The Essential Guide to Understanding the Difference Between Assets and Liabilities: Your First Step to Financial Freedom

In the vast and often intimidating world of personal finance and business, two terms stand out as fundamental pillars: assets and liabilities. For beginners, these words can sound like complex jargon, but grasping their core meaning is not only simple but absolutely essential for managing your money, making smart financial decisions, and building true wealth.

Think of it this way: your financial life is a balancing act. On one side, you have things that bring money in or are worth money. On the other, you have things that take money out or represent what you owe. Understanding which is which is the very first step toward achieving financial clarity and control.

This comprehensive guide will demystify assets and liabilities, explain their crucial differences, and show you why this knowledge is your most powerful tool for financial success.

Why Understanding Assets vs. Liabilities Matters More Than You Think

Before we dive into definitions, let’s address the "why." Why should you care about these terms?

Imagine trying to drive a car without knowing the difference between the accelerator and the brake. You might move, but you wouldn’t be in control, and you’d likely crash. Similarly, trying to navigate your financial life without understanding assets and liabilities is like driving blind.

Knowing the difference allows you to:

- Measure your financial health: Are you building wealth or digging a deeper hole?

- Make informed decisions: Should you buy that new car? Is that investment property a good idea?

- Plan for the future: Retirement, homeownership, business expansion – all depend on accumulating assets and managing liabilities.

- Speak the language of finance: When talking to bankers, advisors, or business partners, this foundational knowledge is key.

Let’s break it down, simply and clearly.

What Are Assets? The Things That Put Money In Your Pocket (or Could)

At its simplest, an asset is anything you own that has economic value and can provide a future benefit. Think of it as something that either puts money into your pocket, has the potential to do so, or could be converted into cash if needed.

Key Characteristics of an Asset:

- Owned by You (or your business): You have legal title or control over it.

- Has Economic Value: It’s worth something; someone else would pay for it.

- Provides Future Benefit: It’s expected to generate cash flow, reduce expenses, or increase in value over time.

- Can Be Converted to Cash: Even if it’s not cash now, it can be sold or liquidated.

Examples of Assets:

To make this concrete, let’s look at common examples for both personal and business finance:

Personal Assets:

- Cash: Money in your checking account, savings account, under your mattress – the most liquid asset.

- Investments:

- Stocks: Shares of ownership in companies.

- Bonds: Loans made to governments or corporations.

- Mutual Funds/ETFs: Collections of stocks or bonds.

- Retirement Accounts: 401(k)s, IRAs, etc., holding various investments.

- Cryptocurrency: Digital assets like Bitcoin or Ethereum.

- Real Estate (Investment Property): A rental house, apartment building, or land you own specifically to generate income or appreciate in value. (Note: Your primary residence can be complex – more on this later!).

- Business Ownership: Your stake in a small business, a startup, or even a side hustle that generates income.

- Valuable Possessions: Collectibles (art, rare coins), precious metals (gold, silver), or other items that hold significant resale value.

- Accounts Receivable (if you’re a freelancer/small business owner): Money owed to you by clients for services or products already delivered.

Business Assets:

- Cash: Operating funds in bank accounts.

- Inventory: Products ready for sale or raw materials.

- Equipment: Machinery, computers, vehicles, tools used in operations.

- Buildings & Land: Property owned by the business.

- Intellectual Property: Patents, trademarks, copyrights, brand names (these can be incredibly valuable!).

- Investments: Any financial instruments held by the business.

Types of Assets:

Assets are often categorized based on how easily and quickly they can be converted into cash, or their expected lifespan.

- Current Assets: Assets that can be converted into cash within one year.

- Examples: Cash, accounts receivable, inventory.

- Non-Current (or Fixed) Assets: Assets that are not expected to be converted into cash within one year, or that are held for long-term use.

- Examples: Property, plant, and equipment (PP&E), long-term investments, intangible assets.

- Tangible Assets: Assets that have a physical form and can be touched.

- Examples: Land, buildings, equipment, inventory, cash.

- Intangible Assets: Assets that do not have a physical form but still have economic value.

- Examples: Patents, trademarks, copyrights, brand recognition, goodwill.

What Are Liabilities? The Things That Take Money Out of Your Pocket

Conversely, a liability is something you owe to someone else – an obligation that will require an outflow of economic benefits (usually cash) in the future. Think of it as a financial debt or obligation that you are responsible for paying.

Key Characteristics of a Liability:

- Owed by You (or your business): It’s a debt or obligation you’re responsible for.

- Represents an Obligation: You are legally bound to pay it back.

- Requires Future Outflow of Resources: It will cost you money, time, or other assets to settle.

- Results from Past Transactions: The debt was incurred because of something that already happened (e.g., you borrowed money, you bought something on credit).

Examples of Liabilities:

Just like assets, liabilities are common in both personal and business finance:

Personal Liabilities:

- Credit Card Debt: Money you owe on your credit cards. Often high-interest.

- Mortgage: The loan you took out to buy your home. This is usually the largest personal liability.

- Student Loans: Money borrowed to finance education.

- Car Loans (Auto Loans): Money borrowed to purchase a vehicle.

- Personal Loans: Unsecured loans from banks or credit unions.

- Medical Bills: Outstanding payments for healthcare services.

- Taxes Owed: Income tax, property tax, etc., that haven’t been paid yet.

- Bills: Utility bills, phone bills, rent (if not owned), etc., that are due.

Business Liabilities:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Bank Loans: Loans taken from financial institutions for business operations or expansion.

- Salaries Payable: Wages owed to employees for work performed but not yet paid.

- Rent Payable: Rent owed for business premises.

- Bonds Payable: Debt securities issued by the company.

- Deferred Revenue: Money received from customers for services or products not yet delivered (an obligation to deliver in the future).

Types of Liabilities:

Liabilities are typically categorized by when they are due to be paid.

- Current Liabilities: Obligations that are due to be paid within one year.

- Examples: Accounts payable, short-term loans, current portion of long-term debt, salaries payable.

- Non-Current (or Long-Term) Liabilities: Obligations that are not due for more than one year.

- Examples: Mortgages, long-term bank loans, bonds payable, deferred tax liabilities.

The Core Difference: Assets vs. Liabilities (The Simplest Explanation)

If you take away nothing else from this article, remember this:

- Assets are what you OWN. They have value and bring money in or could bring money in.

- Liabilities are what you OWE. They represent obligations that take money out.

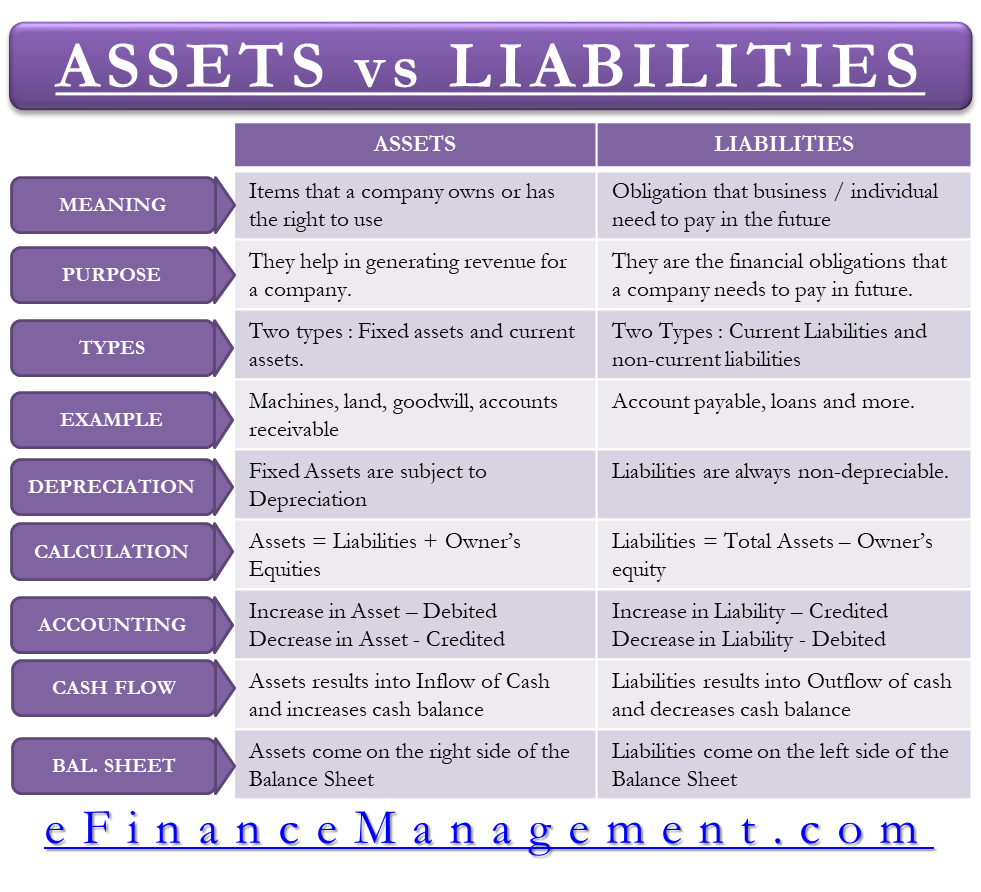

Here’s a quick comparison table to solidify the distinction:

| Feature | ASSET | LIABILITY |

|---|---|---|

| Nature | What you OWN | What you OWE |

| Future Impact | Brings money IN (or saves money) | Takes money OUT (future obligation) |

| Financial Health | Increases your net worth | Decreases your net worth |

| Benefit | Provides economic benefit | Requires economic sacrifice |

| Direction | Represents a resource | Represents an obligation |

| Goal | To accumulate more | To reduce and manage |

Why Does This Matter to YOU? Calculating Your Net Worth

The ultimate reason to understand assets and liabilities is to calculate your Net Worth.

Your Net Worth is a single, powerful number that represents your true financial standing at any given moment. It’s like a financial snapshot of your wealth.

Net Worth = Total Assets – Total Liabilities

- Positive Net Worth: Means you own more than you owe. This is the goal! It indicates you’re building wealth.

- Negative Net Worth: Means you owe more than you own. This is common, especially for young people with student loans or new homeowners with large mortgages, but the goal should be to move towards positive.

Calculating your net worth regularly (e.g., once a year, or quarterly) is one of the most effective ways to track your financial progress. It shows you if your efforts to save, invest, and pay down debt are truly making a difference.

Example:

Let’s say you have:

- Assets:

- Cash: $5,000

- Investments: $20,000

- Value of your car: $10,000

- Total Assets = $35,000

- Liabilities:

- Credit Card Debt: $2,000

- Student Loan: $15,000

- Car Loan: $8,000

- Total Liabilities = $25,000

Your Net Worth = $35,000 (Assets) – $25,000 (Liabilities) = $10,000

A positive net worth of $10,000! This means that if you sold all your assets and paid off all your liabilities, you would have $10,000 left over.

Common Misconceptions: Is My House an Asset or a Liability? What about My Car?

This is where it gets tricky for many beginners, and it’s a crucial point to clarify.

Your Primary Residence (The House You Live In)

- The Common View: "My house is my biggest asset!"

- The Financial Reality (for Net Worth Calculation): While your home is an asset you own and it has value, for most homeowners, the associated mortgage is a massive liability. Furthermore, a primary residence doesn’t typically generate income; instead, it generates expenses (mortgage payments, property taxes, insurance, maintenance).

- When it’s purely an asset: If you own your home outright (no mortgage) AND you rent it out for income, then it’s clearly an income-generating asset.

- The Nuance: From a pure accounting perspective, your house is an asset on your personal balance sheet. However, from a wealth-building perspective, a primary residence that is heavily mortgaged and consumes a significant portion of your income in expenses acts more like a liability in terms of draining cash flow, even if its value appreciates over time. The goal for wealth is to have assets that pay you, not assets that you pay for.

Your Personal Car

- The Common View: "My car is an asset."

- The Financial Reality: While you own it, a personal car is almost always a depreciating asset. This means its value goes down significantly from the moment you drive it off the lot. On top of that, cars come with numerous associated liabilities: car loans, insurance, fuel, maintenance, repairs.

- When it’s purely an asset: If you use your car for a business (e.g., a taxi driver, delivery service) and it generates more income than its depreciation and running costs, then it can be considered a productive asset for your business.

- The Nuance: For most people, a personal car is a significant expense that rapidly loses value. While technically an asset you own, its overall impact on your net worth and cash flow often leans towards it being a net liability due to the ongoing costs and depreciation.

The Golden Rule for Wealth Building:

True assets are things that put money into your pocket (e.g., rental properties, dividend stocks, a profitable business). Liabilities and depreciating assets are things that take money out of your pocket (e.g., consumer debt, a car that only serves personal transport, a primary residence with a large mortgage and high running costs).

How to Build Assets and Reduce Liabilities: Your Path to Financial Freedom

Now that you understand the difference, what can you do with this knowledge? The goal is simple: Increase your assets and decrease your liabilities.

Strategies to Build Assets:

- Save Consistently: Make saving a portion of every paycheck a priority. Start with an emergency fund.

- Invest Wisely: Once you have an emergency fund, put your money to work!

- Start Early: Compounding interest is your best friend.

- Diversify: Don’t put all your eggs in one basket.

- Consider Low-Cost Index Funds/ETFs: A simple and effective way to invest in the market.

- Contribute to Retirement Accounts: 401(k)s, IRAs offer tax advantages.

- Acquire Income-Generating Assets:

- Rental Properties: If feasible, real estate can provide passive income and appreciation.

- Dividend Stocks: Stocks that pay you a portion of the company’s earnings.

- Start a Side Hustle/Business: Turn a skill or hobby into an income stream that can grow into a significant asset.

- Increase Your Earning Potential: Invest in yourself through education, new skills, or career development to increase your income, which in turn allows you to save and invest more.

- Be Mindful of Depreciating Assets: When buying items like cars, consider used models, or models that hold their value better, to minimize the "liability" aspect.

Strategies to Reduce Liabilities:

- Create a Budget: Know exactly where your money is going. This is the first step to gaining control.

- Prioritize High-Interest Debt: Credit card debt is often the most damaging. Pay it off aggressively (e.g., using the snowball or avalanche method).

- Avoid Unnecessary Debt: Think twice before taking out loans for things that depreciate quickly or don’t generate income.

- Refinance Loans: If interest rates have dropped, you might be able to refinance your mortgage or student loans to a lower rate, reducing your monthly payments and total interest paid.

- Live Below Your Means: Spend less than you earn. This simple principle frees up cash to pay down debt and build assets.

- Negotiate: Don’t be afraid to negotiate lower interest rates with credit card companies or better terms on loans.

Conclusion: Your Journey to Financial Empowerment Starts Now

Understanding the difference between assets and liabilities isn’t just about financial jargon; it’s about gaining clarity, control, and confidence over your financial future. It’s the foundational knowledge that empowers you to make smarter decisions, track your progress, and ultimately, build lasting wealth.

Start by listing out your own assets and liabilities. Calculate your net worth. It might be eye-opening, but it’s the critical first step. Once you know where you stand, you can create a strategic plan to accumulate more assets and shed those burdensome liabilities.

Remember, wealth isn’t just about how much money you make; it’s about how much money you keep and how much that money works for you. By focusing on increasing your assets and decreasing your liabilities, you are actively choosing the path to financial freedom. The journey begins with this understanding, and the power to change your financial trajectory is now in your hands.

Post Comment