The Time Value of Money: Why a Dollar Today is Worth More Than Tomorrow (A Beginner’s Guide)

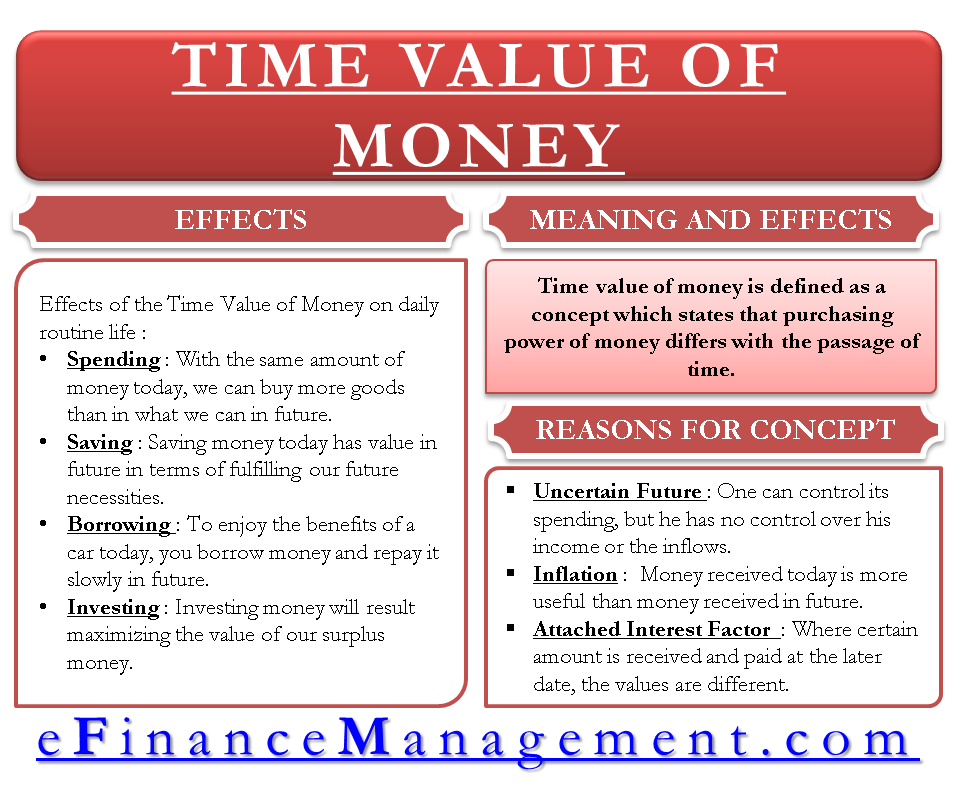

Have you ever heard the saying, "A bird in the hand is worth two in the bush"? In the world of finance, there’s a similar, equally powerful concept: The Time Value of Money (TVM). It’s the fundamental principle that states a sum of money today is worth more than the same sum of money at some point in the future.

Why is this true? It’s not just a fancy financial theory; it’s a practical reality driven by factors like inflation, opportunity cost, and the potential for earnings. Understanding TVM is like gaining a superpower for your personal finances and business decisions. It allows you to compare financial opportunities across different timeframes, making smarter choices about saving, investing, borrowing, and planning for your future.

In this comprehensive guide, we’ll break down the Time Value of Money into easy-to-understand concepts, explore its core components, show you how it works with real-world examples, and explain why mastering it is crucial for your financial success.

What Exactly is the Time Value of Money (TVM)?

At its heart, the Time Value of Money is the idea that money available right now is more valuable than the identical sum in the future due to its potential earning capacity. If you have $100 today, you can invest it, and it could grow to $105 or $110 next year. If you receive that $100 a year from now, you miss out on that year of potential growth.

Think of it this way:

- Would you rather have $1,000 today or $1,000 in one year? Most people would choose today. Why? Because you can do something with that $1,000 now.

This preference for money today isn’t just about instant gratification; it’s rooted in several economic realities:

- Inflation: The purchasing power of money decreases over time due to inflation. What $100 buys today will likely cost more in the future. So, $100 next year will buy you less than $100 today.

- Opportunity Cost: Having money today means you can invest it or use it to generate returns. If you wait to receive the money, you lose out on the opportunity to earn interest or profits during that waiting period. This lost potential gain is your opportunity cost.

- Risk/Uncertainty: There’s always a risk that you might not receive the money in the future (e.g., the person promising it defaults, or unforeseen circumstances arise). Money in hand today eliminates that future uncertainty.

Understanding these factors is the first step to truly grasping the power of TVM.

The Building Blocks of TVM: Key Variables You Need to Know

To work with the Time Value of Money, you need to understand the main components that influence its calculations. Don’t worry, we’ll keep the math simple and focus on the concepts.

- Present Value (PV): This is the current value of a future sum of money or stream of cash flows. It’s what that future money is worth today.

- Example: If you’re promised $1,000 in five years, what is that promise truly worth in today’s dollars, considering you could invest money now and earn a return?

- Future Value (FV): This is the value of an investment or a sum of money at a specified date in the future. It’s what your money today will grow into.

- Example: If you invest $1,000 today at a certain interest rate, how much will it be worth in five years?

- Interest Rate (i or r): Also known as the discount rate, required rate of return, or growth rate. This is the rate at which money grows over time (for future value) or the rate at which future money is "discounted" back to the present (for present value). It represents the cost of borrowing money or the return on an investment.

- Example: If your savings account offers 2% interest, that’s your interest rate. If you expect a 7% return on your stock investments, that’s your expected rate.

- Number of Periods (n): This refers to the total number of compounding or discounting periods. It’s usually expressed in years, but it can also be months, quarters, or any other defined period depending on how often interest is calculated.

- Example: If you’re planning for a goal five years from now, and interest is compounded annually, then n = 5 periods. If compounded monthly, n = 60 periods (5 years * 12 months/year).

- Payment (PMT): This refers to a series of equal payments or receipts occurring at regular intervals. This is used when dealing with annuities (like mortgage payments, rent, or regular savings contributions).

- Example: If you contribute $100 to your retirement account every month, that’s a payment (PMT).

Compounding vs. Discounting: The Two Sides of the TVM Coin

The Time Value of Money concept plays out in two primary ways: compounding and discounting. These are essentially two sides of the same coin, helping us understand how money changes value over time.

1. Compounding: The Power of Growth (Calculating Future Value)

Compounding is the process of earning returns on your initial investment and on the accumulated interest from previous periods. It’s often called "interest on interest" and is the engine behind wealth creation. When you calculate the future value (FV) of a sum, you are essentially compounding.

How it Works (The Snowball Effect):

Imagine a small snowball rolling down a hill. As it rolls, it picks up more snow, getting bigger and bigger. The bigger it gets, the more snow it picks up in each rotation. Compounding works similarly: your money earns interest, and then that interest starts earning interest too, accelerating the growth.

Example:

Let’s say you invest $1,000 (PV) today at an annual interest rate (i) of 5%. You want to know its Future Value (FV) in 1 year (n), 5 years (n), and 10 years (n).

-

Year 1:

- Starting with $1,000

- Interest earned: $1,000 * 0.05 = $50

- FV at Year 1: $1,000 + $50 = $1,050

-

Year 2:

- Starting with $1,050 (your new principal)

- Interest earned: $1,050 * 0.05 = $52.50

- FV at Year 2: $1,050 + $52.50 = $1,102.50

Notice how the interest earned in Year 2 ($52.50) is more than in Year 1 ($50) because you’re earning interest on the previously earned interest. This effect becomes much more significant over longer periods.

- FV at Year 5 (approx.): $1,276.28

- FV at Year 10 (approx.): $1,628.89

This simple example highlights the incredible power of compounding, especially over extended periods. The earlier you start investing, the more time your money has to compound.

2. Discounting: Valuing Future Money Today (Calculating Present Value)

Discounting is the reverse of compounding. It’s the process of determining the present value (PV) of a future sum of money. In other words, it answers the question: "What is a sum of money I expect to receive in the future worth to me today?"

How it Works (Reverse Engineering):

Think of it like peeling back layers. If compounding adds interest to grow money forward, discounting removes interest to bring money backward in time. You’re figuring out how much you would need to invest today at a given interest rate to reach a specific future amount.

Example:

You want to have $5,000 (FV) in 5 years (n) to make a down payment on a car. If you can earn an annual interest rate (i) of 6% on your savings, how much do you need to invest today (PV) to reach that goal?

- This calculation effectively "discounts" that $5,000 back to today’s value, considering the 6% return you could earn over five years.

- The Present Value (PV) you would need to invest today is approximately $3,736.29.

This means if you invest $3,736.29 today at 6% interest compounded annually, it will grow to approximately $5,000 in five years. Discounting is vital for making decisions where you’re evaluating future obligations or potential income streams.

Beyond Theory: Real-World Applications of the Time Value of Money

The Time Value of Money isn’t just for financial professionals. It’s a fundamental concept that underpins many everyday financial decisions. Here’s how it applies to your life:

-

Retirement Planning: This is perhaps the most significant application of TVM.

- Compounding: The earlier you start saving for retirement, the less you need to contribute overall to reach a large nest egg, thanks to the power of compounding. A 25-year-old investing $300/month will likely have significantly more than a 35-year-old investing $500/month, even if the total contributions are similar, simply because of more time for compounding.

- Discounting: When you calculate how much you need to save today to have a certain amount of income in retirement, you’re using present value calculations.

-

Loan Decisions (Mortgages, Car Loans, Student Loans):

- When you take out a loan, the bank is essentially giving you the present value of money, and you are agreeing to pay back the future value through a series of payments (annuity).

- Understanding TVM helps you see how interest rates and loan terms (number of periods) significantly impact the total amount you pay back over time. A slightly lower interest rate or a shorter loan term can save you thousands.

-

Investment Choices:

- Should you invest in a bond that pays a fixed amount in 10 years, or a stock that might grow significantly but has more risk? TVM helps you compare these different options by bringing all future cash flows back to a common present value.

- Comparing two investment opportunities that offer different returns over different periods requires TVM to make an "apples-to-apples" comparison.

-

Saving for a Down Payment or Big Purchase:

- If you need $20,000 for a down payment in 3 years, TVM helps you calculate how much you need to save each month or invest today to reach that goal, given an expected rate of return.

-

Business Decisions:

- Companies use TVM extensively to evaluate projects (e.g., building a new factory). They’ll calculate the Net Present Value (NPV) of future cash flows from a project to see if the project’s expected future earnings are worth the initial investment today.

- They also use it to determine the fair price to pay for another company or to value assets.

-

Lottery Winnings and Legal Settlements:

- If you win a large lottery prize, you often have a choice: a smaller lump sum today or larger payments spread out over many years. TVM calculations help you understand the present value of those future payments so you can make an informed decision. Often, the lump sum is the better financial choice due to immediate investment potential.

How to Leverage the Time Value of Money for Your Financial Success

Understanding TVM is one thing; actively using it to your advantage is another. Here are practical tips to harness its power:

- Start Saving and Investing Early: This is the golden rule of wealth building. The longer your money has to compound, the less principal you need to contribute to achieve your financial goals. Even small, consistent contributions can grow into substantial sums over decades.

- Prioritize High-Interest Debt Repayment: Just as compounding works for your investments, it works against you with debt. High-interest debt (like credit card debt) compounds rapidly, making it very expensive. Paying off these debts quickly is like earning a guaranteed, high rate of return on your money.

- Understand the Impact of Interest Rates: Whether you’re borrowing or investing, a small difference in the interest rate can have a massive impact over time. Shop around for the best rates on loans and seek investments with reasonable returns.

- Be Consistent with Your Contributions: Regular, disciplined saving and investing, even small amounts, are more effective than sporadic large contributions. Consistency ensures your money is always working for you.

- Reinvest Your Earnings: Whenever possible, reinvest any interest, dividends, or capital gains you earn. This allows those earnings to start compounding themselves, further accelerating your wealth growth.

- Use TVM Calculators: You don’t need to be a math whiz. Many free online TVM calculators (for Future Value, Present Value, etc.) are available. Use them to model different scenarios for your savings goals, loan repayments, and investment plans.

- Educate Yourself Continuously: The financial world is dynamic. Keep learning about different investment vehicles, financial products, and economic trends. The more you understand, the better you can apply TVM principles.

Conclusion: Your Financial Future Starts Today

The Time Value of Money is not just an academic concept; it’s the bedrock of sound financial planning and decision-making. By understanding that money today holds more power and potential than the same amount in the future, you unlock the ability to:

- Make smarter investment choices.

- Plan effectively for major life goals like retirement or a home purchase.

- Evaluate loans and debt more critically.

- Avoid costly financial mistakes.

The greatest lesson of TVM is that time is your most valuable asset when it comes to money. The sooner you start leveraging the power of compounding and making informed financial decisions based on the true value of money across time, the brighter your financial future will be. Don’t wait; start making your money work harder for you, today.

Post Comment