Understanding Deposit Insurance Schemes: Your Essential Guide to Protecting Your Hard-Earned Savings

Saving money is a fundamental step towards financial security. Whether you’re putting aside funds for a down payment, retirement, or just a rainy day, you want to be sure your hard-earned cash is safe. But what happens if the bank where you keep your money runs into trouble? This is where deposit insurance schemes come into play – a vital safety net designed to protect your deposits and maintain public confidence in the financial system.

For many, the concept of deposit insurance might seem abstract, or perhaps you’ve only heard of the FDIC in the United States. However, these schemes are a global standard, offering peace of mind to millions of savers worldwide. This comprehensive guide will break down everything you need to know about deposit insurance, explaining it in simple terms so you can understand how your money is protected.

What Exactly Is Deposit Insurance?

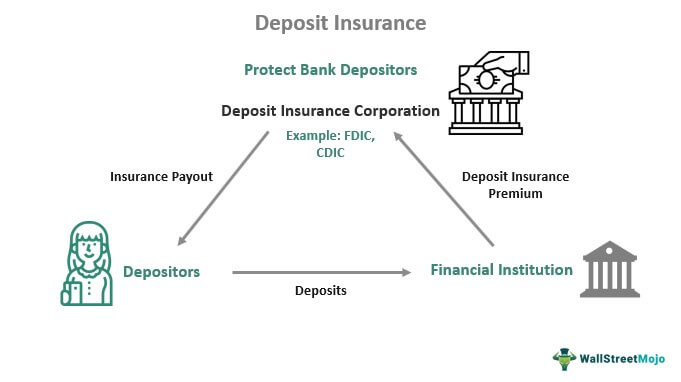

At its core, deposit insurance is a system that guarantees the safety of your money deposited in banks and other financial institutions, up to a certain limit, even if that institution fails. Think of it like an insurance policy for your bank account. If your bank were to go out of business, the deposit insurance agency would step in to ensure you get your covered money back.

These schemes are typically administered by independent government agencies or state-backed corporations. Their primary goal is to:

- Protect depositors: Ensure that individuals and businesses don’t lose their savings due to bank insolvency.

- Maintain financial stability: Prevent widespread panic and "bank runs" (where many customers withdraw their money simultaneously, leading to collapse) by reassuring the public their money is safe.

- Foster public confidence: Encourage people to save and use the banking system, knowing their funds are secure.

Why Do We Need Deposit Insurance? The Lessons of History

The concept of deposit insurance wasn’t always a given. Its widespread adoption came largely out of the painful lessons learned during periods of severe financial instability, most notably the Great Depression in the 1930s.

Before deposit insurance, if a bank failed, depositors often lost everything. This created a climate of fear. Rumors, even unfounded ones, could lead to a bank run. Imagine hundreds or thousands of people rushing to withdraw their money simultaneously. Even a healthy bank could be overwhelmed, as banks operate on a "fractional reserve" system, meaning they don’t keep all deposited money in their vaults; they lend much of it out.

The panic caused by these failures cascaded throughout the economy, leading to a loss of trust, economic stagnation, and widespread hardship. In the United States, the Federal Deposit Insurance Corporation (FDIC) was created in 1933 precisely to stop this cycle. Its success quickly demonstrated the power of deposit insurance to stabilize the financial system and restore public trust. Today, similar schemes exist in over 100 countries.

How Does Deposit Insurance Work? The Mechanics Explained

Understanding the mechanics of deposit insurance can demystify the process and highlight its effectiveness.

1. Who is Covered? (And What Types of Accounts?)

Deposit insurance schemes typically cover common types of deposit accounts held at insured financial institutions. While the exact list can vary by country, generally, these include:

- Checking Accounts (Demand Deposit Accounts)

- Savings Accounts

- Money Market Deposit Accounts (MMDAs)

- Certificates of Deposit (CDs)

- Official Checks (e.g., cashier’s checks, money orders issued by the bank)

It’s crucial to remember that deposit insurance covers deposits made at banks. It does not cover investment products that are not bank deposits. We’ll explore this common misconception in more detail later.

2. What is the Coverage Limit? (And How is it Applied?)

This is one of the most important aspects to understand. Every deposit insurance scheme has a coverage limit – the maximum amount of money it will protect per depositor, per insured institution.

-

Per Depositor, Per Insured Institution: The most common structure is that the coverage limit applies to the total of all your deposits at a single insured bank. For example, if the limit is $250,000 and you have $150,000 in a checking account and $100,000 in a savings account at the same bank, your total $250,000 is covered. If you have $300,000 at that same bank, only $250,000 would be covered.

-

Different Ownership Categories: Most schemes offer ways to increase your coverage beyond the standard limit if you have more money to deposit. This is typically done by holding accounts in different "ownership categories." Examples include:

- Single Accounts: Owned by one person.

- Joint Accounts: Owned by two or more people. Each co-owner’s share is separately insured up to the limit. For example, two people with a joint account might have coverage up to twice the standard limit.

- Retirement Accounts: Such as IRAs or 401(k)s, which are often insured separately from other individual accounts.

- Revocable Trust Accounts: Where funds are held in trust for beneficiaries.

It’s important to note that simply having multiple accounts of the same ownership type at the same bank will not increase your coverage beyond the per-institution limit. For example, having two individual savings accounts at the same bank won’t double your coverage.

Always check with your specific deposit insurance agency or bank for detailed rules on ownership categories and how to maximize your coverage.

3. Who Pays for Deposit Insurance?

This is another common question. The funds for deposit insurance typically come from premiums paid by the member banks themselves. Insured banks pay a fee (often based on their assets or deposit levels) into a central fund managed by the deposit insurance agency.

This means that, in most cases, deposit insurance is not funded by taxpayer money directly. It’s a self-sustaining system where the financial industry contributes to its own stability and the protection of its customers. In rare, extreme circumstances, governments might provide a backstop, but the primary funding mechanism is industry-driven.

4. What Happens if a Bank Fails?

While rare, bank failures do happen. If an insured bank fails, the deposit insurance agency steps in quickly. The process is designed to be as smooth and seamless as possible for depositors:

- Closure and Control: The regulatory authority (e.g., the state banking department or federal regulator) will close the bank and appoint the deposit insurance agency as the receiver.

- Access to Funds: The agency then works to ensure depositors have swift access to their insured funds. This can happen in a few ways:

- Purchase and Assumption: Most commonly, another healthy bank will purchase the failed bank’s assets and assume its deposits. In this scenario, your accounts are simply transferred to the new bank, and you might not even notice a disruption, beyond potentially new account numbers or branding.

- Direct Payout: If no suitable buyer is found, the agency will directly pay out insured deposits to customers, typically within a few business days. This is usually done by mailing checks or directly depositing funds into new accounts at other banks.

- No Action Required from Depositors (Usually): You typically don’t need to file a claim or do anything proactively to get your insured money back. The agency handles the process automatically based on the bank’s records.

The Unmistakable Benefits of Deposit Insurance

The existence of robust deposit insurance schemes provides a multitude of benefits, not just for individual savers, but for the entire economy:

- Peace of Mind for Savers: Knowing your money is protected up to a significant limit allows you to save and invest without constant worry about your bank’s stability. You can "sleep soundly" knowing your hard work is secure.

- Prevention of Bank Runs: By guaranteeing deposits, these schemes remove the incentive for panicking customers to withdraw their money en masse, thereby preventing widespread financial instability.

- Enhanced Financial Stability: They act as a critical shock absorber during times of economic stress, preventing isolated bank failures from spiraling into systemic crises that could threaten the entire financial system.

- Increased Trust in the Banking System: When people trust banks, they are more likely to deposit their money, which banks can then lend out to businesses and individuals, stimulating economic growth.

- Protection for Small Businesses: Many small businesses rely on their bank accounts for day-to-day operations. Deposit insurance ensures their operational funds are safe, allowing them to continue functioning even if their bank fails.

Important Clarifications and Common Misconceptions

Despite their critical role, deposit insurance schemes are often misunderstood. Here are some key clarifications:

-

Not Everything is Covered: This is perhaps the most crucial point. Deposit insurance covers deposits in insured banks. It does NOT cover investment products, even if they are purchased through a bank or its brokerage arm. This includes:

- Stocks

- Bonds (corporate or government)

- Mutual Funds

- Annuities

- Life Insurance Policies

- Cryptocurrencies

- Safe Deposit Box Contents (These are your personal property, not deposits)

These investment products carry their own risks and may be protected by different types of investor protection schemes (e.g., SIPC in the US for brokerage accounts), but they are not covered by deposit insurance. Always understand what you are buying and what protections apply.

-

It’s Not the Government’s Direct Money (Typically): While often government-backed or administered, the funds come from the banks themselves, not directly from general tax revenue, as explained earlier. This distinction is important for understanding the self-sustaining nature of the system.

-

It’s Not Just for Big Banks: Deposit insurance covers all eligible deposits at all insured institutions, regardless of their size. Whether you bank with a large national chain or a small local credit union, your covered deposits are equally protected, provided the institution is a member of the scheme.

-

Credit Unions Have Their Own Schemes: In many countries, credit unions (member-owned financial cooperatives) have their own separate, but similar, deposit insurance schemes. For example, in the US, the National Credit Union Administration (NCUA) provides deposit insurance for federal credit unions.

A Global Perspective: Deposit Insurance Around the World

While the principles are similar, the names and specifics of deposit insurance schemes vary by country. Here are a few prominent examples:

- United States: Federal Deposit Insurance Corporation (FDIC) – Insures deposits up to $250,000 per depositor, per insured bank, for each ownership category.

- Canada: Canada Deposit Insurance Corporation (CDIC) – Insures eligible deposits up to $100,000 per depositor, per member institution, in each of the insured categories.

- United Kingdom: Financial Services Compensation Scheme (FSCS) – Protects deposits up to £85,000 per eligible person, per authorized firm.

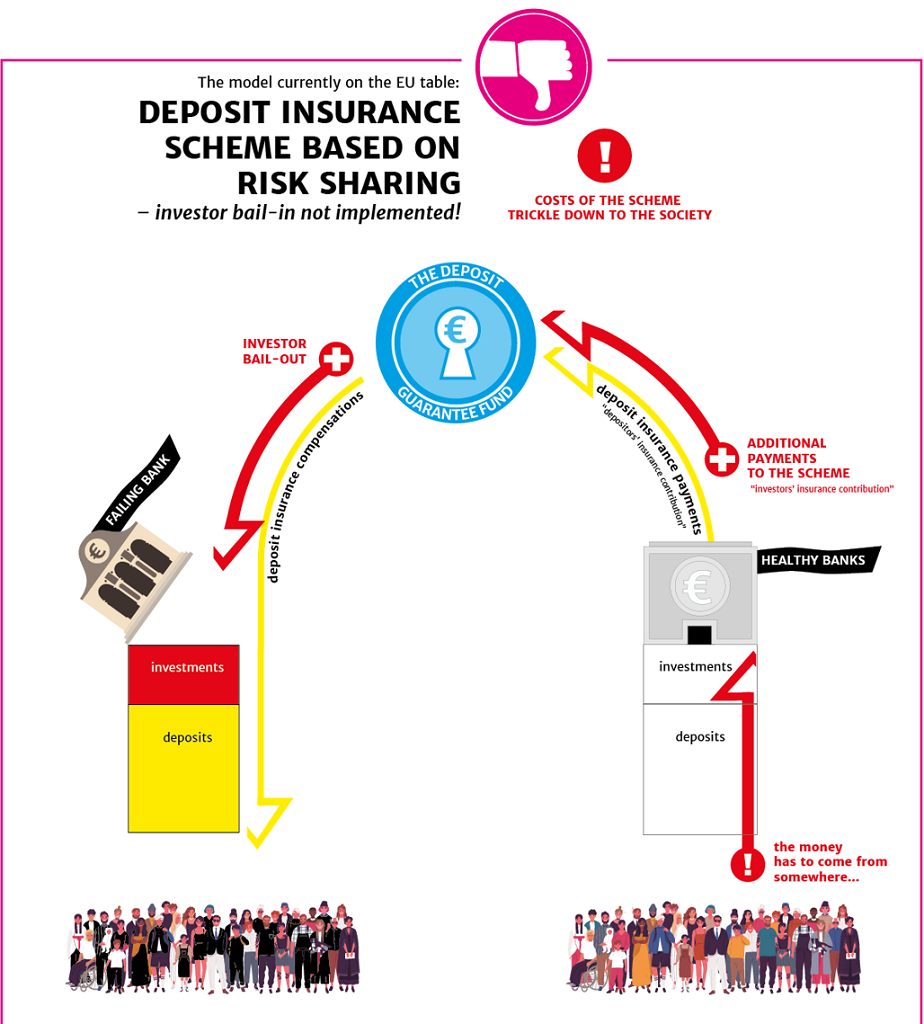

- European Union: Member states of the EU are required to have Deposit Guarantee Schemes (DGS), which typically guarantee deposits up to €100,000 per depositor, per bank.

- Australia: Financial Claims Scheme (FCS) – Protects deposits up to $250,000 per account holder, per authorized deposit-taking institution.

- India: Deposit Insurance and Credit Guarantee Corporation (DICGC) – Insures deposits up to ₹5 lakh (500,000 rupees) per depositor, per bank.

This global presence underscores the recognized importance of deposit insurance as a cornerstone of modern financial stability.

How to Check Your Coverage and Stay Informed

Understanding deposit insurance isn’t just theoretical; it’s practical. Here’s how you can ensure your money is protected:

- Look for the Official Insignia: Insured banks are legally required to display the official insignia of their deposit insurance agency prominently, usually at their branches, ATMs, and on their websites. This is your first clue.

- Verify Institution Status: Visit the official website of your country’s deposit insurance agency. They typically have a "BankFind" or "Insured Institutions" tool where you can search for your bank by name and confirm its insured status.

- Understand Your Accounts: Familiarize yourself with the types of accounts you hold and how they are titled. If you have significant savings, consider how the "per depositor, per institution, per ownership category" rule applies to you.

- Ask Your Bank: Don’t hesitate to ask your bank representatives about their deposit insurance coverage. They should be able to provide clear information and guidance.

- Review the Agency’s Website: The official websites of deposit insurance agencies are excellent resources, providing detailed guides, FAQs, and calculators to help you understand your coverage.

Conclusion

Deposit insurance schemes are unsung heroes of the financial world. They provide an invisible yet incredibly powerful layer of protection for your hard-earned savings, acting as a crucial safeguard against the rare but devastating event of a bank failure. By understanding what deposit insurance is, why it exists, how it works, and what it covers (and doesn’t cover), you empower yourself with knowledge that leads to greater financial security and peace of mind.

So, the next time you deposit money into your bank account, remember that behind the scenes, a robust system is working to ensure your financial future remains secure. Take a few moments to verify your bank’s insured status and understand your coverage – it’s a simple step that offers invaluable protection.

Post Comment