The Misery Index: Unpacking Inflation and Unemployment’s Combined Impact on Your Wallet

Have you ever felt like your money just isn’t going as far as it used to? Or perhaps you know someone who’s struggling to find a job, despite looking everywhere? These feelings of economic struggle aren’t just in your head; they’re often reflected in something economists call the "Misery Index."

While not an official government statistic, the Misery Index is a simple yet powerful way to gauge the overall economic discomfort felt by ordinary people. It takes two of the most significant challenges an economy can face – inflation and unemployment – and combines them into one easy-to-understand number. A higher number generally means more "misery" for consumers and workers.

In this comprehensive guide, we’ll break down the Misery Index, explain its components, show you why it matters to your everyday life, and explore what you can do when the numbers climb.

What Exactly Is The Misery Index?

At its core, the Misery Index is incredibly straightforward. It’s simply the sum of the annual inflation rate and the unemployment rate.

- Misery Index = Inflation Rate + Unemployment Rate

For example, if the inflation rate is 5% and the unemployment rate is 5%, the Misery Index would be 10%. A higher number indicates that people are facing more economic challenges, either because prices are rising rapidly, jobs are scarce, or a difficult combination of both.

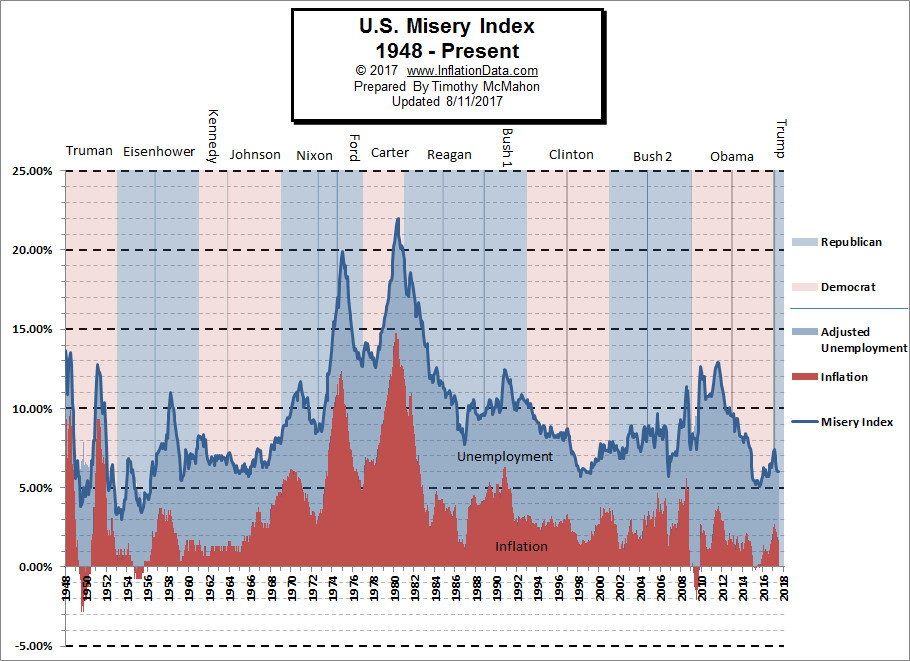

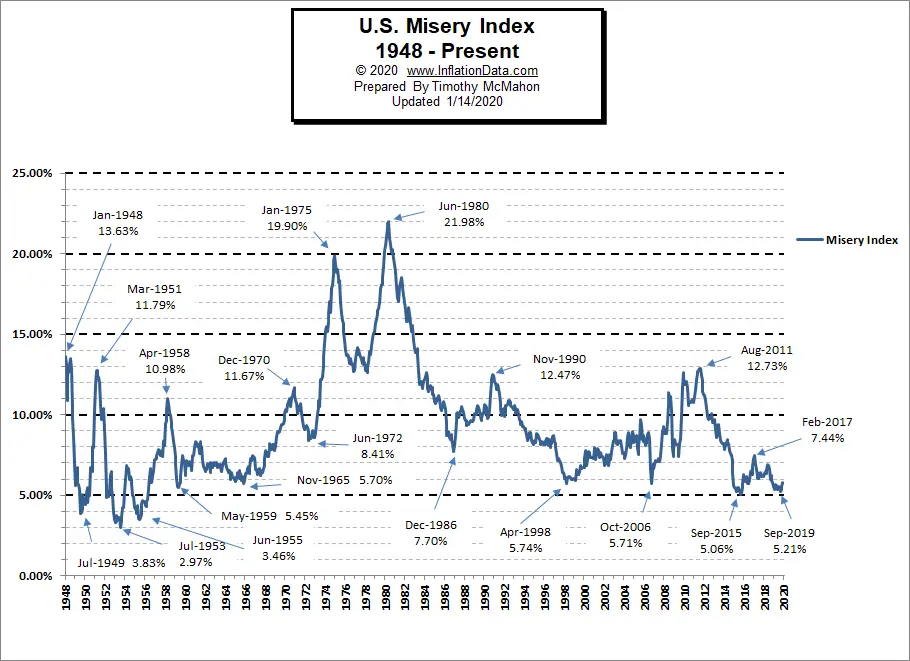

The concept was first popularized by economist Arthur Okun in the 1970s, a period when the United States was grappling with both high inflation and high unemployment simultaneously – a phenomenon known as "stagflation."

The Two Pillars of Misery: Inflation and Unemployment Explained

To truly understand the Misery Index, we need to dig a little deeper into its two crucial components.

1. Inflation: The Silent Thief of Your Purchasing Power

What is it?

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. Think of it this way: if a loaf of bread cost $2 last year and costs $2.20 this year, that’s inflation at work.

Why is it "misery"?

- Reduced Purchasing Power: Your hard-earned money buys less than it used to. If your wages don’t keep pace with inflation, you’re effectively getting poorer.

- Higher Cost of Living: Everything from groceries and gas to housing and healthcare becomes more expensive, squeezing your budget.

- Uncertainty: High or unpredictable inflation makes it difficult for businesses to plan and for individuals to save for the future.

How is it measured?

The most common measure of inflation is the Consumer Price Index (CPI), which tracks the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

2. Unemployment: The Stress of Job Scarcity

What is it?

Unemployment refers to the state where people who are actively looking for work cannot find a job. The unemployment rate is the percentage of the total labor force that is unemployed.

Why is it "misery"?

- Loss of Income: For individuals and families, unemployment means a loss of steady income, leading to financial hardship, debt, and stress.

- Economic Stagnation: When many people are out of work, they spend less, which hurts businesses and slows down the entire economy.

- Lost Potential: Unemployed workers represent unused human capital and talent, which is a loss for society as a whole.

- Psychological Toll: Job loss can lead to feelings of frustration, anxiety, and a decrease in self-esteem.

How is it measured?

The unemployment rate is typically calculated by government agencies (like the Bureau of Labor Statistics in the U.S.) through surveys of households and businesses.

How the Misery Index Works in Practice (Simple Math)

Let’s look at a few hypothetical scenarios to see how the Misery Index reflects different economic situations:

-

Scenario 1: High Inflation, Low Unemployment

- Inflation Rate: 8%

- Unemployment Rate: 3%

- Misery Index: 11% (8 + 3 = 11)

- Interpretation: While jobs are plentiful, the high cost of living is causing significant pain. Your paycheck might be secure, but it’s not stretching very far.

-

Scenario 2: Low Inflation, High Unemployment

- Inflation Rate: 2%

- Unemployment Rate: 9%

- Misery Index: 11% (2 + 9 = 11)

- Interpretation: Prices aren’t rising much, which is good, but many people are struggling because they can’t find work. The lack of income is the primary source of misery.

-

Scenario 3: Stagflation (High Inflation, High Unemployment)

- Inflation Rate: 10%

- Unemployment Rate: 8%

- Misery Index: 18% (10 + 8 = 18)

- Interpretation: This is the worst-case scenario, where both elements contribute heavily to widespread economic hardship. This scenario became prominent in the 1970s.

-

Scenario 4: Ideal Economic Conditions (Low Misery)

- Inflation Rate: 2%

- Unemployment Rate: 4%

- Misery Index: 6% (2 + 4 = 6)

- Interpretation: This represents a healthy economy with stable prices and plenty of job opportunities.

As you can see, a higher Misery Index number generally signals a more challenging economic environment for the average person.

Why Should You Care About the Misery Index? (It’s Not Just for Economists!)

While it might seem like just another economic statistic, the Misery Index has direct implications for your daily life and financial well-being:

- Personal Budgeting: When inflation is high, you need to adjust your budget more frequently to account for rising costs of food, gas, and utilities.

- Job Security & Career Planning: A high unemployment rate signals a tighter job market, making it harder to find new employment or negotiate raises. It might prompt you to invest in new skills or consider different career paths.

- Savings & Investments: High inflation erodes the value of your savings over time. Understanding the economic climate can influence your investment strategies (e.g., considering inflation-protected assets).

- Debt Management: If your income isn’t keeping up with inflation, managing debt can become more challenging.

- Understanding the News: The Misery Index helps you interpret economic headlines and political discussions about the economy. When politicians talk about "economic hardship," they’re often referring to the factors that drive up the Misery Index.

- Informing Decisions: From buying a house to starting a business, your economic environment plays a huge role. The Misery Index offers a quick snapshot of that environment.

What Causes the Misery Index to Rise or Fall?

The two components of the Misery Index are influenced by a complex web of factors:

- Supply and Demand:

- Inflation: If demand for goods and services outstrips supply, prices tend to rise. Shortages (e.g., due to supply chain issues, natural disasters) can also drive up prices.

- Unemployment: If the supply of available workers exceeds the demand from businesses, the unemployment rate tends to rise.

- Government Policies (Fiscal Policy):

- Government spending (e.g., infrastructure projects, stimulus checks) can boost demand and create jobs, but too much spending without corresponding production can lead to inflation.

- Tax policies can also influence consumer spending and business investment.

- Central Bank Policies (Monetary Policy):

- Central banks (like the Federal Reserve in the U.S.) control interest rates and the money supply. Lowering interest rates can stimulate borrowing, spending, and job creation, but can also fuel inflation. Raising rates aims to cool down inflation but can slow economic growth and potentially increase unemployment.

- Global Events:

- Wars, pandemics, natural disasters, and geopolitical tensions can disrupt supply chains, increase energy prices, and impact trade, affecting both inflation and unemployment.

- Technological Advancements:

- Can increase productivity and potentially lower prices (combating inflation), but can also automate jobs (impacting unemployment in some sectors).

- Consumer and Business Confidence:

- If consumers feel confident, they spend more. If businesses feel confident, they invest and hire more. A lack of confidence can lead to reduced spending and layoffs.

Can We Fight the Misery? Government’s Role

Governments and central banks play a critical role in trying to manage the economy and keep the Misery Index low. They primarily use two types of policies:

-

Monetary Policy (Managed by the Central Bank, e.g., The Federal Reserve):

- Interest Rates: The Fed can raise interest rates to make borrowing more expensive, which slows down spending and investment, helping to reduce inflation. Conversely, lowering rates encourages spending and can boost job creation.

- Money Supply: The Fed can also influence the amount of money circulating in the economy.

-

Fiscal Policy (Managed by the Government, e.g., Congress and the President):

- Government Spending: The government can increase or decrease spending on things like infrastructure, defense, or social programs. Increased spending can stimulate the economy and create jobs.

- Taxation: Governments can raise or lower taxes. Lowering taxes can leave more money in people’s pockets, encouraging spending and investment.

The challenge for policymakers is that actions to reduce inflation (like raising interest rates) can sometimes slow down the economy and lead to higher unemployment. Conversely, actions to boost employment (like increased spending) can sometimes lead to higher inflation. It’s a constant balancing act!

What Can You Do During High Misery? Personal Strategies

While you can’t control the overall economy, understanding the Misery Index empowers you to make smarter financial decisions when times are tough:

- Review and Adjust Your Budget:

- Track your spending meticulously. Identify areas where you can cut back, especially on discretionary (non-essential) items.

- Prioritize needs over wants.

- Build or Boost Your Emergency Fund:

- Aim for 3-6 months (or more!) of living expenses saved in an easily accessible account. This provides a crucial safety net if you lose your job or face unexpected expenses due to inflation.

- Focus on Debt Reduction:

- Prioritize paying down high-interest debt (like credit cards). This frees up more of your income for essential spending and reduces financial stress.

- Protect Your Income Stream:

- Upskill: Learn new skills or improve existing ones to make yourself more valuable in the job market.

- Networking: Stay connected with people in your industry.

- Diversify Income: Explore side hustles or freelance work to create additional income streams.

- Smart Shopping and Saving:

- Look for sales, use coupons, and consider generic brands.

- Compare prices before making large purchases.

- Cook at home more often.

- Evaluate subscriptions and memberships you rarely use.

- Consider Long-Term Investments:

- While inflation can hurt cash savings, smart investments (like stocks, real estate, or inflation-protected bonds) can sometimes grow faster than inflation over the long term. Consult a financial advisor.

- Advocate for Yourself:

- If you’re employed, keep track of your accomplishments and be prepared to make a strong case for raises that at least keep pace with inflation.

Conclusion: Understanding Your Economic World

The Misery Index is more than just a number; it’s a reflection of the economic realities faced by millions of people. By combining the crucial factors of inflation and unemployment, it offers a simple yet profound snapshot of the economic well-being (or lack thereof) in a country.

While we all hope for a low Misery Index, understanding its components and the forces that drive it allows you to be a more informed citizen, a smarter consumer, and a more resilient financial planner. The economy will always have its ups and downs, but with knowledge and proactive steps, you can navigate the challenges and work towards a more stable financial future for yourself and your family.

Post Comment