Trade Surplus vs. Trade Deficit: Unpacking the Economic Consequences

In the complex world of international economics, terms like "trade surplus" and "trade deficit" are often thrown around, frequently with strong opinions attached. Some claim a trade surplus is always a sign of a strong, healthy economy, while a trade deficit is seen as a harbinger of doom. But is it really that simple?

The truth, as with most things in economics, is far more nuanced. Understanding the difference between a trade surplus and a trade deficit, and their potential economic consequences, requires digging deeper than the headlines. This article will break down these concepts in an easy-to-understand way, exploring their pros, cons, and why context is always king.

The Balance of Trade: A Country’s Economic Scorecard

Before we dive into surpluses and deficits, let’s understand the overarching concept: the Balance of Trade.

Imagine a country as a giant business. It sells goods and services to other countries (these are its exports) and buys goods and services from other countries (these are its imports). The Balance of Trade is simply the difference between the total value of its exports and the total value of its imports over a specific period, usually a year.

Balance of Trade = Total Value of Exports – Total Value of Imports

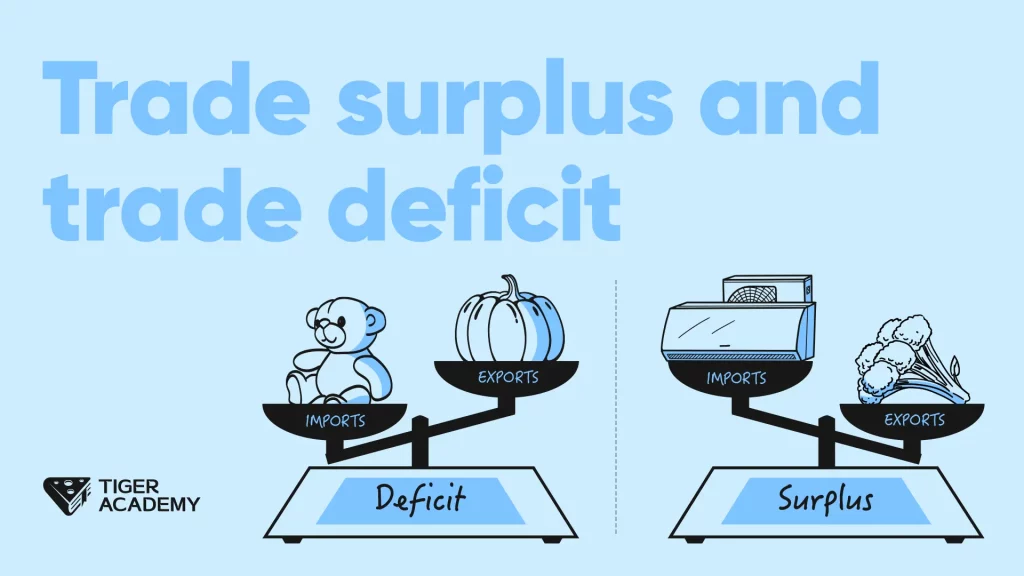

Based on this calculation, a country will experience one of two scenarios:

- Trade Surplus: When a country exports more than it imports.

- Trade Deficit: When a country imports more than it exports.

Let’s explore each in detail.

Understanding a Trade Surplus: The "Selling More" Scenario

A trade surplus occurs when a country sells more goods and services to the rest of the world than it buys. In simpler terms, its exports are greater than its imports.

Example: If Country A sells $100 billion worth of cars, technology, and agricultural products to other countries, but only buys $80 billion worth of oil, clothing, and electronics, it has a trade surplus of $20 billion.

Many economists and politicians often view a trade surplus as a highly desirable outcome, a sign of a robust and competitive economy. Here’s why:

Potential Economic Benefits of a Trade Surplus:

- Job Creation and Economic Growth: When a country exports more, its domestic industries are busy producing goods and services for foreign markets. This often leads to increased production, more factory jobs, higher demand for raw materials, and overall economic expansion.

- Accumulation of Foreign Exchange Reserves: When other countries buy your exports, they pay in their currency or a widely accepted international currency like the US Dollar or Euro. This builds up a country’s foreign exchange reserves, which can be used to stabilize its own currency, pay for future imports, or invest abroad.

- Currency Appreciation: A high demand for a country’s exports means a high demand for its currency (as foreign buyers need to convert their money to pay). This increased demand can cause the domestic currency to strengthen or "appreciate" against other currencies. A stronger currency makes imports cheaper and can reduce inflationary pressures.

- Reduced Foreign Debt: A trade surplus means a country is earning more from abroad than it is spending. This can help a country pay down any existing foreign debt or reduce its reliance on foreign borrowing.

- Increased National Savings and Investment Abroad: The money earned from exports, if not consumed domestically, can be saved or invested in foreign assets, generating future income streams for the nation.

Potential Downsides or Challenges of a Trade Surplus:

- Risk of Protectionism from Other Nations: If one country consistently runs large trade surpluses, other countries running deficits with them might accuse them of unfair trade practices (like currency manipulation or subsidies). This can lead to trade wars, tariffs, and retaliatory measures, harming global trade relations.

- Currency Overvaluation: While some currency appreciation is good, too much can make a country’s exports more expensive for foreign buyers, potentially hurting future export competitiveness. It also makes imports very cheap, which can put pressure on domestic industries.

- Inflationary Pressures: If a country is exporting a large portion of its production, there might be fewer goods available for domestic consumption. If there’s also a lot of money circulating due to export earnings, this can lead to "too much money chasing too few goods," driving up domestic prices (inflation).

- Potential for Domestic Underinvestment: If a country saves and invests too much abroad due to its surplus, it might neglect crucial domestic investments in infrastructure, education, or innovation, which could hinder long-term growth.

Understanding a Trade Deficit: The "Buying More" Scenario

A trade deficit occurs when a country buys more goods and services from the rest of the world than it sells. In this case, its imports are greater than its exports.

Example: If Country B sells $50 billion worth of services and manufactured goods but buys $70 billion worth of consumer electronics, oil, and raw materials, it has a trade deficit of $20 billion.

A trade deficit is often portrayed negatively, as if a country is "losing" money or being exploited. While it can signal underlying issues, it’s not always a bad thing and can even indicate economic strength in certain contexts.

Potential Economic Benefits or Neutral Impacts of a Trade Deficit:

- Increased Consumer Choice and Lower Prices: Imports bring a wider variety of goods and services to consumers, often at competitive prices. This can improve living standards and keep domestic inflation in check.

- Inflow of Foreign Investment (Capital Account Surplus): A trade deficit often goes hand-in-hand with a "capital account surplus." This means that foreigners are sending money into your country – not just to buy goods, but to invest in your businesses, real estate, stocks, or government bonds. This foreign direct investment (FDI) can create jobs, bring new technology, and boost productive capacity.

- Sign of a Strong Domestic Economy: Sometimes, a trade deficit arises because a country’s economy is growing robustly, leading to high consumer demand for goods (both domestic and imported) and strong business investment that requires imported capital goods.

- Access to Essential Goods and Technology: Countries might import crucial raw materials, energy, or advanced technologies that they don’t produce domestically. This access is vital for their own industries and innovation.

- Improved Efficiency and Specialization: Importing goods that can be produced more efficiently elsewhere allows a country to specialize in what it does best, leading to overall global economic efficiency.

Potential Downsides or Challenges of a Trade Deficit:

- Job Losses in Domestic Industries: If imports are significantly cheaper or of higher perceived quality, domestic industries might struggle to compete, leading to factory closures and job losses in those sectors.

- Increased Foreign Debt and Dependence: To finance a persistent trade deficit, a country often needs to borrow money from foreign lenders or sell off domestic assets to foreign investors. This can lead to a build-up of foreign debt and a greater reliance on external financing.

- Currency Depreciation: A persistent trade deficit means a country is sending out more of its currency to pay for imports than it’s receiving from exports. This can reduce demand for its currency, causing it to weaken or "depreciate" against other currencies. A weaker currency makes imports more expensive and can fuel inflation.

- Risk of Capital Flight: If foreign investors lose confidence in a country with a large deficit (e.g., due to political instability or poor economic policies), they might pull their investments out, leading to a sudden and sharp currency depreciation and economic crisis.

- Reduced Long-Term Growth Potential (if debt is for consumption): If the foreign borrowing or investment inflow primarily finances consumption rather than productive investments (like infrastructure or education), it doesn’t build long-term economic capacity and can lead to a less sustainable future.

It’s Not Black and White: Context Matters!

As you can see, both trade surpluses and deficits have their pros and cons. The real economic consequences depend heavily on the context in which they occur. Here are key factors to consider:

- Stage of Economic Development:

- Developing nations often run trade deficits as they import capital goods (machinery, technology) and raw materials to build their industrial base. This deficit, if it fuels productive investment, can be a sign of healthy growth.

- Mature economies might run deficits due to high consumer demand or surpluses if they are highly competitive exporters.

- Causes of the Surplus/Deficit:

- Is a deficit caused by robust domestic demand and foreign investment? (Potentially good)

- Is it caused by a lack of competitiveness and excessive consumption? (Potentially bad)

- Is a surplus caused by efficient, innovative industries? (Good)

- Is it caused by suppressed domestic demand or an undervalued currency? (Could hide underlying issues)

- Type of Goods Traded: Importing raw materials or capital goods (like machinery) that boost a country’s productive capacity can be more beneficial than importing only consumer goods. Similarly, exporting high-value manufactured goods or services generally has a greater economic impact than exporting raw commodities.

- Duration and Sustainability: A short-term deficit or surplus is often less concerning than a persistent, large imbalance. Long-term, unsustainable deficits fueled by debt can be problematic.

- Global Economic Conditions: In a global recession, a trade surplus might be harder to achieve, while in a boom, deficits might naturally rise due to increased demand.

- Monetary and Fiscal Policies: A country’s government spending, taxation, and central bank interest rate decisions all influence its trade balance.

Conclusion: A Balanced Perspective is Key

The terms "trade surplus" and "trade deficit" are not inherently "good" or "bad." They are simply indicators of a country’s economic interactions with the rest of the world.

- A trade surplus can indicate strong competitiveness and job creation but can also lead to trade tensions and currency overvaluation.

- A trade deficit can mean greater consumer choice and foreign investment but can also signal job losses and growing foreign debt.

What truly matters is why a country is experiencing a surplus or deficit, how it is financed, and what impact it has on the long-term health and stability of its economy. Policymakers should focus on creating an environment that fosters productivity, innovation, and sustainable growth, rather than fixating solely on the balance of trade number. A healthy economy is dynamic, and its trade balance will naturally fluctuate based on a multitude of internal and external factors.

Frequently Asked Questions (FAQs)

Q1: Is a trade surplus always good for an economy?

A: Not always. While it often signals strong export industries and job creation, a persistent, large surplus can lead to trade tensions with other countries, currency overvaluation (making future exports more expensive), and potentially less domestic consumption if too much production is diverted for export.

Q2: Is a trade deficit always bad for an economy?

A: Not necessarily. A trade deficit can reflect a strong domestic economy with high consumer demand and significant foreign investment flowing into the country. It can also provide consumers with more choices and lower prices. However, if a deficit is large, persistent, and financed by unsustainable borrowing for consumption rather than productive investment, it can become problematic.

Q3: What is the "ideal" trade balance?

A: There isn’t a single "ideal" trade balance for all countries at all times. A balanced approach, where trade flows support sustainable economic growth and stability, is generally preferred. For some countries, a moderate surplus might be healthy, while for others, a deficit driven by productive foreign investment could be beneficial. The key is balance and sustainability, not a fixed number.

Q4: How does a trade balance affect a country’s currency?

A: A trade surplus generally leads to increased demand for a country’s currency, causing it to appreciate (strengthen). Conversely, a trade deficit typically leads to decreased demand for a country’s currency, causing it to depreciate (weaken).

Q5: What’s the difference between the trade balance and the current account balance?

A: The trade balance only includes the value of exported and imported goods and services. The current account balance is broader; it includes the trade balance plus net income from investments abroad (e.g., dividends, interest) and net transfers (e.g., foreign aid, remittances). So, a current account surplus or deficit gives a more comprehensive picture of a country’s financial flows with the rest of the world.

Post Comment