Understanding Global Economic Cycles: Navigating the Boom and Bust

Have you ever wondered why sometimes jobs are plentiful and everyone seems to be spending, while other times businesses struggle, and people worry about their finances? This isn’t random chaos; it’s the natural ebb and flow of the global economy, known as economic cycles or business cycles.

Just like the seasons, the economy moves through predictable phases of growth and decline. Understanding these "boom and bust" periods is not just for economists; it’s crucial for everyone – from individuals planning their careers and savings, to businesses making investment decisions, and governments crafting policies.

This comprehensive guide will demystify global economic cycles, breaking down their stages, exploring what drives them, and explaining how they impact your everyday life. By the end, you’ll have a clearer picture of why the economy behaves the way it does and how you can better navigate its ups and downs.

What Are Global Economic Cycles?

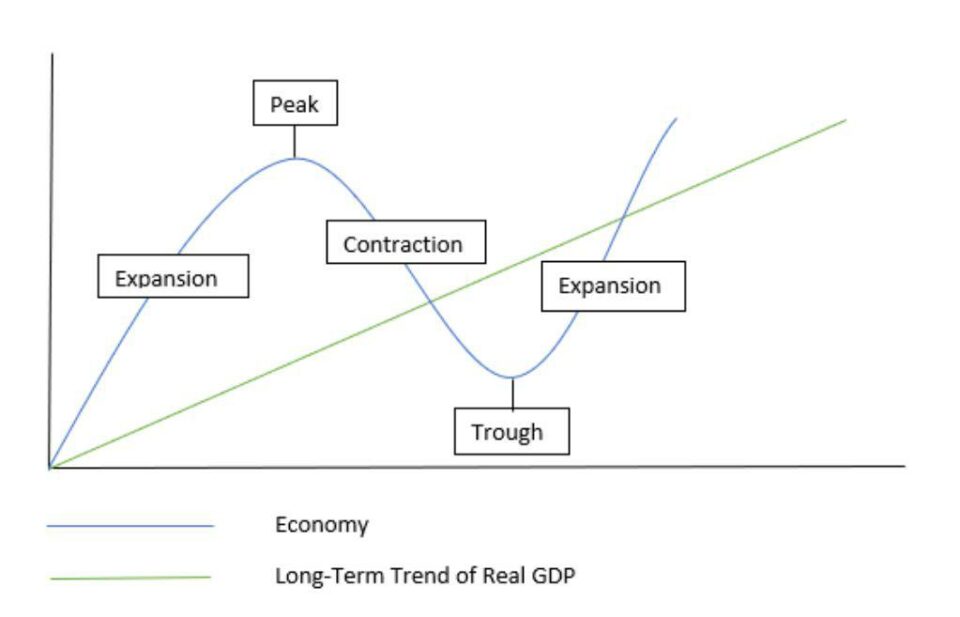

At its simplest, a global economic cycle refers to the overall ups and downs in economic activity over a period of time. It’s the recurring pattern of expansion (growth) and contraction (decline) that a country’s, or even the world’s, economy experiences.

Think of it like a wave: it builds up, reaches a peak, then crashes down, hits a trough, and eventually starts building up again. These cycles are driven by a complex interplay of factors, from human psychology and technological innovation to government policies and global events.

Key characteristics of economic cycles:

- Recurring: They happen repeatedly, though not at fixed intervals.

- Irregular: The length and intensity of each phase can vary significantly.

- Interconnected: What happens in one major economy can often ripple across the globe.

The Four Stages of the Economic Cycle (Boom and Bust Explained)

While the terminology can vary slightly, most economists agree on four main stages that make up a complete economic cycle. Let’s break them down, connecting them to the "boom" and "bust" concepts.

1. Expansion (The "Boom" Begins)

This is the good news phase! An expansion is a period of sustained economic growth. It’s when the economy is humming along, and things generally feel good.

- Characteristics:

- Rising Employment: More jobs are created, and unemployment rates fall.

- Increased Production: Businesses produce more goods and services to meet growing demand.

- Growing Consumer Spending: People have more money and confidence, so they spend more on everything from cars to vacations.

- Higher Business Profits: Companies see their revenues and profits increase.

- Rising Stock Markets: Investor confidence is high, leading to upward trends in stock prices.

- Generally Optimistic Mood: There’s a feeling of prosperity and opportunity.

2. Peak (The Height of the "Boom")

The peak is the highest point of economic activity in a cycle. It’s the moment when growth reaches its maximum, and the economy can’t expand much further without creating problems.

- Characteristics:

- Overheated Economy: Demand might start to outstrip supply, leading to inflation.

- Inflationary Pressures: Prices for goods and services begin to rise rapidly.

- Labor Shortages: Businesses struggle to find enough skilled workers, potentially driving up wages unsustainably.

- Asset Bubbles: Prices of assets like real estate or stocks might become artificially inflated, not reflecting their true value.

- Interest Rate Hikes: Central banks might raise interest rates to cool down the economy and control inflation.

3. Contraction (The "Bust" Begins – Recession)

A contraction is a period of economic decline. If this decline is significant and lasts for at least two consecutive quarters (six months), it’s officially called a recession. This is where the "bust" really takes hold.

- Characteristics:

- Falling Employment: Businesses lay off workers, and unemployment rises.

- Decreased Production: Factories produce less as demand falls.

- Reduced Consumer Spending: People become more cautious, saving money and cutting back on non-essential purchases.

- Lower Business Profits: Companies face declining sales and profits, sometimes leading to bankruptcies.

- Falling Stock Markets: Investor confidence plummets, and stock prices decline.

- Pessimistic Mood: Uncertainty and fear about the future become common.

- Deflationary Pressures (sometimes): In severe or prolonged contractions, prices might even start to fall (deflation), which can also be harmful to the economy.

4. Trough (The Bottom of the "Bust")

The trough is the lowest point of economic activity in a cycle. It’s the rock bottom before the economy starts to recover.

- Characteristics:

- Highest Unemployment: Job losses are at their peak.

- Lowest Production: Economic output is at its minimum.

- Very Low Consumer and Business Confidence: People and companies are highly uncertain about the future.

- Cheap Assets: Stock prices and other asset values are often at their lowest, potentially offering opportunities for long-term investors.

- Government Intervention: Governments and central banks often implement policies (like lowering interest rates or increasing spending) to stimulate the economy out of the trough.

5. Recovery (Emerging from the "Bust")

While sometimes grouped with the early stages of expansion, recovery is a distinct phase where the economy slowly but surely begins to rebound from the trough.

- Characteristics:

- Slow Growth: Economic activity begins to pick up, but cautiously.

- Stabilizing Employment: Job losses slow down, and some hiring might begin.

- Renewed Confidence: A glimmer of optimism returns among consumers and businesses.

- Increased Investment: Businesses start investing again, albeit carefully.

- Government Stimulus: The effects of policies designed to kickstart the economy begin to be felt.

What Drives These Cycles? The Underlying Causes

Economic cycles aren’t random; they’re the result of a complex interplay of forces. Here are some of the major drivers:

1. Supply and Demand Dynamics

This is fundamental economics. When demand for goods and services outstrips supply, prices rise (inflation), and businesses expand. If supply then exceeds demand, prices fall, and businesses contract. This constant adjustment creates fluctuations.

2. Interest Rates and Monetary Policy

- Who controls it? Central banks (like the Federal Reserve in the U.S. or the European Central Bank).

- How it works: Central banks adjust interest rates.

- Lower rates: Make it cheaper to borrow money, encouraging spending and investment (stimulates expansion).

- Higher rates: Make borrowing more expensive, discouraging spending and investment (slows down expansion, can trigger contraction).

- Impact: This is one of the most powerful tools for managing the cycle.

3. Consumer and Business Confidence

- The "Animal Spirits": Economist John Maynard Keynes famously spoke of "animal spirits" – the human emotions and instincts that drive economic behavior.

- Confidence is Key:

- High confidence: Consumers spend, businesses invest and hire.

- Low confidence: Consumers save, businesses cut back and lay off.

- Self-fulfilling prophecy: If enough people believe the economy will improve, their actions can help make it happen. The same is true for a downturn.

4. Investment and Innovation

- New Technologies: Breakthroughs (like the internet or AI) can spur massive investment, job creation, and economic growth for years.

- Investment Cycles: Businesses invest in new factories, equipment, and research. Periods of high investment drive expansion, while periods of low investment contribute to contraction.

5. Government Spending and Fiscal Policy

- Who controls it? Governments.

- How it works: Governments use taxation and spending to influence the economy.

- Increased spending (e.g., infrastructure projects): Can boost demand and create jobs during a contraction.

- Tax cuts: Can encourage spending and investment.

- Austerity (reduced spending, higher taxes): Can slow down an overheated economy.

6. External Shocks

These are unpredictable events that can dramatically shift the economic cycle.

- Examples:

- Natural Disasters: Hurricanes, earthquakes, or pandemics (like COVID-19).

- Wars and Geopolitical Events: Conflict can disrupt trade, supply chains, and confidence.

- Sudden Price Spikes: A sharp rise in oil prices, for instance.

7. Global Interconnectedness

In today’s world, economies are highly linked. A recession in one major country can easily spread to others through:

- Trade: Less demand for exports from other countries.

- Investment: Investors pulling money out of foreign markets.

- Supply Chains: Disruptions in one country affecting production in others.

The Real-World Impact: How Economic Cycles Affect You

Understanding economic cycles isn’t just an academic exercise; it has tangible impacts on your daily life and financial well-being.

1. Jobs and Employment

- Boom: Easier to find jobs, higher wages, more career opportunities.

- Bust: Job scarcity, layoffs, difficulty finding work, wage stagnation.

2. Prices and Inflation

- Boom: Prices tend to rise (inflation) as demand is high and resources become scarce. Your purchasing power might decrease if wages don’t keep up.

- Bust: Price increases slow down, or prices might even fall (deflation), which can sound good but can signal a deeper economic problem.

3. Investments and Savings

- Boom: Stock markets generally perform well, real estate prices may rise, and interest rates on savings might increase.

- Bust: Stock markets often decline, real estate values may drop, and interest rates on savings might fall. It can be a scary time for investors, but also a time when assets become "cheaper" for long-term buying.

4. Business Opportunities

- Boom: Easier to start and grow a business, access to capital is better, consumers are spending.

- Bust: More challenging to start a business, higher risk of failure, consumers are more cautious. However, downturns can also spur innovation and create opportunities for agile businesses.

5. Government Services and Taxes

- Boom: Higher tax revenues for governments (from more jobs and profits), allowing for increased public spending or debt reduction.

- Bust: Lower tax revenues, higher demand for social safety nets (unemployment benefits), potentially leading to increased government debt or cuts in services.

Navigating the Waves: Strategies for Individuals and Businesses

While you can’t stop the economic cycles, you can prepare for them.

For Individuals:

- Build an Emergency Fund: Save 3-6 months (or more) of living expenses. This is your buffer during a downturn.

- Manage Debt Wisely: Pay down high-interest debt, especially during expansion, so you’re less vulnerable during a bust.

- Invest for the Long Term: Don’t panic sell during a downturn. History shows that markets recover. Diversify your investments across different asset classes.

- Invest in Your Skills: Continuously learn and adapt. Skills that are in demand even during recessions (e.g., healthcare, tech) can offer more job security.

- Live Below Your Means: Save more during the good times to weather the bad.

For Businesses:

- Maintain Cash Reserves: Have enough cash to cover expenses for several months, even if sales decline.

- Diversify Revenue Streams: Don’t put all your eggs in one basket. If one market segment struggles, others might still thrive.

- Be Flexible and Adaptable: Be ready to pivot your business model, products, or services in response to changing economic conditions.

- Control Costs: Keep a close eye on expenses, especially during expansion, to avoid overspending.

- Invest Strategically: Consider counter-cyclical investments. Sometimes, a downturn is the best time to acquire assets or invest in R&D when competitors are pulling back.

For Governments and Central Banks:

- Monetary Policy (Central Banks):

- During Contraction: Lower interest rates, quantitative easing (injecting money into the economy) to encourage borrowing and spending.

- During Expansion: Raise interest rates to cool down inflation and prevent overheating.

- Fiscal Policy (Governments):

- During Contraction: Increase government spending (infrastructure, social programs), cut taxes to stimulate demand.

- During Expansion: Reduce spending, raise taxes (or avoid cuts) to pay down debt and prevent overheating.

Conclusion: Understanding is Your Superpower

Global economic cycles of boom and bust are a fundamental part of how our world works. They are natural, inevitable, and have been occurring for centuries. While the specific causes and impacts can vary, the underlying pattern remains.

By understanding the four stages – Expansion, Peak, Contraction, and Trough – and the key drivers behind them, you gain valuable insights that can help you make more informed decisions. You learn to appreciate the good times without being complacent, and to prepare for the challenging times without succumbing to panic.

The economy will always have its ups and downs. Your superpower isn’t stopping the waves; it’s learning how to surf them. By staying informed, being financially prepared, and adapting to change, you can navigate the global economic cycles with greater confidence and resilience.

Post Comment