The Economic Heartbeat: Understanding the Role of Interest Rates in Economic Cycles

Imagine the economy as a living, breathing organism. Just like a human body has a heartbeat that regulates blood flow, the economy has a powerful pulse: interest rates. These seemingly simple numbers play an incredibly significant role, influencing everything from the price of your morning coffee to the stability of global markets. For beginners, understanding their impact can feel daunting, but fear not! This article will demystify the role of interest rates, explaining how they act as a crucial lever, shaping the ups and downs of economic cycles.

What Exactly Are Interest Rates? The Cost of Money

At its core, an interest rate is simply the cost of borrowing money or the return on saving money.

- When you borrow: Whether it’s a loan for a car, a mortgage for a house, or a business loan to expand, the interest rate is the extra amount you pay back on top of the original amount. It’s like renting money for a period.

- When you save: If you put money in a savings account or invest in certain bonds, the interest rate is the payment you receive for lending your money to the bank or institution. It’s your reward for delaying spending.

Think of it as the "price" of money. Like any price, it goes up and down, and these fluctuations have profound effects.

The Central Bank’s Role: The Maestro of Money

Who decides these critical rates? In most countries, it’s the Central Bank. In the United States, it’s the Federal Reserve (the Fed); in Europe, it’s the European Central Bank (ECB); in the UK, it’s the Bank of England (BoE).

The Central Bank acts as the economy’s "maestro," using monetary policy (primarily interest rates) to achieve key goals:

- Price Stability (Controlling Inflation): Keeping prices from rising too quickly (inflation) or falling too much (deflation).

- Maximum Sustainable Employment: Helping to create conditions where as many people as possible have jobs.

- Moderate Long-Term Interest Rates: Contributing to overall financial stability.

By adjusting a key benchmark rate (like the Federal Funds Rate in the US), the Central Bank influences all other interest rates in the economy.

How Interest Rates Influence the Economy: The Ripple Effect

When the Central Bank changes its benchmark interest rate, it sends ripples throughout the entire economy. Here’s how:

1. The Cost of Borrowing: Fueling or Braking Spending

- For Businesses:

- Lower Rates: It becomes cheaper for businesses to borrow money to invest in new equipment, build factories, or hire more staff. This encourages expansion, job creation, and economic growth.

- Higher Rates: Borrowing becomes more expensive, making businesses less likely to invest and expand. This can slow down growth and lead to less hiring.

- For Consumers:

- Lower Rates: Mortgages become cheaper, making buying a home more affordable. Car loans and credit card debt also become less burdensome, encouraging people to spend more.

- Higher Rates: Mortgage payments rise, making homeownership less accessible. Car loans and other forms of credit become more expensive, discouraging large purchases and leading people to save more.

2. Saving Incentives: Spend Now or Save for Later?

- Lower Rates: The return on savings accounts is low, which might encourage people to spend their money now or invest it in riskier assets (like stocks) that offer potentially higher returns.

- Higher Rates: Savings accounts and bonds offer better returns, making it more attractive for people to save their money rather than spend it immediately.

3. Asset Prices: Real Estate and Stocks

- Lower Rates:

- Real Estate: Cheaper mortgages boost demand for homes, pushing up housing prices.

- Stocks: With lower returns on safe investments (like bonds), investors might put more money into stocks, which can drive up stock prices.

- Higher Rates:

- Real Estate: More expensive mortgages cool down the housing market, potentially leading to stable or falling prices.

- Stocks: Higher returns on safer investments can pull money out of the stock market, potentially causing stock prices to fall.

4. Exchange Rates: Global Connections

- Higher Rates: Can attract foreign investors looking for better returns on their investments. This increased demand for a country’s currency can make it stronger, meaning imports become cheaper, but exports become more expensive for other countries to buy.

- Lower Rates: Can make a country’s currency less attractive to foreign investors, potentially weakening it. This makes imports more expensive but exports cheaper, which can boost a country’s sales abroad.

Interest Rates and the Economic Cycle: Boom, Bust, and Beyond

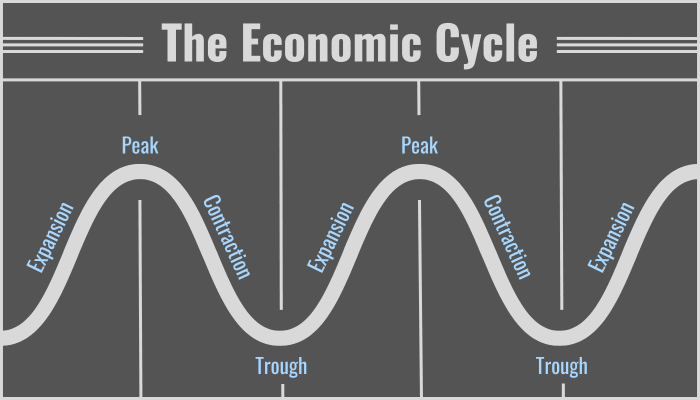

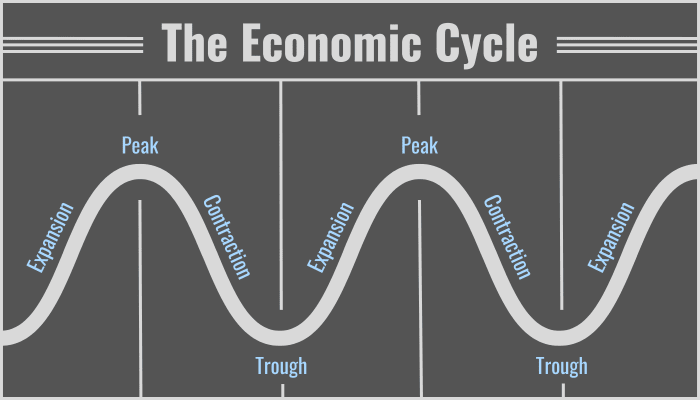

The economy naturally moves in cycles of expansion (growth) and contraction (slowdown/recession). Interest rates are a primary tool Central Banks use to manage these cycles, trying to smooth out the extremes.

1. During an Economic Expansion (Boom): Cooling Things Down

When the economy is growing rapidly, sometimes it can get "too hot." Demand for goods and services might outstrip supply, leading to inflation (prices rising too quickly). In this scenario:

- Central Bank Action: The Central Bank will typically raise interest rates.

- Why? To "cool down" the economy and prevent runaway inflation.

- Effects:

- Borrowing becomes more expensive, slowing down consumer spending and business investment.

- Saving becomes more attractive.

- Demand for goods and services decreases, helping to stabilize prices.

- The goal is a "soft landing" – slowing growth without causing a recession.

2. During an Economic Contraction or Recession (Bust): Stimulating Growth

When the economy slows down significantly, or enters a recession (a prolonged period of declining economic activity), businesses struggle, and unemployment rises. In this scenario:

- Central Bank Action: The Central Bank will typically lower interest rates.

- Why? To stimulate borrowing, spending, and investment, thereby boosting economic activity.

- Effects:

- Borrowing becomes cheaper, encouraging businesses to invest and consumers to spend (e.g., on homes, cars).

- Saving becomes less attractive, prompting people to spend or invest elsewhere.

- This increased demand helps businesses, leads to more hiring, and ideally pulls the economy out of recession.

The Balancing Act: Challenges for Central Banks

Managing interest rates is not an exact science. Central Banks face several challenges:

- Lag Effects: The full impact of an interest rate change isn’t felt immediately. It can take months, or even a year or more, for the effects to fully ripple through the economy. This makes timing crucial and difficult.

- Unforeseen Shocks: Global events (like pandemics, wars, or oil price spikes) can suddenly change economic conditions, requiring rapid and difficult adjustments to interest rate policy.

- Zero Lower Bound (ZLB): Interest rates cannot go below zero indefinitely. If the economy needs more stimulus but rates are already at zero (or close to it), the Central Bank has fewer traditional tools left, sometimes resorting to unconventional measures like "quantitative easing."

- Public and Political Pressure: Interest rate decisions can be unpopular, especially when rates are rising, as they can make borrowing more expensive for everyday people.

Conclusion: The Silent Driver of Economic Fate

Interest rates are far more than just numbers on a bank statement. They are the invisible hand, guided by Central Banks, that steers the ship of the economy. By understanding how they influence borrowing, saving, investment, and ultimately, the pace of economic activity, we gain a clearer picture of why economies expand, contract, and how policymakers attempt to navigate these often turbulent waters.

While their role is complex, their fundamental impact is simple: interest rates determine the cost and reward of money, acting as a critical lever in the ongoing dance of the economic cycle. Keeping an eye on them is key to understanding the economic health of your nation and the world.

Post Comment