Understanding Enterprise Value vs. Equity Value: A Beginner’s Guide to Company Valuation

Ever wondered how financial analysts, investors, and business owners figure out what a company is truly worth? It’s not as simple as looking at its stock price. While the stock price gives us a clue about the Equity Value, there’s another, often more comprehensive, metric called Enterprise Value that tells a different, crucial story.

For beginners, the distinction between these two can be a major source of confusion. But don’t worry! This article will break down Enterprise Value and Equity Value into simple, easy-to-understand concepts, complete with analogies, so you can confidently grasp the true worth of a business.

Why Do We Value Companies? The Big Picture

Before diving into the specifics, let’s understand why we even bother with valuation. Knowing a company’s worth is essential for:

- Investing Decisions: Should I buy, sell, or hold shares in this company?

- Mergers & Acquisitions (M&A): How much should one company pay to acquire another?

- Fundraising: How much equity should a startup give away for a certain investment?

- Strategic Planning: Understanding a company’s value helps management make better long-term decisions.

- Lending: Banks need to assess a company’s value before extending loans.

In essence, valuation helps us make informed financial decisions by attaching a monetary figure to a business.

1. Equity Value: The Shareholder’s Slice of the Pie

Let’s start with the more intuitive of the two: Equity Value.

What is Equity Value?

Equity Value represents the total value of a company that is attributable only to its shareholders. Think of it as the price you’d pay to own all of the common stock of a company, assuming no other claims existed.

It’s the value of the company’s net assets after all liabilities (like debt) have been paid off.

How is Equity Value Calculated? (The Public Company Way)

For publicly traded companies, Equity Value is most commonly known as Market Capitalization (or "Market Cap").

- Equity Value (Market Cap) = Current Share Price × Total Number of Outstanding Shares

Example:

If Company A’s stock trades at $50 per share and it has 10 million shares outstanding, its Equity Value (Market Cap) is:

$50/share × 10,000,000 shares = $500,000,000

What Does Equity Value Represent?

- Shareholder Perspective: It’s the value that belongs directly to the common shareholders.

- Residual Claim: Shareholders are at the bottom of the "payment totem pole." They only get paid after all other obligations (debt, preferred stock, etc.) are satisfied. Equity Value reflects this residual claim.

- Stock Market Focus: This is the metric most commonly discussed when tracking a public company’s performance on the stock market.

When is Equity Value Used?

- Individual Stock Investors: When you buy a stock, you’re buying a piece of the company’s equity.

- IPO Valuations: When a private company goes public, its initial market capitalization is its initial Equity Value.

- Comparing Public Companies: Often used for quick comparisons between companies in the same industry.

Analogy: Imagine a delicious, whole pizza. Equity Value is like the slices of pizza that belong only to the common customers who bought a piece. If the restaurant sells all its slices, the total money it gets for those slices is its Equity Value.

2. Enterprise Value: The Whole Business (Debt and All)

Now, let’s move to Enterprise Value, which offers a more holistic view.

What is Enterprise Value?

Enterprise Value (EV) represents the total value of a company’s core operating business, free from its capital structure (meaning, it doesn’t matter how the company is financed – whether through debt or equity).

Think of it as the theoretical price you would pay to buy out an entire company, including assuming its debt, but also taking into account any cash it has on hand. It’s the value of the assets that generate revenue, regardless of who financed them.

Why is Enterprise Value Different from Equity Value?

The key difference lies in what each metric includes.

- Equity Value focuses only on what common shareholders own.

- Enterprise Value considers all sources of capital – both equity and debt – that fund the company’s operations.

Analogy: If Equity Value was the slices of pizza, Enterprise Value is the value of the entire pizza parlor itself. This includes the oven, the ingredients, the staff, the brand – everything needed to make the pizza, plus any loans the parlor has taken out, but minus any cash it has in the till.

How is Enterprise Value Calculated? (The Formula)

The most common formula for Enterprise Value is:

Enterprise Value (EV) = Market Capitalization (Equity Value) + Total Debt + Preferred Stock + Minority Interest – Cash & Cash Equivalents

Let’s break down each component:

-

Market Capitalization (Equity Value):

- This is our starting point, as calculated above (Share Price × Shares Outstanding). It accounts for the value attributable to common shareholders.

-

+ Total Debt:

- Why add it? If you acquire a company, you’re not just buying its equity; you’re also taking on its existing debt. The debt represents a claim on the company’s assets and future cash flows. To truly own the entire business, you’d be responsible for paying back that debt.

- Includes: Short-term debt, long-term debt, and capital leases.

-

+ Preferred Stock:

- Why add it? Preferred stock is a hybrid security that has characteristics of both debt and equity. Like debt, preferred stockholders usually receive fixed dividend payments and have a claim on assets before common shareholders in case of liquidation. Because it represents a claim on the company’s assets that isn’t included in common equity, it’s added back.

-

+ Minority Interest (Non-Controlling Interest):

- Why add it? If a company owns more than 50% but less than 100% of another subsidiary, the value of the portion it doesn’t own is called minority interest. When you calculate EV for the parent company, you’re looking at the value of the entire consolidated business, including the parts owned by minority shareholders. Therefore, you add back the value of these minority stakes to get the full picture of the operating assets.

-

– Cash & Cash Equivalents:

- Why subtract it? Cash is a non-operating asset. If you acquire a company, any cash on its balance sheet effectively reduces the amount you have to pay, as you can immediately use that cash to pay down debt or fund operations. It’s like buying a house and finding a pile of cash waiting for you inside – it reduces your net cost.

- Includes: Cash, marketable securities, and short-term investments that can be quickly converted to cash.

Example Revisited (Company A):

Let’s continue with Company A, which has an Equity Value of $500,000,000.

-

Assume Company A also has:

- Total Debt: $150,000,000

- Preferred Stock: $20,000,000

- Minority Interest: $5,000,000

- Cash & Cash Equivalents: $30,000,000

-

Enterprise Value (EV) = $500,000,000 (Equity Value) + $150,000,000 (Debt) + $20,000,000 (Preferred Stock) + $5,000,000 (Minority Interest) – $30,000,000 (Cash)

-

EV = $645,000,000

Notice that Company A’s Enterprise Value ($645M) is higher than its Equity Value ($500M). This is typical, as most companies have debt.

What Does Enterprise Value Represent?

- Value to All Capital Providers: It’s the value of the business to all its capital providers – both shareholders and debt holders.

- Acquisition Price: It’s often considered the theoretical "takeover price" of a company, as it includes the debt the acquirer would inherit.

- Operating Business Focus: It gives a cleaner picture of the value of the company’s core operations, removing the influence of how it’s financed.

When is Enterprise Value Used?

- Mergers & Acquisitions (M&A): This is the primary metric used in M&A deals because an acquiring company typically buys the entire business, including its debt.

- Comparable Company Analysis (Comps): When comparing companies, EV is preferred because it neutralizes differences in capital structure. A company with a lot of debt might have a lower Equity Value but a similar EV to a peer with less debt but more equity.

- Discounted Cash Flow (DCF) Analysis: EV is the output of a DCF model, as DCF values the entire operating cash flows of a business before debt payments.

- Valuation Multiples: Ratios like EV/EBITDA or EV/Sales are commonly used to compare companies across industries, as they are less affected by differing debt levels.

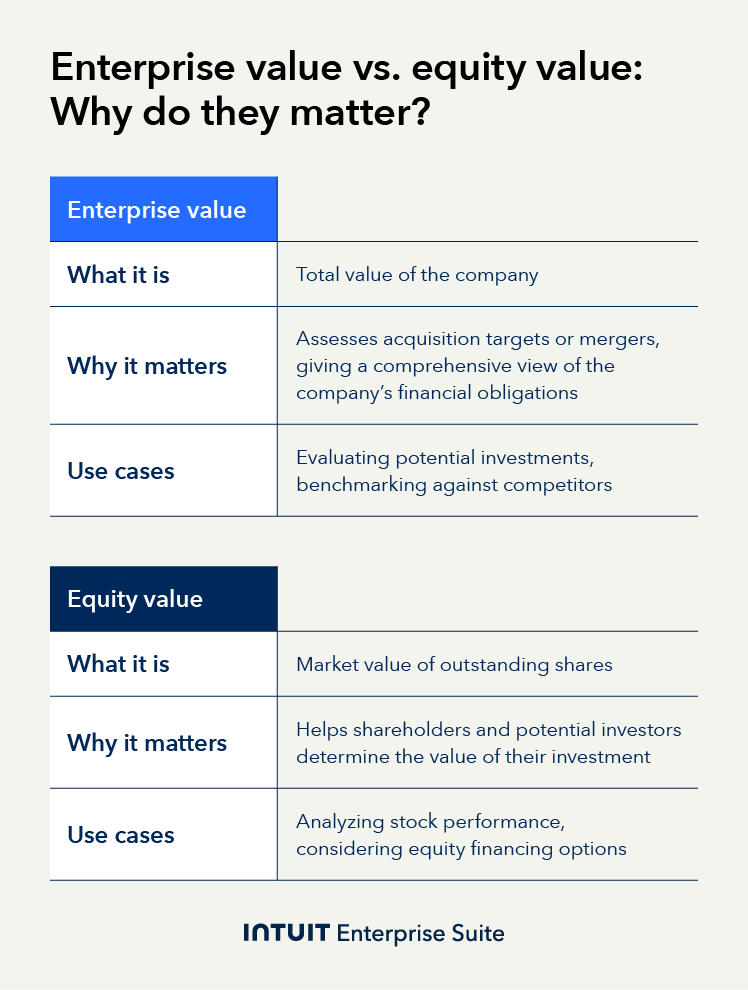

Key Differences Summarized: Equity Value vs. Enterprise Value

Here’s a quick comparison to solidify your understanding:

| Feature | Equity Value (Market Capitalization) | Enterprise Value |

|---|---|---|

| What it Represents | Value attributable to common shareholders | Value of the entire operating business to all capital providers |

| Perspective | Common shareholders | All investors (shareholders, debt holders, preferred holders) |

| Formula | Share Price × Shares Outstanding | Equity Value + Total Debt + Preferred Stock + Minority Interest – Cash |

| Includes Debt? | No (implicitly, debt reduces the value left for equity) | Yes (explicitly added) |

| Includes Cash? | Yes (implicitly, cash increases the value of equity) | No (explicitly subtracted) |

| Primary Use | Public market trading, shareholder returns, quick public comparisons | M&A, comprehensive valuation, comparable company analysis (Comps), DCF |

| Analogy | A slice of pizza (what common customers own) | The whole pizza parlor (the entire operating business) |

Why Do These Differences Matter? Practical Applications

Understanding the difference isn’t just academic; it has significant real-world implications:

-

"Apples-to-Apples" Comparisons:

- Imagine you’re comparing two companies in the same industry. Company A has $100M in debt, while Company B has no debt. If you only look at their Market Cap (Equity Value), Company A might appear "cheaper." However, Enterprise Value neutralizes the effect of debt. By using EV/EBITDA (a common valuation multiple), you can get a truer comparison of their operating performance relative to their total value.

-

Acquisition Price:

- If you’re a company looking to acquire another, you don’t just buy its shares. You also take on its existing financial obligations. Therefore, Enterprise Value is the more relevant metric for determining the total cost of a takeover. It’s the "real" price tag for the entire business.

-

Capital Structure Neutrality:

- EV allows analysts to value a company’s operations independent of its financing decisions. Whether a company chooses to finance itself heavily with debt or equity, its core operating value (EV) should remain relatively consistent. This is crucial for models like Discounted Cash Flow (DCF) where you’re valuing the unlevered free cash flows of the business.

Common Pitfalls and Misconceptions for Beginners

- Confusing Market Cap with EV: They are not the same. Market Cap is a component of EV, but not the whole picture.

- Assuming EV is Always Higher: While EV is typically higher than Equity Value due to the inclusion of debt, it’s not always the case. If a company has a massive amount of cash on its balance sheet and very little debt, its Enterprise Value could theoretically be lower than its Equity Value.

- Ignoring Non-Operating Assets/Liabilities: EV focuses on the operating business. Assets like excess cash or non-operating liabilities need to be adjusted for.

- Using the Wrong Metric: Using Equity Value for an M&A deal or Enterprise Value for individual stock trading can lead to incorrect conclusions. Always consider the context of your analysis.

Conclusion

Understanding the distinction between Enterprise Value and Equity Value is a fundamental step in mastering company valuation.

- Equity Value gives you the shareholder’s perspective – what the common stock is worth.

- Enterprise Value provides a more comprehensive view, representing the total value of the operating business to all its capital providers, making it the preferred metric for M&A and comparable company analysis.

By grasping these two powerful metrics, you’re well on your way to making more informed financial decisions and truly understanding what a company is worth. Keep practicing, and these concepts will become second nature!

Post Comment