The Ultimate Guide to Elasticity of Demand and Supply in International Trade: A Beginner-Friendly Explanation

International trade is a complex dance of supply, demand, prices, and policies. To truly understand its dynamics, one must grasp a fundamental economic concept: elasticity. Far from being a dry academic term, elasticity is the secret sauce that explains why some products command high prices regardless of market changes, while others are highly sensitive to even minor shifts.

This long, SEO-friendly guide will demystify elasticity, explaining its core principles for beginners and then diving deep into its crucial role in the fascinating world of international trade.

What Exactly is Elasticity? The Rubber Band Analogy

Imagine a rubber band. When you pull it, it stretches. How much it stretches depends on how much force you apply and how "stretchy" the rubber band itself is.

In economics, elasticity is similar to that "stretchiness" or "responsiveness." It measures how much one economic variable (like the quantity demanded or supplied) changes in response to a change in another variable (like price or income).

- Elastic: If a small change in one variable causes a large change in another, it’s considered elastic. Think of a very stretchy rubber band.

- Inelastic: If a large change in one variable causes only a small change in another, it’s considered inelastic. Think of a stiff, non-stretchy band.

- Unit Elastic: If the percentage change in one variable is exactly equal to the percentage change in another, it’s unit elastic.

Understanding this responsiveness is crucial for businesses, governments, and anyone involved in the global marketplace.

Part 1: Elasticity of Demand in International Trade

Elasticity of Demand (ED), specifically Price Elasticity of Demand (PED), measures how much the quantity demanded of a good changes when its price changes.

Simplified Concept:

- High PED (Elastic Demand): Consumers are very sensitive to price changes. If the price goes up, they buy much less. If the price goes down, they buy much more.

- Low PED (Inelastic Demand): Consumers are not very sensitive to price changes. Even if the price goes up significantly, they still buy almost the same amount.

Factors Influencing Price Elasticity of Demand (PED):

Several factors determine how elastic or inelastic the demand for a product is:

- Availability of Substitutes:

- Many Substitutes = Elastic: If there are many alternatives (e.g., different brands of smartphones, various types of fruit), consumers can easily switch if the price of one goes up.

- Few/No Substitutes = Inelastic: If a product is unique or has no close alternatives (e.g., life-saving medicine, a very specific rare earth mineral), consumers have fewer options and are less sensitive to price changes.

- Necessity vs. Luxury:

- Necessity = Inelastic: Essential goods like basic food, water, or electricity often have inelastic demand because people need them regardless of price.

- Luxury = Elastic: Non-essential items like designer clothes, high-end electronics, or exotic vacations often have elastic demand. People can easily forgo them if prices rise.

- Proportion of Income Spent:

- Large Proportion = Elastic: If a product represents a significant part of a consumer’s budget (e.g., a car, a house), they are more sensitive to price changes.

- Small Proportion = Inelastic: For inexpensive items (e.g., a stick of gum, a single match), a price change won’t significantly impact purchasing decisions.

- Time Horizon:

- Long-Run = More Elastic: Over a longer period, consumers have more time to find substitutes, adjust their habits, or adapt to price changes. For example, if gas prices rise, immediately people might still drive, but over time they might buy more fuel-efficient cars or use public transport.

- Short-Run = More Inelastic: In the immediate term, consumers have limited options and react less to price changes.

- Definition of the Market:

- Narrowly Defined Market = More Elastic: "Green apples" might have elastic demand because there are many other apple types or fruits.

- Broadly Defined Market = More Inelastic: "Fruit" in general would have more inelastic demand because there are fewer direct substitutes for the entire category.

PED’s Critical Role in International Trade:

Understanding PED is paramount for countries, exporters, and importers navigating the global market.

-

Pricing Strategies for Exporters:

- Exporting Elastic Goods: If a country exports goods for which international demand is highly elastic (e.g., textiles, generic electronics, agricultural commodities), it has limited power to raise prices. Even a small price increase could lead to a significant drop in export volume as foreign buyers switch to competitors or substitutes. To maintain market share and revenue, exporters must be very competitive on price.

- Exporting Inelastic Goods: If a country exports goods for which international demand is inelastic (e.g., unique natural resources like rare earth minerals, specialized high-tech components, essential medicines), it has more pricing power. They can raise prices without a drastic reduction in demand, potentially boosting export revenue significantly.

-

Impact of Tariffs and Trade Barriers:

- Tariffs on Elastic Imports: If a country imposes a tariff on an import with elastic demand, the quantity imported will likely fall sharply. Consumers can easily find domestic substitutes or do without. This can be an effective way to protect domestic industries.

- Tariffs on Inelastic Imports: If a country imposes a tariff on an import with inelastic demand (e.g., essential raw materials, specialized machinery not produced domestically), the quantity imported will not fall significantly. The burden of the tariff (higher prices) will largely be passed on to domestic consumers or industries that rely on that import. This can lead to inflation and higher production costs for domestic businesses.

-

Exchange Rate Fluctuations:

- Stronger Currency (Exports More Expensive): If a country’s currency strengthens, its exports become more expensive for foreign buyers.

- If demand for these exports is elastic, the quantity demanded will fall sharply, negatively impacting export revenue.

- If demand for these exports is inelastic, the quantity demanded will not fall as much, cushioning the blow to export revenue.

- Weaker Currency (Imports More Expensive): If a country’s currency weakens, imports become more expensive.

- If demand for these imports is elastic, the quantity demanded will fall significantly, helping to reduce the trade deficit.

- If demand for these imports is inelastic, the quantity demanded will not fall much, leading to higher import costs and potentially worsening the trade deficit.

- Stronger Currency (Exports More Expensive): If a country’s currency strengthens, its exports become more expensive for foreign buyers.

-

Revenue Maximization for Exporting Nations:

- A nation seeking to maximize its export revenue needs to understand the PED of its key exports.

- If demand is elastic, revenue is maximized by lowering prices (selling more at a slightly lower price).

- If demand is inelastic, revenue is maximized by raising prices (selling slightly less at a much higher price).

Part 2: Elasticity of Supply in International Trade

Elasticity of Supply (ES), specifically Price Elasticity of Supply (PES), measures how much the quantity supplied of a good changes when its price changes.

Simplified Concept:

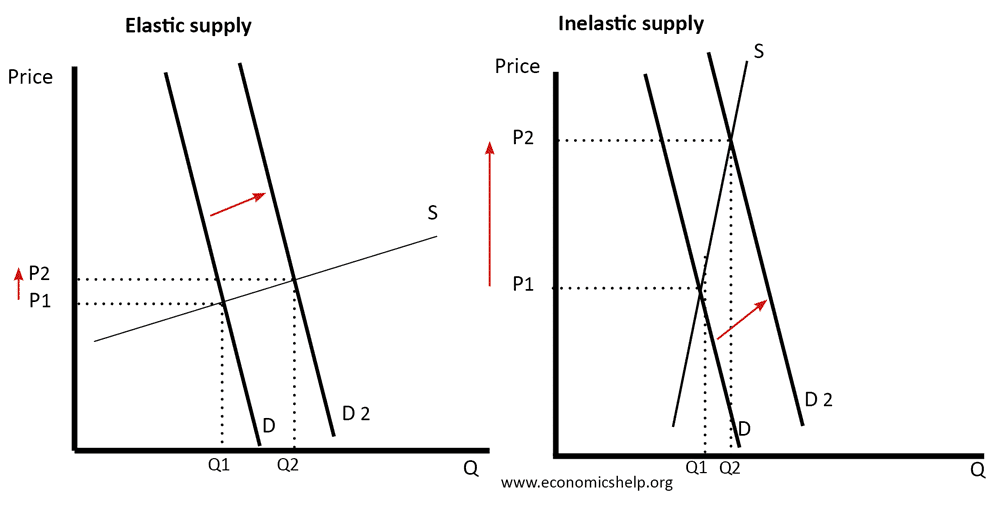

- High PES (Elastic Supply): Producers are very responsive to price changes. If the price goes up, they can easily and quickly increase production. If the price goes down, they can easily and quickly decrease production.

- Low PES (Inelastic Supply): Producers are not very responsive to price changes. Even if the price goes up significantly, they can only slightly increase production.

Factors Influencing Price Elasticity of Supply (PES):

- Time Horizon:

- Long-Run = More Elastic: Over a longer period, producers have enough time to expand factories, train more workers, acquire new technology, or even build new production facilities.

- Short-Run = More Inelastic: In the immediate term, production capacity is fixed. Firms can only increase output by using existing resources more intensively (e.g., overtime), but major expansion is not possible.

- Momentary Supply: In some cases (e.g., fresh fish caught today), supply is perfectly inelastic – it cannot be increased at all, regardless of price.

- Availability of Resources/Inputs:

- Readily Available = Elastic: If raw materials, labor, and machinery are easily obtainable, producers can quickly ramp up production.

- Scarce/Limited = Inelastic: If specialized labor, rare earth minerals, or unique land are required, supply will be inelastic.

- Production Capacity/Flexibility:

- Spare Capacity/Flexible Production = Elastic: Firms with unused machinery or the ability to easily switch production between different goods can respond quickly to price changes.

- Full Capacity/Rigid Production = Inelastic: Firms operating at full capacity or those with highly specialized, inflexible production processes will find it hard to increase supply quickly.

- Ease of Storage:

- Easy to Store = More Elastic: Products that can be easily stored (e.g., manufactured goods, grains) allow producers to hold inventory and release it when prices are favorable.

- Perishable/Difficult to Store = More Inelastic: Perishable goods (e.g., fresh produce, live animals) must be sold quickly, making supply less responsive to price changes in the short term.

PES’s Critical Role in International Trade:

PES is vital for understanding how global markets adjust to changes in demand and how countries can capitalize on or be limited by their production capabilities.

-

Global Price Stability vs. Volatility:

- Inelastic Global Supply: If the global supply of a commodity (e.g., oil, certain agricultural products) is inelastic, even a small increase or decrease in global demand can lead to very large swings in international prices. This can create instability for importing and exporting nations.

- Elastic Global Supply: If global supply is elastic, changes in demand will result in smaller price fluctuations, leading to more stable international markets.

-

A Country’s Export Potential and Responsiveness:

- Elastic Export Supply: A country with elastic supply for its export goods can quickly respond to increased international demand or higher global prices by ramping up production. This allows them to capture a larger share of the global market and boost export revenues.

- Inelastic Export Supply: A country with inelastic supply for its export goods (e.g., due to limited natural resources, lack of infrastructure, or rigid labor markets) cannot easily increase its exports, even if global prices are high. This limits their potential gains from international trade.

-

Impact of Quotas and Trade Agreements:

- Quotas on Inelastic Imports: If a country imposes a quota (a limit on quantity) on an import with inelastic supply from a foreign producer, the foreign producer cannot easily increase supply to circumvent the quota, making the quota more effective in restricting trade.

- Trade Agreements (e.g., Free Trade Agreements): These agreements aim to increase trade. For countries to fully benefit, their industries must have relatively elastic supply to meet the increased demand from partner countries.

-

Resource Allocation and Economic Restructuring:

- Over the long run, countries with more elastic supply in certain sectors can more easily shift resources (labor, capital) into those sectors that are experiencing higher global demand or prices. This allows for efficient resource allocation and can lead to economic growth through specialization in international trade.

Beyond the Basics: Other Key Elasticities in International Trade

While PED and PES are fundamental, two other types of elasticity offer deeper insights into global trade dynamics:

-

Cross-Price Elasticity of Demand (XED):

- What it is: Measures how the quantity demanded of one good changes when the price of another good changes.

- Positive XED: Goods are substitutes (e.g., coffee and tea). If the price of coffee rises, demand for tea increases. In international trade, this helps identify competing products from different countries.

- Negative XED: Goods are complements (e.g., cars and fuel). If the price of cars rises, demand for fuel might decrease. In trade, this is crucial for industries that rely on imported components or sell bundled products internationally.

- Relevance: Helps nations understand how price changes in competing or complementary imports/exports will affect their own trade balances and domestic industries. For instance, if a major exporter of palm oil sees a price drop in a substitute like soybean oil, they can anticipate a negative impact on their palm oil exports.

-

Income Elasticity of Demand (YED):

- What it is: Measures how the quantity demanded of a good changes when consumer income changes.

- Positive YED (Normal Goods): As income rises, demand for the good rises. Most goods fall into this category.

- YED > 1 (Luxury Goods): Demand rises more than proportionally with income (e.g., high-end electronics, international travel). Countries exporting luxury goods benefit significantly from rising global incomes.

- 0 < YED < 1 (Necessity Goods): Demand rises less than proportionally with income (e.g., basic food items). These exports are more stable during economic downturns.

- Negative YED (Inferior Goods): As income rises, demand for the good falls (e.g., cheap instant noodles might be replaced by fresh meals). Countries exporting inferior goods might see reduced demand as developing nations become wealthier.

- Relevance: Crucial for predicting the impact of global economic growth or recession on a country’s exports and imports. Nations whose exports have high YED are more vulnerable during global downturns but benefit greatly during booms.

Real-World Implications and Case Studies

- OPEC and Oil Prices: The Organization of the Petroleum Exporting Countries (OPEC) historically wields significant power because the global demand for oil is relatively inelastic in the short run (people need fuel for cars, heating, etc., and can’t switch easily). By collectively restricting supply (making supply more inelastic), OPEC can cause significant price increases, demonstrating the power of controlling supply of an inelastic good.

- Luxury Goods vs. Staple Foods: Demand for luxury cars (high PED, high YED) is highly sensitive to price changes and global income fluctuations. Exporters of luxury cars face intense competition and are hit hard during recessions. In contrast, staple foods like rice or wheat have inelastic demand (low PED, low YED), making their trade volumes more stable, even if price changes are less impactful on revenue.

- Technological Advancements: When a revolutionary new product enters the market (e.g., the first smartphone), its demand is initially highly inelastic because there are no substitutes. This allows the pioneering company/country to charge premium prices. Over time, as competitors emerge and substitutes become available, the demand for that specific product becomes more elastic.

Key Takeaways for International Trade

- Elasticity is about Responsiveness: How much quantity demanded or supplied changes due to price or income shifts.

- Elastic = Sensitive: Large response to changes.

- Inelastic = Insensitive: Small response to changes.

- For Exporters:

- Elastic Demand: Focus on competitive pricing, volume, and differentiation. Vulnerable to price increases.

- Inelastic Demand: More pricing power, potential for higher revenues through price hikes.

- For Importers:

- Elastic Demand: Tariffs/quotas significantly reduce imports.

- Inelastic Demand: Tariffs/quotas mainly increase costs for domestic consumers/industries.

- For Suppliers (Countries):

- Elastic Supply: Can quickly respond to global demand/price changes, seize opportunities.

- Inelastic Supply: Limited ability to increase exports, constrained by resources/capacity.

- Cross-Price & Income Elasticity: Help predict how demand for one good is affected by prices of other goods or changes in global income, crucial for strategic trade planning.

Conclusion

Elasticity is not just a theoretical concept; it’s a vital tool for understanding and navigating the intricate world of international trade. For nations, businesses, and policymakers, grasping the responsiveness of demand and supply allows for more informed decisions regarding pricing, trade policies, investment in production, and strategic positioning in the global marketplace. By analyzing the "stretchiness" of various markets, players in international trade can better predict outcomes, manage risks, and unlock opportunities for growth and prosperity.

Post Comment