The "Too Big to Fail" Dilemma: Why Some Banks Pose a Risk to Us All

Imagine a tiny corner shop going out of business. It’s sad for the owners and a few customers, but it doesn’t shake the entire economy. Now, imagine a giant, sprawling supermarket chain with thousands of stores, millions of customers, and connections to countless suppliers worldwide. If that supermarket chain suddenly collapsed, the ripple effects would be enormous – job losses, empty shelves, suppliers going bankrupt, and a general panic.

In the world of finance, some banks are like that giant supermarket chain, only even bigger and more interconnected. These are the "Too Big to Fail" (TBTF) institutions. The idea is simple: their collapse would be so catastrophic for the global economy that governments feel compelled to step in and rescue them, often using taxpayer money.

This isn’t just an abstract concept; it’s a real and complex dilemma that has shaped our financial landscape, especially since the 2008 financial crisis. This article will break down the "Too Big to Fail" problem, explain its consequences, and explore the ongoing efforts to solve it, all in easy-to-understand language.

What Exactly Does "Too Big to Fail" Mean?

At its core, "Too Big to Fail" describes a financial institution (usually a bank) that is so large and so deeply intertwined with the global financial system that its sudden failure would trigger a widespread economic collapse – a sort of financial "domino effect."

Think of it like this:

- Size: These banks hold trillions of dollars in assets, manage countless accounts for individuals and businesses, and employ hundreds of thousands of people.

- Interconnectedness: They lend money to other banks, borrow from them, trade complex financial products, and process vast numbers of transactions every second. They are the "plumbing" of the financial system.

- Global Reach: Many TBTF banks operate across multiple countries, meaning their problems can quickly spread across borders.

If such a bank were to go bankrupt, it wouldn’t just be its shareholders and employees who suffer. Its failure could:

- Cause other banks it owes money to also fail.

- Freeze credit markets, making it impossible for businesses to get loans.

- Trigger a massive loss of confidence, leading people to withdraw their money from all banks.

- Ultimately, plunge entire economies into a deep recession or even a depression.

Because the potential consequences are so dire, governments often feel they have no choice but to rescue these banks, even if it means using public funds. This is where the dilemma truly begins.

Why Are Banks "Too Big to Fail"? The Roots of the Problem

The problem of "Too Big to Fail" didn’t emerge overnight. It’s a result of several factors that have evolved over decades:

1. Mergers and Acquisitions: The Quest for Size

Over time, many banks have grown by acquiring smaller banks or merging with competitors. This consolidation was driven by a desire for:

- Economies of Scale: Bigger banks can often operate more efficiently and offer a wider range of services.

- Market Dominance: Larger size means more power and a bigger slice of the financial pie.

- Diversification: Operating in many different areas (retail banking, investment banking, asset management) can theoretically reduce risk – but it also increases complexity.

2. Complex Financial Products and Interconnectedness

Modern banking isn’t just about taking deposits and making loans. Banks are involved in:

- Derivatives: Complex financial contracts whose value is derived from an underlying asset. These can be used for hedging or speculation, but they also create vast, often opaque, webs of obligations between institutions.

- Interbank Lending: Banks constantly lend money to and borrow from each other to manage their daily cash flows. If one major bank stops lending, or cannot repay, it creates a ripple effect.

- Payment Systems: Banks are essential for processing all our daily transactions, from swiping a credit card to wiring money internationally. A disruption here would bring the economy to a halt.

This deep interconnectedness means that a problem in one part of the system can quickly spread throughout, much like a virus.

3. Global Reach and Regulatory Gaps

Many of the largest banks operate across dozens of countries, making them truly global entities. This poses challenges for regulators because:

- Jurisdiction Issues: Which country’s laws apply when a global bank gets into trouble?

- Information Sharing: Regulators in different countries might not share enough information or have consistent rules.

- Contagion: A crisis originating in one country’s operations can quickly spread to its branches or subsidiaries worldwide.

The Consequences of the "Too Big to Fail" Dilemma

The existence of TBTF banks creates several significant problems for the economy and society:

1. Moral Hazard: The "Heads I Win, Tails You Lose" Problem

This is perhaps the most significant consequence. "Moral hazard" occurs when one party takes on more risk because another party bears the cost of that risk.

- For TBTF Banks: If bank executives know their institution is "Too Big to Fail," they might be more inclined to take on excessive risks. Why? Because they believe that if their risky bets pay off, they (and their shareholders) reap huge profits. But if the bets go wrong and the bank faces collapse, the government (and taxpayers) will step in to bail them out, preventing a total loss.

- No Real Consequences: This creates a system where the rewards are privatized, but the losses are socialized. It removes the natural market discipline that would otherwise punish reckless behavior.

2. The Burden on Taxpayers

When a TBTF bank is bailed out, it’s typically done using public funds – your tax money. This means:

- Diversion of Funds: Money used for bailouts could have been spent on public services like education, infrastructure, or healthcare.

- Increased National Debt: Bailouts add to government debt, which future generations will have to repay.

- Public Anger: It creates immense public resentment when ordinary citizens are asked to foot the bill for the mistakes of highly paid bankers.

3. Unfair Competition

TBTF banks often enjoy an unfair advantage over smaller financial institutions. Because they have an implicit government guarantee (the belief that they will be bailed out), they can:

- Borrow More Cheaply: Lenders are more willing to lend to them at lower interest rates because they perceive less risk.

- Attract More Customers: Customers might feel their money is safer in a TBTF bank.

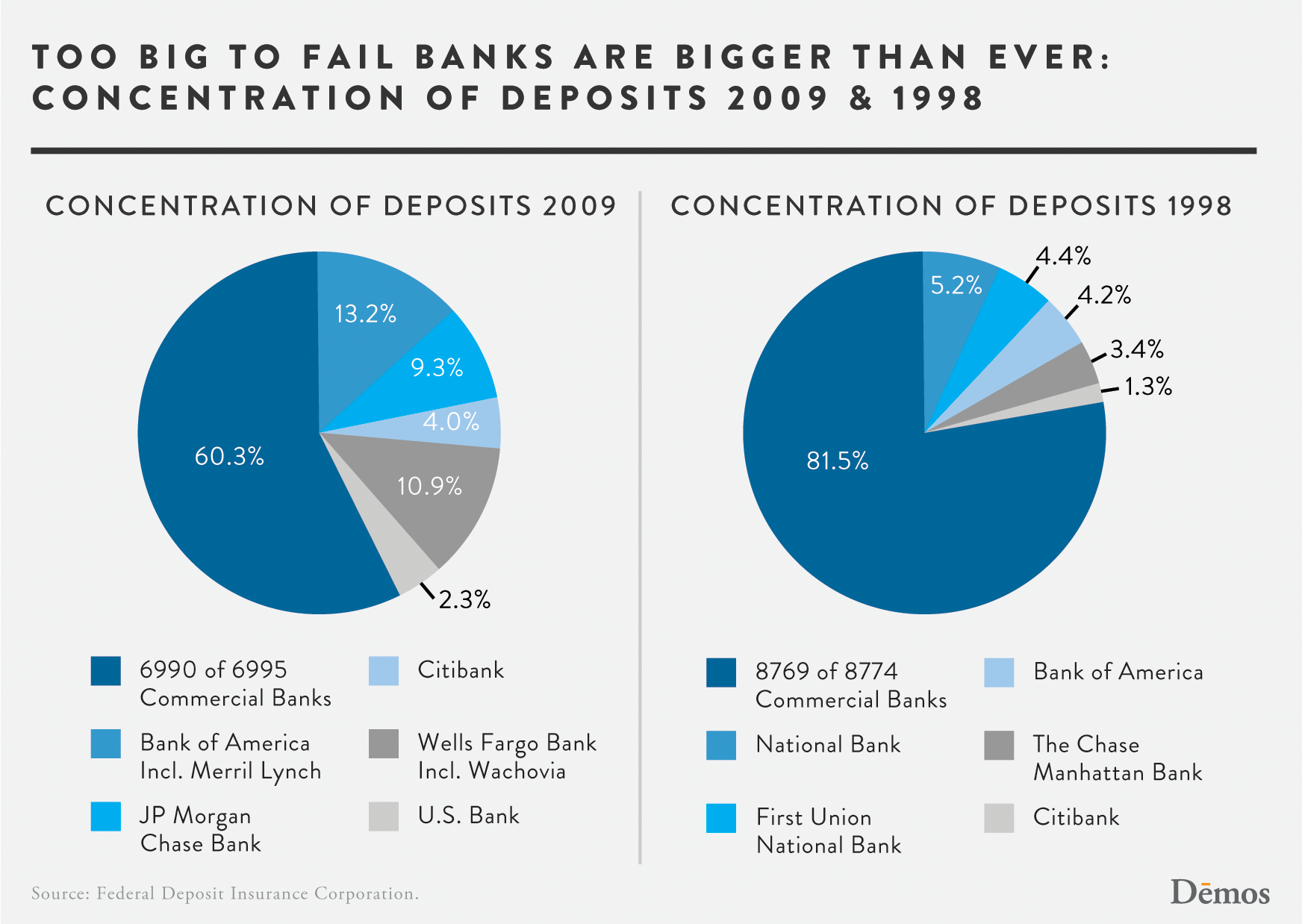

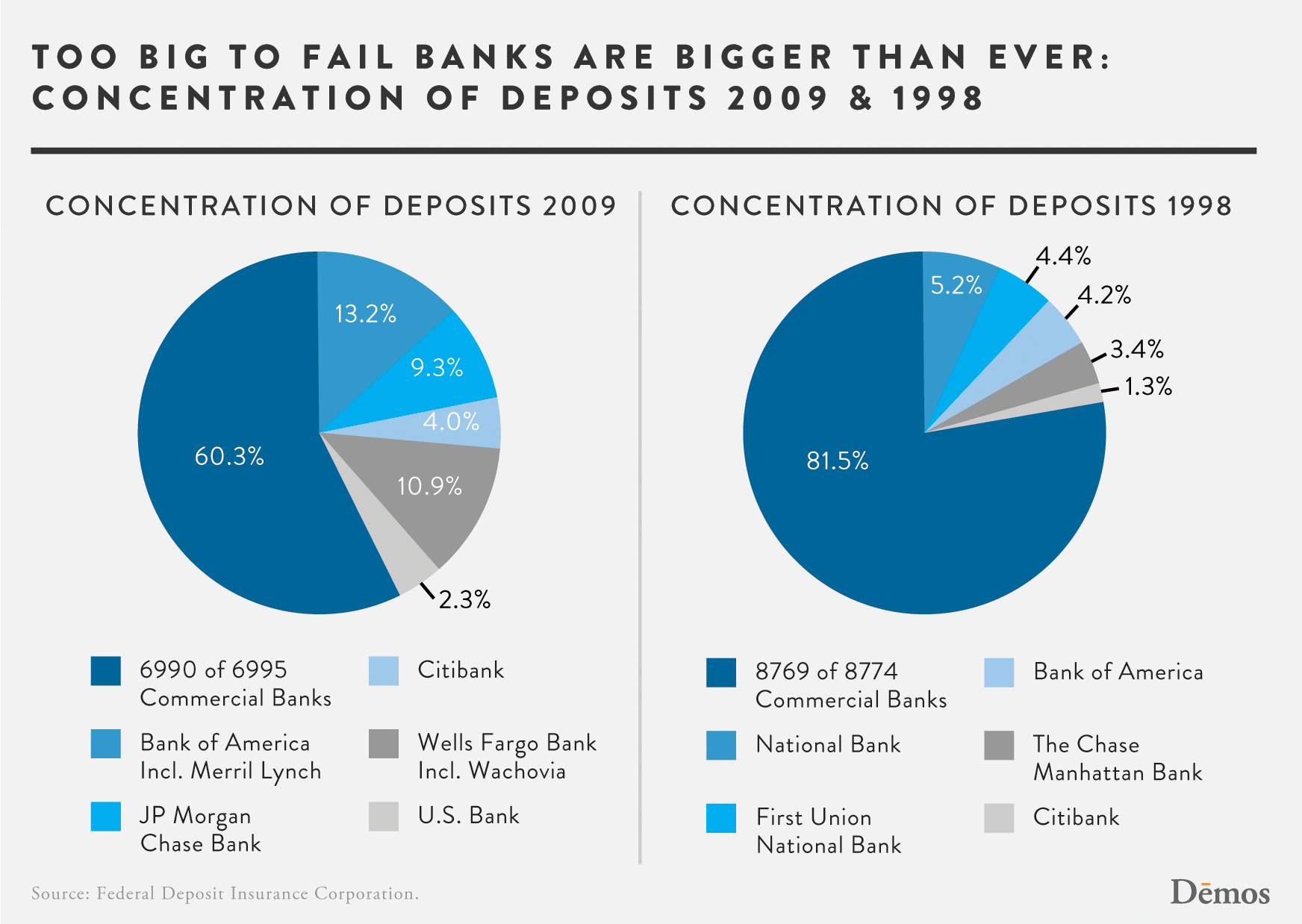

This can stifle competition, make it harder for smaller banks to grow, and lead to an even greater concentration of power in a few large institutions.

4. Systemic Risk

Even with bailouts, the very existence of TBTF banks means the entire financial system remains vulnerable. If a crisis does occur, the sheer scale of the potential problem means the government’s response will be massive and disruptive, potentially leading to:

- Economic Downturns: Recessions, job losses, and reduced economic activity.

- Loss of Confidence: People losing trust in the financial system and the government.

A Glimpse into History: The 2008 Financial Crisis

The "Too Big to Fail" dilemma was starkly illustrated during the 2008 global financial crisis.

- The Spark: The crisis began with a collapse in the U.S. housing market, leading to widespread defaults on subprime mortgages (loans given to borrowers with poor credit).

- The Domino Effect: Many large banks had invested heavily in complex financial products tied to these mortgages. When the housing market crashed, the value of these investments plummeted, leaving banks facing massive losses.

- Lehman Brothers: In September 2008, the investment bank Lehman Brothers, a large and interconnected firm, was not bailed out and went bankrupt. Its collapse sent shockwaves through the global financial system, freezing credit markets and threatening other major institutions.

- The Bailouts: Fearing a complete meltdown, the U.S. government, along with other governments worldwide, stepped in to rescue other struggling giants like AIG (an insurance company that had insured many of the problematic investments) and provide massive support to banks like Citigroup and Bank of America. These bailouts were unprecedented in size and scope, costing taxpayers hundreds of billions of dollars.

The 2008 crisis made it painfully clear that some institutions were indeed "Too Big to Fail," and the cost of letting them collapse was deemed too high. This experience spurred a global effort to address the TBTF problem.

Solutions and Reforms: Trying to Tame the Giants

Since 2008, regulators and governments around the world have implemented various measures to address the "Too Big to Fail" dilemma. Here are some key approaches:

1. Increased Capital Requirements

- What it means: Banks are now required to hold more of their own money (capital) as a cushion against losses. Think of it as a "rainy day fund."

- Why it helps: More capital means banks are less likely to become insolvent during tough times, reducing the need for taxpayer bailouts. The Basel III international agreement sets these standards globally.

2. "Living Wills" (Resolution Plans)

- What it means: Large, complex banks are now required to create detailed plans (often called "living wills") outlining how they would be safely wound down in the event of failure, without causing systemic chaos or requiring a taxpayer bailout.

- Why it helps: These plans aim to make the process of failing more orderly and manageable, much like having an emergency exit plan for a large building.

3. Enhanced Supervision and Stress Tests

- What it means: Regulators now subject large banks to rigorous "stress tests." These are simulations that examine how banks would fare under severe economic shocks (e.g., a deep recession, a sudden stock market crash, a real estate collapse).

- Why it helps: Stress tests help identify vulnerabilities before they become critical problems and ensure banks have enough capital to withstand extreme events.

4. The Dodd-Frank Wall Street Reform and Consumer Protection Act (U.S.)

- What it means: Passed in the U.S. in 2010, this massive piece of legislation introduced sweeping reforms aimed at preventing another financial crisis. It established the Financial Stability Oversight Council (FSOC) to identify and monitor systemic risks and gave regulators new powers to oversee large, non-bank financial institutions.

- Why it helps: It sought to bring more parts of the financial system under scrutiny and provide tools to manage the failure of large firms.

5. International Cooperation

- What it means: Regulators and central banks from different countries are working more closely together through bodies like the Financial Stability Board (FSB) to coordinate policies and share information.

- Why it helps: Since TBTF banks operate globally, a coordinated international approach is essential to manage risks effectively.

6. Debate: Breaking Up the Banks?

- What it means: Some critics argue that the only way to truly solve the TBTF problem is to break up the largest banks into smaller, less complex entities.

- Why it helps (proponents’ view): Smaller banks would be less interconnected, less likely to cause systemic risk, and more likely to be allowed to fail without government intervention.

- Why it’s controversial (opponents’ view): Opponents argue that breaking up banks would reduce efficiency, hinder global competitiveness, and might not solve the underlying problem of interconnectedness.

The Ongoing Debate: Are We There Yet?

Despite significant reforms, the "Too Big to Fail" dilemma remains a hotly debated topic.

- Are Banks Still Too Big? While some banks have restructured, many are still enormous. Critics argue that the reforms haven’t fundamentally changed the underlying structure of the financial system.

- The Shadow Banking System: Many financial activities now happen outside traditional banks, in what’s known as the "shadow banking system" (e.g., hedge funds, money market funds, private equity). These entities are less regulated but can also become "Too Big to Fail" if they grow large and interconnected enough.

- Political Will: Implementing and enforcing strict regulations requires consistent political will, which can ebb and flow depending on the economic climate and political priorities.

- The Global Challenge: As financial markets become even more integrated globally, coordinating effective regulation across all countries remains a monumental task.

The goal is to create a financial system where banks can fail without bringing down the entire economy, ensuring that market discipline applies to all institutions, regardless of their size. This would reduce the moral hazard and protect taxpayers from future bailouts.

Conclusion: An Enduring Challenge

The "Too Big to Fail" dilemma is one of the most profound and persistent challenges facing the global financial system. It’s a balancing act between fostering innovation and growth in finance, and ensuring stability and protecting ordinary citizens from the fallout of reckless risk-taking.

While significant strides have been made since the 2008 crisis, the problem is far from solved. Regulators, policymakers, and the public continue to grapple with fundamental questions: How big is too big? How much risk is acceptable? And who should bear the cost when things go wrong?

Understanding the "Too Big to Fail" problem is crucial for anyone interested in how our economy works, why financial crises happen, and how governments try to prevent them. It’s a reminder that even the biggest institutions are not immune to the forces of the market, but their failures can have consequences that extend far beyond their boardrooms.

Key Takeaways:

- "Too Big to Fail" (TBTF) refers to financial institutions whose collapse would devastate the economy, forcing governments to rescue them.

- Causes: Bank mergers, complex financial products, and global interconnectedness have led to the growth of TBTF banks.

- Consequences: The TBTF dilemma creates moral hazard (banks take more risks knowing they’ll be bailed out), burdens taxpayers, fosters unfair competition, and increases systemic risk.

- 2008 Crisis: The financial meltdown of 2008 highlighted the TBTF problem, leading to massive government bailouts.

- Solutions: Reforms include higher capital requirements, "living wills," stress tests, and increased international cooperation.

- Ongoing Debate: The debate continues over whether current reforms are sufficient and if breaking up the largest banks is necessary.

Post Comment