Unlock Your Financial Future: Your FREE Financial Goal Setting Worksheet & Guide

Do you ever feel like your money just disappears, or that you’re constantly living paycheck to paycheck with no clear direction? You’re not alone. Many people struggle with their finances not because they don’t earn enough, but because they lack a clear roadmap. Without specific goals, it’s easy to drift, spend impulsively, and miss opportunities to build real wealth.

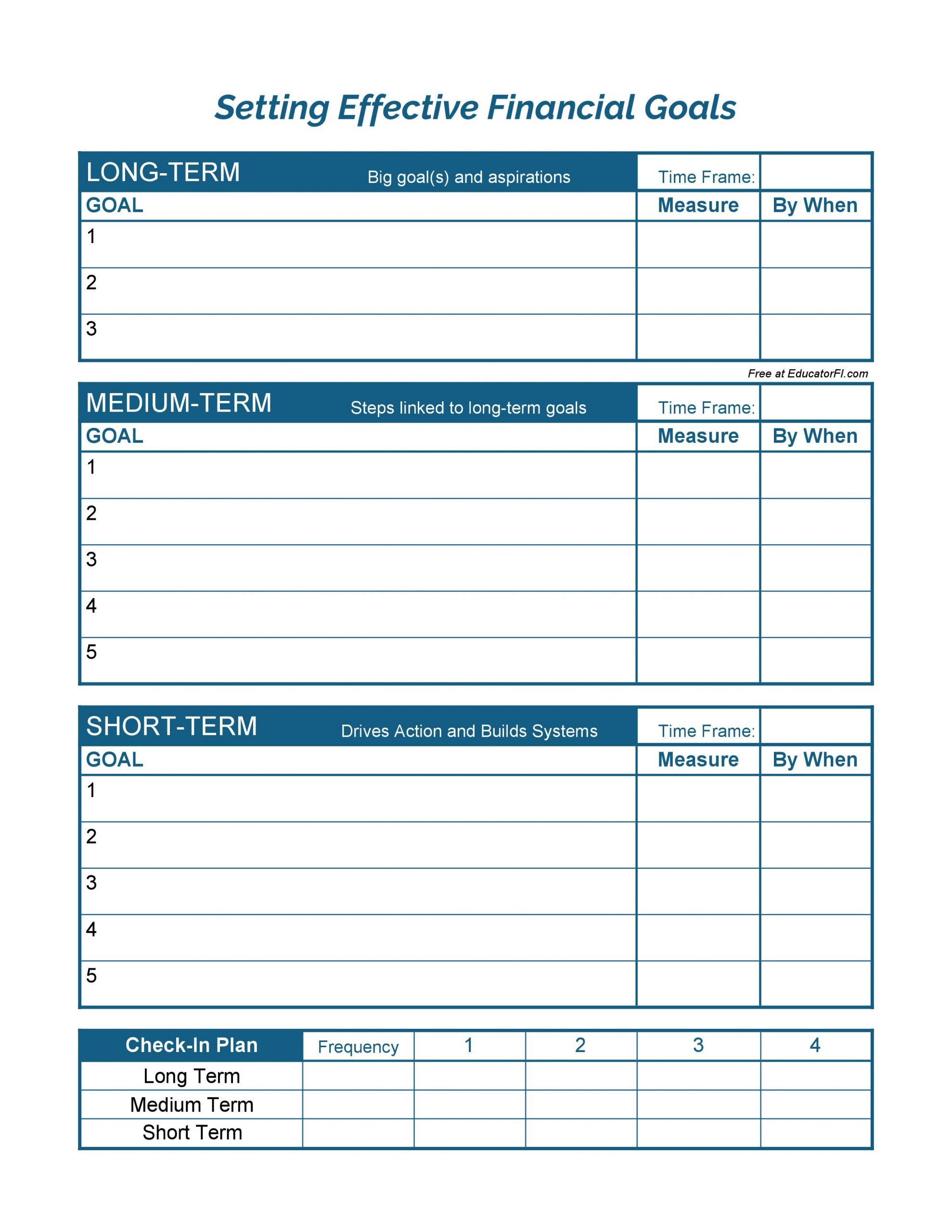

That’s where financial goal setting comes in. It’s the essential first step on your journey to financial stability and freedom. And to make that journey easier, more organized, and incredibly effective, we’ve created a comprehensive, easy-to-use Financial Goal Setting Worksheet (Free Template) just for you!

This article will walk you through why setting financial goals is crucial, how our free template can transform your approach, and how to use it step-by-step to turn your financial dreams into a tangible reality.

Why Financial Goal Setting is Absolutely Crucial for Everyone

Imagine trying to navigate a new city without a map or GPS. You might eventually get somewhere, but it would be slow, frustrating, and you’d likely miss many important landmarks. Your financial life is similar. Without clear goals, you’re just wandering.

Here’s why setting financial goals, and using a tool like our worksheet, is non-negotiable for your financial well-being:

- Provides Clarity and Direction: Vague desires like "I want to be rich" are useless. Specific goals like "I want to save $10,000 for a down payment by 2026" give you a clear target to aim for.

- Boosts Motivation: When you know exactly what you’re working towards, you’re more likely to stay motivated through challenges. Seeing your progress on a worksheet can be incredibly empowering.

- Enables Informed Decision-Making: Should you buy that new gadget or put the money towards your emergency fund? Goals help you prioritize spending and saving, aligning your daily choices with your long-term aspirations.

- Helps Track Progress: A worksheet provides a tangible way to see how far you’ve come and how much further you need to go. This visual feedback keeps you engaged and accountable.

- Reduces Financial Stress: Uncertainty about money is a huge source of stress. Having a plan, even a simple one, brings a sense of control and reduces anxiety.

- Unlocks Your Potential: Many people underestimate what they can achieve. By breaking down big goals into smaller, manageable steps, you’ll discover your true financial potential.

The Power of a Financial Goal Setting Worksheet (Free Template)

So, what exactly is a Financial Goal Setting Worksheet? Simply put, it’s a structured document designed to help you define, organize, and track your financial aspirations. It takes those abstract ideas in your head and puts them on paper (or screen!), making them concrete and actionable.

Our free template isn’t just a blank page; it’s a guided journey. It prompts you to think about:

- What you want to achieve financially.

- Why those goals are important to you.

- How much money you’ll need.

- By when you want to achieve them.

- The specific steps you’ll take to get there.

It’s like having a personalized financial coach guiding you through the goal-setting process, ensuring you cover all the essential bases.

Understanding SMART Financial Goals: Your Blueprint for Success

Before we dive into using the worksheet, it’s vital to understand the SMART framework. This widely used principle turns vague aspirations into clear, actionable goals. Every financial goal you set should be:

- S – Specific: What exactly do you want to achieve? Avoid general statements.

- Instead of: "Save money."

- Try: "Save $5,000 for an emergency fund."

- M – Measurable: How will you know when you’ve reached your goal? Can you track your progress with numbers?

- Instead of: "Pay off debt."

- Try: "Pay off $12,000 of credit card debt."

- A – Achievable: Is this goal realistic given your current income, expenses, and other commitments? It should challenge you but not be impossible.

- Instead of: "Buy a mansion next year on minimum wage."

- Try: "Save $200 per month towards a down payment."

- R – Relevant: Does this goal align with your broader life values and other financial priorities? Is it truly important to you?

- Instead of: "Invest in something I don’t understand."

- Try: "Invest $100 per month in a low-cost index fund to build retirement savings."

- T – Time-bound: When exactly do you want to achieve this goal? Setting a deadline creates urgency and accountability.

- Instead of: "Travel someday."

- Try: "Save $3,000 for a trip to Italy by June 2025."

Our Financial Goal Setting Worksheet (Free Template) is designed to help you make all your goals SMART, ensuring they are well-defined and within reach.

How to Use Your Financial Goal Setting Worksheet (Step-by-Step Guide)

Ready to transform your financial life? Here’s how to effectively use our Financial Goal Setting Worksheet (Free Template):

Step 1: Brainstorm Your Financial Dreams

Don’t hold back! On the worksheet, there will be a section for initial brainstorming. Write down everything you want to achieve financially, big or small, short-term or long-term.

- Examples: Pay off student loans, save for a house, build an emergency fund, travel the world, retire early, buy a new car, start a business, save for a child’s education, invest.

Step 2: Prioritize Your Goals

You probably have more than one goal, and that’s great! But you can’t tackle everything at once. Our worksheet will guide you to prioritize.

- Identify Your Top 3-5 Goals: Which ones are most important to you right now? Which will have the biggest impact?

- Consider Urgency: Are there goals with looming deadlines (e.g., car breaking down, tuition due)?

Step 3: Make Each Goal SMART

Now, take your prioritized goals and apply the SMART framework using the dedicated sections on the worksheet.

- Goal Name: Give it a clear title (e.g., "Emergency Fund").

- Specific: Detail exactly what it is (e.g., "To save 3-6 months’ worth of living expenses").

- Measurable: How much money? (e.g., "$15,000").

- Achievable: Is this realistic? What’s your current income/expenses? (e.g., "Yes, I can save $500/month").

- Relevant: Why is this important to you? (e.g., "To feel secure and avoid debt in case of job loss").

- Time-bound: When will you achieve it? (e.g., "By December 31, 2025").

Step 4: Break Down Your Goals (Short, Medium, Long-Term)

On the worksheet, you’ll categorize your goals, which helps with planning:

- Short-Term Goals (0-1 year):

- Examples: Build a $1,000 starter emergency fund, pay off a small credit card balance, save for a new appliance, vacation fund for next year.

- Medium-Term Goals (1-5 years):

- Examples: Save for a house down payment, pay off student loans, save for a new car, fund a major home renovation, save for a child’s first year of college.

- Long-Term Goals (5+ years):

- Examples: Retirement planning, financial independence, buying a dream home, child’s full college fund, leaving a legacy.

Breaking them down makes big goals less intimidating and helps you see how smaller steps contribute to larger aspirations.

Step 5: Create an Action Plan

This is where the magic happens! For each SMART goal, the worksheet prompts you to list concrete steps you will take.

- Specific Actions: What will you do? (e.g., "Set up automated transfer of $500 to savings every payday," "Cancel unused subscriptions," "Find a side hustle to earn an extra $200/month").

- Milestones: Break down the big goal into smaller achievements (e.g., "Reach $5,000 by June 2024," "Reach $10,000 by December 2024").

- Resources Needed: Do you need to research investment options? Talk to a financial advisor?

Step 6: Track and Review Regularly

Your financial goals aren’t set in stone. Life happens! Our worksheet encourages regular review.

- Monthly/Quarterly Check-ins: Mark your progress on the worksheet. Are you on track? Do you need to adjust your strategy or timeline?

- Celebrate Milestones: Acknowledge your achievements, big or small. This keeps motivation high!

- Adjust as Needed: If your income changes, or a new priority emerges, don’t be afraid to revise your goals. Flexibility is key.

Types of Financial Goals You Can Set (Examples)

Your Financial Goal Setting Worksheet is versatile enough to help you plan for a wide array of aspirations. Here are common examples across different timeframes:

Short-Term Financial Goals (0-1 Year)

- Build a Starter Emergency Fund: Save $1,000 – $2,000 for unexpected expenses (car repair, medical bill).

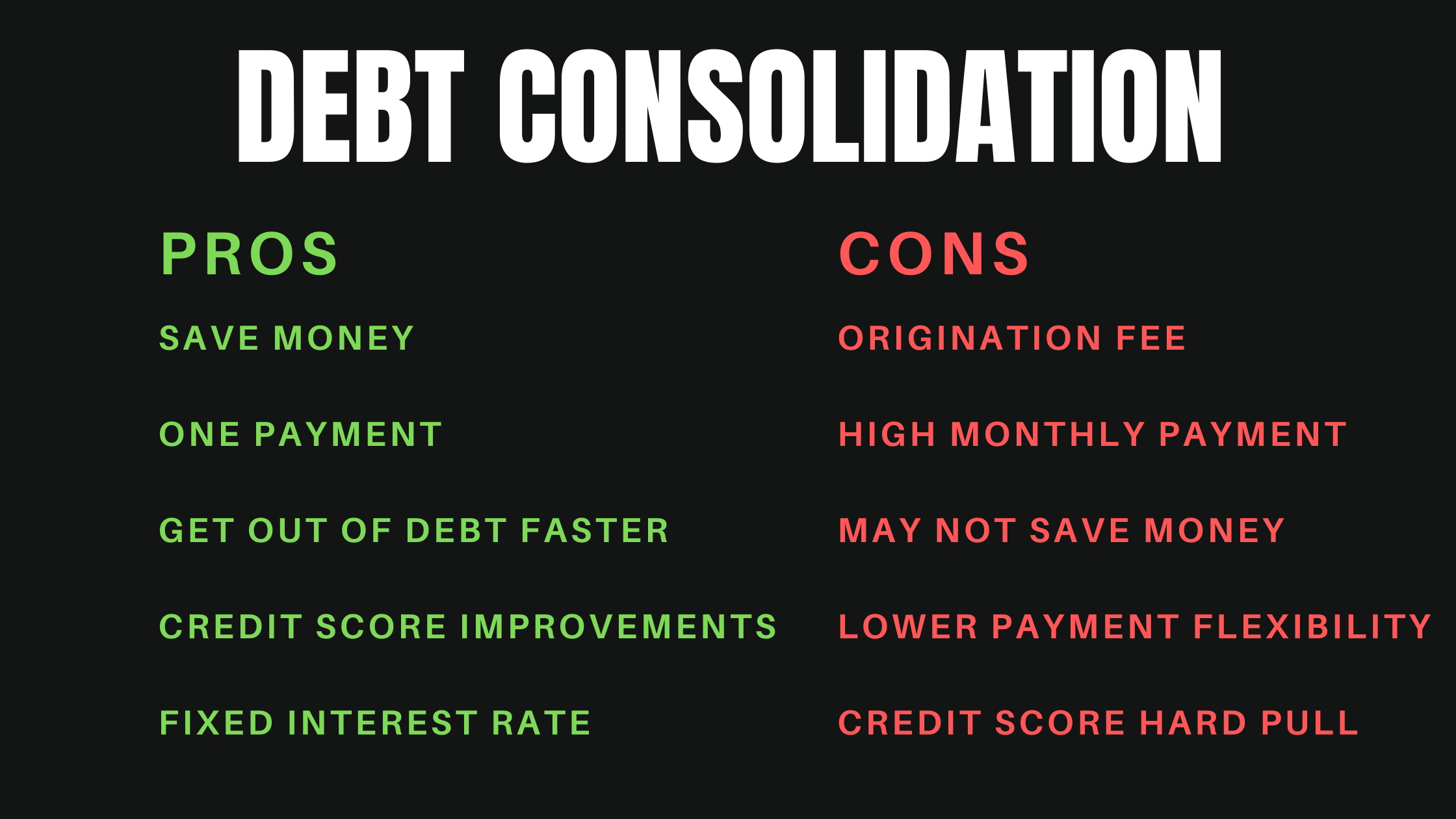

- Pay Off a Small Debt: Eliminate a high-interest credit card balance or a personal loan.

- Save for a Specific Purchase: New laptop, furniture, or a weekend getaway.

- Create a Monthly Budget: Get a clear picture of your income and expenses.

- Start an Investment Account: Begin with a small, manageable contribution.

Medium-Term Financial Goals (1-5 Years)

- Establish a Fully Funded Emergency Fund: 3-6 months of living expenses.

- Save for a House Down Payment: Accumulate funds for a mortgage down payment.

- Pay Off Student Loans or Car Loan: Accelerate debt repayment.

- Save for a Major Vacation: Fund a dream trip abroad.

- Fund a Child’s Education Savings (Early Years): Start contributing to a 529 plan or similar.

- Save for a New Car: Purchase a vehicle with cash or a substantial down payment.

Long-Term Financial Goals (5+ Years)

- Retirement Planning: Build a substantial nest egg for your golden years.

- Financial Independence: Reach a point where passive income covers your living expenses.

- Pay Off Your Mortgage: Become completely debt-free on your home.

- Save for a Child’s Full College Education: Ensure funds are available for higher education.

- Estate Planning: Set up wills, trusts, and other documents to manage your assets.

- Leave a Legacy: Plan for charitable giving or leaving an inheritance.

Where to Get Your FREE Financial Goal Setting Worksheet!

Ready to take control of your money and start building the financial future you deserve?

We’ve made it incredibly easy for you. Our comprehensive, user-friendly Financial Goal Setting Worksheet (Free Template) is available for instant download.

Click Here to Download Your FREE Financial Goal Setting Worksheet Now!

(Note: In a real article, this would be a prominent, clickable button or link)

This printable template is designed to be intuitive for beginners, guiding you through each step of the SMART goal-setting process.

Tips for Success with Your Financial Goals

Having the worksheet is a powerful start, but consistent effort and smart strategies will ensure your success.

- Be Realistic, But Dream Big: Set achievable goals, but don’t limit your aspirations. Break down big dreams into smaller steps.

- Automate Your Savings: Set up automatic transfers from your checking to your savings or investment accounts immediately after you get paid. "Out of sight, out of mind" works wonders!

- Track Your Spending: Knowing where your money goes is crucial. Use budgeting apps, spreadsheets, or even pen and paper to monitor your cash flow.

- Find an Accountability Partner: Share your goals with a trusted friend, family member, or join a financial community.

- Celebrate Milestones: Acknowledge your progress, no matter how small. This keeps you motivated and reinforces positive habits.

- Stay Flexible: Life throws curveballs. Your goals might need adjustments. Don’t get discouraged; adapt and keep moving forward.

- Educate Yourself: Continuously learn about personal finance. The more you know, the better decisions you’ll make.

- Don’t Compare Yourself to Others: Your financial journey is unique. Focus on your own progress and goals.

Conclusion: Your Journey to Financial Freedom Starts Now!

Setting financial goals isn’t just about numbers; it’s about building the life you want. It’s about reducing stress, gaining confidence, and creating opportunities for yourself and your loved ones. While it might seem daunting at first, breaking it down into manageable steps with a clear plan makes all the difference.

Our Financial Goal Setting Worksheet (Free Template) is your practical tool to begin this empowering journey. It will help you clarify your vision, organize your thoughts, and track your progress towards financial freedom.

Don’t let another day pass without a clear financial direction. Download your free template today, fill it out with intention, and take that crucial first step towards a brighter, more secure financial future. Your dreams are within reach – start planning for them now!

Post Comment