The Widening Divide: Global Wealth Inequality – Trends, Causes, and Solutions for a Fairer Future

Are you curious about why some people have so much wealth while others struggle to make ends meet? Have you heard terms like "the top 1%" and wondered what they mean for the global economy?

You’re in the right place. Global wealth inequality is one of the most pressing issues of our time. It affects everything from political stability to social well-being and economic growth. In this long, easy-to-understand guide, we’ll break down what global wealth inequality is, explore its current trends, uncover the main reasons behind it, and look at the powerful policy responses that can help create a more balanced and just world.

What Exactly is Global Wealth Inequality?

Let’s start with the basics. When we talk about wealth, we’re not just talking about how much money someone earns each year (that’s income). Wealth is the total value of everything a person owns, minus any debts they have. Think of it as their "net worth."

This includes:

- Assets: Money in bank accounts, savings, stocks, bonds, real estate (houses, land), cars, businesses, and valuable possessions like art or jewelry.

- Debts: Mortgages, credit card debt, student loans, and any other money owed.

Wealth inequality simply means that wealth is not distributed equally among people. Some individuals or households have a huge amount of wealth, while many others have very little, or even negative wealth (meaning their debts are greater than their assets).

Global wealth inequality takes this concept to the worldwide stage, looking at how wealth is distributed among all the people on Earth, across different countries and regions.

Key Difference: Wealth vs. Income Inequality

While often linked, they’re not the same:

- Income inequality looks at the differences in how much people earn (salaries, wages, profits) over a specific period, like a year.

- Wealth inequality looks at the total accumulated assets over a lifetime or generations. Wealth can be passed down, making it a stronger indicator of long-term economic power and opportunity.

How Do We Measure It?

One common way is to look at the share of wealth held by different groups. For example:

- "The richest 1% owns X% of the world’s wealth."

- "The bottom 50% owns Y% of the world’s wealth."

Another measure is the Gini coefficient, a number between 0 and 1 (or 0% and 100%).

- A Gini coefficient of 0 (or 0%) means perfect equality (everyone has the same wealth).

- A Gini coefficient of 1 (or 100%) means perfect inequality (one person has all the wealth).

- In reality, the global Gini coefficient for wealth is very high, indicating significant inequality.

Current Trends: Is the Gap Widening?

The short answer is: yes, largely. While there have been periods of improvement in some areas (especially in reducing extreme poverty, thanks to growth in countries like China and India), the overall trend in global wealth inequality has been towards a wider gap between the very rich and everyone else.

Here are some key trends:

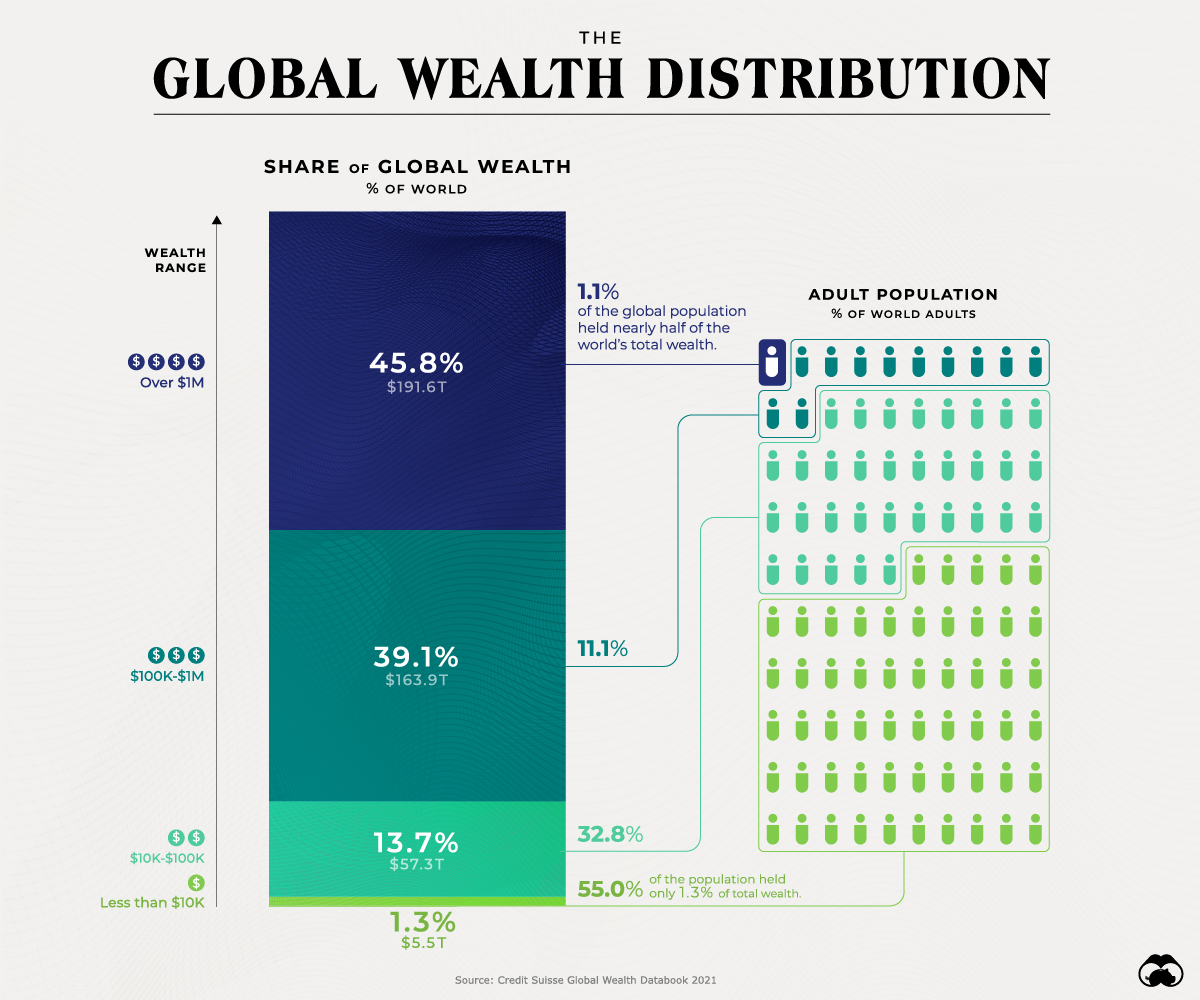

- The Richest are Getting Richer, Faster: Reports from organizations like Oxfam and Credit Suisse consistently show that the wealthiest individuals are accumulating wealth at an astonishing rate. For example, recent data suggests that the richest 1% of the world’s population owns a disproportionately large share of global wealth, often more than the bottom 90% combined.

- The "Billionaire Boom": The number of billionaires and their total wealth have soared in recent decades, even during times of economic crisis.

- COVID-19’s Uneven Impact: The pandemic, while devastating for many, actually accelerated wealth accumulation for the ultra-rich. Stock markets boomed, benefiting those who owned financial assets, while job losses and increased debt disproportionately affected lower and middle-income households.

- Stagnant or Declining Wealth for the Poorest: For a significant portion of the global population, wealth has remained stagnant or even declined, especially when factoring in rising costs of living and debt.

- Regional Disparities Persist: While developing nations have seen economic growth, the wealth per person in high-income countries remains vastly higher than in low-income countries.

In simple terms: Imagine a global pie. The slice for the very few at the top is getting bigger and bigger, while the slices for the majority are staying small or even shrinking.

Why is Wealth Inequality Happening? Understanding the Causes

Wealth inequality is a complex problem with many interconnected roots. Here are some of the main drivers:

-

Economic Policies and Taxation:

- Regressive Tax Systems: In many countries, tax systems have become less progressive over time. This means that wealthy individuals and corporations might pay a smaller percentage of their income or wealth in taxes compared to lower and middle-income earners.

- Tax Cuts for the Rich: Policies that reduce taxes on capital gains (profits from investments) or inheritance taxes tend to benefit the wealthy more, allowing them to keep and grow their fortunes.

- Loopholes and Tax Havens: The existence of complex tax loopholes and offshore tax havens allows wealthy individuals and multinational corporations to avoid paying their fair share of taxes, effectively hoarding wealth outside public reach.

-

Globalization and Financialization:

- Global Competition: Companies can move production to countries with lower wages and fewer regulations, putting downward pressure on wages in higher-income countries.

- Financial Market Dominance: The increasing importance of financial markets (stocks, bonds, derivatives) over real production. Wealth generated from these markets often accumulates at the top, benefiting those with existing capital.

- Deregulation: Loosening of rules on banks and financial institutions can lead to risky behavior and financial crises, which often require public bailouts, transferring wealth to financial institutions while the public bears the cost.

-

Technological Advancements:

- Skill-Biased Technological Change: New technologies (like AI, automation) often increase the demand for highly skilled workers (who earn more) while reducing demand for less skilled labor, pushing down wages for the latter.

- "Winner-Take-All" Markets: Digital platforms and global reach allow a few highly successful individuals or companies to dominate entire markets, accumulating immense wealth.

-

Inherited Wealth and Dynasties:

- Intergenerational Wealth Transfer: A significant portion of wealth is inherited, rather than earned. This creates a cycle where those born into wealthy families have a massive head start in terms of education, opportunities, and capital to invest, perpetuating inequality across generations.

- Weak Inheritance Taxes: Where inheritance taxes are low or easily avoided, large fortunes can pass down largely intact, concentrating wealth over centuries.

-

Unequal Access to Opportunities:

- Education and Healthcare: Lack of access to quality education, healthcare, and nutrition in early life severely limits opportunities for social mobility and wealth accumulation for those born into poverty.

- Financial Exclusion: Many poor individuals and communities lack access to basic financial services like affordable credit, savings accounts, or insurance, making it harder to build assets or cope with economic shocks.

-

Weak Labor Protections and Declining Union Power:

- In many countries, minimum wages have not kept pace with the cost of living or productivity gains.

- The decline in trade union membership and power has weakened workers’ ability to negotiate for better wages, benefits, and working conditions.

The Impact: Why Does Wealth Inequality Matter?

High levels of wealth inequality aren’t just an abstract economic concept; they have profound and often negative consequences for individuals, societies, and the global economy.

- Slower Economic Growth: When wealth is concentrated at the top, overall consumer demand can fall because the wealthy tend to save or invest more, while lower and middle-income groups (who would spend a larger portion of any extra income) have less money. This can stifle economic activity.

- Reduced Social Mobility: The "rags-to-riches" story becomes far less likely. If wealth is inherited and opportunities are limited, it’s incredibly difficult for people born into poverty to improve their economic standing.

- Political Instability and Erosion of Trust: Extreme inequality can lead to social unrest, protests, and a breakdown of trust in institutions. When people feel the system is rigged against them, it can fuel populism and political extremism.

- Health and Education Disparities: Wealth directly impacts access to quality healthcare, nutritious food, and good education. This creates a cycle where the wealthy live longer, healthier lives with better opportunities, while the poor face significant disadvantages.

- Undermining Democracy: Wealthy individuals and corporations can use their financial power to influence political decisions, lobbying for policies that further benefit them, potentially at the expense of the general public.

- Environmental Degradation: The consumption patterns of the very wealthy can have a disproportionately large carbon footprint, and their influence can sometimes hinder environmental protection efforts.

Policy Responses: Solutions for a Fairer Future

Addressing global wealth inequality requires a multi-faceted approach involving governments, international organizations, civil society, and even individuals. Here are some key policy responses:

1. Progressive Taxation and Fair Fiscal Policies:

- Higher Taxes on Wealth and Inheritance: Implement or strengthen wealth taxes (a small annual tax on very large fortunes) and inheritance taxes (taxes on inherited wealth) to redistribute accumulated wealth.

- Progressive Income Tax: Ensure that higher earners pay a proportionally larger share of their income in taxes.

- Crackdown on Tax Havens and Evasion: International cooperation is crucial to close loopholes, share financial information, and prevent wealthy individuals and corporations from hiding their money offshore.

- Fair Corporate Taxation: Ensure multinational corporations pay their fair share of taxes in the countries where they generate profits, rather than shifting profits to low-tax jurisdictions.

2. Investing in Public Services and Social Safety Nets:

- Universal Access to Quality Education: Fund public education from early childhood through higher education, making it accessible and affordable for everyone, regardless of their family’s income. This includes vocational training and lifelong learning.

- Universal Healthcare: Provide comprehensive healthcare services to all citizens, ensuring that health outcomes are not determined by wealth.

- Robust Social Safety Nets: Strengthen unemployment benefits, disability support, affordable housing programs, and pensions to provide a basic standard of living and prevent people from falling into extreme poverty.

- Universal Basic Income (UBI) Exploration: While debated, UBI schemes (where everyone receives a regular, unconditional income) are being explored as a way to provide a financial floor and reduce poverty.

3. Strengthening Labor Rights and Fair Wages:

- Living Minimum Wage: Implement and regularly update minimum wages to ensure they reflect the true cost of living and allow workers to earn enough to support themselves and their families.

- Support for Trade Unions: Protect workers’ rights to organize and collectively bargain for better wages, benefits, and working conditions.

- Fair Employment Practices: Combat wage theft, ensure equal pay for equal work, and promote decent working conditions for all.

4. Financial Regulation and Corporate Governance:

- Stronger Financial Regulations: Implement rules to prevent excessive risk-taking in financial markets, control speculative bubbles, and ensure financial stability.

- Curb Executive Pay: Introduce policies that limit excessively high executive salaries and bonuses, particularly when they are disproportionate to worker wages.

- Promote Worker Ownership: Encourage models like employee stock ownership plans or cooperatives, where workers have a stake in the company’s success and a share of its profits.

5. International Cooperation and Debt Relief:

- Fairer Global Trade Rules: Advocate for trade agreements that prioritize fair labor standards, environmental protection, and equitable benefits, rather than a "race to the bottom."

- Debt Relief for Developing Nations: Alleviate the debt burden on poorer countries, freeing up resources for essential public services and investment in their own populations.

- Global Wealth Taxation Initiatives: Explore international agreements to tax global wealth and use the proceeds to fund development goals.

Challenges in Addressing Wealth Inequality

While the solutions exist, implementing them faces significant hurdles:

- Political Will: Powerful vested interests, including wealthy individuals and corporations, often lobby against policies that would reduce their wealth or influence.

- Globalization’s Complexity: Coordinating international efforts to tax wealth or regulate finance is difficult given different national interests and legal systems.

- Measurement and Data Gaps: Accurately measuring wealth, especially hidden offshore wealth, is challenging.

- Public Understanding and Support: There can be resistance to policies like wealth taxes if the public doesn’t fully understand the problem or perceive them as unfair.

Conclusion: Building a More Equitable Future

Global wealth inequality is not an inevitable outcome; it’s the result of policy choices and systemic structures. While the trends show a worrying widening of the gap, the good news is that we have a range of powerful tools and policy responses at our disposal to address it.

By advocating for progressive taxation, investing in universal public services, strengthening labor rights, and promoting fair financial regulation, we can move towards a world where wealth is more equitably distributed. This isn’t just about fairness; it’s about building more stable, prosperous, and democratic societies for everyone.

The journey to a fairer future requires collective effort, informed discussion, and sustained political will. Understanding the issue is the first crucial step towards making that future a reality.

Frequently Asked Questions (FAQs) about Global Wealth Inequality

Q1: What’s the main difference between wealth and income inequality?

A1: Income inequality refers to differences in how much people earn (like salaries) in a given period. Wealth inequality refers to differences in the total assets people own (like property, savings, stocks) minus their debts. Wealth is accumulated over time and can be passed down generations, making it a stronger indicator of long-term economic power.

Q2: Is wealth inequality always a bad thing?

A2: A certain degree of inequality can be natural in a market economy, as people have different skills, efforts, and risks. However, extreme wealth inequality, like what we see globally, is widely considered detrimental. It can lead to slower economic growth, reduced opportunities, social instability, and political influence by the wealthy that undermines democracy.

Q3: How has COVID-19 impacted global wealth inequality?

A3: The COVID-19 pandemic actually increased wealth inequality. While many people lost jobs and faced financial hardship, the very richest saw their wealth grow significantly due to booming stock markets and rising asset values, benefiting those who already owned substantial financial assets.

Q4: What is a "tax haven" and how does it relate to wealth inequality?

A4: A tax haven is a country or jurisdiction that offers very low or no taxes to foreign individuals and businesses. Wealthy individuals and multinational corporations can use these havens to hide their assets and profits, avoiding taxes in their home countries. This reduces government revenue for public services and exacerbates wealth inequality by allowing the rich to pay less than their fair share.

Q5: Can technological advancements make wealth inequality worse?

A5: Yes, they can. New technologies often favor highly skilled workers, increasing their wages while potentially replacing jobs for less skilled workers. This "skill-biased technological change" can widen the gap between high and low earners. Additionally, "winner-take-all" digital markets allow a few companies or individuals to amass huge fortunes very quickly.

Q6: What is "intergenerational wealth transfer"?

A6: This refers to wealth that is passed down from one generation to the next, typically through inheritance. When large amounts of wealth are inherited, it gives subsequent generations a significant advantage in terms of education, investment opportunities, and financial security, which can perpetuate and deepen wealth inequality over time.

Post Comment