Understanding Capital Gains and Losses: A Beginner’s Guide to Smart Investing and Tax Planning

Investing can be an exciting journey toward financial growth. Whether you’re dabbling in stocks, considering real estate, or investing in mutual funds, one crucial concept you’ll encounter is capital gains and losses. While these terms might sound complex, understanding them is fundamental to managing your investments effectively and optimizing your tax strategy.

This comprehensive guide will break down capital gains and losses into easy-to-understand concepts, helping you navigate the tax implications of your investment decisions.

What Are Capital Gains and Losses? The Basics

At its simplest, a capital gain or loss occurs when you sell an asset for a price different from what you paid for it.

- Capital Gain: You have a capital gain when you sell an asset for more than its original cost (or "basis"). It’s the profit you make from the sale.

- Example: You buy a share of XYZ stock for $50 and later sell it for $70. You have a capital gain of $20 per share.

- Capital Loss: You incur a capital loss when you sell an asset for less than its original cost. It’s the loss you experience from the sale.

- Example: You buy a share of ABC stock for $100 and later sell it for $80. You have a capital loss of $20 per share.

Key Distinction: Realized vs. Unrealized

It’s important to note that capital gains and losses are only "realized" (meaning they become actual profits or losses that are taxable) when you sell the asset. If your stock goes up in value but you haven’t sold it yet, you have an "unrealized" gain. It’s just on paper until you hit the "sell" button.

What Kinds of Assets Are Subject to Capital Gains/Losses?

The term "capital asset" is quite broad and includes most personal property you own and use for investment or personal pleasure. Common examples include:

- Stocks and Bonds: The most common assets associated with capital gains and losses.

- Mutual Funds and Exchange-Traded Funds (ETFs): When you sell shares in these funds, or when the fund distributes capital gains to you.

- Real Estate: This includes your primary home (though special exclusions apply, discussed later), rental properties, and land.

- Collectibles: Items like art, antiques, coins, stamps, and even rare baseball cards.

- Cryptocurrency: Digital assets like Bitcoin and Ethereum are generally treated as property for tax purposes.

- Other Personal Property: This can sometimes include things like valuable jewelry or a boat, depending on how they are used.

The Crucial Concept of "Basis"

To calculate your capital gain or loss, you first need to understand your basis in the asset. Think of basis as your starting point – it’s generally what you paid for the asset, plus any costs associated with acquiring it, and minus any depreciation.

Calculating Gain or Loss:

Selling Price – Adjusted Basis = Capital Gain or Loss

Let’s break down "adjusted basis":

- Original Cost: The price you initially paid for the asset.

- Additions: Costs that increase your basis:

- Commissions and fees paid when buying the asset.

- Costs of improvements (e.g., adding a new room to a house, major renovations).

- Legal fees and other expenses related to acquiring the asset.

- Subtractions: Costs that decrease your basis:

- Depreciation (for rental properties or business assets).

- Any return of capital distributions (for stocks or funds).

Example:

You bought a rental property for $200,000. You paid $5,000 in closing costs. Over the years, you made $30,000 in improvements and claimed $20,000 in depreciation.

- Original Cost: $200,000

- Additions (Closing Costs + Improvements): $5,000 + $30,000 = $35,000

- Subtractions (Depreciation): $20,000

- Adjusted Basis: $200,000 + $35,000 – $20,000 = $215,000

If you then sell the property for $300,000, your capital gain would be $300,000 – $215,000 = $85,000.

Short-Term vs. Long-Term Capital Gains and Losses: Why Timing Matters

This is one of the most critical distinctions in capital gains taxation, as it directly impacts your tax bill. The difference hinges on how long you owned the asset before selling it.

- Short-Term Capital Gains/Losses: These apply to assets you owned for one year or less (365 days or less) before selling.

- Long-Term Capital Gains/Losses: These apply to assets you owned for more than one year (366 days or more) before selling.

Why does this matter? Taxes! The U.S. tax system generally favors long-term investing by taxing long-term capital gains at lower rates than short-term gains.

How Capital Gains Are Taxed

The tax rates for capital gains depend on whether they are short-term or long-term, and your overall taxable income.

1. Short-Term Capital Gains Tax

- Taxed as Ordinary Income: Short-term capital gains are taxed at your regular income tax rates. This means they are added to your wages, salaries, and other income, and taxed according to your income tax bracket.

- Rates: These can range from 10% to 37% (as of current tax laws), depending on your total income.

2. Long-Term Capital Gains Tax

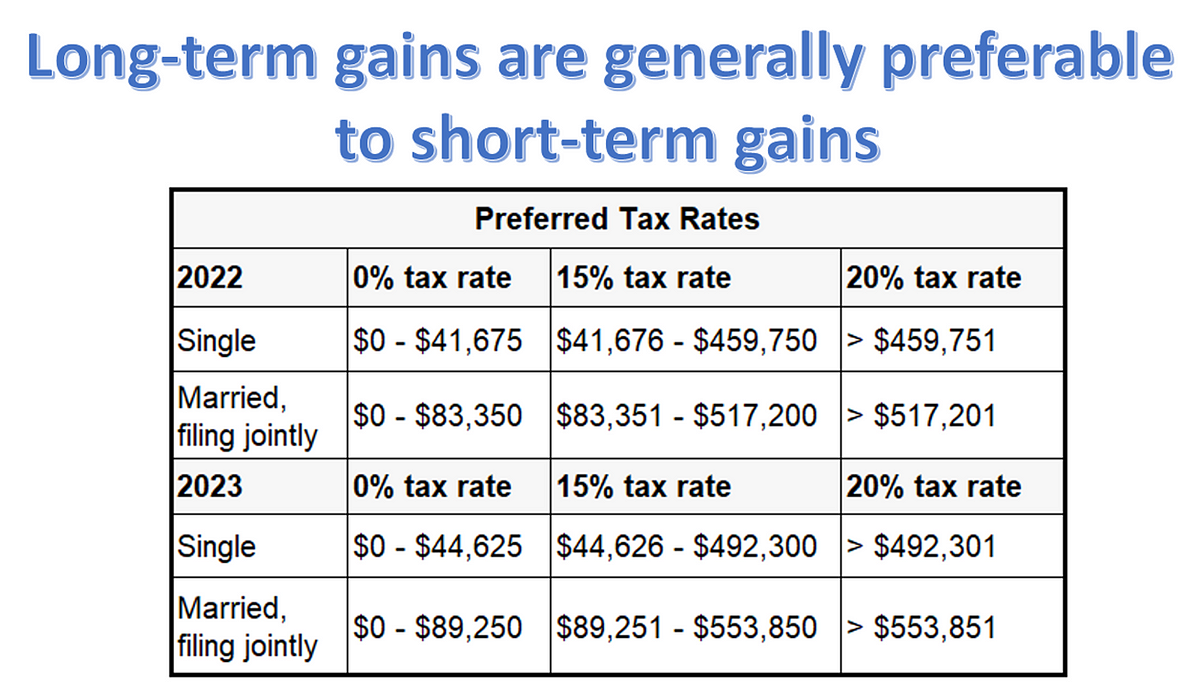

- Preferential Rates: Long-term capital gains enjoy lower, preferential tax rates to encourage long-term investment. These rates are generally 0%, 15%, or 20%.

- Rate Tiers (Example for 2023 Tax Year, Single Filers):

- 0% Rate: For individuals with taxable income up to $44,625.

- 15% Rate: For individuals with taxable income between $44,626 and $492,300.

- 20% Rate: For individuals with taxable income above $492,300.

- Note: These income thresholds are for your total taxable income, not just your capital gains. The capital gain portion is taxed at the applicable rate for the bracket it falls into.

3. Net Investment Income Tax (NIIT)

- Additional Tax for High Earners: Some higher-income taxpayers may also be subject to a 3.8% Net Investment Income Tax (NIIT) on certain investment income, including capital gains. This applies to individuals with Modified Adjusted Gross Income (MAGI) above certain thresholds ($200,000 for single filers, $250,000 for married filing jointly).

Understanding Capital Losses: Not All Bad News

While no one likes to lose money, capital losses aren’t entirely negative from a tax perspective. They can be used to offset capital gains and even a limited amount of ordinary income, potentially reducing your tax liability.

Here’s how capital losses work:

-

Offsetting Capital Gains First:

- You must first use your capital losses to offset any capital gains you have in the same tax year.

- Example: If you have $10,000 in short-term capital gains and $7,000 in short-term capital losses, your net short-term capital gain is $3,000.

- Netting Rules:

- Short-term losses first offset short-term gains.

- Long-term losses first offset long-term gains.

- If you have a net loss in one category (e.g., net short-term loss), it can then offset a net gain in the other category (e.g., net long-term gain).

-

Offsetting Ordinary Income:

- If your capital losses exceed your capital gains after all netting, you can use up to $3,000 of the remaining net capital loss to offset your ordinary income (like wages).

- Example: You have a net capital loss of $5,000 after offsetting all gains. You can use $3,000 of that loss to reduce your taxable income from your job.

-

Capital Loss Carryover:

- If your net capital loss is more than the $3,000 limit, you don’t lose the benefit! The unused portion of the loss can be carried over to future tax years.

- You can continue to use the carryover loss to offset capital gains and up to $3,000 of ordinary income in each subsequent year until the loss is fully used or you pass away.

Special Rules and Considerations

While the basics cover most scenarios, a few special rules are worth knowing:

-

The Wash Sale Rule:

- This rule prevents you from claiming a capital loss on an investment if you buy a "substantially identical" security within 30 days before or after selling the original security.

- Purpose: To prevent investors from selling a stock just to claim a loss for tax purposes, only to immediately buy it back and maintain their position. The loss is disallowed and added to the basis of the new shares.

-

Home Sale Exclusion:

- When you sell your primary residence, you may be able to exclude a significant portion of your capital gain from taxes.

- Exclusion Amounts: Up to $250,000 for single filers and $500,000 for married couples filing jointly.

- Requirements: You must have owned and lived in the home as your main home for at least two of the five years leading up to the sale.

-

Collectibles:

- Capital gains from the sale of collectibles (like art, antiques, or coins) are taxed at a maximum rate of 28%, regardless of your income bracket, if held long-term. Short-term gains on collectibles are still taxed at ordinary income rates.

Strategies to Manage Capital Gains Tax

Understanding capital gains and losses isn’t just about calculating your tax bill; it’s also about strategic planning to potentially reduce it.

-

Hold Investments for the Long Term:

- This is the simplest and often most effective strategy. By holding assets for more than a year, you qualify for the lower long-term capital gains tax rates, which can significantly reduce your tax liability.

-

Tax-Loss Harvesting:

- This involves strategically selling investments at a loss to offset capital gains and potentially up to $3,000 of ordinary income.

- How it works: If you have significant capital gains from profitable sales, you can intentionally sell some losing investments to generate losses that will reduce or even eliminate your capital gains tax. Remember the wash sale rule!

-

Utilize Tax-Advantaged Accounts:

- Investments held within tax-advantaged accounts like 401(k)s, IRAs, and Roth IRAs grow tax-deferred or tax-free.

- Traditional IRA/401(k): You don’t pay capital gains tax until you withdraw money in retirement, at which point it’s taxed as ordinary income.

- Roth IRA/401(k): Qualified withdrawals in retirement are entirely tax-free, meaning you pay no capital gains tax on the growth whatsoever.

-

Donate Appreciated Assets to Charity:

- If you itemize deductions, donating appreciated assets (like stocks you’ve held for more than a year) directly to a qualified charity can be a win-win.

- You avoid paying capital gains tax on the appreciated value, and you can typically claim a charitable deduction for the full fair market value of the asset.

-

Gift Appreciated Assets:

- Gifting appreciated assets to individuals in lower tax brackets (e.g., adult children or grandchildren) who might sell them at the 0% or 15% long-term capital gains rate can be a tax-efficient strategy.

- Be mindful of gift tax rules and annual exclusion limits.

Record-Keeping is Key!

To accurately calculate your capital gains and losses, meticulous record-keeping is essential. Keep track of:

- Purchase Date: The exact date you acquired the asset.

- Purchase Price: The original cost of the asset.

- Commissions and Fees: Any costs incurred when buying or selling.

- Improvements: For real estate, keep receipts and records of all improvements made.

- Sale Date: The exact date you sold the asset.

- Sale Price: The amount you received for the asset.

Most brokerage firms will provide you with a Form 1099-B (Proceeds From Broker and Barter Exchange Transactions) at the end of the year, which summarizes your sales and often includes your basis information. However, always cross-reference and keep your own records, especially for assets not held through a brokerage.

Conclusion

Understanding capital gains and losses is a cornerstone of smart financial management. It’s not just about making money from your investments, but also about understanding how much of that money you get to keep after taxes. By grasping the concepts of basis, short-term vs. long-term, and utilizing available strategies like tax-loss harvesting, you can make informed decisions that optimize your investment returns and minimize your tax burden.

While this guide provides a solid foundation, tax laws can be complex and change frequently. For personalized advice tailored to your specific financial situation, it’s always wise to consult with a qualified financial advisor or tax professional.

Post Comment