Unlock Smarter Decisions: A Beginner’s Guide to Cost-Benefit Analysis

In a world brimming with choices, from personal life decisions to complex business strategies, how do you ensure you’re making the best one? The answer often lies in a powerful, yet surprisingly simple, economic tool: Cost-Benefit Analysis (CBA).

If you’ve ever found yourself weighing the "pros and cons" before a big purchase or a major life change, you’ve already dipped your toes into the waters of CBA. This article will dive deep into Cost-Benefit Analysis, explaining what it is, why it’s crucial, and how you can apply its principles to make clearer, more informed decisions in any area of your life or business.

What Exactly is Cost-Benefit Analysis (CBA)?

At its heart, Cost-Benefit Analysis (CBA) is a systematic process for evaluating a project, decision, or policy by comparing the total expected costs against the total expected benefits. Think of it like a set of old-fashioned scales: on one side, you pile up all the potential downsides (costs), and on the other, you place all the potential upsides (benefits).

The goal is to determine if the benefits outweigh the costs. If they do, the decision or project is generally considered worthwhile. If the costs are greater than the benefits, it might be wise to reconsider or find an alternative.

Key Idea: CBA aims to provide a clear, quantifiable picture, allowing you to move beyond gut feelings and make decisions based on solid data. While it often involves financial calculations, it also considers non-financial aspects, converting them into a common unit (usually money) for a comprehensive comparison.

Why is Cost-Benefit Analysis So Important?

CBA isn’t just an academic exercise; it’s a vital tool for anyone facing significant choices. Here’s why it holds so much power:

- Informed Decision-Making: It moves you beyond guesswork. By systematically listing and valuing costs and benefits, you gain a clearer understanding of the potential outcomes.

- Resource Allocation: Whether it’s money, time, or human resources, CBA helps you decide where to invest your valuable assets for the greatest return.

- Justification and Transparency: For businesses and organizations, CBA provides a strong, data-driven justification for pursuing a project or making a particular investment. It also increases transparency in decision-making processes.

- Risk Mitigation: By thoroughly examining potential costs, you can identify and prepare for risks that might otherwise go unnoticed.

- Comparing Alternatives: CBA allows you to evaluate multiple options side-by-side, helping you choose the path that offers the most net benefit.

- Strategic Planning: It’s an essential component of long-term planning, helping individuals, businesses, and governments set priorities and achieve strategic goals.

How to Conduct a Cost-Benefit Analysis: A Step-by-Step Guide for Beginners

Don’t let the "analysis" part intimidate you. While complex CBAs can involve sophisticated financial modeling, the basic principles are easy to grasp and apply. Here’s a simplified step-by-step guide:

Step 1: Define Your Project or Decision Clearly

Before you can analyze anything, you need to know exactly what you’re analyzing.

- Be Specific: Are you buying a new car? Implementing new software? Starting a new marketing campaign? Hiring a new employee? The more precise you are, the easier the analysis will be.

- Establish Goals: What do you hope to achieve with this decision?

Step 2: Identify All Potential Costs

This is where you brainstorm every single expense or negative consequence associated with your decision. Think broadly!

- Direct Costs: Obvious, out-of-pocket expenses.

- Indirect Costs: Less obvious, but still related.

- Intangible Costs: Non-monetary, harder to quantify but still important.

(We’ll dive deeper into types of costs and benefits shortly.)

Step 3: Identify All Potential Benefits

Now, list every positive outcome or gain you anticipate from your decision. Again, think broadly!

- Direct Benefits: Clear, measurable gains.

- Indirect Benefits: Secondary advantages.

- Intangible Benefits: Non-monetary advantages that improve quality of life, morale, etc.

Step 4: Assign Monetary Values to Costs and Benefits

This is often the trickiest part, especially for beginners. The goal is to convert as many identified costs and benefits as possible into a common currency (e.g., dollars, euros, pounds).

- For Direct Costs/Benefits: This is straightforward (e.g., software license fee, increased sales revenue).

- For Indirect Costs/Benefits: Estimate based on historical data, expert opinions, or comparable situations (e.g., reduced administrative time might translate to salary savings).

- For Intangible Costs/Benefits: This requires creative estimation. For example, improved employee morale (a benefit) might lead to lower turnover and higher productivity, which can be given a monetary value. Reduced stress (a benefit) might lead to fewer sick days. Increased noise pollution (a cost) might decrease property values.

- Tip: If you can’t put an exact number on an intangible, make a reasonable estimate and note your assumptions. It’s better to have an estimate than to ignore it entirely.

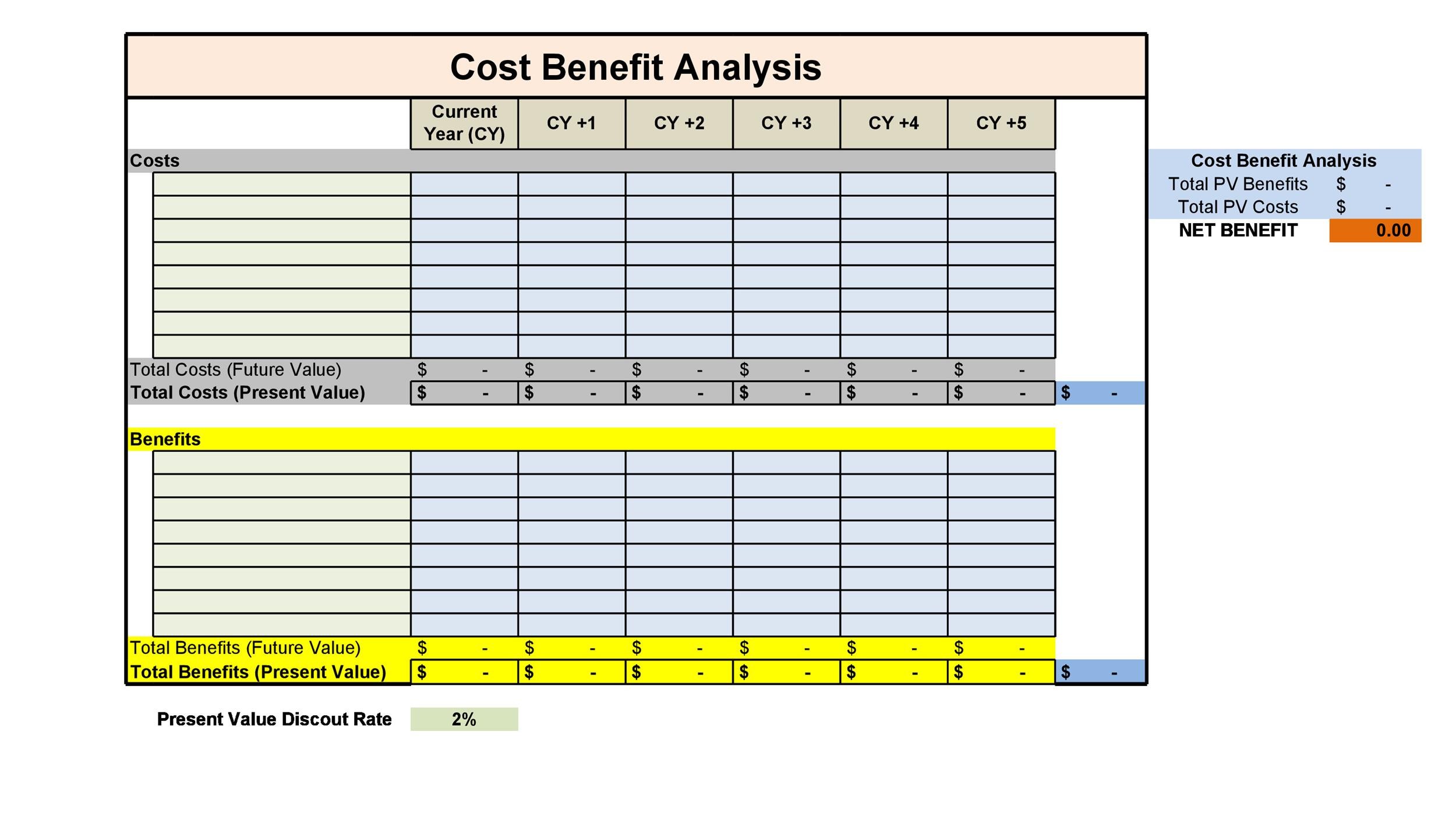

Step 5: Calculate Total Costs and Total Benefits

Sum up all the monetary values you’ve assigned to each side.

- Total Costs = Sum of all identified and valued costs.

- Total Benefits = Sum of all identified and valued benefits.

Step 6: Compare and Analyze

Now, compare your totals:

- Net Benefit: Subtract total costs from total benefits (Total Benefits – Total Costs).

- If the Net Benefit is positive, the project is likely worthwhile.

- If the Net Benefit is negative, the costs outweigh the benefits, and you should reconsider.

- Benefit-Cost Ratio (BCR): Divide total benefits by total costs (Total Benefits / Total Costs).

- If the BCR is greater than 1, benefits outweigh costs.

- If the BCR is less than 1, costs outweigh benefits.

- If the BCR equals 1, benefits equal costs (a break-even point).

Step 7: Consider Qualitative Factors and Uncertainty

Even after assigning numbers, some factors are hard to quantify perfectly.

- Qualitative Factors: These are non-monetary aspects that are still very important (e.g., environmental impact, brand reputation, ethical considerations, personal happiness). Don’t ignore them just because they don’t have a neat dollar sign. Note them down and consider their weight.

- Uncertainty/Risk: Acknowledge that your estimates are just that – estimates. What if the project takes longer? What if the benefits aren’t as high as expected? Consider best-case, worst-case, and most likely scenarios.

Step 8: Make Your Decision

Based on your comprehensive analysis – the numbers, the qualitative factors, and your assessment of risk – make your final decision. CBA provides a robust framework, but the ultimate choice often involves a degree of judgment.

Deeper Dive: Types of Costs and Benefits

To perform a thorough CBA, it’s essential to understand the different categories of costs and benefits you might encounter.

Types of Costs:

- Direct Costs:

- Definition: Expenses directly tied to the project or decision.

- Examples: Raw materials, labor wages, equipment purchase, software licenses, advertising spend, rent for new space.

- Indirect Costs:

- Definition: Expenses not directly tied to the project but necessary for its execution or as a consequence of it. Often overheads or support costs.

- Examples: Administrative support, utilities, general office supplies, increased insurance premiums, maintenance, security, training for staff on new systems.

- Intangible Costs:

- Definition: Non-monetary negative consequences that are hard to put a price on but are still real.

- Examples: Decreased employee morale due to changes, increased stress, damage to brand reputation, loss of customer loyalty, environmental pollution, increased commute time.

- Opportunity Costs:

- Definition: The value of the next best alternative that you give up when you choose a particular option.

- Example: If you invest $10,000 in a new machine, the opportunity cost might be the profit you could have earned by investing that same $10,000 in a different project or in the stock market.

- Sunk Costs:

- Definition: Costs that have already been incurred and cannot be recovered. These should not be included in a CBA for future decisions, as they are irrelevant to the future outcome.

- Example: Money already spent on research and development for a failed product. You can’t get it back, so it shouldn’t influence whether you continue with a new, related project.

Types of Benefits:

- Direct Benefits:

- Definition: Quantifiable, immediate positive outcomes.

- Examples: Increased revenue/sales, reduced operational expenses, higher productivity, direct cost savings (e.g., from energy efficiency).

- Indirect Benefits:

- Definition: Secondary positive outcomes that arise from the project.

- Examples: Improved customer satisfaction leading to repeat business, enhanced brand image, better employee retention, streamlined processes leading to faster service.

- Intangible Benefits:

- Definition: Non-monetary positive consequences that are difficult to quantify but contribute to overall value.

- Examples: Improved employee morale, enhanced public relations, increased social responsibility, greater market share (if not directly tied to revenue), reduced stress, personal fulfillment.

Real-World Examples of Cost-Benefit Analysis in Action

CBA isn’t just for economists or big corporations. It’s used everywhere!

-

Business Example: Implementing New Software

- Costs: Software license fees, implementation services, training staff, potential productivity dip during learning curve, ongoing maintenance.

- Benefits: Increased efficiency, reduced manual errors, faster data processing, improved reporting, potential for new services, enhanced customer experience.

- Decision: If the long-term efficiency gains and potential for new services far outweigh the initial software and training costs, the company would likely proceed.

-

Personal Example: Installing Solar Panels at Home

- Costs: Purchase and installation cost of panels, potential roof repairs, maintenance, insurance adjustments.

- Benefits: Reduced monthly electricity bills, potential for selling excess energy back to grid, increased home value, environmental benefits (reduced carbon footprint), energy independence.

- Decision: If the long-term energy savings and increase in home value exceed the upfront installation costs over the lifespan of the panels, it’s a smart investment.

-

Government Example: Building a New Public Transportation Line

- Costs: Construction costs (land acquisition, materials, labor), ongoing maintenance, operational staff salaries, potential disruption during construction.

- Benefits: Reduced traffic congestion, decreased air pollution, improved access to jobs and services, increased property values near stations, job creation during construction and operation, enhanced public safety.

- Decision: Governments use CBA to justify large infrastructure projects, ensuring the social and economic benefits to the community outweigh the substantial public investment.

Advantages of Using Cost-Benefit Analysis

- Objectivity: Forces a systematic, data-driven approach, reducing reliance on intuition alone.

- Improved Resource Allocation: Helps direct limited resources to projects with the highest potential return.

- Clarity and Transparency: Provides a clear rationale for decisions, which can be easily communicated to stakeholders.

- Risk Identification: Encourages a thorough examination of potential downsides, allowing for proactive planning.

- Better Project Selection: Especially useful when comparing multiple competing projects, helping to identify the most beneficial one.

Challenges and Limitations of Cost-Benefit Analysis

While powerful, CBA isn’t a perfect crystal ball. It has its limitations:

- Quantifying Intangibles: This is the biggest hurdle. How do you accurately put a monetary value on brand reputation, employee morale, or environmental beauty? While estimates can be made, they are often subjective.

- Future Uncertainty: CBA relies on predicting future costs and benefits, which are inherently uncertain. Economic changes, technological advancements, or unforeseen events can skew projections.

- Bias: The person conducting the analysis might unintentionally (or intentionally) inflate benefits or deflate costs to favor a particular outcome.

- Time Value of Money (Advanced Concept): For long-term projects, a dollar today is worth more than a dollar tomorrow. Sophisticated CBAs use techniques like Net Present Value (NPV) and Discounted Cash Flow (DCF) to account for this, but it adds complexity for beginners.

- Ignoring Externalities: A CBA might not fully capture "externalities" – costs or benefits that affect third parties not directly involved in the project (e.g., pollution from a factory impacting a nearby community).

- Ethical and Social Considerations: Sometimes, a project with a negative net benefit might still be pursued for ethical, social, or political reasons that are beyond pure economic calculation.

Beyond the Numbers: The Importance of Qualitative Factors

It’s crucial to remember that CBA is a tool, not a dictator. While the numbers provide a strong foundation, they don’t tell the whole story. Always consider the qualitative factors that couldn’t be neatly assigned a dollar value.

- Does the project align with your core values, even if the financial benefit is marginal?

- Are there significant social or environmental impacts that outweigh the monetary gains?

- How does the decision affect relationships, morale, or long-term reputation?

A holistic decision-making process combines the quantitative insights from CBA with a thoughtful consideration of these intangible, yet vital, qualitative aspects.

Who Uses Cost-Benefit Analysis?

CBA is a versatile tool used by a wide range of individuals and organizations:

- Businesses: For investment decisions, project evaluation, new product development, process improvement, and strategic planning.

- Governments: For public policy decisions, infrastructure projects (roads, bridges, public transport), environmental regulations, and social programs.

- Non-Profit Organizations: To evaluate the impact and efficiency of their programs and initiatives.

- Individuals: For major life decisions like buying a home, changing careers, pursuing higher education, or making significant personal investments.

Conclusion: Empowering Your Decisions with CBA

Cost-Benefit Analysis is more than just a financial exercise; it’s a powerful framework for rational decision-making. By systematically listing, valuing, and comparing the upsides and downsides of any choice, you gain clarity, reduce risk, and significantly improve your chances of achieving desired outcomes.

While quantifying every aspect can be challenging, the process of thinking through all potential costs and benefits, both tangible and intangible, is invaluable in itself. Start simple, practice with smaller decisions, and you’ll soon find yourself making smarter, more confident choices in all areas of your life. Embrace Cost-Benefit Analysis, and unlock a new level of strategic thinking!

Post Comment