Unlock Financial Wisdom: The Ultimate Guide to Financial Literacy Games for Families

In today’s complex world, teaching our children about money is no longer optional; it’s essential. From understanding the value of a dollar to making smart spending choices and planning for the future, financial literacy lays the groundwork for a secure and prosperous life. But let’s be honest: sitting down for a lecture on budgeting isn’t exactly a child’s idea of fun.

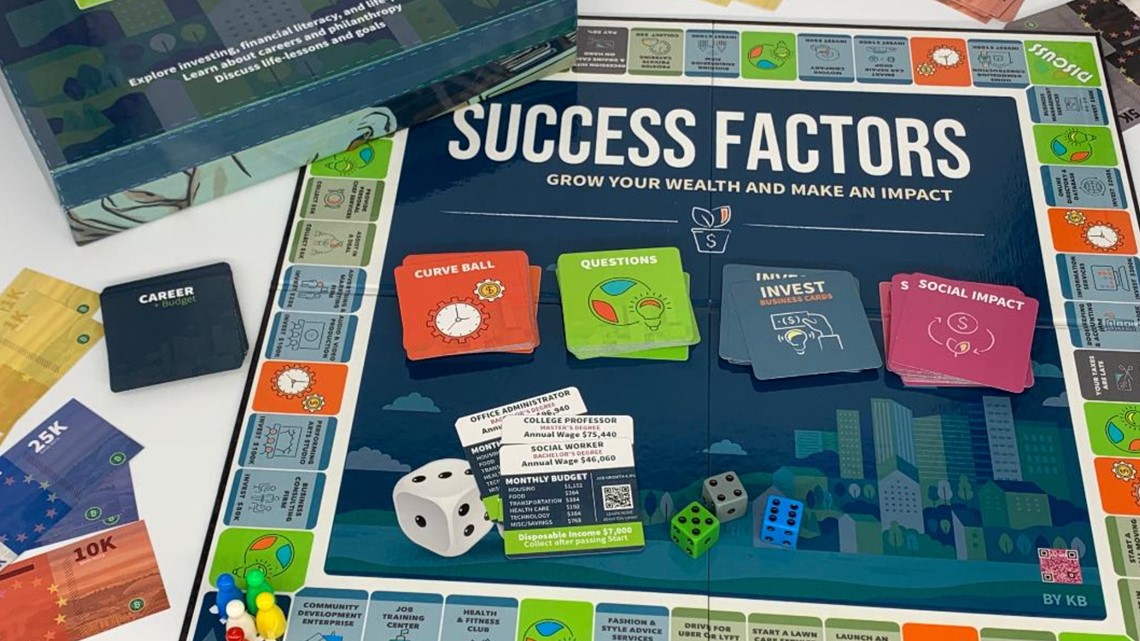

Enter financial literacy games! These engaging, interactive tools transform dry financial concepts into exciting adventures, making learning about money an enjoyable family activity. By turning lessons into play, families can build strong financial foundations together, setting their children up for lifelong success.

Why Financial Literacy Games Are Essential for Families

Why ditch the lecture for a game night? The benefits are numerous and impactful:

- Engaging & Fun: Traditional lectures can be a snooze-fest. Games inject excitement, competition, and discovery, making children want to learn about money.

- Practical Skill Development: Games aren’t just about memorizing terms; they require decision-making, problem-solving, and strategic thinking – all crucial for real-world financial management.

- Safe Environment for Mistakes: In a game, a bad financial decision (like overspending or a risky investment) has no real-world consequences. This allows kids to experiment, learn from errors, and understand cause-and-effect without fear.

- Encourages Family Bonding: Playing together creates shared experiences, laughter, and open conversations about money in a relaxed setting. This strengthens family ties while simultaneously building vital skills.

- Builds Early Habits: The earlier children start understanding financial concepts, the more likely they are to develop positive money habits that will serve them well throughout their lives.

- Demystifies Complex Topics: Concepts like interest, debt, and investment can seem daunting. Games simplify these ideas into manageable, understandable scenarios.

Key Financial Concepts Games Can Teach

Financial literacy games cover a broad spectrum of topics, helping children grasp everything from basic currency to more advanced economic principles. Here are some core concepts they can learn:

- Earning & Income:

- Understanding that money is earned through work or effort.

- Different ways people earn income (salaries, wages, starting a business).

- The concept of taxes (how some money goes to the government).

- Saving & Investing:

- The importance of saving for future goals (a toy, a bike, college).

- Delayed gratification – waiting to buy something bigger later.

- The power of compounding (money earning money over time).

- Basic investment concepts (risk vs. reward, diversification).

- Spending & Budgeting:

- Making smart spending choices – needs vs. wants.

- Creating and sticking to a budget.

- Tracking expenses and understanding where money goes.

- The concept of opportunity cost (choosing one thing means giving up another).

- Debt & Credit (Age-Appropriate):

- Understanding borrowing money and the need to pay it back.

- Basic concepts of interest paid on borrowed money.

- The idea of good vs. bad debt.

- Giving & Philanthropy:

- The importance of sharing wealth with others.

- Understanding charitable giving and its impact.

- The joy of contributing to causes you care about.

Top Financial Literacy Games for Families

Ready to transform your family’s financial learning? Here’s a curated list of fantastic games, ranging from classic board games to innovative online platforms and DIY activities.

Classic Board Games

Board games offer a tangible, social learning experience that brings families together around the table.

-

Monopoly:

- Concepts Taught: Property acquisition, rent collection, debt, bankruptcy, negotiation, strategic investment (buying houses/hotels).

- Why it Works: It’s a classic for a reason! Kids quickly grasp the idea of assets generating income and the risks of over-extending themselves.

- Pro Tip: Discuss the game’s outcomes. What happens when you go bankrupt? How could you have avoided that? What’s the difference between buying properties and just collecting rent?

-

The Game of Life:

- Concepts Taught: Life choices (career, marriage, children), income, expenses (paying for school, houses), insurance, retirement planning, financial ups and downs.

- Why it Works: It provides a simplified life simulation, showing how different decisions impact your financial journey.

- Pro Tip: Encourage kids to think about why they chose a certain career path or whether buying insurance was a good idea in their game scenario.

-

Payday:

- Concepts Taught: Monthly income, managing bills, loans, savings, dealing with unexpected expenses ("Mail" cards).

- Why it Works: It simulates a month of income and expenses, helping kids understand the rhythm of financial management. It’s simpler than Monopoly, focusing on cash flow.

- Pro Tip: Track income and expenses on a simple sheet as you play to reinforce budgeting concepts.

-

Money Bags (A Coin-Counting Game):

- Concepts Taught: Coin recognition, counting money, making change, simple addition/subtraction.

- Why it Works: Perfect for younger children (ages 7+) who are just starting to learn about currency. It makes math fun and practical.

- Pro Tip: Use real coins while playing to make the learning even more concrete.

Online & App-Based Games

Digital games offer interactive experiences, often with instant feedback and engaging visuals.

-

Visa’s Practical Money Skills for Life (Free Online Resources):

- Concepts Taught: Budgeting, saving, credit, debt, financial planning, consumer skills.

- Why it Works: Visa offers a suite of free games and resources tailored for various age groups (elementary, middle school, high school). They are well-designed and cover comprehensive topics.

- Pro Tip: Explore the different modules together and discuss the lessons learned after each game.

-

Banzai (Online Platform):

- Concepts Taught: Real-world budgeting, saving, understanding insurance, taxes, credit scores, unexpected expenses.

- Why it Works: Banzai offers immersive simulations where players manage their finances through realistic scenarios, facing bills, rent, and life’s surprises. It’s often used in schools but accessible to families.

- Pro Tip: Best for older kids and teens (ages 13+). Work through a scenario together, discussing each decision point.

-

Woozles (Money App for Kids):

- Concepts Taught: Earning, saving, spending, simple budgeting, distinguishing needs from wants.

- Why it Works: Designed specifically for young children, it uses colorful animations and simple mechanics to teach basic money concepts.

- Pro Tip: Use the app as a starting point for real-life conversations about allowance and spending choices.

-

Minecraft (Creative Adaptations):

- Concepts Taught: Resource management, trade, supply and demand, earning currency (in-game), building wealth.

- Why it Works: While not explicitly a financial game, its open-world nature allows for incredible financial role-playing. Create a village with a market, set prices for goods, and manage resources.

- Pro Tip: Design specific challenges: "Earn 10 diamonds by selling crops," or "Build a shop and set prices for your goods."

DIY & Role-Playing Games

Sometimes, the best financial games are those you create together, using everyday objects and imagination.

-

The "Allowance" Game:

- Concepts Taught: Earning, saving, spending, giving, budgeting, delayed gratification.

- Why it Works: Turn your family’s allowance system into a game. Create categories for "Spend," "Save," and "Give." Kids earn money for chores or good behavior.

- Pro Tip: Use clear jars or envelopes for each category. Let them track their progress and make their own spending/saving decisions within the system.

-

"Store" or "Market" Play:

- Concepts Taught: Pricing, buying, selling, making change, supply and demand, customer service.

- Why it Works: Set up a mini-store using household items, old toys, or even handmade crafts. Assign prices, use play money (or real coins!), and take turns being the shopper and the cashier.

- Pro Tip: Introduce "sales" or "discounts" to teach about value and promotions.

-

"Future Me" Budgeting:

- Concepts Taught: Income, expenses (rent, food, transportation, entertainment), budgeting, financial planning.

- Why it Works: For older kids, this is a powerful exercise. Give them a hypothetical future income (e.g., as their dream job). Then, have them research and "pay" for realistic expenses (rent, groceries, car insurance, phone bill, entertainment).

- Pro Tip: Use online tools or printouts for realistic average costs. It’s often eye-opening for kids to see how much things really cost.

Tips for Maximizing Learning with Financial Games

Just playing the game isn’t enough; the real learning happens in the discussions that follow.

- Discuss Outcomes: After each game, or even during, ask questions: "Why did you make that choice?" "What would you do differently next time?" "How does this relate to real life?"

- Connect to Real Life: Explicitly link game scenarios to everyday financial situations. "Remember when you ran out of money in the game? That’s why we save for emergencies in real life."

- Adapt to Age: Choose games and concepts appropriate for your child’s developmental stage. Start simple and gradually introduce more complex ideas.

- Make it Fun, Not a Chore: Keep the atmosphere light and playful. The goal is engagement, not perfection. If it feels like school, kids will resist.

- Be a Role Model: Talk openly (and appropriately) about your own financial decisions, good and bad. Let your kids see you budgeting, saving, and making thoughtful choices.

- Consistency is Key: Regular game nights or financial discussions reinforce learning over time.

Conclusion

Financial literacy is a gift that keeps on giving, empowering individuals to navigate the economic landscape with confidence and make informed decisions. By embracing financial literacy games, families can transform what might seem like a daunting subject into a series of fun, memorable, and incredibly valuable learning experiences. So, gather your family, pick a game, and start building a foundation of financial wisdom that will last a lifetime!

Post Comment