The Economic Impact of Global Aging Populations: Navigating the Demographic Shift

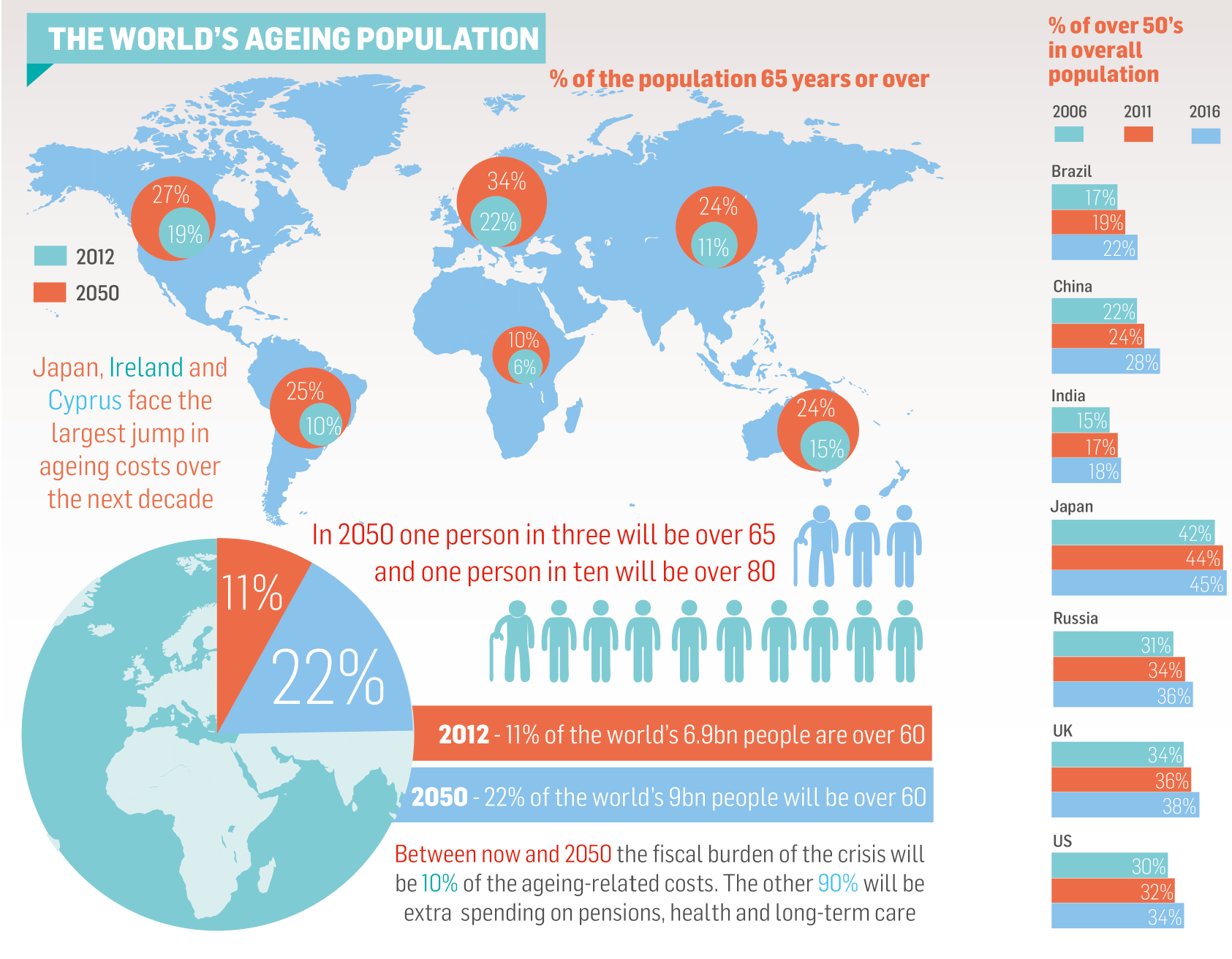

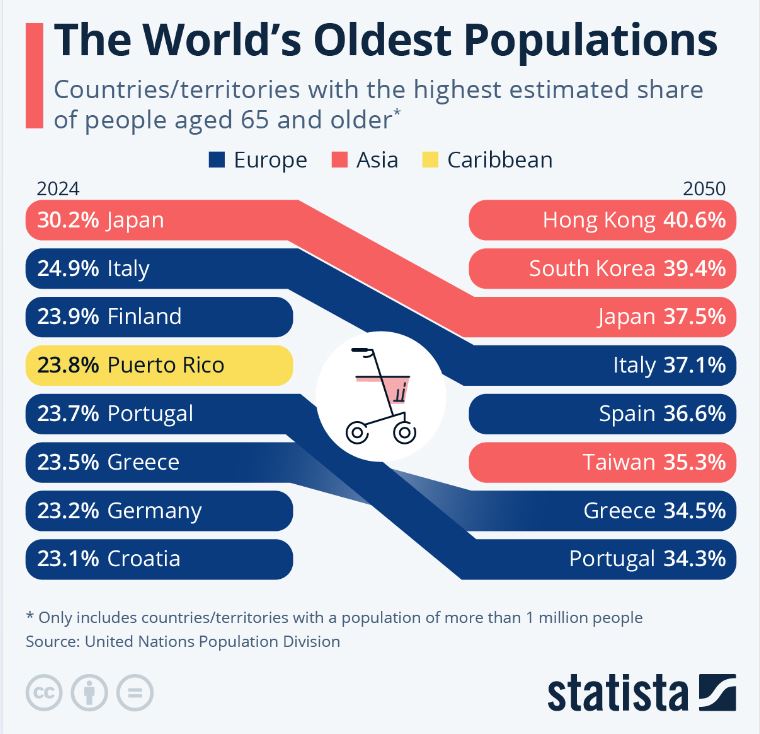

Have you ever noticed that people seem to be living longer than ever before? And perhaps you’ve heard that families, in many parts of the world, are having fewer children. These two trends—longer lives and fewer births—are combining to create one of the most significant demographic shifts in human history: global population aging.

This isn’t just a fascinating social change; it’s a powerful force reshaping economies worldwide. From how governments budget their money to what kind of jobs are available, the aging of our global population has profound economic impacts. Understanding these impacts is crucial for businesses, policymakers, and individuals alike.

In this long-form article, we’ll break down the economic consequences of global aging in easy-to-understand language, exploring both the challenges and the surprising opportunities that lie ahead.

What is Global Aging, and Why Is It Happening?

Before diving into the economic details, let’s clarify what we mean by "global aging." It refers to the increasing median age of the population in a country or region due to rising life expectancy and/or declining birth rates. In simpler terms, there are more older people and relatively fewer younger people.

Key Drivers of Global Aging:

- Increased Life Expectancy: Thanks to advancements in medicine, better nutrition, improved sanitation, and healthier lifestyles, people are simply living longer, healthier lives. A person born today in many developed countries can expect to live well into their 80s or even beyond.

- Decreased Birth Rates: Globally, women are having fewer children. This is due to various factors, including increased access to education and family planning, women’s greater participation in the workforce, rising costs of raising children, and changing social norms.

- The Baby Boomer Effect: In many Western countries, the large "Baby Boomer" generation (born post-WWII) is now reaching retirement age, creating a noticeable bulge in the older age brackets.

This shift means that the "dependency ratio"—the number of dependents (children and elderly) per working-age person—is changing dramatically, with a growing proportion of elderly dependents.

The Economic Challenges of Global Aging

While living longer is a wonderful achievement, the rapid shift in population age structure presents several significant economic challenges.

1. Shrinking Workforce and Slower Economic Growth

- Fewer Workers, Less Output: As a larger proportion of the population moves into retirement, the size of the working-age population tends to shrink. Fewer workers mean less production of goods and services, which can lead to slower overall economic growth (measured by Gross Domestic Product or GDP).

- Labor Shortages: Key industries may face shortages of skilled workers, making it harder for businesses to expand or even maintain current operations. This can particularly impact sectors requiring physical labor or specific technical skills.

- Reduced Innovation: Some argue that an aging workforce might be less adaptable to new technologies or less prone to entrepreneurial risk-taking, potentially slowing down innovation.

2. Rising Healthcare and Long-Term Care Costs

- Increased Demand for Services: Older populations typically require more medical care, including hospital stays, prescription medications, and long-term care facilities. This puts immense pressure on healthcare systems and budgets.

- Chronic Diseases: Age is a major risk factor for many chronic diseases like heart disease, diabetes, and Alzheimer’s. Managing these conditions is expensive and often requires ongoing care.

- Fiscal Strain: Governments, who often subsidize healthcare, face difficult choices: raise taxes, cut other public services, or increase national debt to cover these escalating costs.

3. Strain on Social Security and Pension Systems

- Fewer Contributors, More Beneficiaries: Most "pay-as-you-go" pension systems (like Social Security in the US) rely on current workers paying taxes to fund the benefits of current retirees. With fewer young workers and more retirees, this system becomes unsustainable.

- Funding Gaps: Many pension funds face significant deficits, meaning they don’t have enough money saved to cover future obligations to retirees. This can lead to calls for higher retirement ages, reduced benefits, or increased contributions from workers.

- Intergenerational Equity Concerns: There’s a growing debate about whether younger generations are being asked to bear too heavy a burden to support older generations, potentially leading to social friction.

4. Changing Consumption and Investment Patterns

- Shift in Spending: Older individuals tend to spend differently than younger families. They might spend less on education, housing, and consumer goods, and more on healthcare, travel, and leisure. This requires industries to adapt.

- Lower Savings Rates: As people enter retirement and draw down their savings, national savings rates can decline. Lower savings can mean less capital available for investment, which is essential for economic growth.

- Housing Market Dynamics: Demand for certain types of housing (e.g., family homes) might decrease, while demand for age-restricted communities or accessible housing increases.

5. Fiscal Burden on Governments

- Increased Public Spending: Governments face higher costs for pensions, healthcare, and social services for the elderly.

- Potential for Higher Taxes: To cover these costs, governments may need to raise taxes on workers and businesses, which could discourage investment and economic activity.

- Rising National Debt: If governments choose not to raise taxes or cut spending elsewhere, they may accumulate more debt, which has long-term consequences for economic stability.

The Economic Opportunities in Global Aging

While the challenges are real, global aging isn’t just a story of doom and gloom. It also presents unique economic opportunities and gives rise to what is often called the "Silver Economy."

1. The Rise of the "Silver Economy"

- New Markets and Industries: The needs and preferences of older adults are creating entirely new markets. This includes:

- Assistive Technologies: Smart home devices, fall detection systems, remote monitoring.

- Health and Wellness Products: Specialized fitness programs, nutritional supplements, anti-aging products.

- Leisure and Travel: Tailored travel packages, educational tours, volunteer opportunities for seniors.

- Financial Services: Retirement planning, wealth management, specialized insurance products.

- Elder Care Services: Home care, assisted living, specialized medical facilities.

- Job Creation: These new industries will require skilled workers, creating new job opportunities in areas like gerontology, healthcare technology, and personalized services.

2. Innovation and Technological Advancement

- Automation and Robotics: Aging populations can accelerate the adoption of automation and robotics in industries facing labor shortages, boosting productivity.

- AI in Healthcare: Artificial intelligence can help diagnose diseases earlier, personalize treatments, and manage patient data more efficiently, reducing healthcare costs in the long run.

- Telemedicine and Remote Care: Technology allows for healthcare services to be delivered remotely, improving access and potentially reducing the burden on physical facilities.

3. The Value of an Experienced Workforce

- Retaining Expertise: Older workers possess a wealth of knowledge, experience, and institutional memory that is invaluable to businesses. Policies that encourage flexible work arrangements (part-time, consulting) can help retain this talent.

- Mentorship and Training: Experienced older workers can mentor younger generations, passing on crucial skills and wisdom, and reducing training costs for companies.

- Entrepreneurship: Many older adults are choosing to start new businesses, bringing their experience and capital to new ventures.

4. Healthy Lifestyles and Active Aging

- Productive Longevity: As people live longer and healthier, they remain active and productive members of society for longer. This extends their contribution to the economy, whether through paid work, volunteering, or caregiving.

- Reduced Dependency: Promoting healthy aging through preventative care and active lifestyles can reduce the incidence of chronic diseases, thereby lowering healthcare costs and extending the period of independent living.

Strategies and Solutions for Navigating Global Aging

Addressing the economic impacts of global aging requires a multi-faceted approach involving governments, businesses, and individuals.

1. Policy Reforms and Adaptations

- Adjusting Retirement Ages: Gradually increasing the official retirement age can help sustain pension systems and keep experienced workers in the labor force longer.

- Immigration Policies: Carefully managed immigration can help replenish the working-age population, bringing in new skills and contributing to tax bases.

- Family-Friendly Policies: Supporting families with childcare, parental leave, and financial incentives can help encourage higher birth rates in countries facing severe demographic decline.

- Pension System Reforms: Shifting towards more sustainable pension models, encouraging private savings, and diversifying investment strategies for public funds.

2. Investing in Technology and Automation

- Boost Productivity: Governments and businesses should invest in research and development for automation, robotics, and artificial intelligence to offset shrinking workforces and boost productivity.

- Digital Transformation: Encouraging digital literacy across all age groups and promoting the adoption of digital tools in workplaces.

3. Promoting Lifelong Learning and Re-skilling

- Continuous Education: Creating opportunities for older workers to learn new skills and adapt to changing job markets is essential to keeping them employed and productive.

- Flexible Work Arrangements: Companies should offer flexible schedules, part-time options, and telecommuting to accommodate older workers’ needs and retain their expertise.

- Combatting Ageism: Actively fighting discrimination against older workers in hiring and promotion practices.

4. Reforming Healthcare Systems

- Focus on Prevention: Shifting healthcare spending towards preventive care and wellness programs can reduce the incidence and severity of chronic diseases, lowering long-term costs.

- Integrated Care Models: Developing integrated care systems that coordinate services across different providers (hospitals, home care, social services) can improve efficiency and patient outcomes.

- Technology Adoption: Embracing telemedicine, remote monitoring, and AI-powered diagnostics to make healthcare more accessible and cost-effective.

5. Encouraging Savings and Financial Literacy

- Personal Responsibility: Individuals need to be empowered and educated to take more responsibility for their retirement savings through personal accounts and investments.

- Financial Education: Providing comprehensive financial literacy programs can help people plan better for their longer lifespans.

Conclusion: A Future Shaped by Longevity

Global aging is not a distant threat; it’s a current reality that will profoundly shape our economic future. While the challenges—from strained social safety nets to labor shortages—are significant, they are not insurmountable.

By embracing innovation, reforming outdated policies, investing in human capital, and fostering a culture of lifelong learning, societies can turn the demographic shift into an opportunity. The "silver economy" offers new avenues for growth, technology can enhance productivity and well-being, and the wisdom of an experienced population remains an invaluable asset.

Navigating the economic impact of global aging requires foresight, collaboration, and a willingness to adapt. By proactively addressing these issues, we can ensure that longer lives lead not just to more years, but to more prosperous and sustainable years for everyone. The future of our global economy depends on how well we prepare for the longevity revolution.

Post Comment