Unlock Financial Freedom: The Incredible Benefits of a No-Spend Challenge

In a world filled with endless temptations to spend – from the latest gadgets to daily coffees and impulse online purchases – it’s easy to feel like your money is slipping through your fingers. If you’ve ever felt overwhelmed by your finances, or simply want to take control of where your hard-earned cash goes, you’ve likely heard whispers of a "no-spend challenge."

But what exactly is a no-spend challenge, and why are so many people raving about it? Far from being a deprivation diet for your wallet, a no-spend challenge is a powerful, eye-opening exercise that can dramatically transform your financial habits and lead to a healthier, more intentional life. It’s a period where you commit to not spending money on anything outside of absolute necessities (like rent, utilities, and groceries).

This comprehensive guide will dive deep into the myriad of benefits that await you when you embark on your own no-spend journey. Get ready to discover how this simple yet profound challenge can lead to financial freedom, peace of mind, and a whole new perspective on what truly matters.

What Exactly is a No-Spend Challenge?

Before we jump into the benefits, let’s clarify what a no-spend challenge entails. Simply put, it’s a commitment to only spend money on essentials for a set period of time. This period can range from a weekend, a week, a month, or even longer.

Essentials typically include:

- Housing (rent/mortgage)

- Utilities (electricity, water, internet)

- Groceries (for meals cooked at home)

- Transportation (gas, public transit for work)

- Debt payments

- Necessary medications

What you don’t spend money on:

- Dining out or take-away

- Impulse purchases (clothes, gadgets, decor)

- Entertainment (movies, concerts, subscriptions you don’t use)

- New hobbies or supplies

- Daily coffees or snacks outside the home

- Non-essential beauty products or services

The specific rules are yours to define, making it flexible enough to fit your life, but strict enough to push you out of your comfort zone.

The Incredible Benefits of a No-Spend Challenge

Now, let’s explore why taking a break from spending can be one of the best financial decisions you’ll ever make.

1. Supercharge Your Savings Account

This is perhaps the most obvious, but incredibly impactful, benefit. When you cut out all non-essential spending, you’ll be amazed at how quickly your savings grow.

- Immediate Financial Boost: Even a week-long challenge can show you how much money you unknowingly spend on small, daily purchases. That daily coffee, lunch out, or online impulse buy adds up!

- Faster Goal Achievement: Want to save for a down payment, a dream vacation, or an emergency fund? A no-spend challenge provides a concentrated period of intense saving, allowing you to reach your financial milestones much faster than usual.

- Visual Progress: Seeing your savings account balance swell provides incredible motivation and reinforces positive financial habits.

2. Unmask Your Spending Habits

Many of us spend money almost unconsciously. A no-spend challenge forces you to become acutely aware of every dollar that leaves your wallet.

- Identify Spending Leaks: You’ll quickly discover where your money really goes. Are you prone to impulse buys? Do you spend too much on dining out? The challenge highlights these "leaks" in your budget.

- Distinguish Needs vs. Wants: When you can only spend on essentials, the line between what you need and what you want becomes crystal clear. This clarity is invaluable for long-term financial planning.

- Break Impulse Buying Cycles: The challenge acts as a circuit breaker, stopping the habitual reaching for your wallet. It gives you time to pause and reconsider purchases, often realizing you don’t need them after all.

3. Boost Your Financial Confidence and Control

Feeling overwhelmed by money often stems from a lack of control. A no-spend challenge empowers you to take the reins.

- Reduce Financial Stress: When you’re actively managing your money and seeing positive results, the anxiety surrounding your finances tends to decrease significantly.

- Feel Empowered: Successfully completing a no-spend challenge instills a deep sense of accomplishment and proof that you can control your spending, even when tempted.

- Gain Clarity: You’ll get a clearer picture of your overall financial health, understanding your income, expenses, and savings potential in a way you might not have before.

4. Spark Creativity and Resourcefulness

When buying new things isn’t an option, you’re forced to think outside the box and make do with what you have.

- Discover Free Entertainment: Instead of buying tickets or going out, you’ll find joy in free activities like hiking, reading books from the library, having game nights at home, or visiting free local attractions.

- Cook More at Home: You’ll get creative with ingredients already in your pantry, reducing food waste and saving a significant amount of money that would otherwise be spent on restaurants or takeout.

- Embrace DIY: Need something fixed? You might try to repair it yourself. Bored? You might pick up a long-forgotten hobby using existing supplies. This fosters valuable life skills.

- Borrow and Barter: You might reach out to friends or family to borrow items you need temporarily, strengthening your community ties.

5. Cultivate Mindful Consumption and Reduce Clutter

A no-spend challenge isn’t just about money; it’s about shifting your relationship with possessions and consumption.

- Less Stuff, More Space: By not bringing new items into your home, you naturally reduce clutter and create a more organized, peaceful living environment.

- Appreciate What You Have: When you’re not constantly acquiring new things, you tend to appreciate and make better use of the items you already own.

- Environmental Benefits: Reduced consumption means less waste, fewer resources used, and a smaller carbon footprint – a win for your wallet and the planet.

- Shift in Values: You might find yourself valuing experiences, relationships, and time over material possessions.

6. Accelerate Your Financial Goals

Whatever your big financial dreams are, a no-spend challenge can be a powerful catalyst.

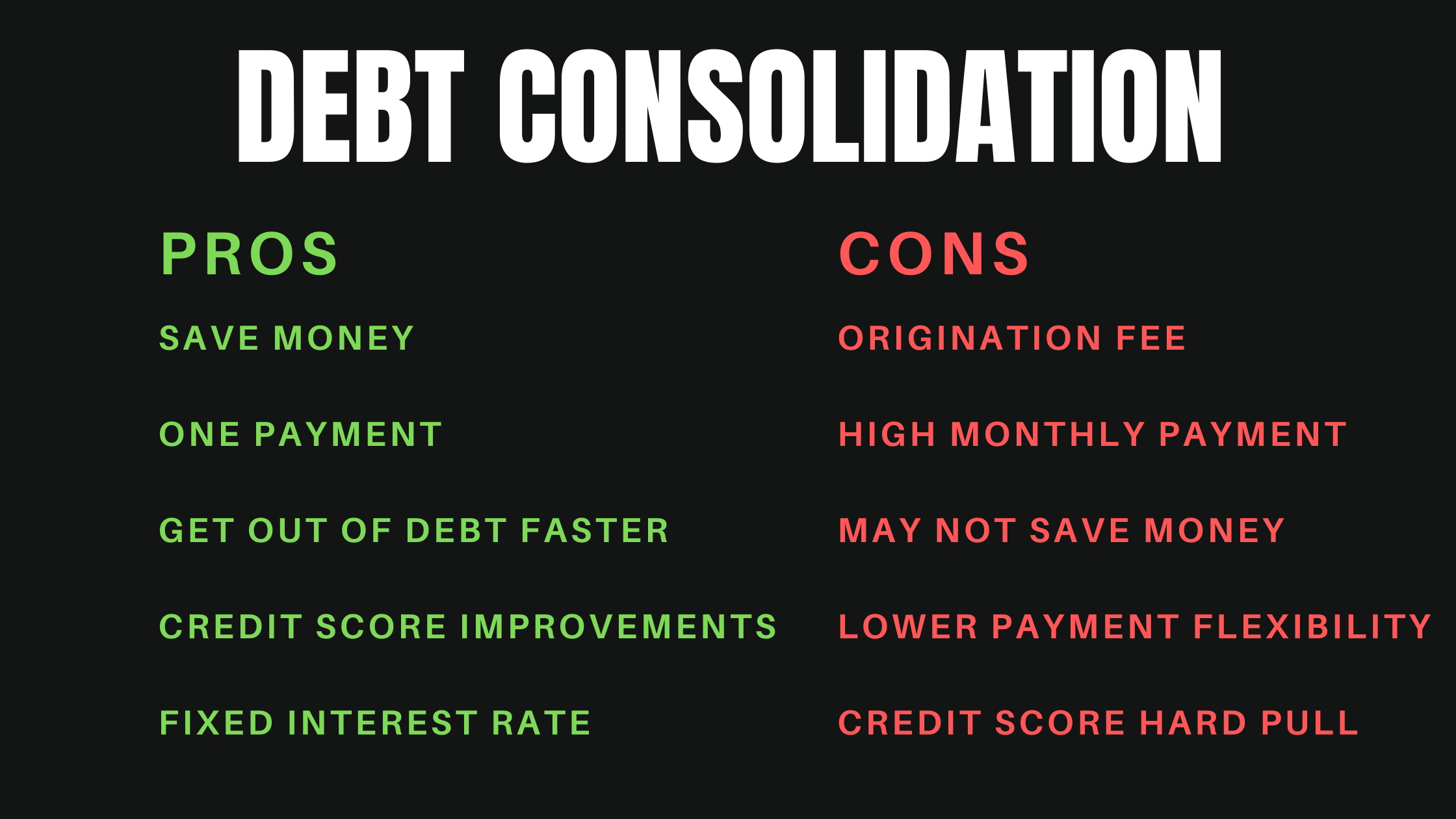

- Debt Reduction: The extra money saved can be directly applied to paying down credit card debt, student loans, or other outstanding balances, helping you become debt-free faster.

- Build an Emergency Fund: Life is unpredictable. A no-spend challenge can quickly beef up your emergency savings, providing a crucial safety net for unexpected expenses.

- Invest More: With more disposable income, you have the opportunity to invest more in your future, whether it’s retirement savings, a college fund, or a brokerage account.

7. Build Lasting Healthy Money Habits

Perhaps the most significant long-term benefit is the development of sustainable financial habits that extend far beyond the challenge period.

- Conscious Spending: You’ll learn to pause before every purchase, asking yourself if it aligns with your values and financial goals.

- Budgeting Skills: The challenge naturally makes you more aware of your budget, making it easier to stick to one in the future.

- Resilience to Temptation: You’ll build mental strength to resist marketing ploys and peer pressure to spend.

- A Healthier Relationship with Money: You’ll start seeing money as a tool to achieve your goals and live a life you love, rather than something that controls you or is meant purely for immediate gratification.

How to Start Your No-Spend Journey

Feeling inspired? Here’s a quick guide to getting started:

- Define Your "Why": What do you hope to achieve? (e.g., save $500, pay off a credit card, understand spending habits).

- Set Your Timeframe: Start small (a weekend or a week) and build up to a month if you’re a beginner.

- Establish Clear Rules: What are your absolute necessities? What will you absolutely NOT spend on? Be specific.

- Track Your Progress: Use a simple spreadsheet, a notebook, or a budgeting app to see your savings grow.

- Tell Someone: Announce your challenge to a friend or family member for accountability and support.

- Plan for Fun (Free) Activities: Think of ways to enjoy yourself without spending money.

- Anticipate Challenges: There will be moments of temptation. Have strategies ready (e.g., call a friend, go for a walk).

Embrace the Challenge, Reap the Rewards

A no-spend challenge is so much more than just a temporary halt to spending; it’s a profound journey of self-discovery, financial empowerment, and mindful living. It teaches you resilience, creativity, and the true value of your money.

By taking this leap, you’re not just saving cash; you’re investing in a future where you have greater control, less stress, and a deeper appreciation for the simple, meaningful things in life. So, are you ready to unlock the incredible benefits and transform your financial world? The challenge awaits!

Post Comment