The Future of Digital Services Taxes: What Businesses Need to Know

In our increasingly digital world, the way companies operate and earn money has transformed dramatically. Traditional tax rules, designed for a brick-and-mortar economy, have struggled to keep up with the borderless nature of online services, cloud computing, and digital advertising. This mismatch led many countries to introduce Digital Services Taxes (DSTs) – and now, a new global tax framework is emerging that could change everything again.

If your business operates online, sells digital products, or provides digital services across borders, understanding the future of DSTs isn’t just about compliance; it’s about strategic planning, managing costs, and ensuring your business thrives in a rapidly evolving tax landscape.

This article will break down what Digital Services Taxes are, why they emerged, the global efforts to replace them, and most importantly, what your business needs to know to navigate these changes.

What Are Digital Services Taxes (DSTs)? A Simple Explanation

Imagine a traditional store that sells goods in a country – it pays taxes there. But what about a company that sells online ads to customers in that same country, or provides cloud storage, without any physical office or employees there? Historically, these digital giants could generate huge profits in a country but pay very little (or no) corporate tax there, thanks to old tax rules that focused on physical presence.

Digital Services Taxes (DSTs) were created by individual countries as a temporary solution to this problem. In simple terms, a DST is usually a tax on the revenue (not profit) generated from certain digital services provided to users in a specific country, regardless of where the company is physically located.

Key Characteristics of DSTs:

- Revenue-based: Unlike corporate income tax, which taxes profits, DSTs tax gross revenue from specific digital activities. This means a company might owe DST even if it’s not making a profit yet.

- Targeted: They generally apply to large multinational companies with significant global and in-country digital revenue. There are often thresholds (e.g., €750 million global revenue and €25 million in-country revenue).

- Specific Services: They typically target services where value is seen as being created by user participation or data, such as:

- Online advertising services (e.g., selling ad space on websites).

- Digital intermediation services (e.g., operating online marketplaces where buyers and sellers connect).

- Sale of user-generated data.

- Sometimes, cloud computing or streaming services.

- Unilateral: Each country introduced its own version of a DST, leading to a complex "patchwork" of different rules and rates around the world.

Why Did Countries Introduce DSTs?

Countries felt that existing international tax rules, which largely relied on a company having a physical presence (like an office or factory) to be taxed, were outdated for the digital age. They saw digital companies making significant money from their citizens and wanted to ensure these companies contributed their "fair share" of tax in those markets.

DSTs were a way for individual countries to assert their taxing rights over the profits generated by highly digitalized businesses, even if a global consensus wasn’t yet in place.

The Global Effort for Reform: OECD & BEPS 2.0

While DSTs provided a quick fix for individual countries, they also created a lot of complexity and tension. Imagine a company trying to comply with dozens of different DST rules, each with its own thresholds and definitions! This led to calls for a more unified, global approach.

This is where the Organisation for Economic Co-operation and Development (OECD) stepped in. The OECD is an international organization that works with governments to tackle economic, social, and environmental challenges. They launched a major initiative known as BEPS 2.0, aiming to update international tax rules for the 21st century.

BEPS stands for Base Erosion and Profit Shifting. It refers to strategies used by some multinational companies to exploit gaps and mismatches in tax rules to shift profits to low-tax or no-tax locations, thereby eroding the tax base of higher-tax countries.

The BEPS 2.0 project has two main "Pillars":

Pillar One: Re-allocating Taxing Rights (The DST Replacement)

Pillar One is the part of the global tax reform directly aimed at addressing the issues that led to DSTs. It proposes a new way to decide where multinational companies pay tax.

- The Core Idea: Instead of just taxing based on physical presence, Pillar One wants to re-allocate a portion of the profits of the largest and most profitable multinational enterprises (MNEs) to the countries where their customers are located and where their sales are made – regardless of physical presence.

- Who it Applies To: It targets MNEs with global revenues above €20 billion and a profit margin of over 10%.

- How it Works (Simplified): A portion of these MNEs’ "residual profit" (profit above a certain routine return) would be re-allocated to "market jurisdictions" (countries where their customers are). This re-allocated profit would then be taxed in those countries.

- The Big Deal for DSTs: The understanding is that once Pillar One is implemented, countries would remove their existing Digital Services Taxes. This is a crucial element of the global agreement – a trade-off for a more stable and predictable international tax system.

Pillar Two: Global Minimum Corporate Tax (The "Top-Up" Tax)

While not directly replacing DSTs, Pillar Two is another critical part of the BEPS 2.0 project and is important context for the future of international taxation.

- The Core Idea: To ensure large multinational corporations pay a minimum level of tax, regardless of where they are headquartered or where they operate.

- The Rate: The agreed minimum corporate tax rate is 15%.

- How it Works (Simplified): If a multinational company pays less than 15% tax in a particular country, other countries where it operates could apply a "top-up tax" to bring its effective tax rate up to 15%. This aims to reduce the incentive for companies to shift profits to low-tax jurisdictions.

- Who it Applies To: MNEs with global revenues above €750 million.

In essence, the OECD’s BEPS 2.0 project aims to create a more stable, fairer, and predictable international tax system for the digital age, ideally replacing the complex and often contentious individual DSTs.

Current State of Play: A Transitional Phase

The journey to implementing Pillar One and Pillar Two has been complex and involves many countries agreeing on intricate details.

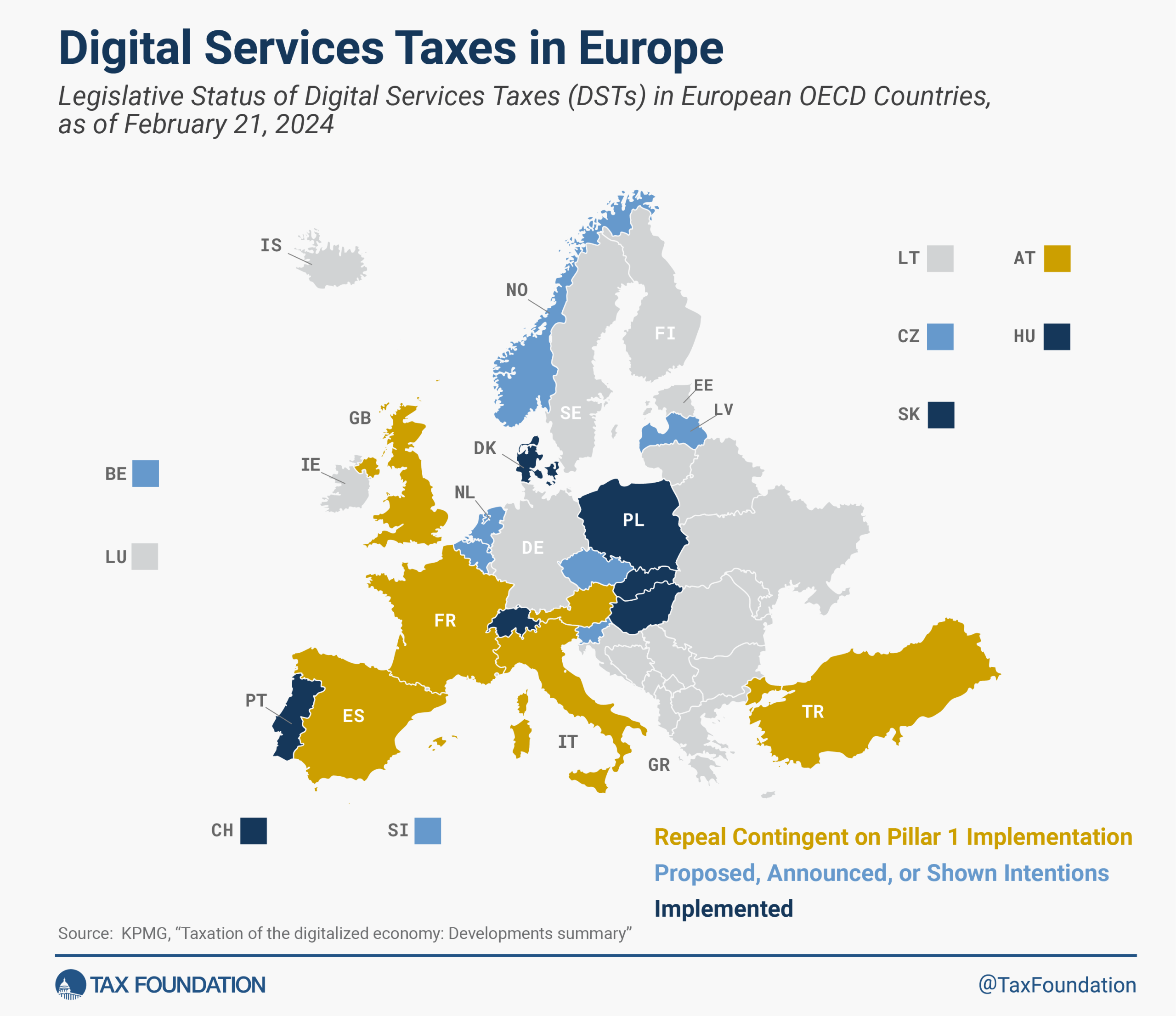

- Many Countries Still Have DSTs: Despite the global agreement to move towards Pillar One, many countries (like France, Italy, Spain, UK, India, Turkey, etc.) still have their DSTs in place. This is because Pillar One is not yet fully implemented.

- Some Countries are Pausing/Repealing: A few countries have agreed to pause or repeal their DSTs once Pillar One comes into effect, or have made commitments based on the progress of the global deal.

- Pillar Two is Further Along: Pillar Two, the global minimum tax, is generally further along in its implementation, with many countries having already passed legislation or being in the process of doing so. This means companies might already be dealing with its implications.

- Uncertainty Remains: While significant progress has been made, the exact timeline for Pillar One’s full implementation and the final fate of all DSTs remains somewhat uncertain. There are still political and technical hurdles to overcome.

What this means for businesses right now is navigating a landscape where both existing DSTs and the emerging global rules (especially Pillar Two) might apply.

What Does This Mean for YOUR Business? What You Need to Know

Even if your business isn’t a tech giant, the future of digital services taxes and global tax reform can have significant implications. Here’s what you need to consider:

1. Identify if You’re Currently Subject to DSTs

- Check Revenue Thresholds: Do you meet the global and in-country revenue thresholds for any countries that currently have a DST? (e.g., global revenue over €750 million, and in-country revenue over a certain amount, often €25 million).

- Review Your Services: Do you offer services typically targeted by DSTs in those countries?

- Online advertising sales?

- Operating an online marketplace (e-commerce, ride-sharing, food delivery, accommodation platforms)?

- Selling user data?

- Providing cloud computing services?

- Streaming content?

- Consult Country-Specific Rules: Each country’s DST has unique rules. You cannot assume what applies in one country applies in another.

2. Understand Compliance Challenges

If you are subject to DSTs:

- Multiple Jurisdictions: You might be subject to DSTs in several different countries, each with its own definitions, rates, reporting requirements, and filing deadlines.

- Data Collection: You’ll need robust systems to accurately track revenue generated from digital services in each specific country. This can be complex, especially for services like online advertising where user location needs to be precisely determined.

- Registration & Filing: You’ll need to register with relevant tax authorities and file regular returns, often quarterly or annually.

3. Assess Financial Implications

- Increased Tax Costs: DSTs are a cost to your business. Since they are based on revenue, they can impact your profitability, especially if profit margins are thin.

- Pricing Strategy: Can you pass on the cost of DSTs to your customers through higher prices? This depends on your market, competition, and customer willingness to pay.

- Double Taxation Risk: Until Pillar One is fully implemented and DSTs are removed, there’s a risk of "double taxation" – meaning you might pay a DST on revenue in one country, and then pay corporate income tax on the same profits in another country, without full credit for the DST paid.

4. Strategic Considerations

- Business Model Review: How might these taxes affect your current and future business models? Could they make certain digital services less profitable in specific markets?

- Market Entry/Exit Decisions: The tax burden could influence decisions about entering new markets or even exiting less profitable ones.

- Location Strategy: While DSTs are generally designed to tax the market where users are, the overall tax landscape might influence where you set up your operations or intellectual property.

Preparing for the Future: Actionable Steps for Your Business

Navigating this evolving tax landscape requires a proactive approach. Here’s what businesses need to do:

-

1. Stay Informed and Monitor Developments

- Follow the OECD: Regularly check the OECD’s BEPS 2.0 project updates, especially concerning Pillar One.

- Monitor Local Legislation: Keep an eye on tax news from countries where you operate or plan to operate, specifically for changes related to DSTs or the implementation of Pillar One and Pillar Two.

- Subscribe to Tax Newsletters: Many professional services firms (accounting, legal) offer newsletters specifically on international tax developments.

-

2. Assess Your Current and Future Tax Exposure

- Current DST Impact: If you’re not already, calculate your potential DST liabilities in countries where you operate.

- Pillar One & Two Impact: Even if you don’t meet the current DST thresholds, understand if your business might fall under Pillar One or Pillar Two in the future as thresholds or rules could evolve.

- Data Readiness: Ensure your internal systems can accurately track revenue by jurisdiction and service type. This data will be crucial for compliance with any new or existing rules.

-

3. Review Contracts and Pricing Strategies

- Tax Clauses: Examine your contracts with customers and suppliers. Do they allow you to adjust pricing for new taxes?

- Pricing Adjustments: Consider whether you need to adjust your pricing to absorb or pass on potential DST costs or the impact of global minimum tax.

-

4. Leverage Technology

- Tax Compliance Software: Explore software solutions that can help automate the calculation, reporting, and filing of taxes across multiple jurisdictions, especially for complex digital services.

- Data Analytics: Use data analytics tools to gain insights into your revenue streams by country and service, helping you identify tax obligations and strategic opportunities.

-

5. Seek Expert Advice

- Consult Tax Professionals: The world of international tax is incredibly complex. Engage with tax advisors, accountants, or lawyers specializing in international taxation and digital services. They can provide tailored advice for your specific business model and help you navigate the intricacies of compliance and planning.

Challenges and Opportunities Ahead

The transition to a new global tax framework presents both challenges and opportunities for businesses.

Challenges:

- Continued Complexity: The period between existing DSTs and full Pillar One implementation will be complex, requiring businesses to manage multiple tax regimes simultaneously.

- Data Demands: The need for granular data on user location and service type will increase significantly.

- Compliance Burden: Initial compliance costs for adapting to new rules will be substantial.

- Uncertainty: Delays or changes in the global agreement could prolong the period of uncertainty.

Opportunities:

- More Predictable Landscape (Eventually): Once fully implemented, a unified global framework should offer more predictability and reduce the risk of unilateral taxes and double taxation.

- Level Playing Field: For some businesses, a global minimum tax and re-allocation of taxing rights could create a more level playing field, as all large multinationals would face similar tax obligations.

- Strategic Planning: Proactive engagement with these changes allows businesses to adapt their strategies, optimize their operations, and maintain competitiveness.

Conclusion: Adapt and Thrive in the Digital Tax Era

The future of Digital Services Taxes is intertwined with the broader global tax reform efforts led by the OECD. While the transition period is undoubtedly challenging, with existing DSTs potentially coexisting with new global rules, the ultimate goal is a more coherent and equitable international tax system for the digital economy.

For your business, the key is awareness and preparedness. By understanding the current landscape, monitoring global developments, assessing your specific tax exposure, and leveraging expert advice, you can not only meet your compliance obligations but also strategically position your business to adapt and thrive in the evolving digital tax era. Don’t wait for the changes to hit; start planning now.

Post Comment