The 50/30/20 Budget Rule Explained: Your Beginner’s Guide to Financial Freedom

Budgeting can feel like a daunting task, conjuring images of complex spreadsheets, endless tracking, and restrictive rules. But what if there was a simple, flexible framework that could help you manage your money, save for your goals, and still enjoy life? Enter the 50/30/20 budget rule, a popular and incredibly effective method for personal finance management.

This comprehensive guide will break down the 50/30/20 rule, explain how it works, and show you how to apply it to your own financial life. Get ready to transform your money habits and build a more secure future!

What Exactly is the 50/30/20 Budget Rule?

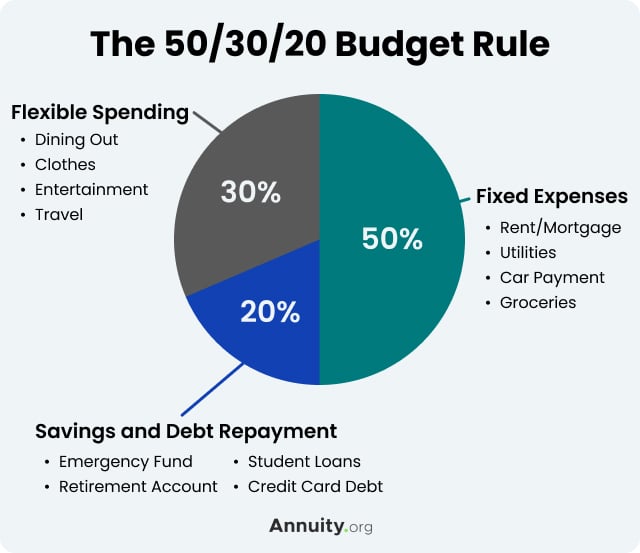

At its heart, the 50/30/20 budget rule is a straightforward guideline for allocating your after-tax income (your net income) into three main categories:

- 50% for Needs: Essential expenses you can’t live without.

- 30% for Wants: Discretionary expenses that improve your quality of life.

- 20% for Savings & Debt Repayment: Money dedicated to your financial future and reducing liabilities.

This rule was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book, "All Your Worth: The Ultimate Lifetime Money Plan." Its appeal lies in its simplicity and flexibility, making it an ideal starting point for anyone looking to gain control over their finances without getting bogged down in overly rigid systems.

Breaking Down the Percentages: Needs, Wants, and Savings

Let’s dive deeper into each category to understand what goes where and why it matters.

1. 50% for Needs: Your Non-Negotiable Expenses

Your "needs" are the absolute essentials – the things you literally cannot live without. These are the expenses that keep a roof over your head, food on your table, and ensure your basic well-being.

What typically falls under "Needs"?

- Housing: Rent or mortgage payments, property taxes, homeowner’s insurance.

- Utilities: Electricity, gas, water, internet (for work/essential communication).

- Groceries: Basic food supplies for cooking at home.

- Transportation: Car payments, gas, public transport fares, essential car insurance.

- Healthcare: Health insurance premiums, essential prescriptions, necessary doctor visits.

- Minimum Debt Payments: The minimum payments required on credit cards, student loans, or other debts to avoid late fees or default. (Note: Extra debt payments go into the 20% category).

- Childcare: If it’s essential for you to work.

Key considerations for Needs:

- Be Honest: It’s easy to categorize something as a "need" when it’s really a "want." For example, while a phone is a need, the latest iPhone model with unlimited data might be a want.

- Bare Necessities: Think about what you must spend to survive and maintain your basic life standard. If you cut it out, would your life be significantly disrupted or impossible?

2. 30% for Wants: Enjoying Life (Responsibly!)

Your "wants" are the discretionary expenses that make life enjoyable and comfortable, but aren’t strictly necessary for survival. This is where you get to decide how to spend your money on things that bring you pleasure and improve your quality of life.

What typically falls under "Wants"?

- Dining Out & Takeaway: Restaurants, coffee shops, fast food.

- Entertainment: Movies, concerts, streaming subscriptions (Netflix, Hulu, Spotify), video games.

- Hobbies & Leisure: Gym memberships (beyond basic health needs), sports equipment, craft supplies.

- Shopping: New clothes (beyond basic necessities), accessories, electronics, home decor.

- Vacations & Travel: Trips, hotels, flights.

- Beauty & Personal Care: Haircuts (beyond basic hygiene), manicures, spa treatments.

- Expensive Coffee/Drinks: Daily lattes or alcoholic beverages.

Key considerations for Wants:

- Balance is Key: The 50/30/20 rule recognizes that you need to enjoy your money. The goal isn’t to eliminate wants entirely, but to ensure they don’t derail your financial goals.

- Flexibility: This is often the most flexible category. If you find your "needs" are a bit high, this is usually the first place to look for cuts.

- Mindful Spending: Before making a "want" purchase, ask yourself if it truly aligns with your values and brings you lasting satisfaction.

3. 20% for Savings & Debt Repayment: Building Your Future

This is the category where you invest in your future self. Dedicating 20% of your income here is crucial for building wealth, achieving financial freedom, and reducing the burden of debt.

What typically falls under "Savings & Debt Repayment"?

- Emergency Fund: A crucial fund (ideally 3-6 months of living expenses) to cover unexpected costs like job loss, medical emergencies, or major car repairs.

- Retirement Accounts: Contributions to a 401(k), IRA, Roth IRA, or other pension plans.

- Investment Accounts: Contributions to a brokerage account for long-term growth.

- Down Payments: Saving for a house, a new car, or other large purchases.

- Extra Debt Payments: Any payments above the minimum required on high-interest debts like credit cards, personal loans, or student loans. Paying down high-interest debt aggressively is essentially a guaranteed return on your money.

- Education Savings: Saving for your children’s college or your own continuing education.

Key considerations for Savings & Debt Repayment:

- Pay Yourself First: Automate transfers to your savings and investment accounts as soon as you get paid. This ensures you prioritize your future.

- Prioritize High-Interest Debt: If you have credit card debt with 18%+ interest, paying it down should be a top priority within this 20%. It’s like saving money by avoiding massive interest payments.

- Consistency: Even small, consistent contributions add up significantly over time due to the power of compounding.

How to Implement the 50/30/20 Budget Rule: A Step-by-Step Guide

Ready to put the 50/30/20 rule into action? Follow these simple steps:

Step 1: Calculate Your After-Tax Income (Net Income)

This is the money you actually receive in your bank account after taxes, deductions for health insurance, 401(k) contributions, etc., are taken out. If you’re paid bi-weekly or weekly, calculate your monthly net income.

- Example: If your monthly gross income is $4,000 and your take-home pay (net income) is $3,000, you’ll base your calculations on $3,000.

Step 2: Allocate Your Percentages

Now, apply the 50/30/20 percentages to your net income:

- 50% for Needs: $3,000 x 0.50 = $1,500

- 30% for Wants: $3,000 x 0.30 = $900

- 20% for Savings & Debt Repayment: $3,000 x 0.20 = $600

So, with a $3,000 net income, your monthly targets would be:

- Needs: Max $1,500

- Wants: Max $900

- Savings & Debt: Min $600

Step 3: Track Your Spending

For the next month or two, meticulously track every dollar you spend. This can be done using:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), Personal Capital, or Simplifi can link to your accounts and categorize transactions automatically.

- Spreadsheets: Google Sheets or Excel templates.

- Pen and Paper: A simple notebook can work if you’re consistent.

The goal here is not to judge, but to get an accurate picture of where your money is currently going.

Step 4: Categorize Your Expenses

Once you have your spending data, go through each expense and assign it to the "Needs," "Wants," or "Savings & Debt Repayment" category. This is where you’ll see how your current spending aligns with (or deviates from) the 50/30/20 rule.

Step 5: Adjust and Optimize

This is the crucial step. Compare your actual spending to your 50/30/20 targets:

- If your Needs are over 50%: Look for ways to reduce them. Can you find a cheaper apartment, cut down on utilities, or optimize your grocery budget? If not, you might need to temporarily reduce your "wants" or "savings" to make room, or focus on increasing your income.

- If your Wants are over 30%: This is often the easiest place to make cuts. Identify areas where you can reduce discretionary spending without feeling deprived. Maybe fewer restaurant meals, canceling an unused subscription, or opting for free entertainment.

- If your Savings & Debt Repayment is under 20%: Re-evaluate your Needs and Wants to free up more money for this vital category. This is your future calling!

Step 6: Automate Your Savings

Make saving effortless. Set up automatic transfers from your checking account to your savings, investment, or debt repayment accounts immediately after you get paid. If you don’t see the money, you’re less likely to spend it.

Step 7: Review Regularly

Your financial situation isn’t static. Review your budget monthly or quarterly. Life changes – you might get a raise, have a new expense, or achieve a financial goal. Adjust your budget as needed to ensure it continues to serve your current circumstances.

Benefits of the 50/30/20 Budget Rule

Choosing the 50/30/20 rule offers several compelling advantages:

- Simplicity: It’s easy to understand and implement, making it perfect for budgeting beginners. You don’t need complex software or accounting degrees.

- Flexibility: It’s a guideline, not a rigid law. You can adjust it to fit your unique circumstances, especially as your income or financial goals change.

- Promotes Balance: Unlike restrictive budgets that can lead to burnout, the 50/30/20 rule encourages you to enjoy your money (with the 30% for wants) while still prioritizing your future.

- Encourages Savings: By explicitly setting aside 20% for savings and debt, it ensures you’re always making progress towards your financial goals.

- Reduces Financial Stress: When you have a clear plan for your money, you’ll feel more in control and less anxious about your finances.

- Adaptable: It works for various income levels, though lower incomes might find it more challenging to hit the 50% needs target initially.

Common Questions & Troubleshooting

"What if my Needs are more than 50%?"

This is a common challenge, especially in high cost-of-living areas or with lower incomes. Here’s how to address it:

- Ruthlessly Cut Wants: Temporarily reduce your "wants" to free up more money.

- Optimize Needs: Can you refinance your mortgage, find a cheaper rental, carpool, or reduce utility consumption?

- Increase Income: Look for ways to earn more money, such as a side hustle, overtime, or negotiating a raise.

- Adjust Percentages (Temporarily): In the short term, you might have a 60/20/20 or even a 70/10/20 budget. The goal is to work towards the ideal 50/30/20 over time as you optimize your spending or increase income.

"Can I adjust the percentages?"

Absolutely! The 50/30/20 rule is a guideline. If you have significant high-interest debt, you might choose a 50/20/30 split (less on wants, more on debt). If you’re saving for a major goal like a house down payment, you might temporarily shift to 40/30/30. The key is to understand the purpose of each category and adjust based on your current financial priorities.

"Is the 50/30/20 rule suitable for everyone?"

It’s a fantastic starting point for most people, especially those without complex financial situations or extremely high incomes. Those with very high incomes might find they can save significantly more than 20%, while those with very low incomes might struggle to fit their needs into 50%. However, even in these cases, the principle of separating needs, wants, and savings remains incredibly valuable.

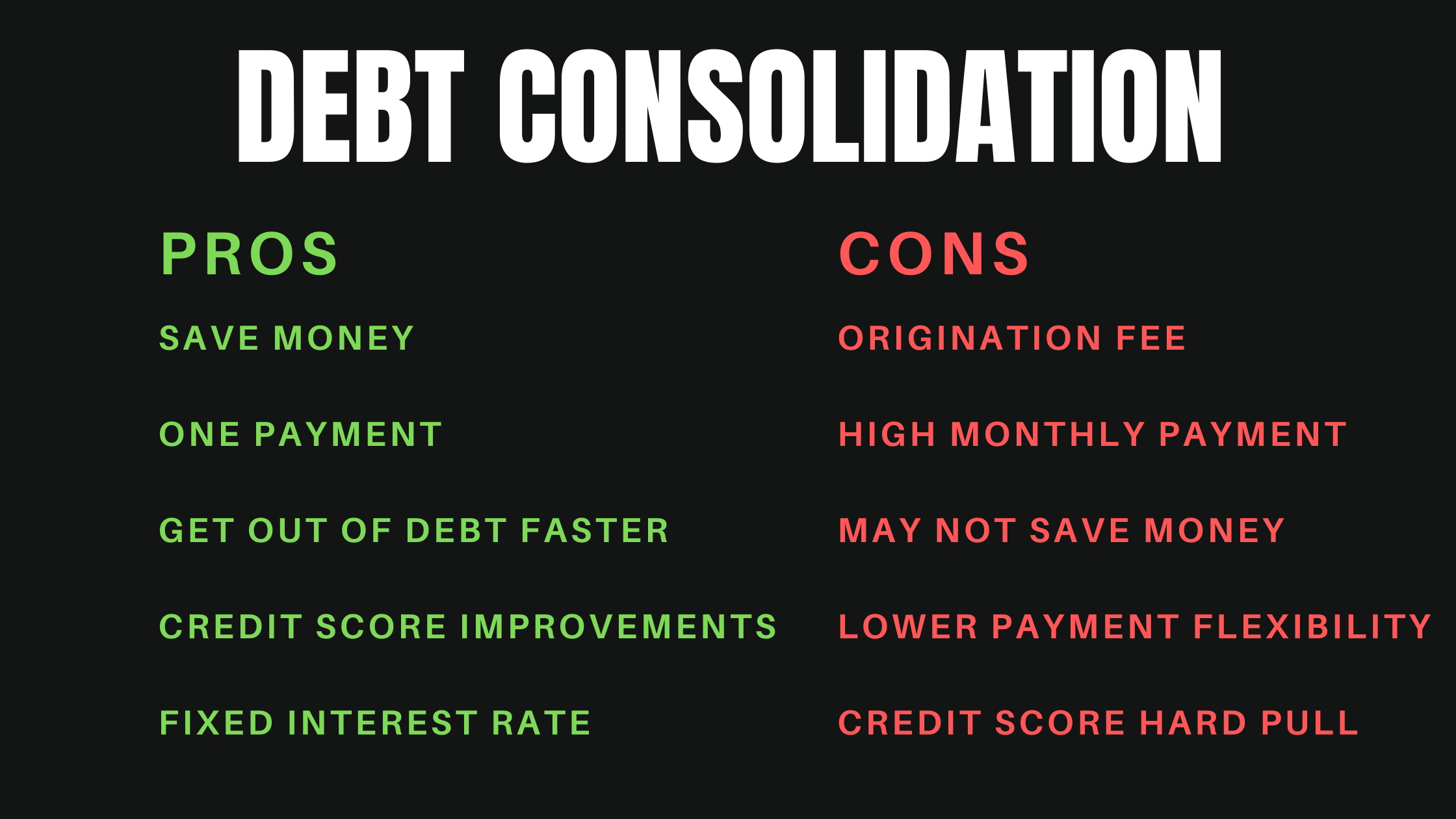

"What if I have a lot of debt?"

If you have high-interest debt (like credit card debt), paying it off aggressively should be a primary focus within your 20% savings and debt repayment category. Think of paying down debt as a guaranteed return on your money – you’re avoiding future interest payments. Once that debt is gone, you can redirect that 20% entirely to traditional savings and investments.

Take Control of Your Money Today!

The 50/30/20 budget rule is more than just a budgeting method; it’s a philosophy for managing your money that promotes balance, financial responsibility, and a clear path to achieving your goals. It empowers you to make conscious decisions about your spending, ensuring your money works for you, not against you.

Don’t wait for the "perfect" time. Start by calculating your net income, tracking your expenses, and applying the 50/30/20 framework today. With consistency and a little patience, you’ll be well on your way to financial freedom and a future where you’re in complete control of your money.

Post Comment