The weight of debt can feel suffocating. Whether it’s credit card balances, personal loans, or student debt, the sheer number of payments and the ever-present interest can make financial freedom seem like an impossible dream. But what if there was a simple, yet incredibly powerful strategy that not only helps you pay off debt faster but also keeps you motivated along the way?

Enter the Debt Snowball Method. This isn’t just a financial strategy; it’s a psychological one, designed to build momentum and empower you to conquer your debt, one small victory at a time. If you’re looking for an easy-to-understand path to becoming debt-free, you’ve come to the right place.

Understanding the Debt Snowball Method: Your Simple Path to Financial Freedom

What Exactly is the Debt Snowball Method?

At its core, the Debt Snowball Method is a debt repayment strategy where you pay off your debts in order from the smallest balance to the largest. The name comes from the idea of a snowball rolling down a hill: it starts small, but as it picks up more snow, it gets bigger and bigger, gaining momentum.

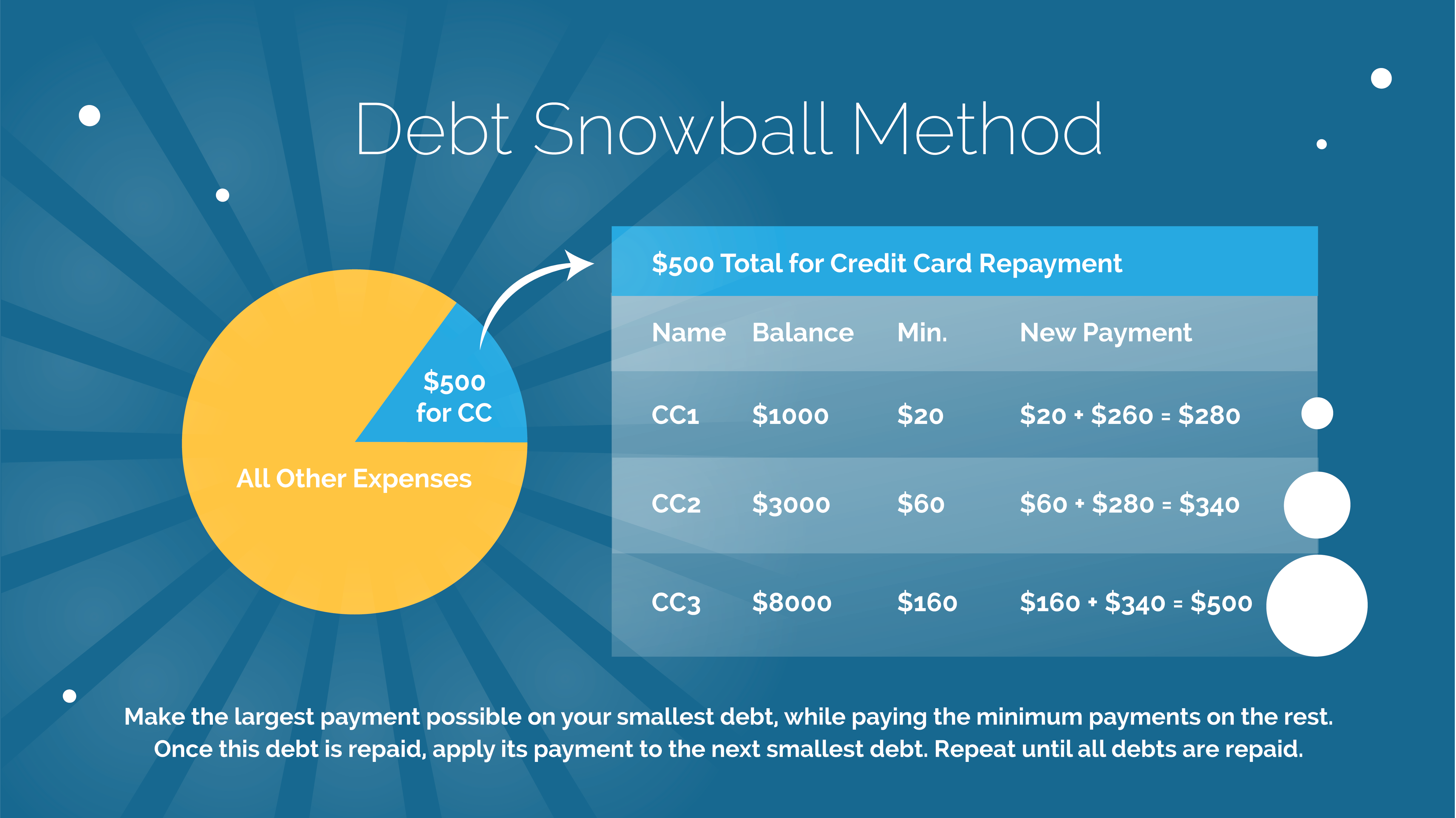

Here’s the basic concept:

- List all your debts from the smallest balance to the largest, regardless of the interest rate.

- Make minimum payments on all debts except the smallest one.

- Throw every extra dollar you can at that smallest debt until it’s completely paid off.

- Once the smallest debt is gone, you take the money you were paying on it (the minimum payment + any extra you were throwing at it) and add it to the minimum payment of your next smallest debt.

- You continue this process, with each paid-off debt "snowballing" its payment into the next, larger debt.

The magic of the Debt Snowball isn’t just in the math; it’s in the psychological wins. By quickly eliminating smaller debts, you experience immediate success, which fuels your motivation to keep going.

How to Implement the Debt Snowball Method: A Step-by-Step Guide

Ready to get started? Follow these simple steps to put the Debt Snowball into action:

Step 1: List All Your Debts

Gather all your debt statements. This includes:

- Credit cards

- Personal loans

- Medical bills

- Student loans (though larger ones might be better suited for avalanche, snowball can still work)

- Car loans

- Any other outstanding balances

For each debt, write down:

- The name of the creditor (e.g., Visa, Student Loan Servicer)

- The current balance

- The minimum monthly payment

- The interest rate (useful for comparison, but not the primary focus for snowball)

Step 2: Arrange Your Debts from Smallest to Largest Balance

This is the cornerstone of the Debt Snowball. Ignore interest rates for this step. Simply order your debts based on their outstanding balance, from the lowest amount to the highest.

Example:

- Credit Card A: $500 (Min. Payment: $25)

- Medical Bill: $750 (Min. Payment: $30)

- Credit Card B: $2,000 (Min. Payment: $60)

- Personal Loan: $5,000 (Min. Payment: $150)

- Car Loan: $15,000 (Min. Payment: $300)

Step 3: Make Minimum Payments on All But the Smallest Debt

For all debts except the one at the very top of your list (the smallest one), continue to pay only the minimum required payment each month. This ensures you avoid late fees and keep your accounts in good standing.

Step 4: Attack the Smallest Debt with Extra Payments

This is where the real action happens! Take every extra dollar you can find in your budget and throw it at your smallest debt. This means:

- Any money you free up from cutting expenses (e.g., dining out less, canceling unused subscriptions).

- Bonus money, tax refunds, gifts.

- Income from a side hustle.

Add all of this extra money to the minimum payment of your smallest debt. Your goal is to pay it off as quickly as possible.

Step 5: Roll the Payment to the Next Debt

Once your smallest debt is paid off (celebrate this huge win!), you don’t just keep that extra money. Instead, you take the entire payment amount you were making on that first debt (its minimum payment + any extra money you were putting towards it) and add it to the minimum payment of your next smallest debt.

Continuing our example:

- Month 1: You pay off Credit Card A ($500). Let’s say you were paying its $25 minimum + an extra $75 = $100 total.

- Month 2: Now you take that full $100 and add it to the minimum payment of your Medical Bill ($30). So, you’re now paying $130 per month on the Medical Bill. You continue making minimum payments on Credit Card B, Personal Loan, and Car Loan.

- Once the Medical Bill is paid off, you take the $130 you were paying on it and add it to the minimum payment of Credit Card B ($60). Now you’re paying $190 on Credit Card B.

Step 6: Repeat Until All Debts Are Gone

Keep repeating this process. As each debt is eliminated, your "snowball" payment grows larger and larger, allowing you to tackle bigger debts with increasing speed. You’ll be amazed at how quickly you gain momentum and see your debt balances shrink.

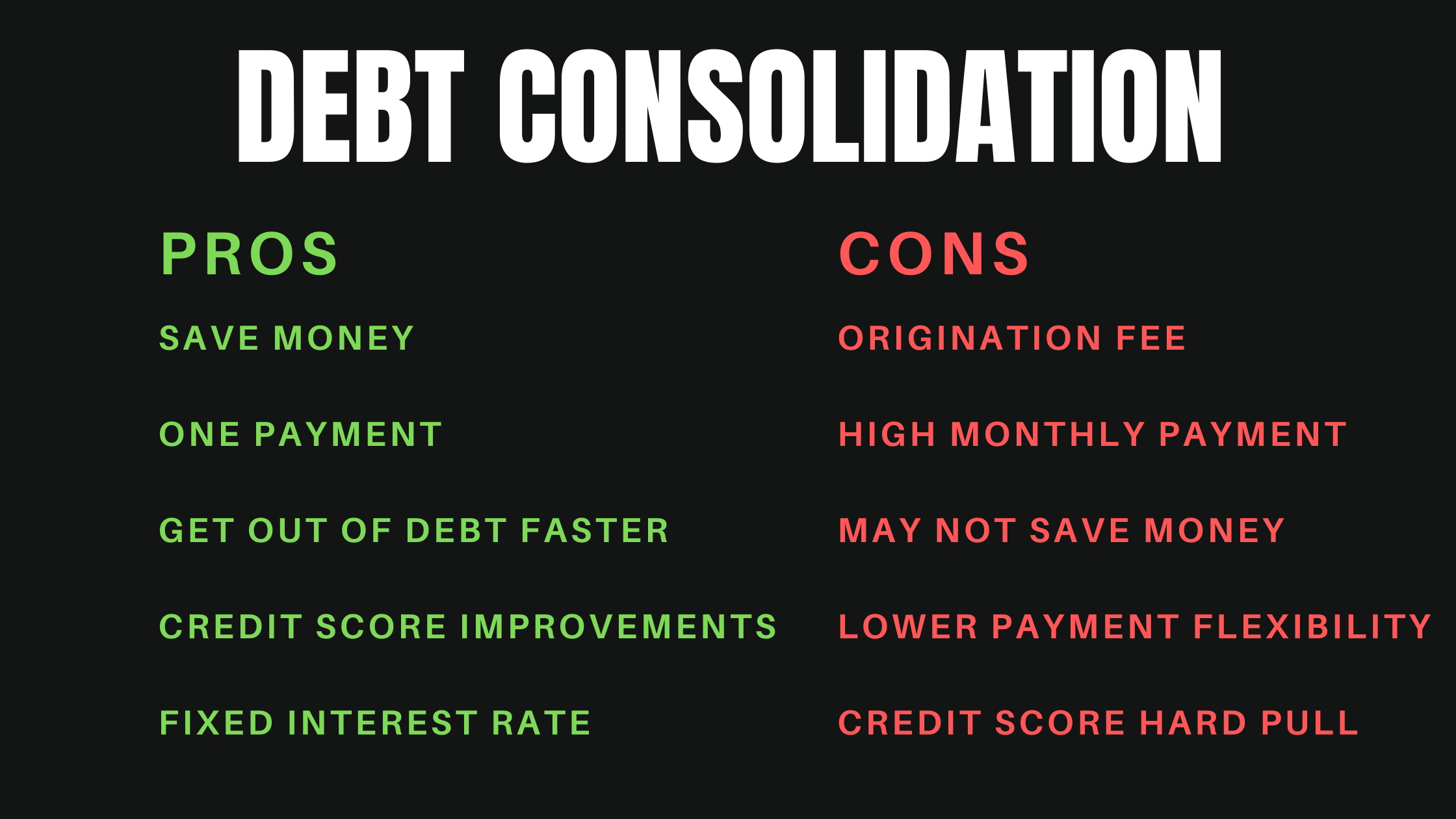

Debt Snowball vs. Debt Avalanche: Which is Right for You?

When researching debt repayment strategies, you’ll inevitably come across the Debt Avalanche Method. It’s important to understand the difference between the two to make an informed decision for your financial journey.

The Debt Avalanche Method Explained

Unlike the Debt Snowball, the Debt Avalanche Method focuses on paying off debts with the highest interest rates first, regardless of their balance. You still make minimum payments on all other debts, but all extra money goes towards the debt accruing the most interest.

Pros of Debt Avalanche:

- Saves the most money on interest: Mathematically, this method is superior because you’re attacking the most expensive debts first, reducing the overall interest paid over the life of your debt.

- Faster overall debt elimination (financially): By minimizing interest, you technically get out of debt faster in terms of the total time it takes to pay everything off.

Cons of Debt Avalanche:

- Less immediate gratification: If your highest interest debt also happens to be a large one, it can take a long time to pay it off, potentially leading to demotivation.

- Requires strong discipline: You need to be committed even if you don’t see quick wins.

Which Method Should You Choose?

-

Choose Debt Snowball if:

- You need motivation and quick wins to stay on track.

- You tend to get discouraged easily.

- You have several small debts that you can quickly eliminate.

- You prioritize psychological momentum over saving the absolute most on interest.

-

Choose Debt Avalanche if:

- You are highly disciplined and motivated by numbers.

- You want to save the maximum amount of money on interest.

- You have a few high-interest debts that are significantly costing you money.

Many financial experts, like Dave Ramsey, advocate for the Debt Snowball primarily because of its powerful psychological benefits. For most people, staying motivated is more challenging than the math itself.

Who is the Debt Snowball Method Best For?

The Debt Snowball Method is particularly effective for individuals who:

- Struggle with motivation: The quick wins provide the encouragement needed to stick with the plan.

- Have multiple small debts: Rapidly eliminating these can clear mental clutter and build confidence.

- Are just starting their debt-free journey: It offers a simple, easy-to-understand approach that doesn’t require complex calculations.

- Feel overwhelmed by debt: Breaking down debt into manageable chunks makes the goal feel achievable.

- Prioritize behavioral change: It helps develop positive financial habits through consistent action and positive reinforcement.

Tips for Success with the Debt Snowball

Implementing the Debt Snowball is one thing; sticking with it is another. Here are some crucial tips to ensure your success:

- Create a Detailed Budget: Know exactly where your money is going. Identify areas where you can cut expenses to free up more money for your debt payments. Every extra dollar helps your snowball grow faster.

- Find Extra Money: Look for ways to boost your income, even temporarily. Consider a side hustle, selling unused items, or picking up extra shifts.

- Automate Payments: Set up automatic minimum payments for all your debts (except the one you’re attacking) to ensure you never miss a payment. Manually send the extra payment to your focus debt.

- Cut Up Credit Cards (Optional but Recommended): If you struggle with impulse spending, consider cutting up your credit cards or freezing them to prevent accumulating new debt.

- Avoid New Debt: While on your debt-free journey, commit to not taking on any new debt. This is crucial to prevent backsliding.

- Celebrate Milestones: Acknowledge and celebrate each debt you pay off. These small victories reinforce your efforts and keep you motivated.

- Stay Consistent: Debt repayment is a marathon, not a sprint. There will be tough months, but consistency is key. Don’t give up!

- Track Your Progress: Use a spreadsheet, an app, or even a physical chart to visualize your debt shrinking. Seeing the numbers go down can be incredibly motivating.

The Benefits of Using the Debt Snowball

The advantages of embracing the Debt Snowball Method extend far beyond just paying off debt:

- Powerful Psychological Momentum: The most significant benefit. Paying off that first debt, then the second, creates a powerful sense of achievement that propels you forward.

- Simplified Repayment Strategy: It’s easy to understand and implement, making it accessible to anyone, regardless of their financial literacy.

- Faster Perceived Debt Elimination: While the Avalanche might save more money on interest, the Snowball often feels faster because you’re getting quick wins and seeing accounts zero out.

- Improved Financial Habits: The process forces you to budget, track spending, and prioritize debt repayment, leading to healthier money habits in the long run.

- Reduced Stress and Anxiety: As debts are eliminated, the mental burden of financial obligations lightens significantly, leading to greater peace of mind.

- Increased Confidence: Successfully tackling your debt builds confidence not just in your financial abilities but in your overall capacity to set and achieve challenging goals.

Potential Drawbacks/Considerations

While highly effective, it’s fair to acknowledge potential drawbacks of the Debt Snowball:

- May Pay More Interest: As mentioned, if you have a very high-interest debt that isn’t your smallest, you might pay more in total interest compared to the Debt Avalanche method. For some, the psychological benefit outweighs this financial cost.

- Requires Discipline: Like any financial plan, it requires commitment and sticking to your budget, especially when faced with temptations to spend.

Conclusion: Your Journey to Financial Freedom Starts Now

The Debt Snowball Method is more than just a numbers game; it’s a strategic approach to debt repayment that harnesses the power of human psychology. By focusing on quick wins and building momentum, it empowers you to take control of your finances, eliminate debt, and ultimately achieve true financial freedom.

If you’ve felt overwhelmed by debt, or struggled to stick with other repayment plans, give the Debt Snowball Method a try. Start small, stay consistent, celebrate your victories, and watch your debt snowball melt away, paving the way for a brighter, debt-free future. Your journey to financial peace begins today.

Post Comment