The Circular Flow of Income: How Money Moves in an Economy (And Why It Matters!)

Have you ever wondered how a country’s economy actually works? How does money get from your pocket to the store, and back again? It might seem like a complicated dance of billions of transactions, but at its heart, the movement of money in an economy can be understood through a powerful, yet simple, concept: The Circular Flow of Income.

This fundamental economic model helps us visualize how money, goods, and services flow continuously between different parts of the economy. Understanding it is like having a map to how a nation earns, spends, and saves, offering crucial insights into economic health and growth.

In this comprehensive guide, we’ll break down the Circular Flow of Income, starting with its simplest form and gradually adding layers of complexity, making it easy for anyone to grasp this vital economic concept.

What is the Circular Flow of Income?

At its core, the Circular Flow of Income is a model that illustrates the continuous movement of money, goods, and services between different sectors of an economy. Imagine it as a giant, never-ending loop where what one group spends, another group receives as income.

It shows that:

- Income generated by production is used for expenditure.

- This expenditure then becomes income for someone else.

- This income, in turn, is used for more expenditure, and so the cycle continues.

This model is a cornerstone of macroeconomics, helping economists and policymakers understand key indicators like Gross Domestic Product (GDP), inflation, and unemployment.

The Simplest Model: The Two-Sector Circular Flow (Households and Firms)

Let’s start with the most basic version of the circular flow, involving just two main players: Households and Firms.

1. Households: The Consumers and Resource Providers

- Who they are: You, me, our families – basically, everyone living in a dwelling.

- Their roles:

- Consumers: They buy goods and services from firms.

- Resource Providers: They own and provide the "factors of production" to firms.

2. Firms: The Producers

- Who they are: Businesses, companies, factories – any entity that produces goods and services.

- Their role:

- Producers: They use the factors of production to create goods and services.

- Employers: They hire resources (especially labor) from households.

The Two Flows: Real Flow and Money Flow

In this two-sector model, there are two distinct, yet interconnected, flows:

-

The Real Flow (Inner Loop): This represents the movement of physical goods, services, and the factors of production.

- From Households to Firms: Households provide factors of production (land, labor, capital, entrepreneurship) to firms.

- Land: Natural resources used in production.

- Labor: Human effort and skills.

- Capital: Man-made resources used to produce other goods (e.g., machinery, buildings).

- Entrepreneurship: The ability to organize and manage the other factors of production.

- From Firms to Households: Firms use these factors to produce goods and services, which they then sell back to households.

- From Households to Firms: Households provide factors of production (land, labor, capital, entrepreneurship) to firms.

-

The Money Flow (Outer Loop): This represents the movement of money payments for the real flows.

- From Firms to Households: Firms pay households for the factors of production they use. These payments are the income for households:

- Wages for labor

- Rent for land

- Interest for capital

- Profits for entrepreneurship

- From Households to Firms: Households use this income to purchase the goods and services produced by firms. This is the expenditure of households and the revenue for firms.

- From Firms to Households: Firms pay households for the factors of production they use. These payments are the income for households:

In essence: Households provide resources to firms, firms pay households for those resources, households use that money to buy products from firms, and firms use that money to pay for resources again. It’s a continuous, self-sustaining loop!

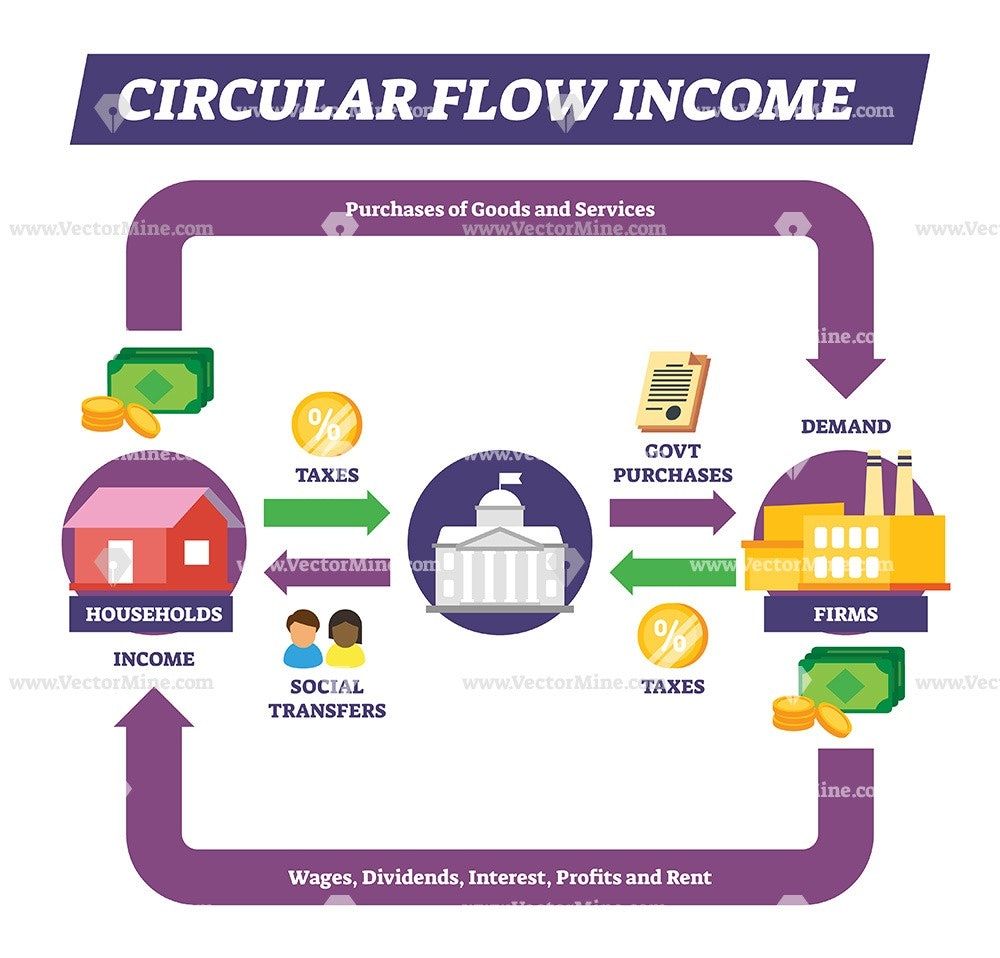

Expanding the Model: The Three-Sector Circular Flow (Adding Government)

The two-sector model is a great starting point, but real economies are more complex. Let’s introduce a crucial third player: the Government.

3. Government: The Regulator and Public Service Provider

- Who they are: Local, state, and national government bodies.

- Their roles:

- Taxation: Collects taxes from both households and firms. This is a leakage from the direct flow between households and firms.

- Government Spending (G): Spends money on public goods and services (e.g., infrastructure, education, healthcare, defense). This is an injection back into the flow.

- Transfer Payments: Provides social benefits to households (e.g., unemployment benefits, social security) without direct exchange for goods/services.

- Subsidies: Provides financial support to firms.

How the Government Affects the Flow:

- Money Flow from Households/Firms to Government:

- Taxes: Households pay income tax, property tax. Firms pay corporate tax. This money leaves the main expenditure-income loop.

- Money Flow from Government to Households/Firms:

- Government Purchases: The government buys goods and services from firms (e.g., building roads, buying military equipment). This revenue flows to firms.

- Wages and Salaries: The government employs many people (civil servants, teachers, police), paying them wages and salaries, which become household income.

- Transfer Payments: Money goes directly to households (e.g., welfare checks), boosting their income.

- Subsidies: Money goes directly to firms, reducing their costs or increasing their revenue.

The government’s involvement shows how income is redistributed and how public services are funded, influencing the overall level of economic activity.

Further Expansion: The Four-Sector Circular Flow (Adding Financial Markets & The Foreign Sector)

To get closer to a complete picture of a modern economy, we need to add two more vital sectors: Financial Markets and the Foreign Sector (Rest of the World).

4. Financial Markets (Financial Intermediaries)

- Who they are: Banks, stock markets, insurance companies, pension funds – institutions that facilitate the borrowing and lending of money.

- Their roles:

- Channel Savings: They collect savings from households and firms (money not immediately spent).

- Provide Investment: They lend these savings to firms for investment (e.g., buying new machinery, building new factories) or to households for purchases (e.g., mortgages).

How Financial Markets Affect the Flow:

- Savings (S): When households or firms save money instead of spending it, this money is deposited into financial institutions. Savings are a leakage from the immediate spending stream.

- Investment (I): Financial institutions then lend this saved money to firms for investment purposes. Investment is an injection back into the circular flow, as it generates income and production.

- Key Idea: Financial markets bridge the gap between savings and investment, allowing money that isn’t immediately spent to be used to create future productive capacity.

5. The Foreign Sector (Rest of the World)

- Who they are: All other countries and their economic agents (households, firms, governments).

- Their roles: Facilitate international trade (imports and exports) and financial flows.

How the Foreign Sector Affects the Flow:

- Imports (M): When households, firms, or the government buy goods and services from other countries, money flows out of the domestic economy to the foreign sector. Imports are a leakage.

- Example: Buying a car made in Japan.

- Exports (X): When domestic firms sell goods and services to other countries, money flows into the domestic economy from the foreign sector. Exports are an injection.

- Example: Selling software developed in the US to a German company.

The foreign sector highlights how interconnected global economies are, and how international trade impacts a nation’s income and expenditure.

Leakages and Injections: Understanding Economic Fluctuations

The concept of leakages and injections is crucial for understanding how the circular flow can expand or contract, leading to economic growth or recession.

-

Leakages: Money that leaves the immediate spending stream and doesn’t directly return as income within the current flow.

- Savings (S): Money saved by households or firms rather than spent.

- Taxes (T): Money paid to the government.

- Imports (M): Money spent on goods and services from other countries.

-

Injections: Money that enters the circular flow from outside the immediate spending stream.

- Investment (I): Spending by firms on capital goods (financed by savings).

- Government Spending (G): Spending by the government on goods, services, and transfers.

- Exports (X): Money received from the sale of goods and services to other countries.

The Balance of Leakages and Injections:

- If Injections > Leakages: The economy is likely to grow. More money is entering the flow than leaving, leading to increased production, income, and employment.

- If Leakages > Injections: The economy is likely to contract. More money is leaving the flow than entering, leading to reduced production, income, and potential job losses.

- If Injections = Leakages: The economy is in equilibrium, meaning the circular flow is stable, with no tendency to expand or contract.

Understanding this balance is vital for policymakers when considering fiscal (government spending and taxation) and monetary (interest rates, money supply) policies.

Why is the Circular Flow of Income Important? (Practical Applications)

The Circular Flow of Income model is far more than just an abstract concept; it provides a foundational understanding for many real-world economic phenomena and policy decisions:

-

Measuring Economic Activity (GDP): The model shows that total expenditure in an economy must equal total income, which must also equal the total value of goods and services produced. This forms the basis for measuring a nation’s Gross Domestic Product (GDP), which can be calculated in three ways:

- Expenditure Approach: Sum of all spending (C + I + G + (X-M)).

- Income Approach: Sum of all incomes earned (wages, rent, interest, profit).

- Production/Output Approach: Sum of the value of all final goods and services produced.

The circular flow demonstrates why these three approaches should yield the same result.

-

Understanding Economic Health: A robust and active circular flow indicates a healthy, growing economy. Stagnation or contraction in the flow signals economic problems.

-

Policy Making:

- Fiscal Policy: Governments use the model to understand how changes in taxes (leakage) or government spending (injection) will affect the overall economy. For example, increased government spending can stimulate a sluggish economy.

- Monetary Policy: Central banks use it to see how influencing interest rates (affecting savings and investment) can impact economic activity. Lower interest rates might encourage investment (injection) and discourage savings (leakage).

-

Predicting Economic Trends: By observing changes in savings, investment, imports, exports, and government activities, economists can better predict future economic performance.

-

Interdependence: It clearly illustrates the interdependence between different sectors of the economy. A change in one sector (e.g., a rise in household savings) can have ripple effects throughout the entire system.

Conclusion: The Ever-Flowing Economic River

The Circular Flow of Income is a powerful, yet elegant, model that demystifies how money moves through an economy. From the simple exchange between households and firms to the complex interplay of government, financial markets, and international trade, it provides a clear visual of economic life.

By understanding leakages and injections, we can see why economies expand or contract, and how various policies aim to keep the economic "river" flowing smoothly and robustly. It’s the fundamental blueprint for understanding the pulse of a nation’s economy – a continuous, dynamic, and interconnected flow that impacts every one of us.

Post Comment