The Power of Dollar-Cost Averaging: Your Beginner’s Guide to Smarter Investing

The world of investing can often feel like a turbulent ocean. Market ups and downs, economic forecasts, and the constant stream of financial news can be overwhelming, leading many to hesitate or make impulsive decisions driven by fear or greed. But what if there was a simple, disciplined strategy that could help you navigate these choppy waters, reduce risk, and steadily build wealth over time?

Enter Dollar-Cost Averaging (DCA).

Often hailed as a cornerstone of smart, long-term investing, Dollar-Cost Averaging is a strategy that takes the emotion out of investing and puts the power of consistency to work for you. Whether you’re a complete beginner or looking to refine your investment approach, understanding DCA is crucial for achieving your financial goals.

What Exactly Is Dollar-Cost Averaging (DCA)?

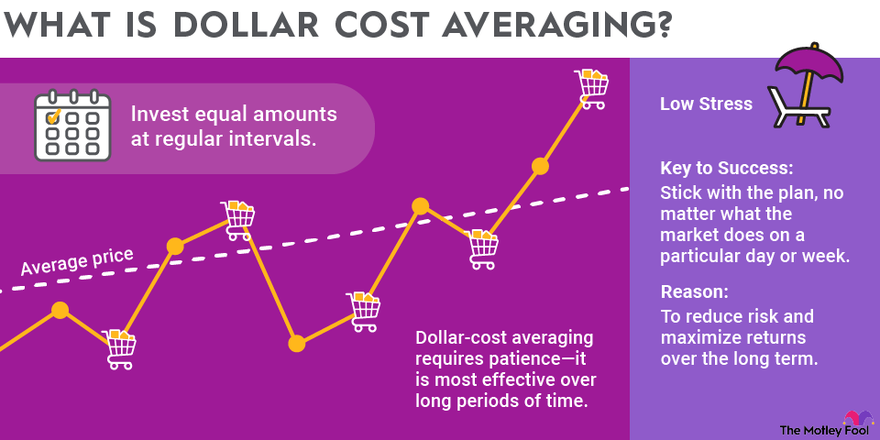

In its simplest form, Dollar-Cost Averaging is an investment strategy where you invest a fixed amount of money into a particular asset (like stocks, exchange-traded funds, mutual funds, or even cryptocurrency) at regular intervals, regardless of the asset’s price.

Instead of trying to "time the market" – buying when you think prices are low and selling when you think they’re high – DCA advocates for a consistent, scheduled approach.

Think of it like this: Imagine you’re buying groceries. Instead of trying to guess the absolute lowest price for milk and buying a year’s supply all at once, you simply buy a gallon every week or two, knowing that over time, the average price you pay will be reasonable. DCA applies this same logic to your investments.

How Does Dollar-Cost Averaging Work Its Magic?

The true genius of DCA lies in how it handles market volatility. By investing a fixed dollar amount regularly, you automatically buy:

- More shares when prices are low.

- Fewer shares when prices are high.

This strategy leads to a lower average cost per share over time compared to if you had invested a lump sum at a market peak. Let’s look at a simple example:

| Month | Investment Amount | Price Per Share | Shares Purchased |

|---|---|---|---|

| January | $100 | $10 | 10 |

| February | $100 | $8 | 12.5 |

| March | $100 | $12 | 8.33 |

| Total | $300 | 30.83 |

In this scenario, your total investment is $300, and you’ve accumulated 30.83 shares. Your average cost per share is $300 / 30.83 = $9.73. Notice how this is lower than the average of the prices ($10 + $8 + $12) / 3 = $10. This is the power of buying more shares when the price is low.

The Unstoppable Power of DCA: Key Benefits

Dollar-Cost Averaging isn’t just a strategy; it’s a financial philosophy that empowers investors with several significant advantages:

-

It Takes Emotion Out of Investing:

- Fear and greed are the biggest enemies of successful investors. When the market drops, fear often leads people to sell at a loss. When it soars, greed can push them to buy at the peak. DCA eliminates the need to make these emotionally charged decisions. You simply stick to your plan.

-

It Reduces Market Timing Risk:

- No one – not even the most seasoned professionals – can consistently predict the highs and lows of the market. Trying to "buy low and sell high" is incredibly difficult and often leads to missed opportunities or costly mistakes. DCA acknowledges this reality and bypasses the need for perfect timing altogether.

-

It Leverages Market Volatility to Your Advantage:

- Instead of fearing market dips, DCA actually turns them into opportunities. When prices fall, your fixed investment amount buys more shares, effectively "averaging down" your cost. When prices recover, you benefit from having accumulated more shares at a lower price.

-

It Fosters Discipline and Consistency:

- Successful investing is a marathon, not a sprint. DCA instills the discipline of regular savings and investing, which is a cornerstone of long-term wealth accumulation. Automating your investments makes this discipline effortless.

-

It Makes Investing Accessible to Everyone:

- You don’t need a large lump sum to start investing. With DCA, you can begin with relatively small, manageable amounts – perhaps $50, $100, or $200 – invested weekly, bi-weekly, or monthly. This makes investing achievable for people at all income levels.

-

It Harnesses the Power of Compounding:

- While not directly part of the DCA mechanism, consistency is key to unlocking compounding. By regularly investing, you give your money more time to grow, and that growth can then generate its own returns, creating a powerful snowball effect over the long term.

Is Dollar-Cost Averaging Always the Best Strategy?

While DCA is incredibly powerful, especially for beginners and long-term investors, it’s important to acknowledge a common debate. If you have a large lump sum of money available (e.g., an inheritance, a bonus), historical data sometimes suggests that investing the entire sum at once (lump-sum investing) can outperform DCA over very long periods, particularly in consistently rising markets.

However, this comes with a huge caveat: Lump-sum investing exposes you to the immediate risk of a market downturn right after your investment. For most people, especially those who receive income regularly rather than in large windfalls, and those who prioritize risk reduction and peace of mind, DCA remains the superior and more practical strategy. It mitigates the regret of investing at a market peak and provides a smooth, stress-free path to wealth building.

How to Implement Dollar-Cost Averaging in Your Portfolio

Putting DCA into practice is simpler than you might think:

-

Choose Your Investment Vehicle:

- ETFs (Exchange-Traded Funds): Popular for their diversification, low costs, and ease of trading. You can find ETFs that track broad markets (like the S&P 500), specific industries, or even global markets.

- Mutual Funds: Professionally managed funds that invest in a diversified portfolio of securities.

- Individual Stocks: While riskier for beginners, you can DCA into a few strong, blue-chip companies.

- Cryptocurrency: Many platforms now offer DCA features for Bitcoin, Ethereum, and other digital assets. (Note: Crypto is highly volatile and carries significant risk).

- Robo-Advisors: These automated platforms are excellent for DCA, allowing you to set up recurring investments into diversified portfolios tailored to your risk tolerance.

-

Determine Your Investment Amount and Frequency:

- Decide how much you can comfortably invest without impacting your essential living expenses. Even $25 or $50 a week or bi-weekly can make a difference over time.

- Choose a frequency that aligns with your income (e.g., weekly, bi-weekly, monthly).

-

Automate Your Investments:

- This is the most critical step for success. Set up automatic transfers from your bank account to your brokerage account, and then set up automatic purchases of your chosen investments. This removes the need for manual action and ensures consistency.

-

Stay Consistent and Patient:

- The true power of DCA unfolds over years, even decades. Resist the urge to check your portfolio daily or react to short-term market fluctuations. Trust the process and focus on your long-term goals.

Who is Dollar-Cost Averaging For?

DCA is an ideal strategy for:

- Beginner Investors: It simplifies the complex world of investing and removes the pressure of market timing.

- Individuals with Regular Income: Perfect for those who receive a steady paycheck and can allocate a portion to investments.

- Long-Term Investors: It’s designed for those with a time horizon of 5, 10, 20+ years, who are saving for retirement, a down payment, or other significant goals.

- Risk-Averse Individuals: By smoothing out volatility, DCA helps reduce the psychological stress associated with market swings.

- Anyone Who Wants to Build Wealth Consistently: It’s a proven method for steady asset accumulation.

Conclusion: Embrace the Simplicity, Reap the Rewards

The power of Dollar-Cost Averaging isn’t in some complex financial trick; it’s in its elegant simplicity and unwavering discipline. By committing to regular, fixed investments, you neutralize the emotional rollercoaster of the market, harness volatility to your advantage, and systematically build your investment portfolio over time.

For beginners especially, DCA is more than just a strategy – it’s a foundational habit that can pave the way to significant long-term wealth. Stop waiting for the "perfect" time to invest. The best time to start Dollar-Cost Averaging was yesterday; the next best time is today. Embrace the power of consistency, and watch your financial future grow.

Frequently Asked Questions (FAQs) About Dollar-Cost Averaging

Q1: Is Dollar-Cost Averaging good for beginners?

A1: Absolutely! DCA is one of the best strategies for beginners because it simplifies investing, removes the need to time the market, and instills a disciplined approach.

Q2: Does DCA work in a bull market (rising market)?

A2: Yes, DCA still works in a bull market. While you might buy fewer shares as prices rise, you are consistently participating in the market’s growth. It ensures you’re invested and benefiting from the overall upward trend, even if you don’t catch the absolute lowest price.

Q3: How often should I Dollar-Cost Average?

A3: The most common frequencies are weekly, bi-weekly, or monthly. The best frequency depends on when you receive your income and what feels most manageable for your budget. The key is consistency, not the exact interval.

Q4: What are the best investments for Dollar-Cost Averaging?

A4: Broad market index funds or ETFs (like those tracking the S&P 500 or total stock market), diversified mutual funds, and even blue-chip stocks are excellent choices. These assets tend to grow over the long term and are less volatile than individual speculative stocks or highly volatile assets.

Q5: Can I stop Dollar-Cost Averaging if the market is crashing?

A5: It’s generally advised not to stop DCA during market crashes. This is precisely when DCA is most effective, as your fixed investment amount buys significantly more shares at lower prices. When the market eventually recovers (as it historically always has), you’ll benefit immensely from having continued investing during the downturn.

Post Comment