Unlock Savings: Your Ultimate Guide to Negotiating Lower Interest Rates

Feeling the squeeze from high interest rates on your credit cards, loans, or even your mortgage? You’re not alone. Many people simply accept the interest rate they’re given, unaware that it’s often a starting point, not a final destination.

The truth is, negotiating lower interest rates is a powerful financial strategy that can save you hundreds, even thousands, of dollars over time. It’s not just for financial wizards or the ultra-rich – it’s a skill anyone can learn. This comprehensive guide will walk you through everything you need to know, from understanding your debt to making the call and securing a better deal.

Let’s dive in and learn how to put more money back in your pocket!

Why Bother Negotiating? The Power of a Lower Rate

You might be thinking, "Is it really worth the effort?" The answer is a resounding YES! Even a small reduction in your interest rate can have a massive impact. Here’s why:

- Save Money on Interest Payments: This is the most obvious benefit. Less interest means more of your payment goes towards the actual principal (the amount you borrowed), reducing your overall debt faster.

- Pay Off Debt Faster: With less money going to interest, your debt shrinks more quickly. This can shave months or even years off your repayment timeline.

- Reduce Financial Stress: High interest rates can make debt feel like an insurmountable mountain. A lower rate makes your payments more manageable and gives you a clear path to financial freedom.

- Free Up Cash Flow: When your minimum payments are lower (because less is going to interest), you have more discretionary income for other financial goals, like saving, investing, or even enjoying life.

- Improve Your Credit Score (Indirectly): By paying off debt faster, you reduce your credit utilization (the amount of credit you’re using compared to your total available credit), which is a significant factor in your credit score.

Imagine saving $50 a month. That’s $600 a year, or $3,000 over five years! Now imagine what you could do with that extra money.

What Types of Debt Can You Negotiate?

Not all debt is created equal when it comes to negotiation. Here’s a breakdown of common types of debt and their negotiability:

1. Credit Cards (Your Best Bet!)

- High Negotiability: Credit card companies are often the most open to negotiation, especially if you have a good payment history or a compelling reason (like a competitor’s lower offer). They want to keep you as a customer.

- Why They Negotiate: They face high churn rates (people closing accounts) and would rather offer you a slightly lower rate than lose you to another issuer offering a 0% balance transfer.

2. Personal Loans

- Moderate Negotiability: If you have a good payment history and your credit score has improved significantly since you took out the loan, you might be able to negotiate. However, refinancing (taking out a new loan at a lower rate to pay off the old one) is often a more common strategy here.

3. Auto Loans

- Moderate to Low Negotiability (on existing loans): Once you’ve signed an auto loan, direct negotiation on the existing rate is less common. However, if your credit has improved, or market rates have dropped, refinancing your auto loan through another lender is a very effective way to get a lower rate.

4. Student Loans

- Varies Greatly:

- Federal Student Loans: Direct negotiation on interest rates is generally not possible. Your rates are set by Congress. However, you can explore options like income-driven repayment plans (which can lower your monthly payment based on income, though not the interest rate itself) or loan consolidation (which averages your existing rates).

- Private Student Loans: These are more like personal loans. If your credit has improved, you might be able to refinance them with another private lender for a lower rate.

5. Mortgages

- Low Negotiability (on existing loans): Your mortgage interest rate is fixed at the time of signing (for fixed-rate mortgages) or adjusts based on an index (for adjustable-rate mortgages). You generally cannot negotiate a lower rate on your existing mortgage with your current lender unless you’re facing extreme hardship and they offer a loan modification (which is different from a simple rate reduction).

- High Negotiability (via Refinancing): Just like auto and private student loans, refinancing your mortgage is the primary way to get a lower interest rate if market rates have dropped or your credit score has significantly improved. This involves taking out a brand new loan to pay off your old one.

Key Takeaway: For most loans (auto, private student, mortgage), refinancing is often the most effective path to a lower rate, rather than direct negotiation on the existing loan. Credit cards are the easiest target for direct negotiation.

Before You Call: Essential Preparation Steps

Negotiation is about leverage. The more prepared you are, the stronger your position will be. Don’t pick up the phone without completing these steps:

1. Check Your Credit Score

Your credit score is the biggest indicator of your creditworthiness. Lenders use it to assess risk. A higher score (generally 700+) gives you much more leverage.

- How to Check: You can get free credit reports from AnnualCreditReport.com (one free report from each of the three bureaus annually). Many credit card companies and banks also offer free credit score monitoring.

- What to Look For: Are there any errors? Have you been making payments on time? A recent improvement in your score since you opened the account is a great talking point.

2. Know Your Numbers (Inside and Out)

Gather all the details about the account you want to negotiate:

- Current Interest Rate (APR): This is the most crucial number.

- Current Balance: How much do you owe?

- Account Number: You’ll need this for identification.

- Payment History: Have you been consistently making on-time payments? This is a huge selling point. Lenders prefer reliable customers.

- Length of Time as a Customer: Are you a loyal, long-standing customer? This can also give you leverage.

3. Research Competitor Rates

This is your secret weapon. Look up current interest rates offered by other lenders or credit card companies, especially for balance transfer offers (0% APR for a promotional period).

- Why This Works: You can say, "I’ve been a loyal customer, but I’m seeing offers for X% elsewhere, or 0% for 12 months. Can you match or beat that?" This shows you’re serious and have options.

4. Understand Your "Why"

Be ready to articulate why you deserve a lower rate.

- Good Payment History: "I’ve made all my payments on time for the past X years."

- Improved Credit Score: "My credit score has improved significantly since I opened this account."

- Competitive Offer: "I’ve received offers from other companies with lower rates."

- Financial Hardship (Use with Caution): If you’re genuinely struggling, you can explain that a lower rate would help you manage your payments and avoid defaulting. However, be aware that some lenders might view this as a higher risk.

5. Be Prepared to Walk Away (Mentally)

You don’t have to accept their first offer, or any offer if it’s not good enough. Having other options (like a balance transfer or another lender) gives you confidence and makes you a stronger negotiator.

The Negotiation Playbook: Step-by-Step

Now that you’re prepared, it’s time to make the call.

Step 1: Call the Right Department

- Start with Customer Service: Dial the number on the back of your card or loan statement.

- Ask for the "Retention Department" or "Customer Loyalty Department": These departments have more authority to offer concessions. If the first representative can’t help, politely ask to be transferred.

Step 2: Be Polite, Confident, and Clear

- Start Positively: "Hello, my name is [Your Name], and I’m calling about my [Credit Card/Loan] account number [Account Number]. I’ve been a loyal customer for [X years], and I appreciate your service."

- State Your Objective Clearly: "I’m calling today to see if there’s any way to lower my interest rate. I’ve noticed my rate is [current APR] and I’m looking to reduce the amount of interest I’m paying."

- Present Your Leverage:

- "My credit score has improved to [Your Score] since I opened this account."

- "I’ve been making all my payments on time, and I’ve never missed one."

- "I’ve recently received offers from other companies for rates as low as [X%] / 0% APR for [X months]."

- "I’m considering consolidating my debt to a lower-interest option, but I’d prefer to stay with you if possible."

- Reiterate Your Value: "I really value being a customer with [Company Name], and I’d like to continue doing business with you, but a lower interest rate would help me manage my finances more effectively."

Step 3: Listen and Respond

- Don’t interrupt: Let the representative speak.

- Be prepared for initial resistance: They might say no at first, or say "that rate is competitive."

- Reiterate your points: "I understand, but given my excellent payment history and improved credit, I was hoping there might be something you could do. Other companies are offering…"

- Ask Directly: "Is there anything you can do to lower my rate?" or "What kind of rates can you offer a customer like me?"

Step 4: Be Patient and Persistent (But Not Aggressive)

- It might take a few tries: If the first representative can’t help, politely thank them and try calling back another day. You might get a different representative with more authority or a different disposition.

- Don’t get emotional: Stay calm and rational. Your goal is to get a better rate, not to vent frustration.

Step 5: Get it in Writing!

If they offer you a lower rate:

- Confirm the new rate: "So, just to confirm, my new interest rate will be [new APR] starting on [date]?"

- Ask for confirmation: "Will I receive written confirmation of this change via email or mail?"

- Note the details: Write down the date, time, the name of the representative you spoke with, and the new agreed-upon rate. This is crucial for your records.

- Check your next statement: Make sure the new rate is reflected correctly.

What If They Say No? Don’t Give Up!

Even if your current lender says no, you still have powerful options.

1. Balance Transfer Offers (For Credit Cards)

- What it is: Many credit card companies offer 0% APR on balance transfers for a promotional period (e.g., 12-21 months). You transfer your high-interest debt from one card to a new one.

- Considerations:

- Balance Transfer Fee: There’s usually a fee (typically 3-5% of the transferred amount). Factor this into your savings calculation.

- Promotional Period: Make sure you can pay off the transferred balance before the 0% APR period ends, or the interest rate will jump significantly.

- New Debt: Don’t rack up new debt on the old card or the new card. This defeats the purpose.

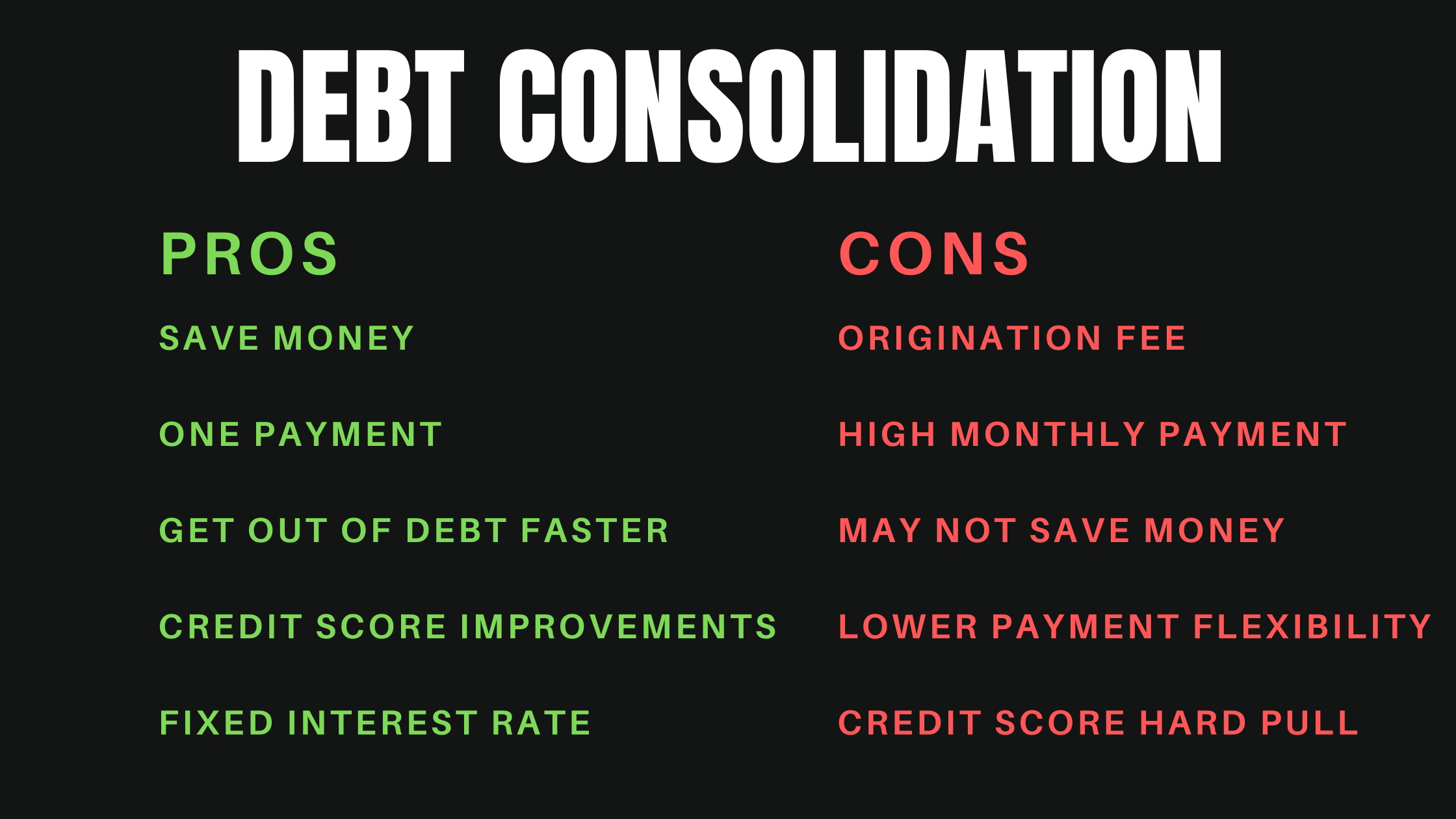

2. Debt Consolidation Loan

- What it is: A single personal loan taken out at a lower interest rate to pay off multiple higher-interest debts (like credit cards).

- Benefits: Simpler payments (one monthly payment), potentially lower interest, fixed repayment schedule.

- Considerations: Requires a good credit score to qualify for a low rate. Make sure the new loan’s interest rate is significantly lower than your existing debts.

3. Refinance Your Loan (Auto, Private Student, Mortgage)

- What it is: Applying for a brand new loan (with a new lender) at a lower interest rate to pay off your existing loan.

- Benefits: Can significantly reduce monthly payments and total interest paid.

- Considerations: There may be closing costs or fees associated with refinancing. Ensure the savings outweigh these costs. Your credit score needs to be strong enough to qualify for better terms.

4. Credit Counseling

- What it is: Non-profit credit counseling agencies can help you create a budget, develop a debt management plan (DMP), and in some cases, negotiate with creditors on your behalf for lower interest rates or more favorable terms.

- Benefits: Professional guidance, potential for lower payments, structured approach to debt payoff.

- Considerations: There might be a small monthly fee for DMPs. Research the agency to ensure it’s reputable (look for NFCC accreditation).

Maintaining Your Lower Rate & Building Good Habits

Congratulations, you’ve secured a lower rate! Now, it’s crucial to maintain that advantage and continue building healthy financial habits.

- Make Payments On Time, Every Time: This is paramount. Missing payments can cause your rate to revert to a higher penalty APR and damage your credit score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit on credit cards. This shows lenders you’re responsible.

- Monitor Your Credit Regularly: Keep an eye on your credit report for errors and track your score’s progress.

- Review Your Rates Periodically: Market rates change. Your credit score might improve even further. Make it a habit to review your interest rates every 12-18 months and be ready to negotiate again or explore refinancing.

- Avoid New Debt: The goal is to get out of debt, not to accumulate more. Use your savings from lower interest to accelerate your debt payoff.

Conclusion: Take Control of Your Financial Future

Negotiating lower interest rates isn’t just about saving money – it’s about taking control of your financial life. It empowers you to make your money work harder for you, instead of for lenders.

By being informed, prepared, and persistent, you can significantly reduce your debt burden, accelerate your path to financial freedom, and unlock thousands of dollars in savings. Don’t wait for your debt to disappear on its own; take the initiative today. Pick up the phone, do your research, and start saving! Your wallet will thank you.

Post Comment