The Ultimate Guide to Employee Benefits: Health Insurance, Retirement Plans, and Beyond

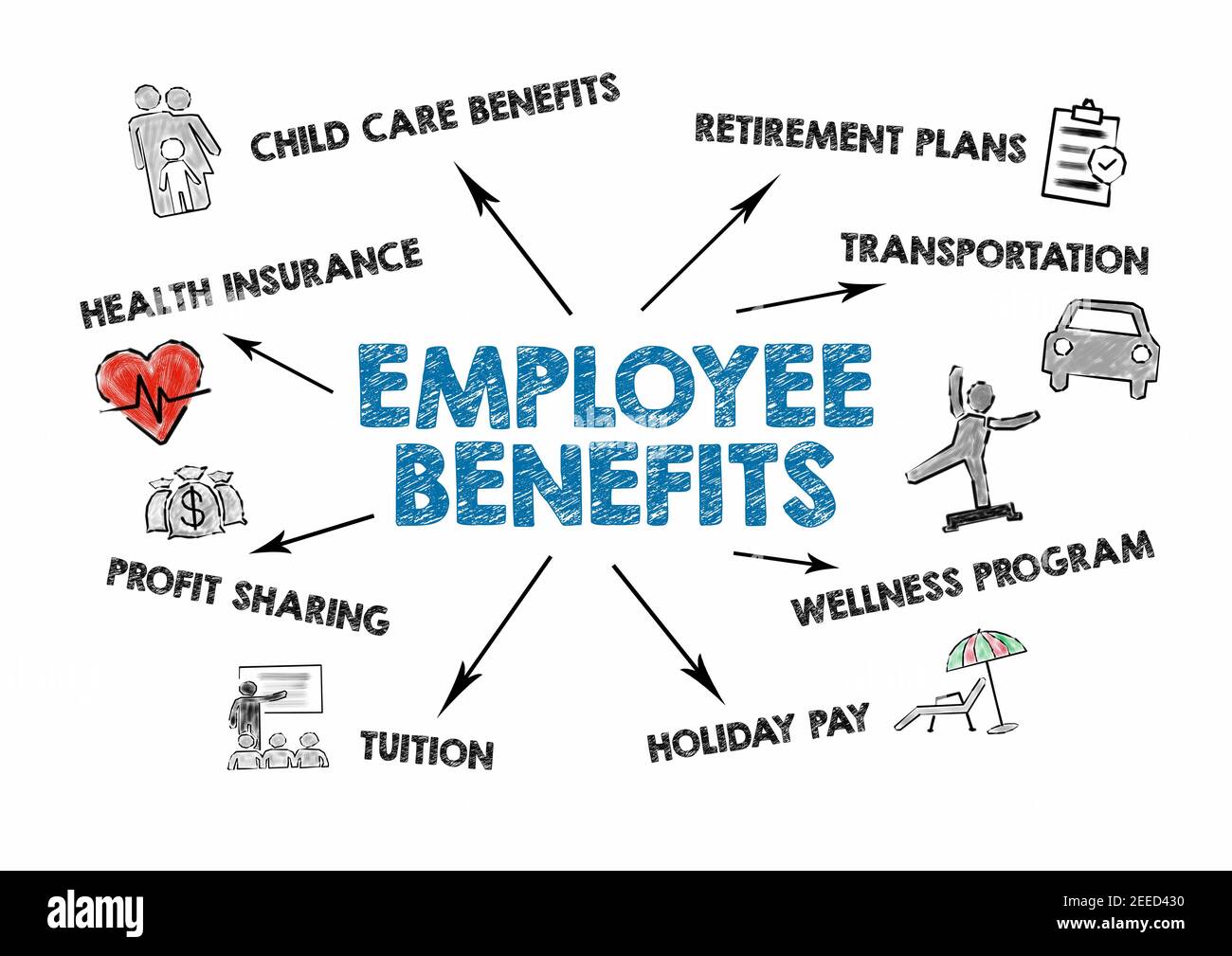

When you’re looking for a new job or evaluating your current one, salary is often the first thing that comes to mind. But smart employees know that a great employee benefits package can be just as valuable – sometimes even more so – than your take-home pay. These benefits are the extra perks and protections an employer offers beyond your regular wages.

Think of employee benefits as a crucial part of your overall compensation. They are designed to support your health, financial well-being, work-life balance, and professional growth. For beginners, understanding these benefits can feel like learning a new language, but don’t worry, we’re here to break it down into easy-to-understand terms.

In this comprehensive guide, we’ll explore the most common and valuable types of employee benefits, from the essential health insurance and retirement plans to the exciting "extras" that can truly enhance your life.

What Are Employee Benefits, Anyway?

At its core, employee benefits are non-wage compensation provided to employees in addition to their salaries. These can be mandatory (like Social Security contributions in some countries) or voluntary offerings from the employer. The goal? To attract, retain, and motivate a talented workforce by showing that the company invests in its people.

For you, the employee, these benefits offer:

- Financial Security: Protecting you from unexpected costs.

- Peace of Mind: Knowing you’re covered for the future.

- Work-Life Balance: Helping you manage personal and professional life.

- Career Growth: Providing opportunities to learn and advance.

- Overall Well-being: Supporting your physical and mental health.

Core Employee Benefits: The Essentials

Let’s start with the big ones – the employee benefits that are often considered standard and are highly sought after.

1. Health Insurance: Your Safety Net

Health insurance is arguably the most crucial employee benefit. It’s designed to protect you and your family from the high costs of medical care, prescriptions, and preventative services. Without it, a single illness or accident could lead to crushing debt.

Why it’s essential:

- Covers doctor visits, hospital stays, surgeries, and emergency care.

- Often includes preventative care like check-ups and vaccinations.

- Provides peace of mind knowing you’re covered in case of illness or injury.

Common Types of Health Insurance Plans:

- HMO (Health Maintenance Organization):

- How it works: You choose a primary care physician (PCP) within the HMO network who then refers you to specialists.

- Pros: Lower monthly premiums, usually lower out-of-pocket costs.

- Cons: Less flexibility in choosing doctors, need referrals for specialists.

- PPO (Preferred Provider Organization):

- How it works: You have more flexibility to choose doctors and specialists, both in and out of the network (though out-of-network care costs more). You don’t usually need a referral to see a specialist.

- Pros: Greater choice of providers, no referrals needed.

- Cons: Higher monthly premiums, potentially higher out-of-pocket costs for out-of-network care.

- POS (Point of Service):

- How it works: A hybrid of HMO and PPO. You choose a PCP within the network but can go out of network for care (at a higher cost) with a referral.

- Pros: More flexibility than an HMO, but with some cost control.

- Cons: Still requires referrals for out-of-network care.

- HDHP (High-Deductible Health Plan):

- How it works: Has a higher deductible (the amount you pay before your insurance starts to cover costs) but lower monthly premiums. Often paired with a Health Savings Account (HSA).

- Pros: Lower premiums, HSA allows tax-advantaged savings for medical expenses.

- Cons: You pay more out-of-pocket before insurance kicks in.

Beyond Medical: Many employers also offer:

- Dental Insurance: Covers routine cleanings, fillings, and more complex procedures.

- Vision Insurance: Helps with the cost of eye exams, glasses, and contact lenses.

2. Retirement Plans: Planning for Tomorrow

Saving for retirement might seem far off, especially if you’re just starting your career. However, retirement plans offered by employers are incredibly valuable and can make a huge difference in your financial future.

Why it’s essential:

- Allows you to save money specifically for when you stop working.

- Often comes with tax advantages, meaning you pay less tax now or later.

- Employer contributions can significantly boost your savings.

Common Types of Retirement Plans:

- 401(k) (Private Sector):

- How it works: You contribute a portion of your pre-tax paycheck, and your employer might match some of your contributions. Your money grows tax-deferred until retirement.

- Employer Match: This is FREE MONEY! If your employer offers to match your contributions (e.g., they contribute 50 cents for every dollar you put in, up to a certain percentage of your salary), always contribute enough to get the full match. It’s an instant, guaranteed return on your investment.

- 403(b) (Non-Profit/Public Sector):

- How it works: Similar to a 401(k) but for employees of public schools, hospitals, and non-profit organizations.

- Pension Plans (Defined Benefit Plans):

- How it works: Less common now, but some older companies and government jobs still offer them. The employer promises a specific monthly payment to you in retirement, based on your salary and years of service. The employer manages the investments.

- IRA (Individual Retirement Account):

- While not an employer-sponsored plan, employers might facilitate contributions to an IRA, or you can open one independently. They offer different tax benefits (Traditional vs. Roth).

Key takeaway: Always contribute to your retirement plan, especially if there’s an employer match. It’s one of the best ways to build long-term wealth.

Beyond the Basics: Enhancing Your Work-Life

While health and retirement are foundational, many employers offer a variety of other employee benefits that can significantly improve your quality of life.

3. Paid Time Off (PTO): Recharge and Rejuvenate

Paid Time Off (PTO) is crucial for maintaining a healthy work-life balance and preventing burnout. It allows you to take time away from work without losing income.

- Vacation Days: Time off for leisure, travel, or personal enjoyment.

- Sick Days: Time off when you’re unwell or need to care for a sick family member.

- Paid Holidays: Days off for public holidays (e.g., New Year’s Day, Thanksgiving).

- Personal Days: Flexible days you can use for various personal needs, often combined with vacation and sick days into a single PTO bank.

- Bereavement Leave: Time off to mourn the loss of a loved one.

- Jury Duty Leave: Time off to fulfill civic duties.

4. Wellness Programs: Investing in You

Many companies are recognizing the link between employee well-being and productivity. Wellness programs encourage healthy habits and can include:

- Gym Memberships or Discounts: Access to fitness facilities.

- On-site Fitness Classes: Yoga, Zumba, etc.

- Health Screenings: Blood pressure checks, cholesterol screenings.

- Smoking Cessation Programs: Support to quit smoking.

- Stress Management Resources: Mindfulness apps, counseling services.

- Weight Loss Programs: Guidance and support for healthy eating.

5. Professional Development & Learning Opportunities

Investing in your employees’ growth benefits both you and the company. These employee benefits help you build new skills and advance your career.

- Tuition Reimbursement: Company pays for part or all of your college courses or degrees.

- Training Programs: Internal or external workshops and seminars.

- Certifications: Covering the cost of industry-recognized certifications.

- Conference Attendance: Sponsoring your participation in industry conferences.

- Mentorship Programs: Pairing you with experienced colleagues for guidance.

6. Work-Life Balance Perks: A Modern Must-Have

These employee benefits help you juggle your professional responsibilities with your personal life, leading to greater satisfaction and retention.

- Flexible Work Hours: Adjusting your start and end times to fit personal needs.

- Remote Work Options (Work-from-Home): The ability to work from outside the office, either full-time or hybrid.

- Childcare Assistance: On-site daycare, subsidies, or referral services.

- Parental Leave: Paid time off for new parents (maternity, paternity, adoption leave).

- Employee Assistance Programs (EAP): Confidential counseling and referral services for personal or work-related issues (stress, grief, financial problems).

- Commuter Benefits: Pre-tax savings on public transportation or parking.

7. Other Valuable Benefits

The list of employee benefits is constantly evolving. Here are a few more you might encounter:

- Life Insurance: Provides a lump sum payment to your beneficiaries if you pass away.

- Disability Insurance: Replaces a portion of your income if you become unable to work due to illness or injury (short-term or long-term).

- Legal Services: Access to discounted legal advice.

- Pet Insurance: Helps cover veterinary costs for your furry friends.

- Employee Discounts: Special pricing on company products/services or from partner businesses.

- Free Meals/Snacks: A nice perk that can save you money on food.

- Fitness Centers/Gyms: On-site facilities.

- Company Stock Options/ESOPs: Giving employees a stake in the company’s success.

Why Employee Benefits Matter (For Everyone!)

Understanding the various types of employee benefits is one thing, but truly appreciating their impact is another. They are a win-win for both employees and employers.

For Employees:

- Financial Security: Reduces out-of-pocket costs for healthcare, helps save for retirement, and provides income protection.

- Improved Health & Well-being: Access to quality medical care, mental health support, and wellness programs.

- Better Work-Life Balance: Flexibility, PTO, and family-friendly policies reduce stress and improve quality of life.

- Career Advancement: Training and development opportunities help you grow professionally.

- Increased Job Satisfaction & Loyalty: Feeling valued by your employer makes you more committed and happier at work.

For Employers:

- Attract Top Talent: A strong employee benefits package makes a company more appealing to skilled job seekers.

- Retain Employees: Happy, healthy, and supported employees are less likely to leave, reducing turnover costs.

- Boost Morale & Productivity: When employees feel cared for, they are more engaged, motivated, and productive.

- Enhance Company Culture: A focus on employee benefits demonstrates a commitment to employee well-being and a positive work environment.

- Tax Advantages: Many employee benefits offer tax deductions for employers.

How to Evaluate an Employee Benefits Package

When you’re comparing job offers or reviewing your current benefits, don’t just look at the list. Consider these factors:

- Your Personal Needs: Do you have a family? Are you planning to start one? Do you have chronic health conditions? Are you debt-free or looking to save aggressively for a house? Your life stage and personal situation will heavily influence which employee benefits are most valuable to you.

- Costs Involved: Understand the premiums you’ll pay for insurance, deductibles, co-pays, and out-of-pocket maximums. A lower premium doesn’t always mean lower overall costs.

- The "Whole Picture": Don’t just focus on one benefit. A lower salary with amazing employee benefits (like a generous 401(k) match and comprehensive health insurance) might be better than a higher salary with minimal benefits.

- Flexibility and Customization: Do you have options within the plans? Can you choose between different health insurance tiers?

- Company Culture Around Benefits: Do employees actually use their PTO? Is there support for wellness programs? A great benefit on paper is only valuable if you feel comfortable taking advantage of it.

- Ask Questions: During the interview process or with HR, don’t hesitate to ask for detailed information about the employee benefits package. Get specific numbers and understand how things work.

Conclusion

Employee benefits are far more than just "nice-to-haves" – they are integral to your financial security, health, and overall quality of life. From the foundational health insurance and retirement plans that protect your future, to the myriad of other perks that support your daily well-being and professional growth, a robust employee benefits package is a clear sign of an employer who values their people.

Take the time to understand, evaluate, and appreciate the employee benefits available to you. They are a powerful tool for building a stable, healthy, and fulfilling career journey. Investing in your understanding of these benefits is truly an investment in yourself.

Post Comment