The Importance of a Cash Flow Statement for Decision Making: Your Business’s Financial GPS

Imagine trying to navigate a bustling city without a map or GPS, relying only on a single photo taken at one moment in time. You might know what one street looks like, but you’d have no idea how to get from point A to point B, where the traffic is flowing, or if you’re about to hit a dead end.

In the world of business, your Cash Flow Statement is that essential GPS. While your Income Statement (Profit & Loss) shows you if you made a profit and your Balance Sheet provides a snapshot of your assets and liabilities, it’s the Cash Flow Statement that reveals the true movement of money in and out of your business. It’s the lifeblood, the oxygen, the fuel that keeps your business alive and thriving.

For anyone from a small business owner to a seasoned executive, understanding and utilizing your Cash Flow Statement is not just good practice – it’s absolutely critical for smart, informed decision making.

What Exactly Is a Cash Flow Statement? (The Basics for Beginners)

Think of your business as having a "bank account." The Cash Flow Statement tracks every dollar that comes into that account and every dollar that leaves it over a specific period (e.g., a month, a quarter, a year). It shows you if you have enough actual cash on hand to pay your bills, invest in growth, or simply keep the lights on.

Unlike the Income Statement, which uses the "accrual method" (recording revenue when earned and expenses when incurred, regardless of when cash changes hands), the Cash Flow Statement focuses purely on cash. This is a crucial distinction. A business can be profitable on paper but still run out of cash – a situation known as being "cash-poor" or "illiquid."

The Cash Flow Statement is typically divided into three main sections, each providing unique insights into where your money is coming from and where it’s going:

-

Cash Flow from Operating Activities:

- This section shows the cash generated or used from your core business operations. Think of it as the money made (or lost) from selling your products or services and paying for the day-to-day costs of running your business (e.g., salaries, rent, utilities, inventory purchases).

- Why it matters: A strong, positive cash flow from operations indicates that your primary business activities are generating enough cash to sustain themselves.

-

Cash Flow from Investing Activities:

- This section tracks the cash used for or generated from long-term investments. This includes buying or selling assets like property, plant, and equipment (PP&E), or investments in other companies.

- Why it matters: It shows how a company is investing in its future growth or divesting assets. For example, buying new machinery would be a cash outflow here. Selling an old building would be a cash inflow.

-

Cash Flow from Financing Activities:

- This section deals with how a business raises and repays cash from lenders and owners. It includes activities like issuing new debt (borrowing money), repaying loans, issuing new stock, buying back stock, or paying dividends to shareholders.

- Why it matters: It reveals how a company is funding its operations and growth, and how it’s managing its debt and equity.

By combining these three sections, the Cash Flow Statement provides a comprehensive picture of your cash position and how it’s changing over time.

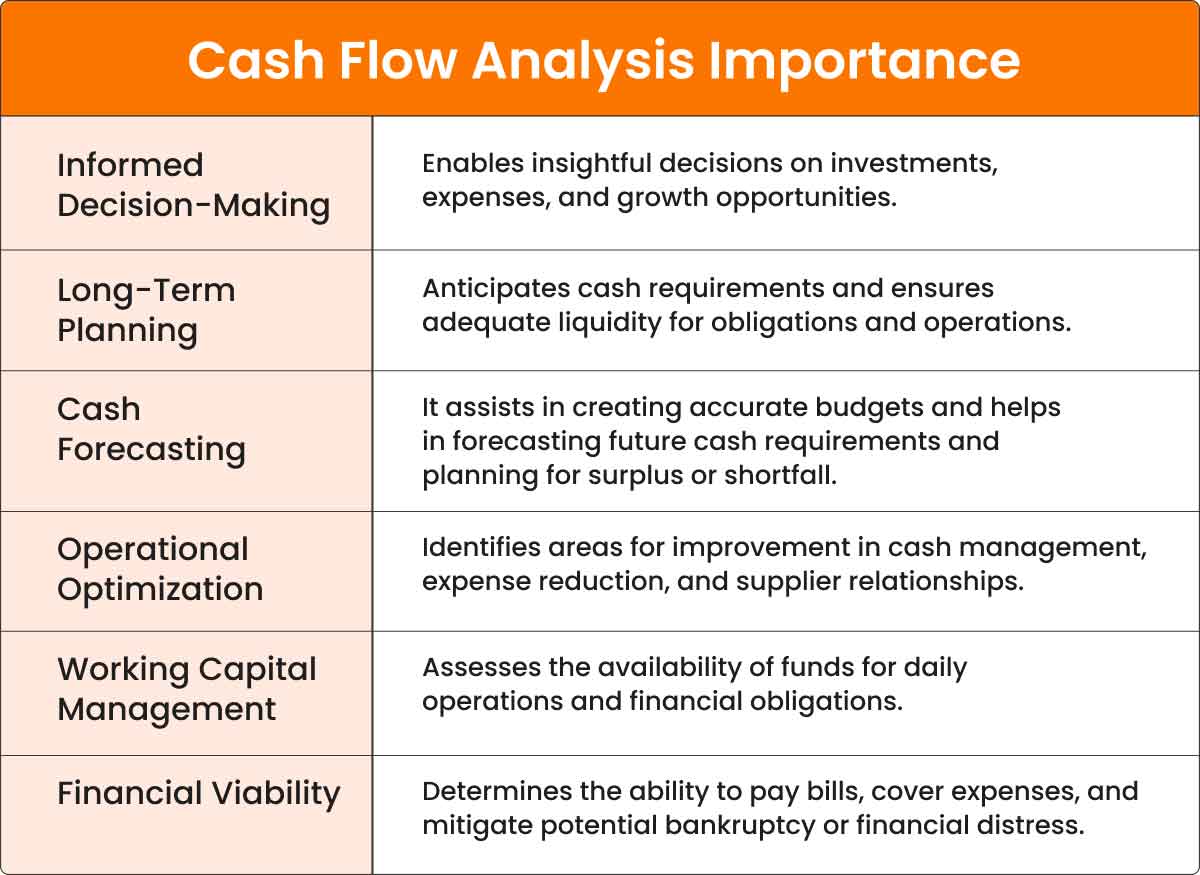

Why is the Cash Flow Statement So Important for Smart Decision Making?

Now that we understand what it is, let’s dive into the core reason why this document is indispensable for every decision a business makes.

1. Assessing Liquidity: Can You Pay Your Bills?

- The Decision: Do I have enough money to cover my immediate expenses like payroll, rent, and supplier invoices? Can I afford to take on a new project that requires upfront costs?

- The Insight: The Cash Flow Statement, especially the "Cash Flow from Operating Activities," directly answers this. A positive operating cash flow means your core business is generating enough cash to meet its short-term obligations. A consistently negative operating cash flow, even if your Income Statement shows a profit, is a huge red flag indicating you might face a cash crunch very soon.

- Decision Impact: Helps you decide if you need to delay payments, seek short-term financing, or speed up collections from customers. It prevents the embarrassing and damaging situation of bouncing checks or missing payroll.

2. Evaluating Solvency: Are You Stable in the Long Run?

- The Decision: Can my business meet its long-term financial obligations, such as loan repayments or lease agreements? Is it sustainable?

- The Insight: While liquidity is about the short-term, solvency is about long-term financial health. The Cash Flow Statement, particularly the "Financing Activities" section, reveals how a company is managing its debt. If a business consistently has to borrow money or issue new stock just to cover basic operations, it signals a potential solvency issue.

- Decision Impact: Informs decisions about taking on new debt, making large capital expenditures, or even considering business expansion. Lenders and investors scrutinize this to determine if you’re a safe bet.

3. Unmasking "Paper Profits" vs. Real Cash: Profitability in Action

- The Decision: My Income Statement shows a profit, but my bank account is empty. What’s going on? Should I expand, or am I in trouble?

- The Insight: This is perhaps the most crucial distinction for beginners. An Income Statement can show a profit even if cash hasn’t been received yet (e.g., sales made on credit). The Cash Flow Statement strips away these non-cash items to show you the actual cash generated. If a business is profitable but has negative operating cash flow, it means its sales aren’t converting into cash quickly enough, which is a recipe for disaster.

- Decision Impact: Prevents overconfidence based on accrual profits. It forces you to look at payment terms, collection efficiency, and inventory management. You might decide to offer early payment discounts to customers or negotiate better payment terms with suppliers to improve cash flow, even if it slightly impacts your "paper profit."

4. Informing Budgeting and Forecasting: Planning for the Future

- The Decision: How much cash will I have next quarter? Can I afford that new piece of equipment next year? How much can I allocate to marketing?

- The Insight: Historical cash flow data is invaluable for creating accurate budgets and future financial forecasts. By understanding past trends in cash inflows and outflows, you can make more realistic predictions about future cash availability.

- Decision Impact: Enables proactive financial planning. You can set realistic spending limits, anticipate cash shortages (and plan how to cover them), and make informed decisions about future investments and operational expenditures. It’s your crystal ball for cash.

5. Guiding Investment Decisions: Where to Put Your Money

- The Decision: Should I buy new machinery? Is this a good time to acquire another business? Can I afford to develop a new product line?

- The Insight: The "Investing Activities" section, combined with a healthy operating cash flow, tells you if your business is generating enough internal cash to fund its growth ambitions without relying too heavily on external financing. A company with strong positive operating cash flow has more flexibility to invest in its future.

- Decision Impact: Helps you prioritize capital expenditures. You can decide whether to fund growth internally or if you’ll need to seek additional funding from banks or investors. It also highlights if your past investments are generating positive returns (cash inflows).

6. Managing Debt Effectively: Borrowing Smartly

- The Decision: Should I take out a loan? Can I repay my existing debts on time? How much debt can my business realistically handle?

- The Insight: The "Financing Activities" section, along with your operating cash flow, provides a clear picture of your ability to service debt. If your operating cash flow is consistently strong, you have a better capacity to take on and repay loans. Conversely, if you’re constantly borrowing just to stay afloat, it’s a warning sign.

- Decision Impact: Crucial for managing debt levels and relationships with lenders. It helps you negotiate better loan terms, avoid defaults, and make strategic decisions about refinancing or taking on new lines of credit.

7. Identifying Cash Traps and Inefficiencies: Plugging the Leaks

- The Decision: Where is all my cash going? Are there areas where I’m spending too much or receiving too little?

- The Insight: By scrutinizing the detailed line items within each section, you can pinpoint areas where cash is being tied up unnecessarily or inefficiently. For example, a significant increase in inventory might show up as a large cash outflow from operations, indicating too much cash is sitting in unsold goods. Slow collection of receivables also ties up cash.

- Decision Impact: Leads to operational improvements. You might decide to optimize inventory levels, tighten credit policies with customers, or renegotiate payment terms with suppliers to free up cash.

8. Boosting Investor and Lender Confidence: Attracting Funding

- The Decision: How can I convince investors to fund my startup, or a bank to give me a loan for expansion?

- The Insight: While profit is good, investors and lenders are primarily interested in cash. They want to see that a business can generate enough cash to repay loans, pay dividends, or fund its own growth. A robust Cash Flow Statement demonstrates financial stability and the ability to convert sales into tangible cash.

- Decision Impact: A clear, positive Cash Flow Statement is a powerful tool in fundraising. It builds trust and credibility, making your business more attractive to external funding sources.

9. Supporting Strategic Growth: Scaling Responsibly

- The Decision: Is my business financially ready to open a new branch, launch a major marketing campaign, or hire a significant number of new employees?

- The Insight: Sustainable growth isn’t just about sales; it’s about having the cash to support that growth. Growing too fast without sufficient cash flow is a common reason businesses fail. The Cash Flow Statement helps you understand if your current cash generation can support your growth aspirations.

- Decision Impact: Enables controlled and sustainable expansion. It helps prevent overextending your resources and ensures you have the financial backbone to support your strategic initiatives.

How to Use Your Cash Flow Statement for Better Decisions (Actionable Steps)

Simply having a Cash Flow Statement isn’t enough. You need to actively use it:

- Review Regularly: Don’t just look at it once a year. Review it monthly or quarterly to spot trends and issues early.

- Compare Periods: Look at your current statement against previous periods (e.g., this month vs. last month, this quarter vs. same quarter last year). Are things improving or deteriorating?

- Look for Trends: Is your operating cash flow consistently positive and growing? Is your investing cash flow showing healthy investments? Are you relying too much on financing activities for day-to-day operations?

- Integrate with Other Statements: Never look at the Cash Flow Statement in isolation. Compare it with your Income Statement and Balance Sheet for a holistic view.

- Don’t Just Look at the Bottom Line: While the net change in cash is important, dive into the details of each activity (operating, investing, financing) to understand the why behind the numbers.

Common Mistakes to Avoid

- Ignoring It: Believing profit is the only metric that matters. This is a recipe for disaster.

- Confusing Cash with Profit: They are distinct concepts. A profitable business can still go bankrupt due to lack of cash.

- Not Reviewing Regularly: Cash flow is dynamic. You need to monitor it constantly.

- Not Acting on Insights: The statement provides valuable data, but it’s useless if you don’t use it to make operational or strategic changes.

Conclusion: Your Business’s Financial Compass

The Cash Flow Statement is more than just another financial report; it’s your business’s financial compass, guiding you through the economic landscape. It provides an unfiltered, real-time view of your cash health, enabling you to make proactive, informed decisions that drive sustainable growth and prevent financial crises.

By understanding where your cash comes from and where it goes, you empower yourself to manage your business effectively, seize opportunities, and navigate challenges with confidence. Don’t let your business run out of fuel; embrace the power of your Cash Flow Statement and steer your enterprise towards a robust and prosperous future.

Post Comment