Unlock Financial Agility: Using Lines of Credit for Seamless Short-Term Cash Flow Management

In the dynamic world of business, cash flow is king. Even highly profitable companies can face moments when incoming payments don’t quite align with outgoing expenses, leading to what’s often called a "cash flow gap." This isn’t necessarily a sign of financial trouble, but rather a common operational reality. So, how do smart businesses navigate these temporary tight spots without halting operations or missing crucial payments? The answer often lies in a powerful, flexible financial tool: the Line of Credit (LOC).

This comprehensive guide will demystify lines of credit, explaining how they work and, more importantly, how they can be strategically utilized to manage your short-term cash flow needs, keeping your business running smoothly and confidently.

What Exactly is a Line of Credit? Understanding the Basics

Imagine a credit card, but specifically designed for your business, often with lower interest rates and higher limits. That’s a good starting point for understanding a Line of Credit.

Unlike a traditional loan, where you receive a lump sum upfront and begin repaying it immediately (plus interest), a line of credit is a revolving credit facility. This means:

- You’re approved for a maximum amount: This is your credit limit (e.g., $50,000).

- You only borrow what you need, when you need it: You can draw funds up to your limit, pay them back, and then draw again, much like using a credit card.

- Interest is only paid on the amount you’ve actually borrowed: If you have a $50,000 LOC but only use $10,000, you only pay interest on that $10,000. Once you repay it, your available credit replenishes.

- Flexible repayment: While there are minimum payment requirements (often interest-only for a period), you have the flexibility to pay down the principal balance as quickly as you like, reducing your interest costs.

This flexibility makes lines of credit an invaluable tool for managing the ebb and flow of a business’s daily operations.

Line of Credit vs. Traditional Loan: Spotting the Differences

While both are forms of debt, their purposes and structures differ significantly. Understanding these distinctions is key to choosing the right financing for your needs.

| Feature | Line of Credit (LOC) | Traditional Term Loan |

|---|---|---|

| Purpose | Short-term, ongoing, flexible cash flow management | Long-term, specific, one-time expenditures |

| Funding | Access funds as needed, up to a limit | Lump sum disbursed upfront |

| Repayment | Revolving; pay interest on drawn amount; principal replenishes credit | Fixed monthly payments (principal + interest) |

| Interest | Only on the amount drawn | On the entire loan amount, from day one |

| Availability | Funds available repeatedly once repaid | Funds are gone once repaid (must reapply for new loan) |

| Ideal For | Working capital, bridging gaps, emergencies | Equipment purchase, real estate, major expansion |

Why Businesses Face Short-Term Cash Flow Gaps

Even the most successful businesses can experience temporary cash flow challenges. These aren’t necessarily signs of financial distress, but rather common occurrences that an LOC can help manage:

- Seasonal Fluctuations: Businesses like landscaping, retail, or tourism often have peak seasons and slow seasons. An LOC can help cover expenses during leaner months until revenue picks up.

- Slow-Paying Customers: You’ve delivered the service or product, but your clients take 30, 60, or even 90 days to pay their invoices. Meanwhile, your bills (payroll, rent, utilities) are due now.

- Unexpected Expenses: A piece of crucial equipment breaks down, or a sudden, large order requires more raw materials than you have on hand.

- Inventory Buildup: Needing to purchase a large amount of inventory to meet anticipated demand, before those sales materialize.

- Payroll Gaps: Ensuring employees are paid on time, even if a major client payment is delayed.

- Bridge Financing: Covering costs between the start of a project and when the first payment is received.

Key Benefits of Using a Line of Credit for Short-Term Cash Flow

When used wisely, a line of credit offers compelling advantages for managing your business’s day-to-day financial needs:

- Unmatched Flexibility: This is the LOC’s greatest strength. You’re not locked into a fixed payment schedule on a large sum you may not fully need. You can draw precisely the amount required, repay it, and draw again.

- Cost-Effective: Because you only pay interest on the amount you’ve actually borrowed, LOCs can be more cost-effective than term loans for short-term needs. You avoid paying interest on a lump sum sitting idle in your account.

- Quick Access to Funds: Once approved, funds are typically available much faster than applying for a new loan each time you have a need. This "always-on" access is crucial for seizing opportunities or addressing emergencies.

- Peace of Mind: Knowing you have a financial safety net available can significantly reduce stress and allow you to focus on growing your business, rather than worrying about making ends meet.

- Retain Ownership & Control: Unlike equity financing (selling a stake in your company), an LOC is debt financing. You maintain full ownership and control of your business.

- Improved Cash Flow Management: An LOC allows you to smooth out inconsistencies in your cash flow, ensuring you can meet obligations, invest in immediate opportunities, and maintain a healthy working capital balance.

When to Use a Line of Credit (and When NOT To)

While incredibly useful, a line of credit isn’t a silver bullet for all financial challenges. Knowing when to use it (and when to avoid it) is crucial for responsible financial management.

Ideal Scenarios for Using an LOC:

- Bridging Accounts Receivable Gaps: When waiting for customer payments but needing to cover immediate expenses like payroll or rent.

- Managing Seasonal Inventory: Purchasing larger quantities of goods before peak season, then repaying as sales come in.

- Covering Unexpected Expenses: Repairing essential equipment, dealing with unforeseen operational costs, or handling emergency supplies.

- Taking Advantage of Discounts: If a supplier offers a discount for early payment, an LOC can provide the funds to seize that saving, even if customer payments are pending.

- Funding Short-Term Projects: Covering upfront costs for a project before the first payment milestone is reached.

- Ensuring Payroll Consistency: Guaranteeing employees are paid on time, every time, regardless of temporary revenue dips.

When NOT to Use an LOC:

- For Long-Term Investments: An LOC is not suitable for buying real estate, large machinery, or funding major, long-term business expansion. These require a traditional term loan or equity financing.

- To Consolidate Existing Debt: While tempting, using an LOC to pay off other high-interest debt can lead to a cycle of debt if the underlying spending habits aren’t addressed.

- To Fund a Failing Business: If your business consistently operates at a loss and cannot generate enough revenue to repay its debts, an LOC will only deepen the hole. It’s a tool for managing temporary gaps, not for sustained losses.

- As a Primary Source of Operating Capital: While it helps with cash flow, your primary operating capital should come from your business’s core revenues, not continuous reliance on borrowed funds.

- Without a Clear Repayment Plan: Never draw on an LOC without a clear understanding of how and when you will repay the drawn amount.

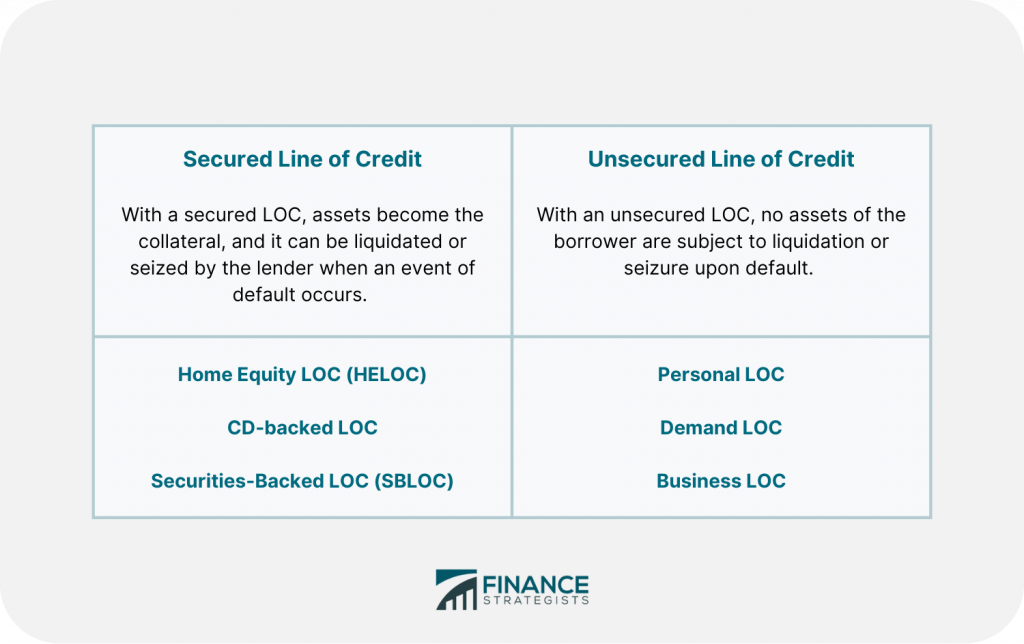

Types of Lines of Credit

Lines of credit generally fall into two main categories:

-

Secured Line of Credit:

- What it is: Backed by collateral, such as accounts receivable, inventory, real estate, or other business assets.

- Pros: Often comes with lower interest rates and higher credit limits due to reduced risk for the lender. Easier to qualify for if you have limited credit history but valuable assets.

- Cons: Your assets are at risk if you default on payments.

-

Unsecured Line of Credit:

- What it is: Not backed by specific collateral. Approval is based primarily on the borrower’s creditworthiness, financial history, and business revenue.

- Pros: No assets are pledged, offering more flexibility and less risk of asset forfeiture.

- Cons: Typically has higher interest rates and lower credit limits compared to secured LOCs, and requires a stronger credit profile to qualify.

Most businesses will apply for a Business Line of Credit, but individuals might encounter Personal Lines of Credit or Home Equity Lines of Credit (HELOCs). While the principles are similar, the focus here is on business applications.

Applying for a Line of Credit: What Lenders Look For

When you apply for a line of credit, lenders want to assess your ability to repay the borrowed funds. They typically look at:

- Credit Score (Personal & Business): A strong personal credit score (for smaller businesses) and a healthy business credit score indicate financial responsibility.

- Financial Statements: Lenders will review your balance sheets, income statements (profit & loss), and cash flow statements to understand your business’s financial health, profitability, and liquidity.

- Time in Business: Generally, lenders prefer businesses that have been operating for at least 1-2 years.

- Revenue & Profitability: Consistent, healthy revenue and demonstrated profitability are key indicators of repayment capacity.

- Business Plan: A clear understanding of your business operations, market, and how you intend to use the LOC can be beneficial.

- Collateral (for Secured LOCs): If applying for a secured line, they will assess the value and liquidity of the assets you’re pledging.

Gathering these documents and understanding your financial position before applying will streamline the process.

Managing Your Line of Credit Responsibly

While an LOC offers incredible flexibility, it’s a tool that requires discipline to avoid potential pitfalls.

- Only Borrow What You Need: Resist the temptation to draw more than necessary. The more you borrow, the more interest you pay.

- Have a Clear Repayment Strategy: Before you draw funds, know exactly how and when you plan to repay them. Link draws to specific incoming payments or revenue streams.

- Monitor Your Usage: Keep a close eye on your outstanding balance, available credit, and interest payments. Don’t let it become a "set it and forget it" tool.

- Pay Down Principal Regularly: The faster you pay down the principal, the less interest you’ll accrue over time.

- Don’t Max Out Your Limit: Keeping some available credit demonstrates good financial health and provides a buffer for unexpected, larger needs.

- Understand the Terms: Be fully aware of your interest rate (variable vs. fixed), any fees (origination, annual, inactivity), and the repayment schedule.

Common Misconceptions About Lines of Credit

Let’s clear up a few common misunderstandings:

- "It’s Free Money": Absolutely not. It’s borrowed money that must be repaid with interest.

- "It’s Just Like a Credit Card": While similar in revolving nature, business LOCs often have lower interest rates, higher limits, and are intended for operational business needs, not consumer purchases.

- "It’s For Any Business Need": As discussed, it’s best suited for short-term, cyclical, or emergency cash flow, not long-term investments.

- "It Means My Business is Struggling": Not at all. Many healthy, growing businesses use LOCs strategically to optimize their working capital and seize opportunities. It’s a sign of proactive financial management.

Conclusion: Empowering Your Business with Smart Cash Flow Management

A Line of Credit, when understood and used strategically, is an incredibly powerful asset for any business navigating the inevitable ups and downs of cash flow. It provides the financial agility to bridge temporary gaps, manage unexpected expenses, and seize timely opportunities without disrupting your core operations or resorting to more expensive, less flexible financing options.

By embracing the principles of responsible borrowing and disciplined management, your business can leverage a line of credit to ensure seamless financial operations, foster growth, and maintain the peace of mind that comes with robust liquidity. Consider whether a line of credit is the right tool to unlock your business’s full financial potential.

Post Comment