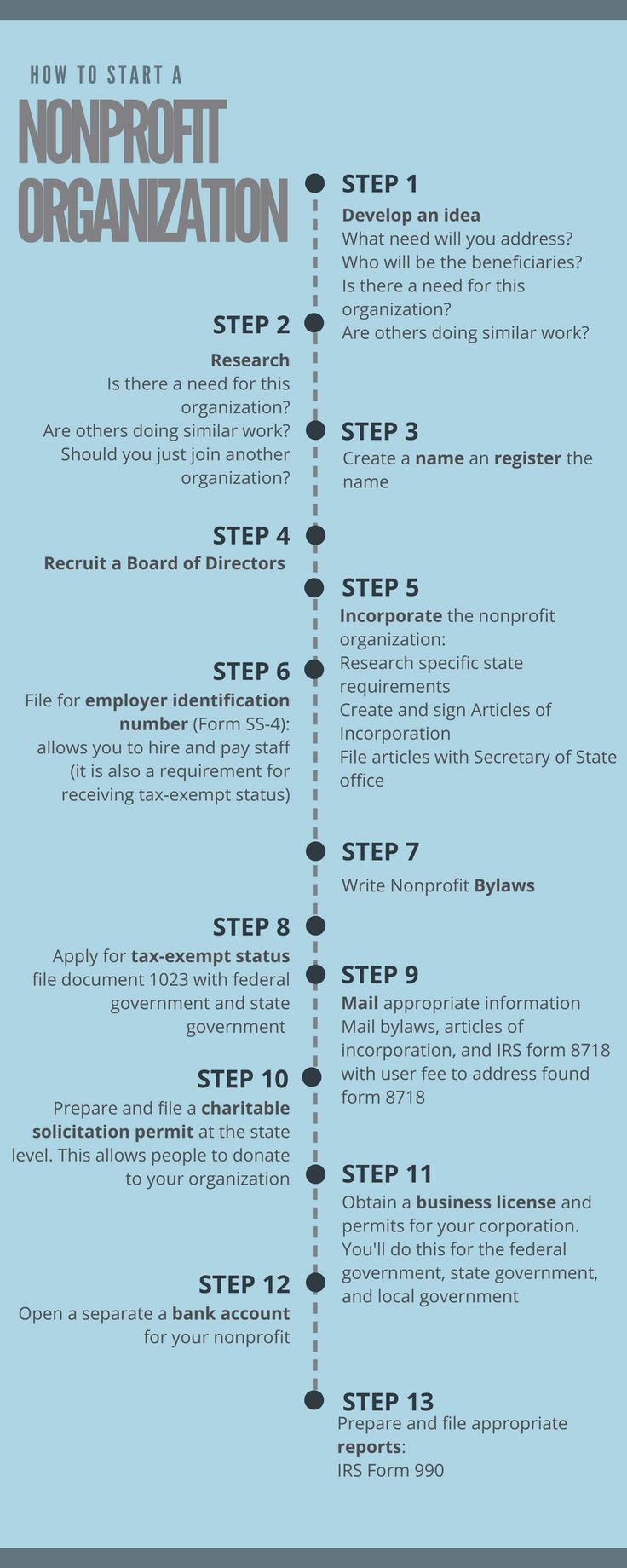

Starting a Non-Profit Organization: Your Comprehensive Step-by-Step Guide to Making a Difference

Do you dream of tackling a pressing social issue, supporting a cause you deeply care about, or fostering positive change in your community? Starting a non-profit organization can be an incredibly rewarding way to turn that passion into tangible impact. While the process might seem daunting at first, it’s entirely achievable with a clear plan and a step-by-step approach.

This comprehensive guide will walk you through everything you need to know, from defining your purpose to securing tax-exempt status, all in language that’s easy for beginners to understand. Let’s dive in and start building something truly meaningful!

What Exactly Is a Non-Profit Organization?

Before we begin, let’s clarify what a non-profit is. At its core, a non-profit organization is a group formed for the purpose of serving the public good, rather than generating profit for its owners or shareholders. Any money earned by the organization (through donations, grants, or program fees) must be reinvested back into its mission and operations.

The most common type of non-profit is a 501(c)(3) organization, which is recognized by the IRS as a public charity and allows donors to make tax-deductible contributions. This guide will primarily focus on establishing a 501(c)(3).

Phase 1: Laying the Foundation – Defining Your Purpose and Vision

Every great non-profit starts with a clear idea and a passionate heart. This initial phase is about solidifying your vision.

Step 1: Define Your Vision, Mission, and Core Values

This is the bedrock of your entire organization. Don’t skip this critical step!

- Your Vision Statement: This describes the ultimate, long-term impact you hope to achieve. It’s your ideal future world.

- Example: "A world where every child has access to quality education, regardless of their socioeconomic background."

- Your Mission Statement: This is a concise, action-oriented statement that explains what your organization does, who it serves, and why it exists. It should be memorable and inspiring.

- Example: "To provide free after-school tutoring and mentorship programs to underserved youth in our community, fostering academic success and personal growth."

- Your Core Values: These are the guiding principles that dictate your organization’s behavior, decisions, and culture.

- Examples: Integrity, compassion, community, innovation, transparency.

Why this is important: These statements will guide every decision you make, attract the right people (board members, volunteers, donors), and clearly communicate your purpose to the world.

Step 2: Conduct Research and Needs Assessment

Is there a real need for your proposed non-profit?

- Identify the Problem: Clearly articulate the specific issue you’re addressing.

- Research Existing Organizations: Are there other non-profits doing similar work? If so, how will yours be different or fill a unique gap? Collaboration can also be powerful!

- Talk to Your Community: Engage with potential beneficiaries, community leaders, and experts to understand the needs and gauge interest.

Step 3: Choose Your Organization’s Name

Your name should be:

- Memorable and Meaningful: Reflect your mission.

- Unique: Avoid confusion with existing organizations.

- Available: Check state business registries, federal trademark databases (USPTO), and domain name availability.

Pro Tip: Consider reserving your domain name and social media handles as soon as you have a strong contender for your name.

Phase 2: Building Your Organizational Structure

Once your purpose is clear, it’s time to build the framework that will bring your vision to life.

Step 4: Assemble Your Founding Board of Directors

Your Board of Directors is the governing body of your non-profit. They provide oversight, strategic guidance, and ensure the organization stays true to its mission.

- Minimum Members: Most states require at least three board members.

- Diverse Skills: Look for individuals with a variety of skills:

- Legal expertise

- Financial management

- Fundraising experience

- Program development

- Community connections

- Passion for your cause

- No Compensation: Board members of 501(c)(3) organizations are typically unpaid volunteers.

Why they’re crucial: A strong, engaged board is essential for legitimacy, good governance, and long-term success.

Step 5: Develop Your Bylaws

Bylaws are the operational manual for your non-profit. They outline how your organization will be governed and managed. This document is required by the IRS for 501(c)(3) status.

Your bylaws should include:

- Name and purpose of the organization

- Membership (if any)

- Board of Directors structure (number, terms, election process)

- Roles and responsibilities of officers (Chair, Secretary, Treasurer)

- Meeting procedures (how often, quorum requirements)

- Conflict of interest policy

- Amendment procedures for the bylaws themselves

- Dissolution clause (what happens to assets if the organization closes)

Pro Tip: You can find many sample non-profit bylaws online, but it’s wise to have an attorney review yours to ensure compliance with state and federal laws.

Phase 3: The Legal Formalities – Becoming a Recognized Non-Profit

This is often the most technical part, involving state and federal applications.

Step 6: File Your Articles of Incorporation (State Level)

This is the legal document that officially creates your non-profit corporation in your state. You’ll file this with your Secretary of State’s office (or equivalent state agency).

- Information Needed: Your organization’s name, purpose, initial board members, registered agent (an individual or entity designated to receive legal documents), and a dissolution clause.

- State Specifics: Requirements vary by state, so check your state’s Secretary of State website for exact forms and fees.

Outcome: Once approved, your organization officially exists as a legal entity in your state. You are now a state-recognized non-profit corporation. This is different from being a federal tax-exempt non-profit.

Step 7: Obtain Your Employer Identification Number (EIN)

An EIN is like a Social Security number for your organization. It’s a unique nine-digit number assigned by the IRS, and you’ll need it to open a bank account, apply for 501(c)(3) status, and hire employees.

- How to Get It: Apply online directly through the IRS website. It’s free and usually takes only a few minutes.

Step 8: Apply for 501(c)(3) Tax-Exempt Status (Federal Level)

This is the big one! Securing 501(c)(3) status from the IRS is what allows your organization to receive tax-deductible donations and often qualifies you for grants.

- Form 1023 or 1023-EZ:

- Form 1023-EZ: A shorter, simpler form for smaller organizations (typically those projecting gross receipts of less than $50,000 annually for the next three years and assets under $250,000). Check the IRS eligibility requirements carefully.

- Form 1023: The full application. This is a detailed document that requires a thorough description of your activities, financial data (past and projected), copies of your Articles of Incorporation and Bylaws, and specific narratives about how you meet the requirements for 501(c)(3) status.

- Key Elements of the Application:

- Organizational Test: Your organizing documents (Articles of Incorporation, Bylaws) must meet specific IRS requirements.

- Operational Test: Your activities must primarily serve an exempt purpose (charitable, educational, religious, scientific, etc.).

- Narrative Description: You’ll need to explain in detail your programs, activities, and how they further your mission.

- Financial Data: Provide budgets and financial projections.

- Timeline: The IRS processing time can vary significantly, from a few weeks for Form 1023-EZ to several months or even a year for Form 1023.

- User Fee: There is a fee associated with filing Form 1023 or 1023-EZ.

Recommendation: While you can file these forms yourself, many organizations choose to work with an attorney or consultant experienced in non-profit law due to the complexity and importance of this application.

Phase 4: Setting Up Operations and Getting Started

Congratulations! Once you have your 501(c)(3) status, you’re officially recognized as a tax-exempt public charity. Now it’s time to set up for success.

Step 9: Set Up Your Organizational Infrastructure

- Open a Bank Account: With your EIN and Articles of Incorporation, open a dedicated bank account in your non-profit’s name. Do NOT use personal accounts for organizational funds.

- Establish Financial Systems: Implement basic accounting software or spreadsheets to track income and expenses. Transparency and accurate record-keeping are paramount.

- Create a Communications Plan: Develop a simple website, social media presence, and email list to communicate your mission and progress.

- Insurance: Consider general liability insurance to protect your organization.

Step 10: Register for State and Local Compliance

Your 501(c)(3) status is federal, but states have their own requirements.

- Charitable Solicitation Registration: Most states require non-profits to register before soliciting donations from their residents. This is often an annual requirement.

- State Tax Exemptions: Apply for state sales tax exemption or property tax exemption if applicable in your state.

- Local Permits/Licenses: Check with your city or county for any local permits or licenses required to operate (e.g., business licenses, zoning permits).

Phase 5: Sustaining Your Mission – Fundraising and Ongoing Compliance

Your non-profit is now legally established! The real work of making an impact begins.

Step 11: Begin Fundraising and Program Development

With 501(c)(3) status, you can now actively seek tax-deductible donations.

- Develop a Fundraising Strategy: Don’t put all your eggs in one basket. Consider:

- Individual donations (online, direct mail)

- Grant applications (foundations, government)

- Corporate sponsorships

- Fundraising events

- Planned giving

- Build Your Programs: Start implementing the activities and services that fulfill your mission. Document your impact!

Step 12: Ensure Ongoing Compliance and Good Governance

Maintaining your non-profit status requires ongoing diligence.

- Annual IRS Filings (Form 990): Most 501(c)(3) organizations must file an annual information return with the IRS (Form 990, 990-EZ, or 990-N postcard, depending on your gross receipts). Failure to file for three consecutive years can lead to automatic revocation of your tax-exempt status.

- Annual State Filings: File annual reports with your Secretary of State and renew any charitable solicitation registrations.

- Regular Board Meetings: Hold regular board meetings as outlined in your bylaws. Keep detailed minutes.

- Financial Transparency: Maintain accurate financial records and make them accessible to your board and, where appropriate, to the public.

- Conflict of Interest Policy: Actively manage potential conflicts of interest among board members and staff.

You’re Ready to Make a Difference!

Starting a non-profit organization is a journey, not a sprint. It requires dedication, resilience, and a deep commitment to your cause. While the initial steps involve legal and administrative hurdles, remember that each one brings you closer to realizing your vision and creating lasting positive change.

Don’t be afraid to seek guidance from experienced non-profit leaders, legal professionals, and community resources along the way. Your passion, combined with a solid plan, will empower you to build an organization that truly impacts lives. Go forth and make your mark on the world!

Post Comment