Understanding the Chart of Accounts for Your Business: The Financial Roadmap You Can’t Do Without

Starting and running a business is an exciting journey, but it comes with a lot of moving parts. Among the most critical, yet often overlooked, elements is your financial foundation. Just as a building needs a blueprint, your business needs a clear financial structure. This is where the Chart of Accounts (COA) comes in – it’s the organized list that classifies every financial transaction your business makes.

For many small business owners and beginners, the term "Chart of Accounts" might sound intimidating, like something only accountants need to worry about. But in reality, understanding your COA is fundamental to gaining control over your finances, making informed decisions, and ensuring your business thrives.

This comprehensive guide will demystify the Chart of Accounts, explaining what it is, why it’s so vital, its core components, and how to build one that truly serves your business.

What Exactly Is a Chart of Accounts?

Imagine your business’s finances as a vast filing cabinet. Every time money comes in or goes out, it’s like a document that needs to be filed. If you just throw everything into one drawer, you’ll never find what you’re looking for!

The Chart of Accounts (COA) is simply an organized, comprehensive list of all the financial accounts in your business’s general ledger. Think of it as:

- A financial roadmap: It guides where every dollar is recorded.

- A categorized list: Each account has a unique name and usually a number, allowing you to group similar transactions together.

- The backbone of your accounting system: Every financial report, from your Income Statement to your Balance Sheet, is generated directly from the data sorted by your Chart of Accounts.

Essentially, the COA provides a systematic way to categorize your business’s financial activities, making it easier to track, analyze, and report on your financial health.

Why Is the Chart of Accounts So Crucial for Your Business?

You might be thinking, "Do I really need this if my business is small?" The answer is a resounding yes. A well-structured Chart of Accounts offers numerous benefits that are invaluable for businesses of all sizes:

- Clarity and Organization: It brings order to financial chaos. Instead of a jumbled mess of transactions, you have a clear, logical structure where every dollar has a designated home.

- Accurate Financial Reporting: Your Income Statement (Profit & Loss) and Balance Sheet directly pull information from your COA. Without a proper structure, these vital reports would be inaccurate or impossible to generate.

- Informed Decision-Making: When you know exactly where your money is going and coming from, you can make smarter decisions about pricing, expenses, investments, and growth strategies.

- Tax Preparation Made Easy: A well-organized COA simplifies tax time immensely. All your income and deductible expenses are already categorized, making it easier for you or your accountant to file accurately and on time.

- Compliance and Audits: Should your business ever face an audit, a clear COA demonstrates that you maintain meticulous financial records, which is crucial for compliance.

- Budgeting and Forecasting: By understanding past financial trends through your COA, you can create more realistic budgets and forecasts for the future.

- Integration with Accounting Software: Modern accounting software like QuickBooks, Xero, and FreshBooks are built around a Chart of Accounts. Understanding it allows you to use these tools effectively.

- Scalability: As your business grows, your COA can adapt, allowing you to add new accounts as needed without disrupting your entire financial system.

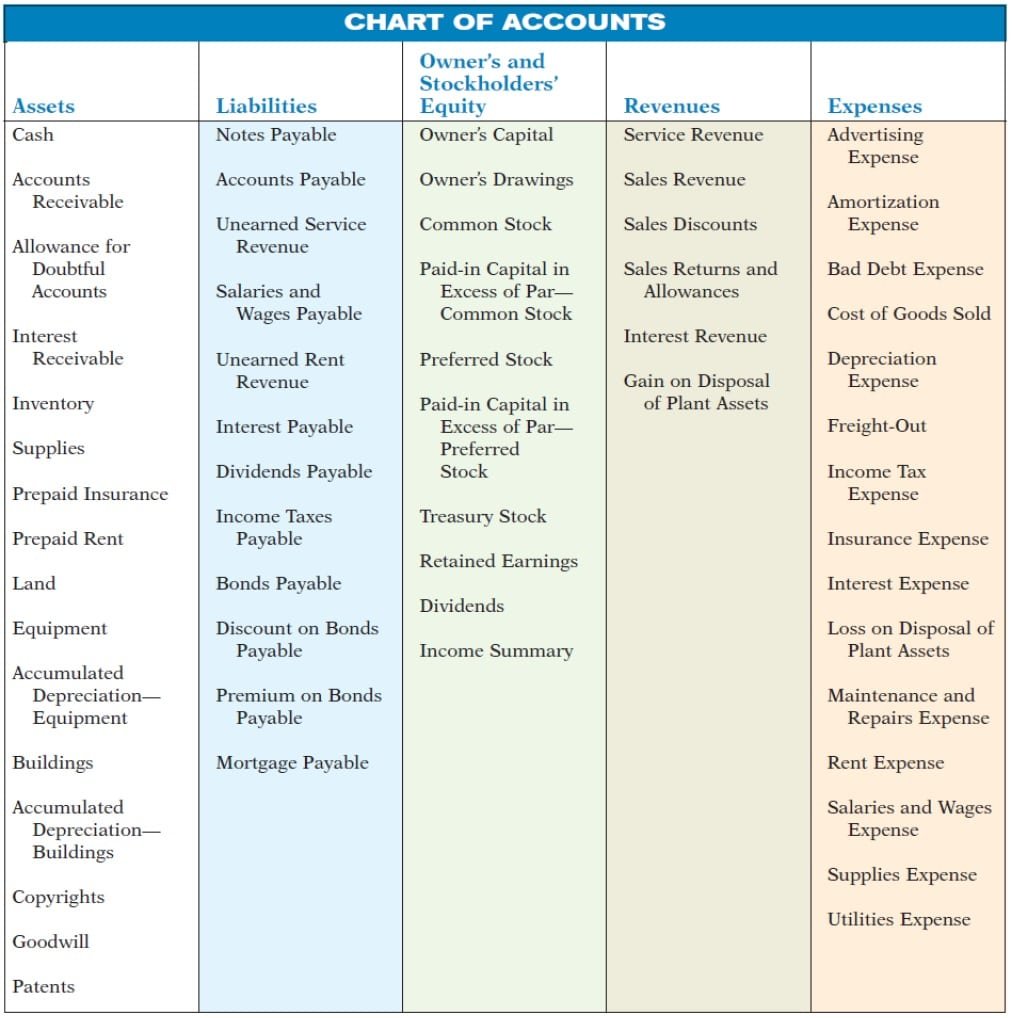

The Five Pillars: Main Account Categories Explained

Every Chart of Accounts is built upon five fundamental account categories. Understanding these is key to grasping how your business’s finances are organized. Each category typically has a range of numbers assigned to it for easy identification and grouping.

1. Assets (Account Numbers typically starting with 1000s)

What they are: Assets are anything your business owns that has economic value and can provide a future benefit. Think of them as resources that can generate income or reduce expenses.

- Examples:

- Cash: Money in your bank accounts, petty cash.

- Accounts Receivable (A/R): Money owed to your business by customers for goods or services already delivered.

- Inventory: Products you have on hand to sell.

- Prepaid Expenses: Expenses paid in advance (e.g., rent for the next six months).

- Property, Plant, and Equipment (PP&E): Land, buildings, machinery, vehicles, computers – anything used for a long period in your business operations.

- Investments: Stocks, bonds, or other financial instruments held by the business.

2. Liabilities (Account Numbers typically starting with 2000s)

What they are: Liabilities are what your business owes to others. These are financial obligations that need to be paid in the future.

- Examples:

- Accounts Payable (A/P): Money your business owes to suppliers or vendors for goods or services you’ve received but haven’t yet paid for.

- Loans Payable: Money borrowed from banks or other lenders.

- Credit Card Debt: Balances owed on business credit cards.

- Accrued Expenses: Expenses incurred but not yet paid (e.g., salaries owed to employees for work done).

- Unearned Revenue: Money received from customers for goods or services that have not yet been delivered (e.g., a customer pays upfront for a year of service).

3. Equity (Account Numbers typically starting with 3000s)

What it is: Equity represents the owner’s stake in the business. It’s what’s left over if you sell all your assets and pay off all your liabilities. For sole proprietorships, it’s often called "Owner’s Equity" or "Owner’s Capital." For corporations, it’s "Shareholder’s Equity."

- Examples:

- Owner’s Capital/Investment: Money or assets the owner puts into the business.

- Owner’s Draws: Money or assets the owner takes out of the business for personal use.

- Retained Earnings: Accumulated profits of the business that have not been distributed to owners or shareholders.

- Common Stock/Preferred Stock: (For corporations) The value of shares issued to investors.

4. Revenue (or Income) (Account Numbers typically starting with 4000s)

What it is: Revenue is the money your business earns from its primary operations and other sources. This is where the cash flow into your business is recorded.

- Examples:

- Sales Revenue: Money earned from selling your core products or services.

- Service Revenue: Money earned from providing services.

- Interest Income: Money earned from interest on investments or bank accounts.

- Rental Income: Money earned from renting out property.

- Consulting Income: Money earned from consulting services.

5. Expenses (Account Numbers typically starting with 5000s and up)

What they are: Expenses are the costs incurred by your business in the process of generating revenue. This is where the cash flow out of your business is recorded.

- Examples:

- Cost of Goods Sold (COGS): The direct costs associated with producing the goods sold by your business (e.g., raw materials, direct labor).

- Rent Expense: Cost of office or retail space.

- Utilities Expense: Electricity, water, internet, gas bills.

- Salaries & Wages Expense: Payments to employees.

- Marketing & Advertising Expense: Costs of promoting your business.

- Office Supplies Expense: Cost of paper, pens, toner, etc.

- Travel Expense: Costs related to business travel.

- Insurance Expense: Premiums paid for business insurance.

- Depreciation Expense: The allocation of the cost of a tangible asset over its useful life.

How Accounts Are Typically Numbered (and Why)

While you can technically name accounts anything you want, assigning numerical codes to each account is a standard and highly recommended practice. This numbering system:

- Provides structure: It creates a logical flow, making it easy to locate accounts.

- Facilitates data entry: In accounting software, you can quickly type a number instead of a long account name.

- Aids in reporting: Reports can be generated based on number ranges, providing quick summaries of categories.

A common numbering convention looks like this:

- 1000 – 1999: Assets

- 2000 – 2999: Liabilities

- 3000 – 3999: Equity

- 4000 – 4999: Revenue

- 5000 – 5999: Cost of Goods Sold (often separated from other expenses)

- 6000 – 9999: Operating Expenses (e.g., 6000-6999 for administrative, 7000-7999 for selling, etc.)

Within these ranges, you can create sub-accounts. For example, under "Cash" (1010), you might have:

- 1010 – Checking Account

- 1015 – Savings Account

- 1020 – Petty Cash

Building Your Own Chart of Accounts: Best Practices

While accounting software often provides a default COA, it’s rarely perfect for every business. Here’s how to build or customize one that truly fits your needs:

- Start with a Template: Most accounting software (QuickBooks, Xero, Wave, etc.) will offer a standard COA based on your industry. This is a great starting point.

- Keep it Simple (Initially): Don’t overcomplicate it. Begin with the essential accounts you know you’ll need. You can always add more specific accounts later as your business grows and your needs evolve. Too many accounts can make data entry cumbersome and reporting confusing.

- Be Consistent: Once you’ve named an account (e.g., "Office Supplies Expense"), stick with it. Avoid creating similar accounts like "Supplies" or "Office Costs" that could lead to miscategorization.

- Consider Your Industry: A retail business will need "Inventory" and "Cost of Goods Sold," while a service-based business might not. A restaurant will need "Food Costs" and "Beverage Sales," which are unique to their industry. Tailor your COA to reflect your specific operations.

- Think About Your Reporting Needs: What information do you want to see regularly? Do you need to track marketing expenses separately from advertising? Do you want to see detailed utility costs (electricity, water, gas) or just a single "Utilities Expense"? Your COA should support the reports you want to generate.

- Use Sub-Accounts Wisely: Sub-accounts are powerful for detail without clutter. For example, under "Utilities Expense," you could have sub-accounts for "Electricity," "Water," and "Internet." This allows you to see the total utility cost and also drill down into specific components.

- Review and Refine Regularly: Your business changes, and so should your COA. Annually, or whenever you introduce new products/services or significant expenses, review your COA to ensure it’s still accurate and serving your needs.

Common Mistakes to Avoid

- Too Many Accounts: Over-categorization leads to complexity, makes data entry slower, and can obscure high-level insights.

- Too Few Accounts: Under-categorization means you won’t have enough detail to make informed decisions or accurately track specific expenses/revenues.

- Inconsistent Naming: Using different names for the same type of transaction (e.g., "Travel," "Business Trips," "T&E") makes reporting a nightmare.

- Mixing Personal and Business Accounts: A fundamental rule of business accounting! Never use business accounts for personal transactions or vice versa. Create a "Owner’s Draw" account for personal withdrawals.

- Not Understanding the Account Types: Misclassifying an asset as an expense, or a liability as equity, will lead to inaccurate financial statements.

Chart of Accounts and Your Accounting Software

Virtually all modern accounting software solutions come with a pre-built Chart of Accounts. When you set up your business in QuickBooks, Xero, Wave, or FreshBooks, you’ll be prompted to select an industry, and the software will generate a standard COA for you.

Key things to remember:

- Customize It: Don’t just accept the default. Go through it and rename, add, or delete accounts to match your specific business activities.

- Learn Your Software’s Structure: Each software might have slight variations in how they present or number accounts. Spend time familiarizing yourself.

- Seek Professional Help: If you’re unsure, a bookkeeper or accountant can help you set up or refine your COA within your chosen software. This initial investment can save you headaches down the line.

The COA in Action: How it Feeds Your Financial Reports

Understanding the Chart of Accounts is crucial because it directly impacts the two most important financial statements for your business:

-

The Income Statement (Profit & Loss Statement): This report shows your business’s profitability over a period (e.g., a month, quarter, or year). It’s primarily generated from your Revenue and Expense accounts.

- Formula: Revenue – Cost of Goods Sold – Operating Expenses = Net Income (Profit/Loss)

-

The Balance Sheet: This report provides a snapshot of your business’s financial health at a specific point in time. It’s generated from your Asset, Liability, and Equity accounts.

- Formula: Assets = Liabilities + Equity (This fundamental accounting equation must always balance!)

By properly categorizing transactions using your Chart of Accounts, you ensure that these critical reports are accurate, providing you with the true picture of your business’s financial performance and position.

Conclusion: Take Control of Your Financial Future

The Chart of Accounts might seem like a dry, technical topic, but it is the unsung hero of organized and insightful financial management. It’s the framework that allows you to transform raw transaction data into meaningful information.

By investing time in understanding and customizing your Chart of Accounts, you’re not just organizing numbers; you’re gaining clarity, improving decision-making, streamlining tax preparation, and ultimately, building a stronger, more resilient business. Don’t let your financial information be a mystery – unlock its potential with a well-structured Chart of Accounts.

Ready to get your finances in order? Start by reviewing your current accounting software’s Chart of Accounts, or if you’re just starting out, begin building your tailored financial roadmap today!

Post Comment