 20" fee structure: a 2% annual management fee on assets under management (AUM) and a 20% performance fee on any profits generated. This incentivizes managers to perform well.

- Absolute Returns Focus: While mutual funds often aim to beat a specific market benchmark (like the S&P 500), hedge funds typically strive for "absolute returns" – positive returns regardless of whether the market goes up or down. This pursuit of alpha (returns beyond what the market offers) is central to their appeal.

Why Do Hedge Fund Strategies Matter So Much?

The "strategy" is the very DNA of a hedge fund. It dictates:

- How the fund aims to make money: Is it by picking individual stocks, betting on global economic trends, or exploiting pricing inefficiencies?

- The level of risk taken: Some strategies are inherently riskier than others.

- The types of assets it invests in: Equities, bonds, currencies, commodities, real estate, or even distressed companies.

- Its performance in different market conditions: A strategy that thrives in a bull market might struggle in a bear market, and vice-versa.

- Its liquidity: How easily can investors get their money out?

Understanding these strategies helps investors align their goals and risk tolerance with the right type of fund.

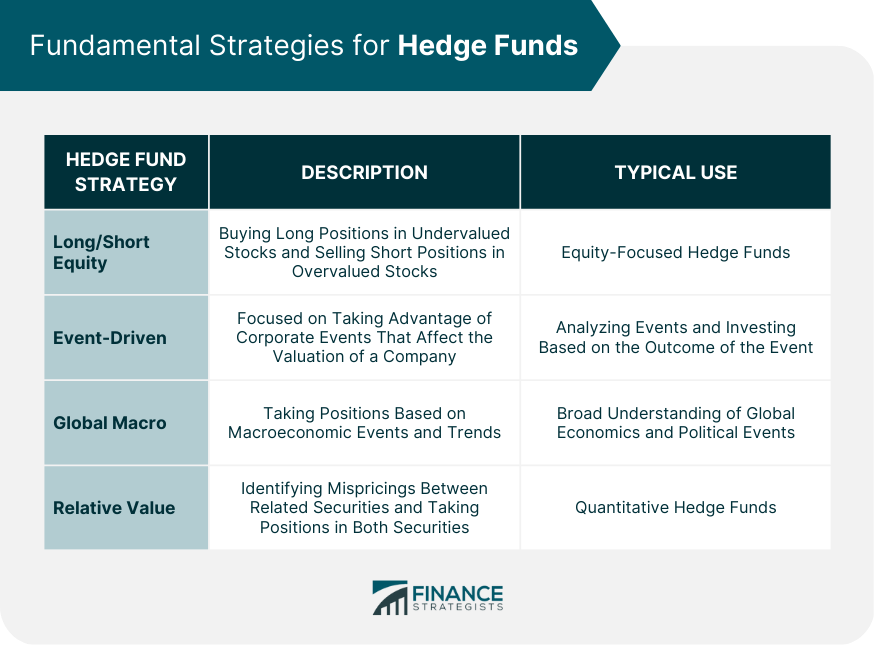

The Main Hedge Fund Strategies (Simplified)

Hedge fund strategies are incredibly diverse, often blending elements or evolving over time. However, most fall into a few core categories, each with a distinct approach to generating returns.

1. Equity Long/Short

- Concept: This is one of the most common and easily understood strategies. It involves simultaneously holding long positions (buying stocks, expecting them to rise) and short positions (selling borrowed stocks, expecting them to fall).

- How it Works: The goal is to profit from both rising and falling stock prices. By balancing long and short positions, the fund aims to reduce its overall market exposure (its "beta"), making it less dependent on the general direction of the stock market. This is often referred to as aiming for market neutrality.

- Example: A fund might go long on a well-managed tech company with strong growth prospects while simultaneously shorting a struggling competitor with outdated products.

- Goal: Generate returns from the difference in performance between the long and short positions, rather than just riding the market’s wave.

- Considerations: Requires strong stock-picking skills and thorough fundamental analysis. Can still be impacted by market volatility, especially if the "long" and "short" bets don’t offset each other as expected.

2. Event-Driven

- Concept: These funds seek to profit from specific corporate events that are expected to affect a company’s stock price.

- How it Works: Managers analyze events like:

- Mergers & Acquisitions (M&A): Betting on the success or failure of a takeover, or exploiting price discrepancies between the acquiring and target companies.

- Bankruptcies & Restructurings: Investing in the debt or equity of companies in financial distress, hoping for a successful turnaround or favorable payout post-reorganization (often called "distressed debt" investing).

- Spin-offs: Investing in parent companies or their newly separated subsidiaries, anticipating a re-evaluation of their true worth.

- Share Buybacks: Anticipating an increase in share price due to reduced share count.

- Goal: Profit from the market’s reaction (or misreaction) to these discrete, identifiable corporate actions.

- Considerations: Requires deep legal and financial analysis of corporate transactions. Risks include deals falling apart, regulatory hurdles, or unexpected outcomes.

3. Global Macro

- Concept: This is a "top-down" approach where funds make investment decisions based on broad economic, political, and social trends around the world.

- How it Works: Managers analyze macroeconomic factors such as:

- Interest Rates: Betting on central bank policies.

- Currency Exchange Rates: Predicting the strength or weakness of different currencies.

- Commodity Prices: Forecasting oil, gold, or agricultural price movements.

- Geopolitical Events: Wars, elections, trade agreements.

- Example: A global macro fund might anticipate a rise in interest rates in a certain country, leading them to short its bonds and go long on its currency.

- Goal: Generate profits from large-scale shifts in global markets. These funds often take concentrated, leveraged positions.

- Considerations: Highly complex and requires a deep understanding of global economics and politics. Can be very volatile due to the leverage employed and the unpredictability of global events. Famous for large, bold bets (e.g., George Soros’s bet against the British pound).

4. Relative Value Arbitrage

- Concept: This strategy seeks to profit from temporary price discrepancies between closely related securities, assuming these prices will eventually converge. It’s often seen as a lower-risk, lower-return strategy compared to others.

- How it Works: Funds look for "mispricings" in:

- Convertible Arbitrage: Exploiting pricing differences between a company’s stock and its convertible bonds (bonds that can be converted into stock).

- Fixed Income Arbitrage: Finding discrepancies between related bonds (e.g., U.S. Treasuries vs. corporate bonds, or bonds of different maturities).

- Merger Arbitrage (a type of event-driven, but also relative value): Buying shares of a target company in an announced merger and short-selling shares of the acquiring company, betting on the deal’s completion and the convergence of prices.

- Goal: Capture small, predictable profits from temporary market inefficiencies.

- Considerations: Relies on the assumption that prices will correct themselves. Can be highly sensitive to liquidity issues (if the discrepancy doesn’t close quickly) and "tail risks" (unforeseen extreme events that cause prices to diverge further). Often uses significant leverage to amplify small returns.

5. Credit Strategies

- Concept: Focuses on investing in debt instruments, often those that are distressed or offer high yields.

- How it Works:

- Distressed Debt: Buying the debt of companies facing bankruptcy or severe financial difficulty, hoping for a restructuring that recovers value, or even taking control of the company.

- High-Yield Bonds (Junk Bonds): Investing in bonds issued by companies with lower credit ratings, which offer higher interest payments to compensate for increased risk.

- Bank Loans: Investing in loans made by banks, often to private companies.

- Goal: Generate returns from interest payments, successful debt restructuring, or appreciation in the value of the debt as a company’s financial health improves.

- Considerations: High risk, especially with distressed debt, as the company might still go bankrupt. Requires deep credit analysis and understanding of legal frameworks for bankruptcy.

6. Multi-Strategy

- Concept: Instead of focusing on a single strategy, these funds diversify their investments across several different hedge fund strategies.

- How it Works: A multi-strategy fund might allocate capital to teams specializing in equity long/short, global macro, and relative value arbitrage, all within the same fund.

- Goal: To smooth out returns and reduce overall volatility by not being overly reliant on the success of one particular strategy. If one strategy performs poorly, another might perform well, offsetting losses.

- Considerations: Often have higher fees due to the complexity of managing multiple teams and strategies. Requires strong internal risk management and capital allocation across diverse approaches.

Key Investment Tools & Concepts Used Across Strategies

Beyond the overarching strategies, hedge funds employ specific tools and concepts to execute their plans.

- Short Selling: As mentioned, this involves borrowing shares of a stock and selling them, hoping to buy them back later at a lower price to return to the lender, profiting from the decline. It’s a key tool for betting against companies or hedging long positions.

- Leverage: Using borrowed money to increase the potential return of an investment. While it can magnify gains, it also dramatically amplifies losses, making it a double-edged sword.

- Derivatives: Financial contracts whose value is derived from an underlying asset (like a stock, bond, commodity, or currency). Examples include:

- Options: Give the holder the right (but not the obligation) to buy or sell an asset at a specific price by a certain date.

- Futures: Obligate the holder to buy or sell an asset at a specific price on a specific date.

- Hedge funds use derivatives for hedging risks, speculating on price movements, or gaining exposure to assets without owning them outright.

- Diversification: While hedge funds often take concentrated bets, they also employ diversification across different assets, strategies (in multi-strategy funds), or geographies to reduce overall portfolio risk.

- Risk Management: This is paramount for hedge funds. They employ sophisticated models and processes to identify, measure, and manage various types of risk (market risk, credit risk, liquidity risk, operational risk).

Choosing a Hedge Fund: What Investors Look For

For accredited investors considering a hedge fund, simply understanding the strategies isn’t enough. Key factors to evaluate include:

- Track Record & Performance: Consistent, strong returns over various market cycles.

- Strategy Clarity: A clear, well-articulated strategy that makes sense.

- Risk Management Framework: How does the fund identify, measure, and mitigate risks?

- Team & Expertise: The experience and skill of the portfolio managers and research team.

- Fees & Transparency: Understanding the fee structure (2 and 20, high-water marks, hurdles) and the level of transparency provided to investors.

- Liquidity: How often can you redeem your investment (monthly, quarterly, annually)? Some funds have "lock-up" periods.

- Operational Due Diligence: Assessing the fund’s operational infrastructure, legal structure, and third-party service providers (auditors, administrators).

The Future of Hedge Fund Strategies

The world of finance is constantly evolving, and hedge funds are at the forefront of adopting new technologies and adapting to market shifts:

- Quantitative Strategies & AI/Machine Learning: More funds are using complex algorithms, artificial intelligence, and machine learning to identify trading opportunities, manage risk, and execute trades at high speed.

- ESG Investing: Environmental, Social, and Governance (ESG) factors are increasingly being integrated into investment decisions, with some funds specializing in companies that meet certain ESG criteria.

- Digital Assets: While still nascent, some hedge funds are exploring strategies around cryptocurrencies and blockchain technology.

- Increased Specialization: As markets become more complex, some funds are becoming even more specialized in niche areas or very specific types of arbitrage.

Frequently Asked Questions About Hedge Fund Strategies

Q1: What is "Alpha" in hedge fund terms?

A1: Alpha represents the excess return of an investment relative to the return of a benchmark index. In simpler terms, it’s the skill-based return generated by the fund manager, beyond what you’d expect from simply tracking the market. Hedge funds constantly strive to generate positive alpha.

Q2: Are hedge funds riskier than mutual funds?

A2: Generally, yes. Hedge funds have the flexibility to use more aggressive strategies, leverage, and complex instruments, which can lead to higher potential returns but also significantly higher risks and potential losses. Their less regulated nature also contributes to this higher risk profile.

Q3: Who can invest in hedge funds?

A3: In most countries, hedge funds are only open to "accredited investors" or "qualified purchasers" – individuals or institutions that meet specific criteria regarding income, net worth, or assets under management. This is due to their higher risk and complexity.

Q4: What’s the main difference between a hedge fund and a mutual fund?

A4:

- Regulation: Mutual funds are highly regulated; hedge funds are less so.

- Investors: Mutual funds are for the general public; hedge funds are for accredited investors.

- Fees: Mutual funds typically have lower management fees; hedge funds have higher management fees plus performance fees.

- Strategies: Mutual funds generally stick to long-only positions in traditional assets; hedge funds use a wide array of strategies, including short-selling, leverage, and derivatives.

- Goal: Mutual funds aim to beat a benchmark; hedge funds aim for absolute returns regardless of market direction.

Q5: What are the typical fees for a hedge fund?

A5: The most common fee structure is "2 and 20," meaning a 2% annual management fee on the assets under management and a 20% performance fee on any profits generated. There might also be "high-water marks" (meaning no performance fee until previous losses are recovered) and "hurdle rates" (a minimum return needed before performance fees kick in).

Conclusion

Hedge fund strategies are the engines that drive these powerful investment vehicles. From the stock-picking prowess of Equity Long/Short to the big-picture bets of Global Macro, and the meticulous arbitrage of Relative Value, each strategy offers a unique approach to navigating the financial markets.

While their world might seem exclusive, understanding these strategies provides invaluable insight into advanced investment techniques, risk management, and the relentless pursuit of "alpha." For the curious beginner, this journey into hedge fund strategies is not just about finance; it’s about appreciating the diverse and innovative ways capital is deployed in the global economy. Always remember to consult with a qualified financial advisor before making any investment decisions.

Post Comment