The Profound Impact of Credit on Your Financial Future: A Comprehensive Guide for Beginners

Imagine trying to build a house without a strong foundation. It wouldn’t stand for long, right? In the world of personal finance, your credit is that crucial foundation. It’s an unseen force, a quiet influencer that shapes nearly every major financial decision and opportunity you’ll encounter throughout your life.

For many, especially beginners, the concept of credit can seem mysterious, even intimidating. But understanding its power is not just for financial experts; it’s essential for everyone who wants to achieve their financial goals. This long, SEO-friendly article will demystify credit, explain its profound impact, and provide actionable steps to build and maintain a healthy credit profile, ensuring a brighter financial future.

What Exactly Is Credit? A Simple Explanation

At its core, credit is simply the ability to borrow money or access goods and services with the understanding that you’ll pay for them later. It’s based on trust – the lender (a bank, credit card company, etc.) trusts you to repay the borrowed amount, usually with interest, by an agreed-upon date.

Think of it like borrowing a friend’s car. They lend it to you because they trust you’ll return it on time, in good condition, and with gas. In the financial world, instead of a car, you’re borrowing money, and your "trustworthiness" is measured by your creditworthiness.

Common Types of Credit:

- Credit Cards: A revolving line of credit that allows you to borrow up to a certain limit, repay it, and then borrow again.

- Loans:

- Installment Loans: You borrow a fixed amount and repay it over a set period with fixed payments (e.g., car loans, personal loans, student loans).

- Mortgages: A large loan used to buy a home, repaid over many years.

- Lines of Credit: Similar to a credit card but often for larger amounts or specific purposes (e.g., home equity line of credit – HELOC).

The Cornerstone: Your Credit Score

When lenders decide whether to offer you credit, and on what terms, they primarily look at your credit score. This is a three-digit number, typically ranging from 300 to 850, that acts as a summary of your creditworthiness. The higher your score, the more financially responsible you appear.

The most widely used credit scoring model is FICO Score, though you might also hear of VantageScore. Both are designed to predict how likely you are to repay borrowed money.

Understanding Credit Score Ranges (General Guide):

- Excellent (800-850): Top-tier borrowers, qualify for the best rates and offers.

- Very Good (740-799): Strong borrowers, excellent rates.

- Good (670-739): Average borrowers, good rates.

- Fair (580-669): Subprime borrowers, may get approved but with higher interest rates.

- Poor (300-579): High-risk borrowers, difficult to get approved, very high interest rates if approved.

Why is this number so important? Because it influences virtually every aspect of your financial life.

How Credit Positively Impacts Your Financial Future

A strong credit history and a high credit score open doors to numerous opportunities and save you significant money over your lifetime.

-

Easier Access to Loans & Credit Cards:

- Mortgages: A good score is crucial for buying a home. Lenders want to see you can handle a large, long-term debt. A higher score means a better interest rate, saving you tens of thousands (or even hundreds of thousands) of dollars over the life of the loan.

- Car Loans: Similar to mortgages, a good score secures lower interest rates on car financing, reducing your monthly payments and total cost.

- Personal Loans & Student Loans: Easier approval and better terms for these essential financial tools.

- Credit Cards: Qualify for cards with lower interest rates, higher credit limits, and valuable rewards programs (cash back, travel points).

-

Lower Interest Rates: This is arguably the biggest benefit. Lenders view high-score individuals as less risky, so they charge less for the privilege of borrowing money. This translates to substantial savings on all types of loans.

-

Lower Insurance Premiums: In many states, insurance companies (auto, home, renter’s) use credit-based insurance scores to help determine your rates. A good credit history can lead to lower premiums.

-

Easier Rental Applications: Landlords often check your credit report to assess your reliability as a tenant. A strong score can give you an edge in competitive rental markets.

-

Utility & Service Connections: Utility companies (electricity, water, gas, internet) may check your credit. Good credit can mean waiving security deposits, making it easier and cheaper to set up new accounts.

-

Potential Employment Opportunities: While less common now, some employers, particularly those in financial roles or with access to sensitive information, may review your credit history. A responsible credit profile can reflect positively on your overall character.

-

Financial Flexibility & Emergency Preparedness: A healthy credit card with a decent limit can be a lifesaver in an unexpected emergency (medical bill, car repair) when you don’t have enough cash on hand.

The Downside: When Credit Goes Wrong

Just as good credit can open doors, poor credit can slam them shut, leading to significant financial stress and limited opportunities.

-

Difficulty Getting Approved: Banks and lenders will be hesitant to lend you money if your credit score is low. You might be denied for mortgages, car loans, personal loans, and even basic credit cards.

-

Higher Interest Rates: If you do get approved with bad credit, you’ll pay significantly higher interest rates. This means:

- A car loan that should cost you $300/month might be $450/month.

- Credit card interest rates could be 25% or more, making it incredibly difficult to pay off balances.

- You end up paying much more for the same product or service over time.

-

Limited Housing Options: Landlords may reject your rental application or demand a much larger security deposit.

-

Higher Insurance Premiums: As mentioned, poor credit can lead to higher insurance costs.

-

Security Deposits for Utilities: You might have to pay hefty security deposits just to get basic services like electricity or a cell phone plan.

-

Financial Stress & Debt Cycle: High interest rates and mounting debt can create a vicious cycle, making it nearly impossible to get ahead financially. The stress of constant debt can impact your mental and physical health.

-

Predatory Lending: When traditional lenders deny you, you might be tempted by high-cost alternatives like payday loans or title loans, which come with exorbitant fees and interest, trapping you further in debt.

Key Factors Influencing Your Credit Score

Understanding what goes into your credit score is the first step toward improving it. While the exact formulas are proprietary, the major credit bureaus (Experian, Equifax, TransUnion) and scoring models generally consider these factors:

-

Payment History (Approx. 35%):

- Most Important Factor! This shows whether you pay your bills on time.

- Good: Always paying on time.

- Bad: Late payments (even by a few days), collections, charge-offs, bankruptcies. A single 30-day late payment can significantly drop your score.

-

Amounts Owed / Credit Utilization (Approx. 30%):

- This measures how much of your available credit you’re currently using.

- Good: Keeping your credit utilization ratio low (ideally below 30% of your total available credit). For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300.

- Bad: Maxing out your credit cards or consistently using a high percentage of your available credit.

-

Length of Credit History (Approx. 15%):

- This considers how long your credit accounts have been open and how long it’s been since you used them.

- Good: A longer history of responsible credit use is generally better.

- Bad: Opening many new accounts quickly or closing old, established accounts.

-

New Credit (Approx. 10%):

- This looks at how many new credit accounts you’ve opened recently and the number of "hard inquiries" (when a lender checks your credit for a loan application).

- Good: Opening new accounts sparingly and only when needed.

- Bad: Opening too many new accounts in a short period, which can signal higher risk.

-

Credit Mix (Approx. 10%):

- This refers to the different types of credit you have (e.g., a mix of revolving credit like credit cards and installment loans like a car loan).

- Good: A healthy mix can show you can responsibly manage different types of debt.

- Bad: Only having one type of credit, or no credit at all.

Building a Strong Credit Foundation (Even as a Beginner)

If you’re new to credit or have a low score, don’t despair! Building good credit takes time and discipline, but it’s entirely achievable.

-

Start Small with a Secured Credit Card:

- These cards require a cash deposit, which typically becomes your credit limit. This minimizes risk for the lender.

- Use it for small, regular purchases you can immediately pay off (e.g., gas, groceries).

- Key: Pay your balance in full and on time every month. After 6-12 months of responsible use, the lender may convert it to a regular unsecured card and return your deposit.

-

Consider a Credit-Builder Loan:

- You make payments into an account, and once the loan is fully repaid, you receive the money.

- The payments are reported to credit bureaus, helping to establish positive payment history.

-

Become an Authorized User:

- Ask a trusted family member (e.g., a parent) with excellent credit to add you as an authorized user on one of their credit cards.

- Their good payment history will then appear on your credit report.

- Important: Ensure they are responsible with their credit, and ideally, don’t actually use the card yourself unless agreed upon.

-

Pay All Your Bills On Time, Every Time:

- This includes not just credit accounts, but also utility bills, rent, and student loans. While not all of these are reported to credit bureaus, a history of late payments can eventually show up and negatively impact your score. Some services (like Experian Boost or RentReporters) can help get your on-time rent and utility payments reported.

-

Keep Credit Utilization Low:

- As mentioned, try to keep your credit card balances below 30% of your available credit limit. Even better if you can keep it below 10%.

- Pay off your balance in full each month if possible.

-

Don’t Close Old Credit Accounts (Unless Necessary):

- The length of your credit history matters. Keeping older accounts open (even if you don’t use them regularly) contributes to a longer average age of accounts, which is good for your score.

-

Monitor Your Credit Report Regularly:

- You are entitled to a free credit report from each of the three major bureaus (Experian, Equifax, TransUnion) once every 12 months via AnnualCreditReport.com.

- Check for errors or signs of identity theft. Dispute any inaccuracies immediately.

-

Be Patient: Building good credit is a marathon, not a sprint. It takes consistent, responsible behavior over time.

Managing Debt Responsibly

If you already have credit, managing your debt is crucial for maintaining a healthy financial future.

- Create a Budget: Know exactly where your money is going. This helps you identify areas to cut back and free up funds for debt repayment.

- Prioritize High-Interest Debt: Focus on paying off credit cards and other loans with the highest interest rates first. This is often called the "debt avalanche" method and saves you the most money.

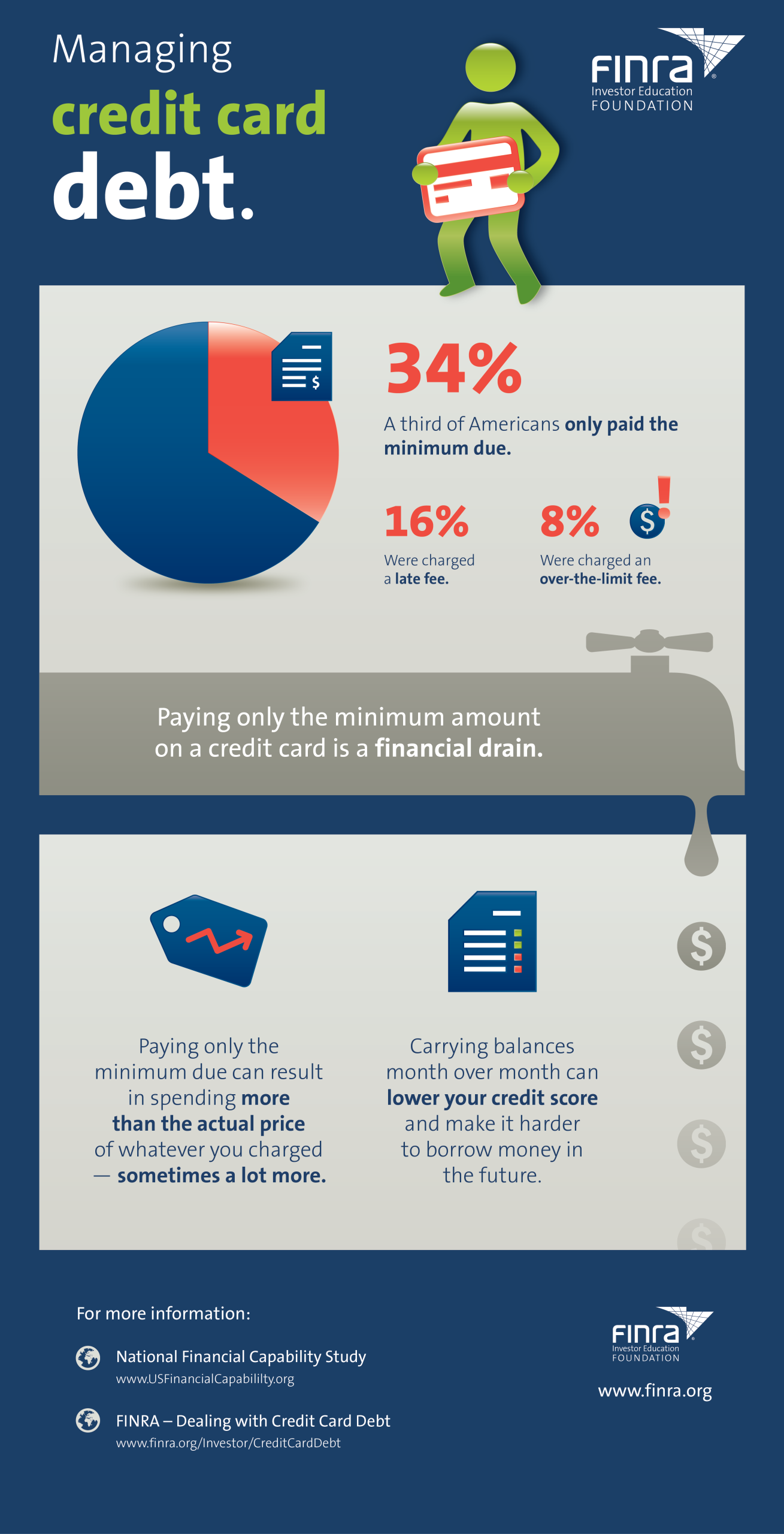

- Pay More Than the Minimum: While minimum payments keep you out of default, they do little to reduce your principal balance. Pay as much as you can afford.

- Avoid Taking on New Debt: While working to pay down existing debt, resist the urge to take on more.

- Consider Debt Consolidation (Carefully): If you have multiple high-interest debts, a debt consolidation loan or balance transfer credit card might help simplify payments and reduce interest. However, this only works if you stop accumulating new debt.

- Seek Professional Help: If you feel overwhelmed, consider contacting a non-profit credit counseling agency. They can help you create a debt management plan.

Protecting Your Credit: Safeguarding Your Financial Future

Your credit health can be vulnerable to fraud and identity theft. Proactive steps are essential:

- Monitor Your Statements: Review credit card and bank statements regularly for unauthorized charges.

- Check Your Credit Reports: As mentioned, get your free annual reports and scrutinize them for accounts you don’t recognize or inaccurate information.

- Use Strong, Unique Passwords: Especially for online banking and credit accounts.

- Be Wary of Phishing Scams: Don’t click suspicious links or provide personal information in response to unsolicited emails or calls.

- Shred Sensitive Documents: Before discarding, shred bills, credit card offers, and other documents containing personal information.

- Consider a Credit Freeze: If you’re concerned about identity theft, you can place a freeze on your credit reports with each of the three bureaus. This prevents new creditors from accessing your report, making it harder for identity thieves to open accounts in your name.

The Long-Term Vision: Credit as a Tool, Not a Crutch

Credit is not inherently good or bad; it’s a powerful financial tool. When used wisely, it can unlock opportunities, save you money, and provide flexibility. When misused, it can lead to a cycle of debt and financial hardship.

Your financial future is a marathon, not a sprint. Building and maintaining good credit is a continuous process that requires diligence and smart decision-making. By understanding the impact of credit, actively managing your credit score, and protecting your financial information, you are laying a strong foundation for a secure and prosperous life.

Frequently Asked Questions (FAQs) About Credit

Q1: How long does it take to build good credit?

A1: Generally, it takes at least 6-12 months of consistent, responsible credit use to establish a thin file. To achieve a "good" or "excellent" score (670+), it often takes several years of diligent management.

Q2: Does checking my credit score hurt it?

A2: No, checking your own credit score (a "soft inquiry") does not hurt it. This is why it’s encouraged to monitor your score regularly. A "hard inquiry," which happens when you apply for new credit (like a loan or credit card), can temporarily lower your score by a few points, but the impact is usually minor and short-lived.

Q3: What’s considered a "good" credit score?

A3: While definitions vary slightly, a FICO score of 670 or higher is generally considered "good." Scores above 740 are considered "very good," and 800+ is "excellent."

Q4: Should I close old credit card accounts I don’t use?

A4: Generally, no. Closing old accounts can negatively impact your credit score in two ways: it reduces your overall available credit (increasing your utilization ratio) and shortens your average length of credit history. It’s usually better to keep them open, even if you just use them for a small, recurring charge that you pay off immediately.

Q5: What if I have no credit history at all?

A5: This is known as having a "thin file." Start by applying for a secured credit card or a credit-builder loan. You can also ask a trusted family member to add you as an authorized user on their well-managed credit card. Some companies also report rent or utility payments, which can help.

By embracing these principles and making informed choices about credit, you empower yourself to navigate the financial world with confidence and unlock a future filled with opportunity. Start today – your financial future depends on it!

Post Comment