Understanding Your Net Worth: The Essential Guide to Calculating Your Financial Health

Do you ever wonder where you truly stand financially? Beyond your monthly income and expenses, there’s a powerful metric that gives you a complete snapshot of your financial health: your Net Worth. For many, the concept can seem daunting or reserved for the ultra-wealthy. But the truth is, understanding and calculating your net worth is a fundamental step in taking control of your financial future, regardless of your current income or assets.

This comprehensive guide will demystify net worth, explain why it’s crucial for everyone, and walk you through a simple, step-by-step process to calculate your own. By the end, you’ll have a clear picture of your financial standing and the knowledge to start building a more secure future.

What Exactly Is Net Worth? (The Core Concept)

At its simplest, your net worth is the total value of everything you own (your assets) minus everything you owe (your liabilities).

Think of it like this: If you were to sell all your possessions today and pay off all your debts, the money you’d have left (or the amount you’d still owe) would be your net worth.

The core formula is straightforward:

Assets – Liabilities = Net Worth

Your net worth provides a single, powerful number that tells you if you’re building wealth, staying stagnant, or falling into debt. It’s not about how much money you make, but how much wealth you’ve accumulated over time.

Why Understanding Your Net Worth Matters (More Than Just a Number)

Calculating your net worth isn’t just an academic exercise; it’s a vital tool for financial empowerment. Here’s why it’s so important for everyone, from recent graduates to seasoned professionals:

- A Clear Financial Snapshot: Your net worth gives you an objective, bird’s-eye view of your financial situation at any given moment. It cuts through the noise of daily spending and income to show you the bigger picture.

- Tracking Your Progress: By calculating your net worth regularly (e.g., quarterly or annually), you can track your financial journey over time. Are you moving closer to your financial goals? Are your efforts to save and invest paying off? This metric provides measurable proof of progress.

- Informed Decision-Making: Knowing your net worth helps you make smarter financial decisions. Should you take on that new car loan? Can you afford to buy a house? Your net worth can help guide these critical choices.

- Setting Realistic Goals: Whether your goal is retirement, buying a home, starting a business, or achieving financial independence, your net worth provides a baseline. It helps you set realistic, achievable targets and understand the steps needed to get there.

- Motivation and Accountability: Seeing your net worth grow can be incredibly motivating. It provides tangible proof that your hard work and financial discipline are paying off, encouraging you to stay on track or even accelerate your wealth-building efforts.

- Identifying Financial Strengths & Weaknesses: Is your net worth low due to high debt? Or is it stagnant because you’re not saving enough? The calculation helps pinpoint areas where you need to focus your financial efforts.

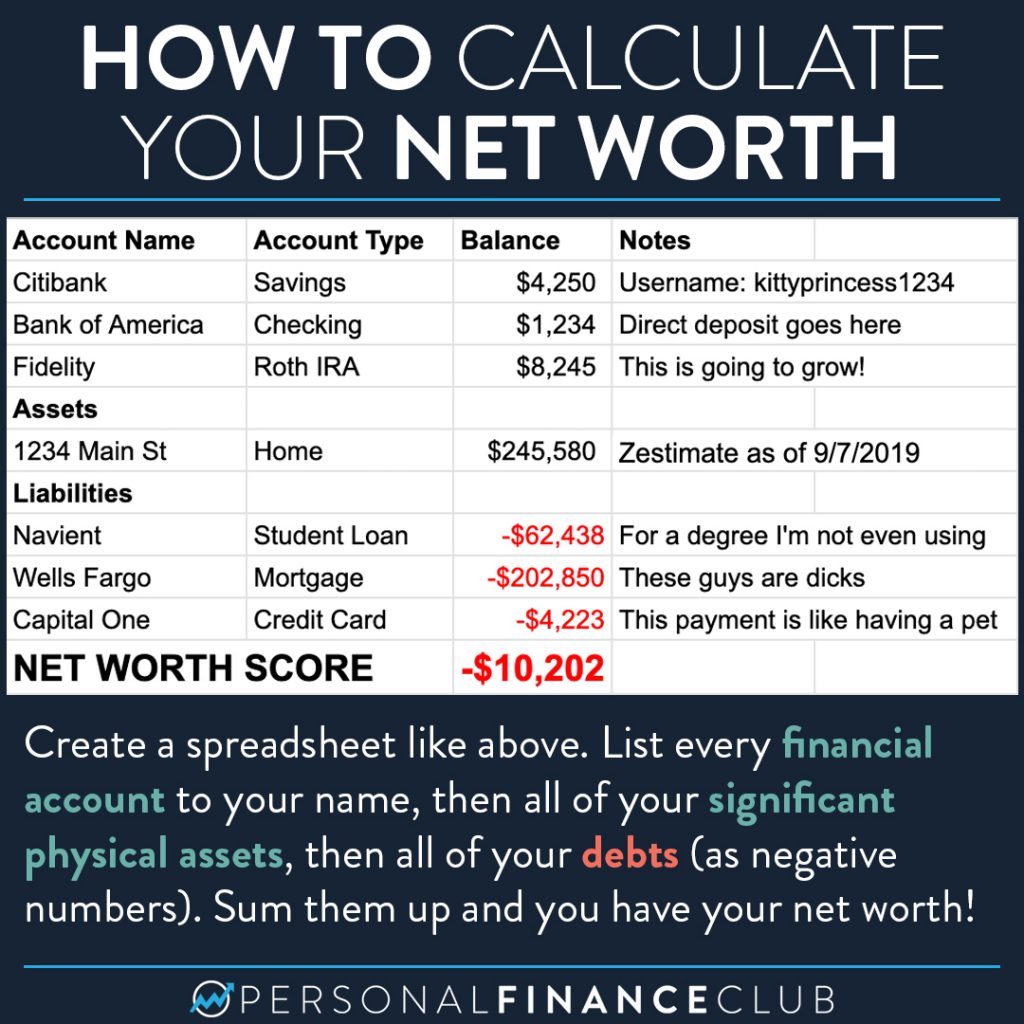

Step-by-Step: How to Calculate Your Net Worth

Calculating your net worth is simpler than you might think. All you need is a pen and paper, a spreadsheet, or a simple online tool. Let’s break it down.

Step 1: List Your Assets (What You Own)

Assets are anything you own that has monetary value. When listing them, always use their current market value – what they would sell for today, not what you paid for them.

Categories of Assets to Consider:

- Liquid Assets (Easily Convertible to Cash):

- Cash: Money in your wallet or at home.

- Checking Accounts: Balances in your primary checking accounts.

- Savings Accounts: Balances in all your savings accounts, including emergency funds.

- Money Market Accounts: Funds held in money market accounts.

- Investment Assets:

- Stocks, Bonds, Mutual Funds, ETFs: Current market value of your investment portfolios.

- Retirement Accounts:

- 401(k)s, 403(b)s, 457s (employer-sponsored plans)

- IRAs (Traditional, Roth, SEP, SIMPLE)

- Pension plans (the current vested value, if applicable)

- Brokerage Accounts: Any non-retirement investment accounts.

- Health Savings Accounts (HSAs): If invested, include the investment portion.

- Educational Savings Accounts (e.g., 529 plans): Current value.

- Cryptocurrency: Current market value of your holdings.

- Real Estate Assets:

- Primary Residence: The current market value of your home. You can get estimates from online tools (like Zillow or Redfin) or by checking recent comparable sales in your area.

- Investment Properties: Current market value of any rental properties or land you own.

- Personal Use Assets (Often Overvalued, Be Realistic!):

- Vehicles: Current market value of cars, motorcycles, boats, etc. (Use sites like Kelley Blue Book or NADAguides).

- Valuable Collectibles/Possessions: Art, jewelry, antiques, precious metals, significant electronics (like high-end computers), or other items with significant resale value. Be very conservative here; most personal belongings like furniture or everyday electronics have little resale value.

- Business Ownership: Your equity stake in any businesses you own.

How to Value Your Assets:

- Bank/Investment Accounts: Simply check your latest statement or log into your online account.

- Real Estate: Use online estimation tools, consult a local real estate agent for a free comparative market analysis, or get a professional appraisal.

- Vehicles: Use online pricing guides (Kelley Blue Book, Edmunds, NADAguides).

- Other Valuables: For significant items, consider professional appraisals or research recent auction/sales prices.

Your Asset List Example:

- Checking Account Balance: $3,500

- Savings Account Balance: $12,000

- 401(k) Value: $75,000

- Roth IRA Value: $20,000

- Investment Property Value: $300,000

- Primary Residence Value: $450,000

- Car (current market value): $15,000

- Jewelry/Collectibles: $5,000

- TOTAL ASSETS: $880,500

Step 2: List Your Liabilities (What You Owe)

Liabilities are all the debts you owe to others. When listing them, use the outstanding balance – the amount you still need to pay off.

Categories of Liabilities to Consider:

- Secured Debts (Backed by an Asset):

- Mortgages: Outstanding balance on your primary residence and any investment properties.

- Car Loans: Remaining balance on your vehicle loans.

- Home Equity Loans/Lines of Credit (HELOCs): Any outstanding balance.

- Unsecured Debts (Not Backed by an Asset):

- Credit Card Debt: Total outstanding balance across all credit cards.

- Student Loans: Remaining balance on federal and private student loans.

- Personal Loans: Any unsecured loans from banks or private lenders.

- Medical Debt: Outstanding medical bills.

- Payday Loans: Any short-term, high-interest loans.

- Other Loans: Any money borrowed from friends, family, or other sources.

How to Find Your Liability Balances:

- Loan Statements: Check your latest statements for mortgages, car loans, student loans, and personal loans.

- Online Accounts: Log in to your bank, credit card, and loan provider accounts to see current balances.

Your Liability List Example:

- Primary Residence Mortgage: $300,000

- Investment Property Mortgage: $200,000

- Car Loan: $10,000

- Student Loans: $35,000

- Credit Card Debt: $8,000

- TOTAL LIABILITIES: $553,000

Step 3: Do the Math! (Assets – Liabilities = Net Worth)

Once you have your total assets and total liabilities, simply subtract your liabilities from your assets.

Using Our Example:

- Total Assets: $880,500

- Total Liabilities: $553,000

Net Worth Calculation:

$880,500 (Assets) – $553,000 (Liabilities) = $327,500 (Net Worth)

Interpreting Your Net Worth:

- Positive Net Worth: This means you own more than you owe. A positive and growing net worth is generally a sign of good financial health and wealth accumulation.

- Negative Net Worth: This means you owe more than you own. This is common for young people with student loans, or those with significant consumer debt. It indicates that you need to focus on reducing debt and building assets.

- Zero Net Worth: Your assets and liabilities are equal. You’re breaking even.

Example Calculation: Meet Alex

Let’s put it all together with a hypothetical person, Alex.

Alex’s Assets:

- Checking Account: $2,500

- Savings Account: $10,000

- 401(k): $60,000

- Roth IRA: $15,000

- Primary Residence (current market value): $350,000

- Car (current market value): $18,000

- Total Assets: $455,500

Alex’s Liabilities:

- Primary Residence Mortgage: $280,000

- Car Loan: $12,000

- Student Loans: $40,000

- Credit Card Debt: $5,000

- Total Liabilities: $337,000

Alex’s Net Worth Calculation:

$455,500 (Total Assets) – $337,000 (Total Liabilities) = $118,500 (Alex’s Net Worth)

Alex has a positive net worth, indicating good financial progress!

Common Mistakes and Pitfalls When Calculating Net Worth

While the process is straightforward, some common errors can skew your results. Be mindful of these:

- Overvaluing Personal Assets: Most personal belongings (furniture, clothes, everyday electronics) have little to no resale value. Don’t inflate your assets by assigning unrealistic values to these items. Stick to truly valuable items like art, significant jewelry, or collectibles.

- Ignoring Small Debts: Don’t forget about smaller liabilities like outstanding medical bills, short-term loans, or even money you owe a friend or family member. Every dollar owed counts.

- Not Including All Accounts: Double-check that you’ve included every single bank account, investment account, and loan account you have, even if they seem minor.

- Doing It Only Once: Your net worth is a dynamic number. It changes as you save, spend, invest, pay down debt, and as market values fluctuate. Calculate it regularly (quarterly or annually) to get an accurate picture of your progress.

- Comparing Yourself to Others: Everyone’s financial journey is unique. Comparing your net worth to friends, family, or online averages can be demotivating and unhelpful. Focus on your own progress and goals.

- Confusing Income with Net Worth: Your net worth is not your salary. A high income doesn’t automatically mean a high net worth if you’re spending everything you earn or carrying a lot of debt.

Tips for Improving Your Net Worth

Once you know your net worth, the next logical step is to improve it! Here are key strategies:

- Increase Your Assets:

- Save More: Automate contributions to your savings accounts.

- Invest Regularly: Contribute consistently to your retirement accounts (401k, IRA) and other investment vehicles. The power of compounding can significantly boost your assets over time.

- Pay Down Your Mortgage: For many, their home is their largest asset. Paying down your mortgage principal increases your home equity, which directly boosts your net worth.

- Grow Your Income: Seek raises, start a side hustle, or invest in skills that command higher pay. More income means more potential to save and invest.

- Decrease Your Liabilities:

- Aggressively Pay Down High-Interest Debt: Focus on credit card debt, personal loans, and other high-interest liabilities first. The money saved on interest can then be put towards building assets.

- Avoid New Debt: Be mindful of taking on unnecessary new loans or increasing credit card balances.

- Refinance Loans: If possible, refinance high-interest loans (like student loans or mortgages) to lower your monthly payments and overall interest paid, freeing up cash flow.

- Budget and Track Spending: A solid budget helps you identify where your money is going, allowing you to reallocate funds from unnecessary spending to savings and debt reduction.

- Regularly Review Your Net Worth: Make it a habit to calculate your net worth at least once a year, or even quarterly. This helps you stay accountable, celebrate progress, and adjust your strategy as needed.

- Seek Professional Advice: If your financial situation is complex, or you need help creating a long-term financial plan, consider consulting a certified financial planner.

Conclusion: Take Control of Your Financial Story

Understanding and calculating your net worth is the bedrock of sound personal finance. It transforms abstract financial concepts into concrete numbers that empower you to make informed decisions and track your journey towards financial freedom.

It might feel intimidating at first, especially if your net worth is lower than you’d like. But remember, this isn’t about judgment; it’s about clarity. Once you know where you stand, you can set clear goals and develop a strategic plan to improve your financial health.

So, take that first step today. Gather your statements, list your assets, tally your liabilities, and calculate your net worth. It’s the first and most powerful step on your path to building lasting wealth and securing your financial future.

Post Comment