The Importance of Working Capital for SMEs: Your Business’s Financial Oxygen

Imagine your small or medium-sized enterprise (SME) as a living organism. If your sales are the food it consumes, then working capital is the oxygen that flows through its veins, keeping every part functioning. Without enough oxygen, even the healthiest body will struggle and eventually fail. Similarly, without sufficient working capital, even a profitable SME can find itself in serious trouble.

For many SME owners, terms like "balance sheet" or "profit and loss" might seem complex. But understanding working capital is one of the most fundamental financial concepts you can grasp. It’s not just about making a profit; it’s about having enough readily available cash to keep your doors open, pay your bills, and seize new opportunities.

In this comprehensive guide, we’ll break down working capital into easy-to-understand terms, explain why it’s so vital for SMEs, and provide practical strategies to manage it effectively.

What Exactly is Working Capital? (The Simple Definition)

At its core, working capital is a measure of your business’s short-term financial health and operational efficiency. It’s the difference between what you own that can be quickly converted into cash (your current assets) and what you owe that’s due soon (your current liabilities).

Think of it like this:

-

Current Assets: These are things your business owns that can be turned into cash within one year.

- Cash: Money in your bank accounts.

- Accounts Receivable: Money owed to you by customers for goods or services already delivered (e.g., invoices you’ve sent out).

- Inventory: Products you have on hand ready to sell, or raw materials waiting to be used.

- Prepaid Expenses: Payments made in advance for services or goods (e.g., rent paid for the next month).

-

Current Liabilities: These are debts or obligations your business needs to pay within one year.

- Accounts Payable: Money you owe to your suppliers for goods or services you’ve received (e.g., bills from your vendors).

- Short-Term Loans: Any portion of a loan due within the next 12 months.

- Accrued Expenses: Expenses incurred but not yet paid (e.g., employee wages earned but not yet paid).

- Customer Deposits: Money received from customers for services or products not yet delivered.

The Formula:

Working Capital = Current Assets – Current Liabilities

- Positive Working Capital: This means you have more current assets than current liabilities. It’s a good sign, indicating you have enough short-term funds to cover your immediate obligations and potentially invest in growth.

- Negative Working Capital: This means your current liabilities exceed your current assets. It can be a red flag, suggesting you might struggle to meet your short-term debts. While some very efficient businesses can operate with low or even negative working capital, for most SMEs, it’s a sign of potential trouble.

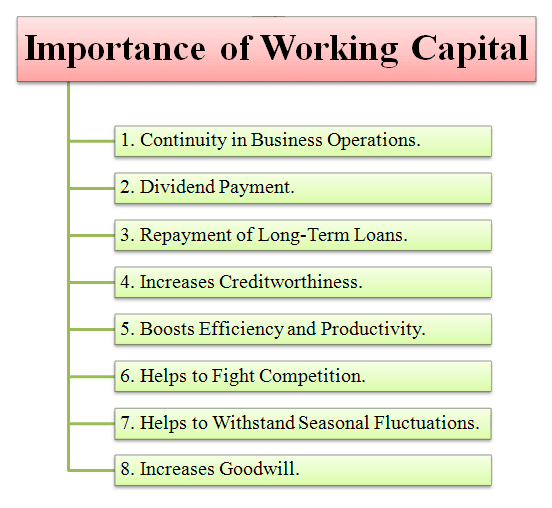

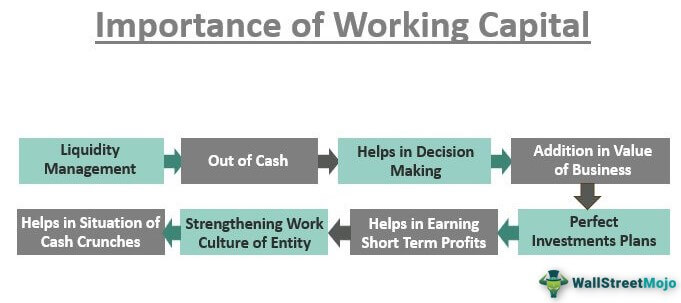

Why is Working Capital So Important for SMEs?

Working capital isn’t just a number on a spreadsheet; it’s the engine that keeps your business running smoothly day-to-day and allows it to navigate unexpected bumps in the road.

Here’s why it’s absolutely crucial for small and medium-sized businesses:

-

Day-to-Day Operations & Survival:

- This is the most fundamental reason. Working capital pays for your daily operational expenses: rent, utilities, employee salaries, raw materials, marketing, and more. Without it, you simply can’t operate.

- It ensures you can purchase inventory, pay suppliers on time, and cover unexpected minor costs without disrupting your cash flow.

-

Handling Unexpected Challenges & Emergencies:

- Life (and business) is unpredictable. A sudden drop in sales, an unexpected repair, a key customer paying late, or a supply chain disruption can quickly drain your cash reserves.

- Healthy working capital acts as a financial safety net, allowing you to absorb these shocks without resorting to high-interest loans or worse, closing your doors. It provides peace of mind.

-

Seizing Growth Opportunities:

- Growth often requires investment. Maybe you want to launch a new product, expand into a new market, upgrade equipment, or hire more staff. These opportunities often demand upfront cash.

- Sufficient working capital allows you to act quickly on these opportunities, giving you a competitive edge. You won’t miss out because you’re waiting for payments or trying to secure financing.

-

Improving Supplier & Customer Relationships:

- Suppliers: Paying your suppliers on time (or even early!) builds trust and strengthens relationships. This can lead to better credit terms, discounts, priority service, or access to higher-quality materials.

- Customers: Adequate working capital means you can maintain sufficient inventory, fulfill orders promptly, and offer flexible payment terms if necessary, enhancing customer satisfaction and loyalty.

-

Avoiding Costly Debt & Financial Distress:

- When working capital runs low, many SMEs resort to borrowing, often at high interest rates, just to cover basic expenses. This can quickly create a vicious cycle of debt.

- Good working capital management reduces the need for short-term loans, saving you interest costs and improving your profitability. It helps you maintain financial independence.

-

Better Decision Making & Strategic Planning:

- Knowing you have a healthy working capital position frees you up to think strategically, rather than constantly worrying about the next bill.

- It allows you to plan for the future, invest in long-term projects, and make confident business decisions based on growth, not just survival.

Common Working Capital Challenges for SMEs

Despite its importance, many SMEs struggle with managing their working capital. Here are some common pitfalls:

- Late Payments from Customers (Accounts Receivable): This is a massive headache for many small businesses. You’ve done the work, but the money isn’t in your bank account, tying up your cash.

- Poor Inventory Management: Having too much inventory means cash is sitting idle on your shelves. Having too little means you might miss sales opportunities. Finding the right balance is tricky.

- Seasonal Fluctuations: Many businesses experience peaks and troughs in demand. Managing cash flow during slow periods can be challenging if working capital isn’t properly planned for.

- Rapid Growth: Paradoxically, rapid growth can strain working capital. You might need to buy more inventory, hire more staff, or invest in marketing before the increased revenue comes in.

- Lack of Financial Planning & Forecasting: Without a clear understanding of future cash inflows and outflows, it’s easy to be caught off guard by shortages.

- Over-reliance on Debt: Constantly borrowing to cover operational gaps instead of optimizing existing assets and liabilities can quickly become unsustainable.

Strategies to Optimize Your Working Capital (Practical Tips for SMEs)

Managing working capital isn’t about having an endless supply of cash; it’s about efficiently using the cash you have and ensuring money moves smoothly through your business.

Here are actionable strategies you can implement:

-

Manage Your Receivables (Get Paid Faster!):

- Clear Payment Terms: State your payment terms (e.g., Net 30 days) clearly on all invoices.

- Invoice Promptly: Send invoices immediately after delivering goods or services.

- Follow Up Regularly: Don’t be afraid to chase late payments politely but persistently. Set up automated reminders.

- Offer Incentives for Early Payment: A small discount (e.g., 2% if paid within 10 days) can encourage quicker payments.

- Consider Deposits: For larger projects, ask for an upfront deposit to cover initial costs.

- Credit Checks: For new, larger clients, consider a quick credit check to assess their payment history.

-

Manage Your Payables (Pay Smartly!):

- Negotiate Payment Terms: Work with your suppliers for longer payment terms (e.g., Net 60 days) if possible, without damaging relationships.

- Pay on Time, Not Early: Unless there’s an early payment discount, hold onto your cash until the due date. This maximizes the time cash stays in your business.

- Automate Payments: Ensure you don’t miss due dates, which can incur late fees.

-

Optimize Your Inventory (Don’t Tie Up Cash!):

- Forecast Demand Accurately: Use historical data and market trends to predict what you’ll sell and when.

- Implement Just-in-Time (JIT) Principles: Aim to receive materials or products just as they are needed, minimizing storage costs and capital tied up. (Be mindful of supply chain risks, however).

- Regular Stock Takes: Identify slow-moving or obsolete inventory and consider liquidating it to free up cash.

- Supplier Relationships: Build strong relationships that allow for flexible ordering and quick delivery times.

-

Master Cash Flow Forecasting:

- This is perhaps the most powerful tool. Create a detailed forecast of your expected cash inflows (sales, receivables) and outflows (expenses, payables) for the next 3, 6, or 12 months.

- Identify potential cash shortfalls before they happen, giving you time to plan and take corrective action.

- Use simple spreadsheets or accounting software to help with this.

-

Explore Appropriate Funding Options (When Needed):

- Line of Credit: A flexible loan that allows you to borrow up to a certain limit, repay, and re-borrow as needed. Great for bridging short-term cash flow gaps.

- Invoice Factoring/Financing: Selling your accounts receivable (invoices) to a third party for immediate cash. You get cash quickly, but at a fee.

- SBA Loans/Traditional Bank Loans: For larger, longer-term investments, but require a solid business plan and credit history.

- Bootstrapping: Relying on your own generated cash flow as much as possible to fund growth.

-

Regular Monitoring & Review:

- Don’t just set it and forget it! Regularly review your working capital position (weekly or monthly).

- Compare your actual cash flow to your forecasts.

- Identify trends and adjust your strategies as needed.

- Your accounting software can provide real-time insights into your current assets and liabilities.

The Bottom Line: Working Capital is Your Business’s Financial Resilience

For SMEs, working capital isn’t a fancy financial term for accountants; it’s the daily reality of your business. It determines whether you can pay your staff, keep your lights on, and whether you can take that big order that comes your way.

By proactively managing your current assets and liabilities, you’re not just improving your financial statements; you’re building a more resilient, stable, and growth-ready business. Understanding and optimizing your working capital is one of the smartest investments of time and effort an SME owner can make. It empowers you to navigate challenges, seize opportunities, and ultimately, achieve long-term success.

Post Comment