The Unshakeable Shield: The Vital Importance of an Emergency Fund for Financial Peace

Life is a beautiful, unpredictable journey. While we all hope for smooth sailing, the truth is that storms can arise without warning. A sudden car repair, an unexpected medical bill, a job loss, or a leaky roof – these are the curveballs life can throw our way. Without a solid financial foundation, these unexpected events can quickly spiral into overwhelming debt and immense stress.

This is where the unsung hero of personal finance steps in: The Emergency Fund.

Often overlooked or underestimated, an emergency fund isn’t just a "nice-to-have"; it’s a fundamental pillar of financial stability, offering peace of mind and acting as your personal financial safety net. If you’re new to managing your money, understanding and building an emergency fund is arguably the most crucial first step you can take.

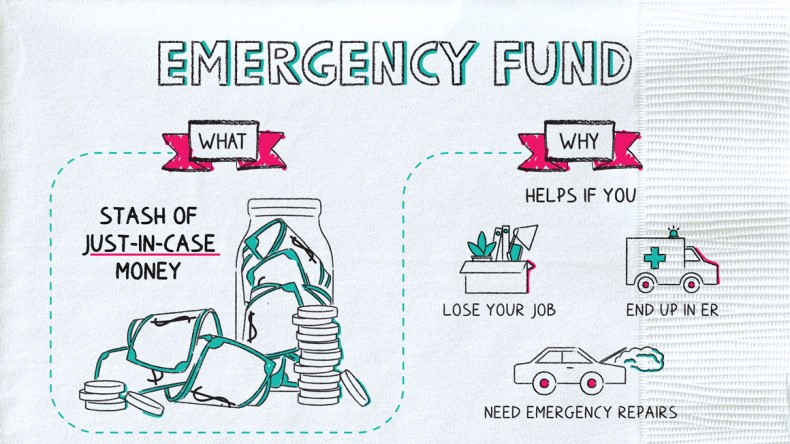

What Exactly Is an Emergency Fund?

Let’s start with a clear definition. An emergency fund is a dedicated stash of money, kept separate from your regular checking or savings accounts, specifically reserved for unforeseen and unavoidable expenses.

Think of it as your personal financial "rainy day" fund. It’s not for:

- A new pair of shoes or a designer bag.

- A down payment on a house (that’s a separate savings goal).

- A fancy vacation.

- Holiday shopping.

It is for:

- Unexpected job loss.

- A sudden major car repair (engine trouble, transmission).

- An urgent medical bill or emergency room visit.

- Essential home repairs (burst pipe, furnace breakdown).

- A necessary emergency trip.

The key here is "unforeseen and unavoidable." If you can plan for it, it’s not an emergency.

Why You Absolutely Need One: The Core Benefits

The importance of an emergency fund cannot be overstated. It provides a multitude of benefits that extend far beyond simply having money in the bank.

1. Protection Against Life’s Curveballs

This is the most obvious and direct benefit. Life is full of surprises, and not all of them are pleasant.

- Job Loss: Imagine waking up to the news that your position has been eliminated. Without an emergency fund, the immediate panic of how to pay rent or buy groceries can be paralyzing. With a fund, you have a cushion to cover essential living expenses while you search for new employment.

- Medical Emergencies: Accidents happen, and illnesses strike. Even with good health insurance, co-pays, deductibles, and uncovered services can quickly add up. An emergency fund ensures you can focus on getting well, not on how to pay the bills.

- Car Troubles: Your car breaks down on the highway. The repair bill is $1,000. If you rely on your car for work, this isn’t an optional expense. An emergency fund lets you get back on the road without financial strain.

- Home Repairs: A pipe bursts, the water heater fails, or the roof leaks. These aren’t minor inconveniences; they’re immediate problems that need fixing to maintain your home’s integrity and your comfort.

An emergency fund acts as a financial shock absorber, softening the blow of these unexpected events and preventing them from derailing your entire financial life.

2. Avoiding the Debt Trap

Without an emergency fund, where do people turn when an unexpected expense arises? Often, they resort to high-interest credit cards, personal loans, or even predatory payday loans. This is a dangerous cycle:

- Credit Card Debt: Charging an emergency expense to a credit card might seem like an easy fix, but the high-interest rates (often 18-25% APR or more) mean you’ll pay back far more than you borrowed. Minimum payments barely touch the principal, and you can quickly find yourself drowning in debt, making it even harder to save for the future.

- Personal Loans: While potentially lower interest than credit cards, they still incur interest and add another monthly payment to your budget.

- Payday Loans: These are the most dangerous, with exorbitant interest rates that can trap you in a never-ending cycle of borrowing to pay off old loans.

An emergency fund allows you to pay cash for these unexpected costs, completely avoiding interest charges and the stress of accumulating debt. It’s a proactive step that saves you money and heartache in the long run.

3. Peace of Mind and Reduced Stress

Perhaps one of the most intangible yet powerful benefits of an emergency fund is the incredible peace of mind it provides. Knowing you have a financial safety net significantly reduces anxiety about the future.

- Less Worry: You’re less likely to constantly worry about "what if" scenarios.

- Better Sleep: Financial stress is a major contributor to sleepless nights and overall well-being issues. An emergency fund helps alleviate that burden.

- Freedom: It allows you to make decisions based on your best interests, rather than being forced into desperate choices due to financial pressure. For example, if you’re unhappy in your job, an emergency fund gives you the breathing room to look for a new one without immediate panic.

This sense of security empowers you to live more freely and confidently, knowing you’re prepared for whatever comes your way.

4. Opportunity and Flexibility

While primarily for emergencies, a robust emergency fund can also open doors to unexpected opportunities:

- Career Changes: Want to switch industries or go back to school for a certification? An emergency fund can provide a buffer during a period of reduced income or while you gain new skills.

- Taking a Risk: Perhaps a fantastic business opportunity arises that requires a small initial investment, or a dream job comes up that requires a move. An emergency fund ensures you’re stable enough to consider these options without jeopardizing your basic needs.

- Avoiding Forced Sales: If you suddenly need cash, you won’t be forced to sell valuable assets (like investments or even your car) at a loss just to cover an urgent bill.

It gives you the flexibility to navigate life’s twists and turns with more grace and strategic thinking.

5. Building Financial Resilience

An emergency fund is a cornerstone of overall financial resilience. It teaches you discipline, prepares you for the unexpected, and acts as a foundation upon which you can build other financial goals. Once your emergency fund is fully stocked, you can confidently pursue other objectives like:

- Saving for a down payment on a home.

- Investing for retirement.

- Paying off student loans.

- Saving for your children’s education.

Without an emergency fund, every financial step forward can be jeopardized by a sudden setback. With it, you build a robust financial fortress that can withstand many storms.

How Much Should Be In Your Emergency Fund?

This is a common question, and the answer isn’t a one-size-fits-all. The generally accepted guideline is to aim for 3 to 6 months’ worth of essential living expenses.

What are essential living expenses?

These are the non-negotiable costs you need to survive:

- Rent/Mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation (gas, public transport)

- Insurance premiums

- Minimum debt payments (though ideally you’d be aggressively paying down high-interest debt before fully funding your emergency fund)

Factors to Consider When Determining Your Target:

- Job Security: If your job is very stable, 3 months might be sufficient. If you work in an unstable industry or are self-employed, aiming for 6-12 months is wiser.

- Dependents: Do you have children or other family members who rely on your income? More dependents mean you’ll need a larger cushion.

- Health: Do you have any chronic health conditions that might lead to unexpected medical bills?

- Other Income Sources: Do you have a spouse whose income could support you if yours stopped?

- Lifestyle: While an emergency fund is for essential expenses, your personal comfort level might dictate a slightly larger fund.

Example:

If your essential monthly expenses add up to $2,500:

- 3 months’ fund = $7,500

- 6 months’ fund = $15,000

Start by aiming for a smaller, more achievable goal first, like $1,000. This is often enough to cover many common small emergencies and provides an immediate sense of security. Once you hit $1,000, you can then work towards your 3-6 month goal.

Where Should You Keep Your Emergency Fund?

The location of your emergency fund is crucial. It needs to be:

- Accessible: You need to be able to get to the money quickly if a true emergency strikes.

- Separate: It needs to be out of sight and out of mind, so you’re not tempted to spend it on non-emergencies.

- Safe: It should be in an insured account (like an FDIC-insured bank).

The best place for most people is a high-yield savings account (HYSA).

- High-Yield: These accounts offer a higher interest rate than traditional savings accounts, meaning your money grows a little bit while it sits there, helping to combat inflation.

- Accessibility: You can usually transfer money to your checking account within 1-3 business days.

- Separation: By having it at a different bank or a separate online account, you’re less likely to accidentally spend it.

Avoid:

- Your checking account: Too easy to spend.

- The stock market: While investments can grow, they also carry risk and can lose value, meaning your emergency money might not be there when you need it. Plus, it’s not immediately accessible.

How to Build Your Emergency Fund (Actionable Steps for Beginners)

Building an emergency fund might seem daunting, especially if you’re starting from scratch. But remember, every big financial goal is achieved one small step at a time.

-

Make a Budget (and Stick to It!): This is the foundation. You need to know exactly how much money is coming in and where it’s going. Identify areas where you can cut back to free up cash for savings.

- Tip: Use apps, spreadsheets, or even pen and paper. The goal is awareness.

-

Set a Specific Goal: Don’t just say "I want to save money." Set a target amount (e.g., "$1,000 for my mini-emergency fund" or "$7,500 for 3 months of expenses"). This gives you something concrete to work towards.

-

Automate Your Savings: This is perhaps the most powerful tip. Set up an automatic transfer from your checking account to your emergency fund savings account every payday. Treat it like a bill you have to pay yourself. Even if it’s just $25 or $50 to start, consistency is key.

- Why it works: You don’t have to think about it, and you learn to live without that money.

-

Cut Unnecessary Expenses: Go through your budget with a fine-tooth comb.

- Are you paying for subscriptions you don’t use? Cancel them.

- Can you pack your lunch instead of buying it?

- Can you brew coffee at home instead of buying a daily latte?

- Look for ways to reduce utility bills (turn off lights, adjust thermostat).

- Even small cuts add up quickly!

-

Boost Your Income:

- Side Hustle: Can you deliver food, freelance, babysit, or sell crafts in your spare time?

- Sell Unused Items: Declutter your home and sell clothes, electronics, or furniture you no longer need. Every dollar earned goes straight to your emergency fund.

- Ask for a Raise: If appropriate, negotiate for higher pay at your current job.

-

Use Windfalls Wisely: Did you get a tax refund, a bonus at work, or a monetary gift? Resist the urge to splurge. Direct a significant portion (or all) of it straight into your emergency fund.

-

Start Small, But Start Now: Don’t wait until you can save "a lot." Even $5 a week is better than nothing. The most important step is the first one. Momentum builds over time.

Common Mistakes to Avoid

As you embark on your emergency fund journey, be aware of these common pitfalls:

- Not Having One at All: The biggest mistake! It leaves you vulnerable to financial disaster.

- Using It for Non-Emergencies: This is where discipline comes in. That new TV or vacation is NOT an emergency. Dipping into your fund for wants defeats its purpose.

- Not Replenishing It: If you do have to use your emergency fund for a legitimate emergency, make sure to prioritize rebuilding it as quickly as possible.

- Keeping It Too Accessible (e.g., in checking): While it needs to be accessible, it shouldn’t be so easy to transfer that you treat it like regular spending money. A separate HYSA is ideal.

- Waiting for the "Perfect Time": There’s no perfect time to start saving. The best time is always now.

Conclusion: Your Foundation for Financial Freedom

An emergency fund isn’t just about money; it’s about empowerment, security, and peace of mind. It’s the shield that protects you from life’s unexpected blows, preventing minor setbacks from becoming major crises.

By diligently building and maintaining this vital financial tool, you’re not just saving money; you’re investing in your future, reducing stress, avoiding debt, and laying a strong foundation for true financial freedom. Start today, even if it’s just a small amount. Your future self will thank you.

Post Comment