The Invisible Hand: Adam Smith’s Enduring Legacy Explained for Beginners

Have you ever wondered how a bustling city feeds its millions without a central planner dictating who bakes the bread, who butchers the meat, or who sells the clothes? Or how new technologies appear as if by magic, seemingly anticipating our desires? The answer, according to one of history’s most influential thinkers, lies in something he called "The Invisible Hand."

This seemingly mystical concept, introduced by the Scottish economist and philosopher Adam Smith, is one of the most powerful and misunderstood ideas in economics. Far from being a literal hand, it’s a brilliant metaphor that helps explain how individual self-interest, operating within a free market, can unintentionally lead to the greater good for society.

In this long, comprehensive guide, we’ll dive deep into Adam Smith’s "Invisible Hand," breaking down its core principles, exploring its enduring legacy, and understanding why it remains a cornerstone of economic thought today. Whether you’re new to economics or just looking to refresh your understanding, get ready to demystify one of history’s most fascinating concepts!

Who Was Adam Smith? The Father of Modern Economics

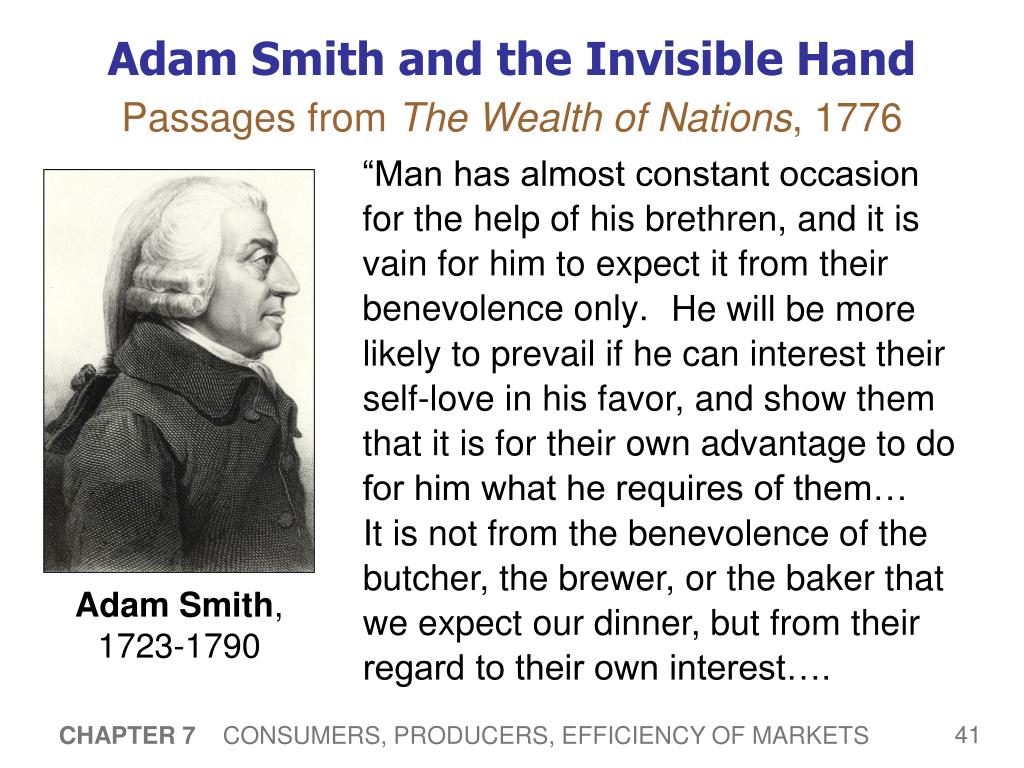

Before we grasp the Invisible Hand, it’s essential to know the person who coined the term: Adam Smith (1723-1790).

Often hailed as the "Father of Modern Economics," Adam Smith was a Scottish moral philosopher who lived during the Enlightenment, a period of profound intellectual and philosophical development in Europe. While he held a professorship in moral philosophy, his most famous work laid the groundwork for what we now call economics.

Key Facts about Adam Smith:

- Birthplace: Kirkcaldy, Scotland

- Profession: Moral Philosopher, University Professor

- Most Famous Work: An Inquiry into the Nature and Causes of the Wealth of Nations (published in 1776 – the same year as the American Declaration of Independence!)

"The Wealth of Nations," as it’s commonly known, was a revolutionary book. It wasn’t just an economic treatise; it was a comprehensive study of human nature, societal organization, and the mechanisms that drive prosperity. In this groundbreaking work, Smith challenged the prevailing economic system of his time (mercantilism, which focused on accumulating gold and strict government control) and proposed a radical new vision: the free market.

Unpacking the Invisible Hand: The Core Idea

So, what exactly is this "Invisible Hand" that Adam Smith talked about?

At its heart, the Invisible Hand is a metaphor describing the unintended social benefits of individual self-interested actions. It suggests that when individuals are left free to pursue their own economic goals, without excessive government interference, the market will naturally guide them towards actions that benefit society as a whole.

Let’s break it down with a simple example:

- Imagine a Baker: A baker doesn’t wake up in the morning thinking, "How can I best serve my community today?" While they might feel a sense of civic duty, their primary motivation is to earn a living. They want to make money to support themselves and their family.

- Self-Interest in Action: To earn money, the baker must produce delicious, affordable bread that people want to buy. If their bread is stale, overpriced, or hard to find, customers will go elsewhere.

- The "Invisible Hand" at Work: By pursuing their own self-interest (making money), the baker is compelled to serve the interests of the community. They produce fresh bread, at a competitive price, readily available. The result? A well-fed community, not because the baker was altruistic, but because the market "guided" their self-interest towards a socially beneficial outcome.

Adam Smith’s Famous Quote:

Smith famously wrote in The Wealth of Nations:

"It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages."

This quote perfectly encapsulates the core idea: our daily needs are met not by the kindness of strangers, but by their pursuit of their own gain, guided by the market’s "invisible hand."

How Does the Invisible Hand "Work"? Key Mechanisms

The Invisible Hand isn’t magic; it works through a combination of fundamental economic principles that interact within a free market. These include:

-

Competition:

- The Driver: In a market with many sellers (like many bakers), competition is fierce. If one baker tries to charge too much, customers will simply buy from another. If one baker’s bread isn’t as good, customers will choose a competitor’s.

- The Outcome: This forces businesses to be efficient, innovate, and offer the best possible products at the lowest possible prices. Consumers benefit directly from this drive for excellence and affordability.

-

Supply and Demand:

- The Balancing Act: The Invisible Hand is heavily reliant on the forces of supply (how much producers are willing to offer) and demand (how much consumers want).

- The Adjustment: If there’s high demand for a product (e.g., a new smartphone), its price might rise, signaling to producers that there’s an opportunity to make a profit. More companies will then enter the market, increasing supply. As supply increases, prices may stabilize or even fall. Conversely, if demand falls, prices drop, and producers shift resources to other goods consumers want more.

- The Outcome: This dynamic constantly pushes the market towards an equilibrium where the right amount of goods and services are produced at prices that both buyers and sellers find acceptable.

-

Efficiency and Resource Allocation:

- Optimal Use: The Invisible Hand encourages the most efficient use of society’s limited resources (labor, raw materials, capital).

- The Mechanism: Businesses that use resources inefficiently will be outcompeted by those who are more efficient. Resources naturally flow to industries and businesses that are most effectively meeting consumer demand.

- The Outcome: This leads to greater overall productivity and wealth for the nation, as resources aren’t wasted on things people don’t want or aren’t produced efficiently.

The Invisible Hand’s Enduring Legacy and Impact

Adam Smith’s concept of the Invisible Hand, along with his broader arguments for free markets, laid the foundational stones for much of modern economic thought and policy. Its legacy is vast and continues to shape our world:

- Foundation of Modern Capitalism: The idea that markets, driven by individual incentives, can self-regulate and allocate resources efficiently is a cornerstone of capitalist economies worldwide.

- Advocacy for Limited Government Intervention: Smith argued against heavy government intervention (like tariffs, monopolies, and detailed production controls) because he believed it distorted the natural workings of the Invisible Hand, leading to inefficiencies and reduced wealth. This concept became known as laissez-faire economics (French for "let do" or "let go").

- Promoter of Free Trade: If markets work best when left alone, then barriers between nations (like tariffs) also hinder the Invisible Hand. Smith was a strong advocate for free trade, believing it would lead to greater specialization, efficiency, and overall global prosperity.

- Influence on Economic Policy: Smith’s ideas heavily influenced economic thinkers and policymakers for centuries, contributing to the rise of market-based economies across Europe and North America.

- Understanding Economic Behavior: Even today, economists use the principles derived from the Invisible Hand to understand consumer behavior, firm strategies, and market dynamics.

Important Nuances and Criticisms of the Invisible Hand

While powerful, the Invisible Hand is not a magical solution, nor is it without its critics and limitations. A balanced understanding requires acknowledging these nuances:

-

It’s a Metaphor, Not a Literal Force: The Invisible Hand isn’t some mystical entity guiding markets. It’s a way of describing the complex interplay of human actions and market forces. It doesn’t imply a conscious, benevolent force.

-

Requires a Strong Legal and Institutional Framework: Smith himself understood that the Invisible Hand operates within a framework of rules. For it to work effectively, a society needs:

- Rule of Law: Clear, enforced laws that protect property rights and contracts.

- Justice System: Fair and impartial courts.

- Trust: A basic level of trust among participants.

- Ethical Behavior: While self-interest is key, Smith also wrote about the importance of moral sentiments and sympathy in his other major work, The Theory of Moral Sentiments. He wasn’t advocating for pure greed.

-

Market Failures: The Invisible Hand doesn’t always lead to optimal outcomes. These situations are known as "market failures":

- Monopolies: When one company dominates a market, competition is stifled, and the "hand" can’t guide prices or quality effectively.

- Public Goods: Goods that are non-excludable (everyone can use them) and non-rivalrous (one person’s use doesn’t diminish another’s) – like streetlights, national defense, or clean air – are often underprovided by the free market because individual self-interest doesn’t incentivize their production.

- Externalities: These are side effects of production or consumption that affect third parties not involved in the transaction.

- Negative Externalities: Pollution from a factory benefits the factory owner (lower costs) but harms the community (health issues, environmental damage). The market doesn’t naturally account for these costs.

- Positive Externalities: Education benefits the individual but also society as a whole (more informed citizens, innovation). The market might under-provide education if left entirely to itself.

- Information Asymmetry: When one party in a transaction has significantly more or better information than the other (e.g., a used car salesman knowing hidden defects), the market can become inefficient or unfair.

-

Income Inequality: While the Invisible Hand can drive overall wealth, it doesn’t guarantee an equitable distribution of that wealth. Free markets can lead to significant disparities in income and wealth, which often requires government intervention (e.g., progressive taxation, social safety nets) to address.

-

Role of Government: The debate over the "right" amount of government intervention is ongoing. While Smith advocated for limited government, he recognized its essential role in:

- Providing public goods.

- Enforcing contracts and property rights.

- Maintaining national defense.

- Regulating monopolies.

- Ensuring a stable currency.

Many modern economists argue that some level of government intervention is necessary to correct market failures and ensure a fair and stable economy.

The Invisible Hand in the 21st Century

Despite its 18th-century origins, the concept of the Invisible Hand remains incredibly relevant in today’s complex global economy:

- Global Supply Chains: The intricate web of global trade, where components from dozens of countries come together to form a single product (like your smartphone), is a powerful testament to the Invisible Hand at work. No central authority planned it; it evolved through millions of self-interested decisions by companies seeking efficiency and profit.

- Technological Innovation: The rapid pace of technological advancement – from artificial intelligence to renewable energy – is largely driven by companies and individuals pursuing opportunities and competing for market share, illustrating the Invisible Hand’s role in innovation.

- Debates on Regulation: Whenever there’s a financial crisis, an environmental disaster, or a debate about industry standards, the discussion often circles back to the balance between allowing the Invisible Hand to operate freely and the need for government regulation to prevent market failures or protect public interest.

- Emerging Markets: As developing nations transition to market-based economies, they often grapple with the same questions Adam Smith posed: How much government intervention is beneficial, and where should the market be allowed to lead?

Conclusion: Adam Smith’s Enduring Vision

The Invisible Hand is more than just an economic theory; it’s a profound insight into human nature and societal organization. Adam Smith’s genius lay in recognizing that even seemingly selfish actions, when channeled through a competitive market, can collectively produce order, innovation, and prosperity for all.

While the world has grown infinitely more complex since Smith’s time, and we’ve learned that markets aren’t perfect, his core idea remains vital. It reminds us of the incredible power of individual liberty, the efficiency of decentralized decision-making, and the intricate, often unseen, forces that shape our economic lives.

Understanding the Invisible Hand helps us appreciate the intricate dance of supply and demand, the driving force of competition, and the delicate balance between individual freedom and collective well-being. It’s a legacy that continues to spark debate, inspire innovation, and guide our understanding of the economic world we inhabit.

So, the next time you enjoy a freshly baked loaf of bread, remember the baker, their self-interest, and the remarkable "Invisible Hand" that helped bring it to your table.

Post Comment